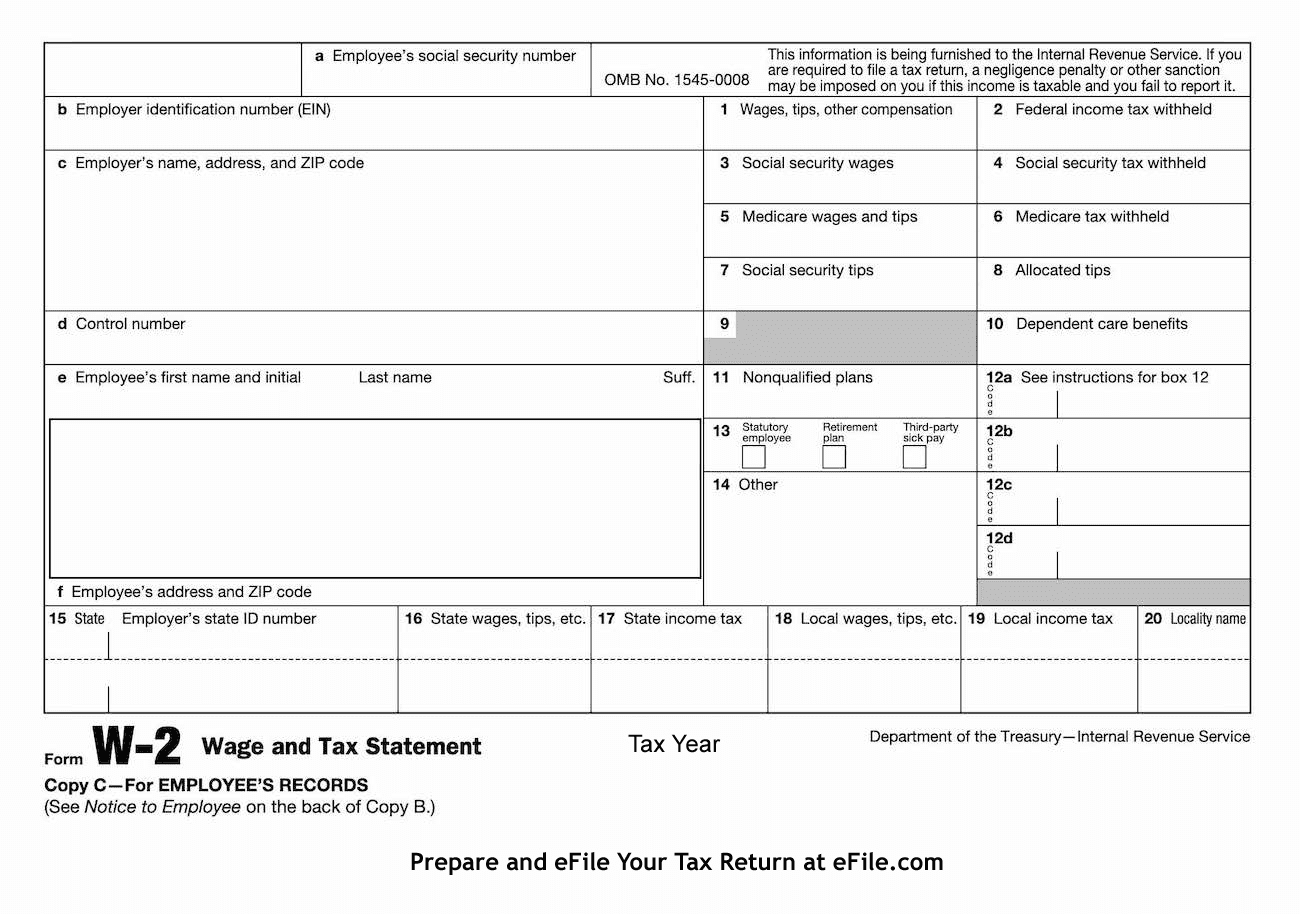

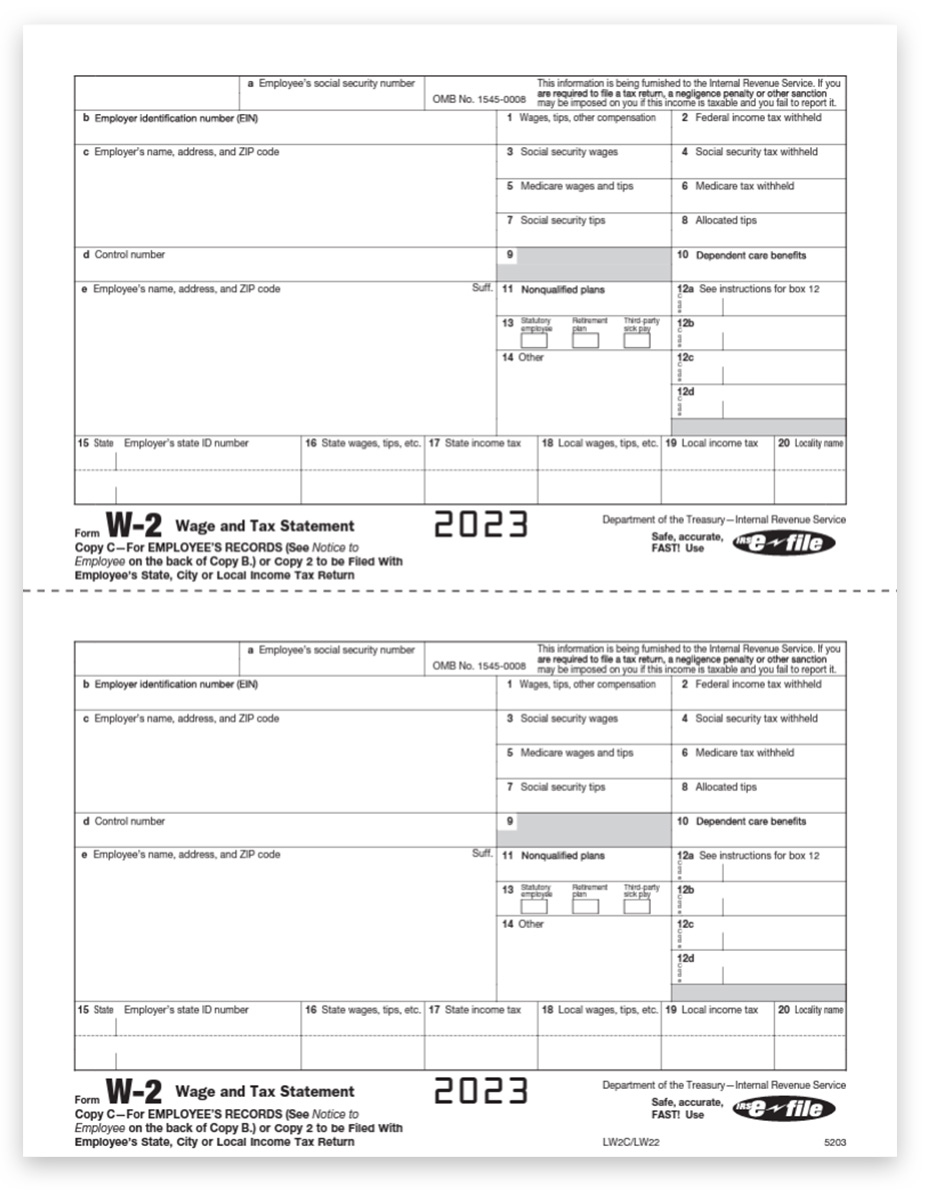

How Can I Get A Copy Of My W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Tax Smile: Easy Ways to Get Your W2 Form!

Tax season is here again, and while it may not be everyone’s favorite time of year, there are ways to make the process smoother and more enjoyable. One of the first steps in filing your taxes is obtaining your W2 form from your employer. This document contains important information about your earnings and taxes withheld throughout the year, so it’s crucial to have it in hand before you can file your tax return. But fear not, as we have some tips to help you easily access your W2 form and get one step closer to unlocking your tax smile!

Discover the Joy of Tax Season with These Tips!

The first tip to easily access your W2 form is to check your email or mailbox. Many employers now provide electronic copies of the W2 form to their employees, which can be accessed through their online portal or sent directly to their email address. If you haven’t received it yet, reach out to your employer’s HR department to request a copy. You can also check your physical mailbox, as some employers still mail out paper copies of the W2 form to their employees. By taking a few simple steps to check your email or mailbox, you can quickly get your hands on the W2 form you need to file your taxes.

Another easy way to access your W2 form is through an online tax preparation service. Many tax preparation companies offer the option to import your W2 form directly into their software, making the filing process a breeze. Simply create an account with the tax preparation service of your choice, follow the prompts to import your W2 form, and you’ll be well on your way to filing your taxes. Not only does this method save you time and hassle, but it also ensures that your tax return is accurate and error-free. So why not take advantage of technology to make your tax season a little brighter?

If you’re still having trouble accessing your W2 form, don’t panic. Reach out to your employer directly and ask for assistance. They should be able to provide you with a copy of your W2 form or guide you on where to find it. Remember, tax season doesn’t have to be overwhelming or stressful. By following these tips and staying proactive, you can easily unlock your tax smile and breeze through the filing process. So take a deep breath, gather your documents, and get ready to conquer tax season with confidence!

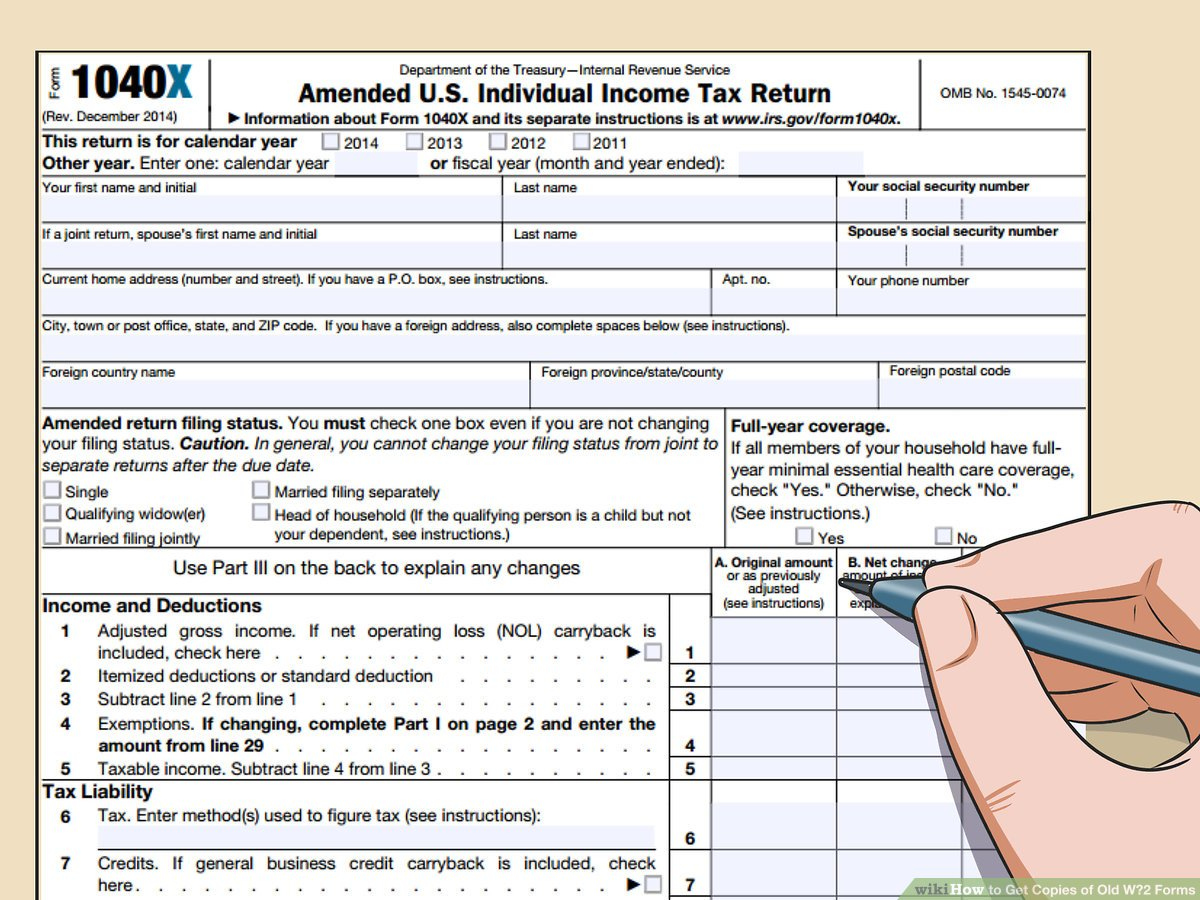

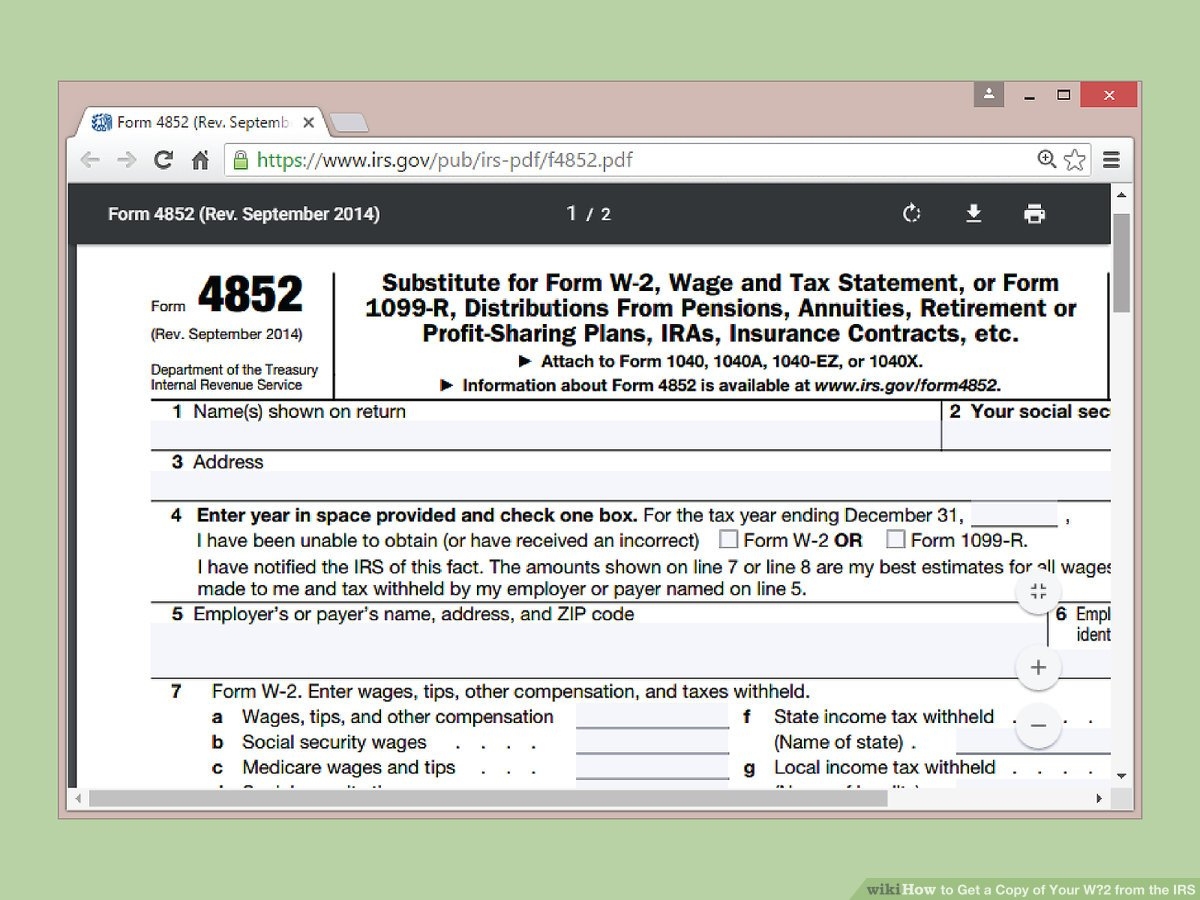

Below are some images related to How Can I Get A Copy Of My W2 Form

how can i get a copy of my social security w2 online, how can i get a copy of my w2 form, how can i get a copy of my w2 from my employer, how can i get a copy of my w2 from social security, how can i get a copy of my w2 online, , How Can I Get A Copy Of My W2 Form.

how can i get a copy of my social security w2 online, how can i get a copy of my w2 form, how can i get a copy of my w2 from my employer, how can i get a copy of my w2 from social security, how can i get a copy of my w2 online, , How Can I Get A Copy Of My W2 Form.