W2 Form For Walmart Employees – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

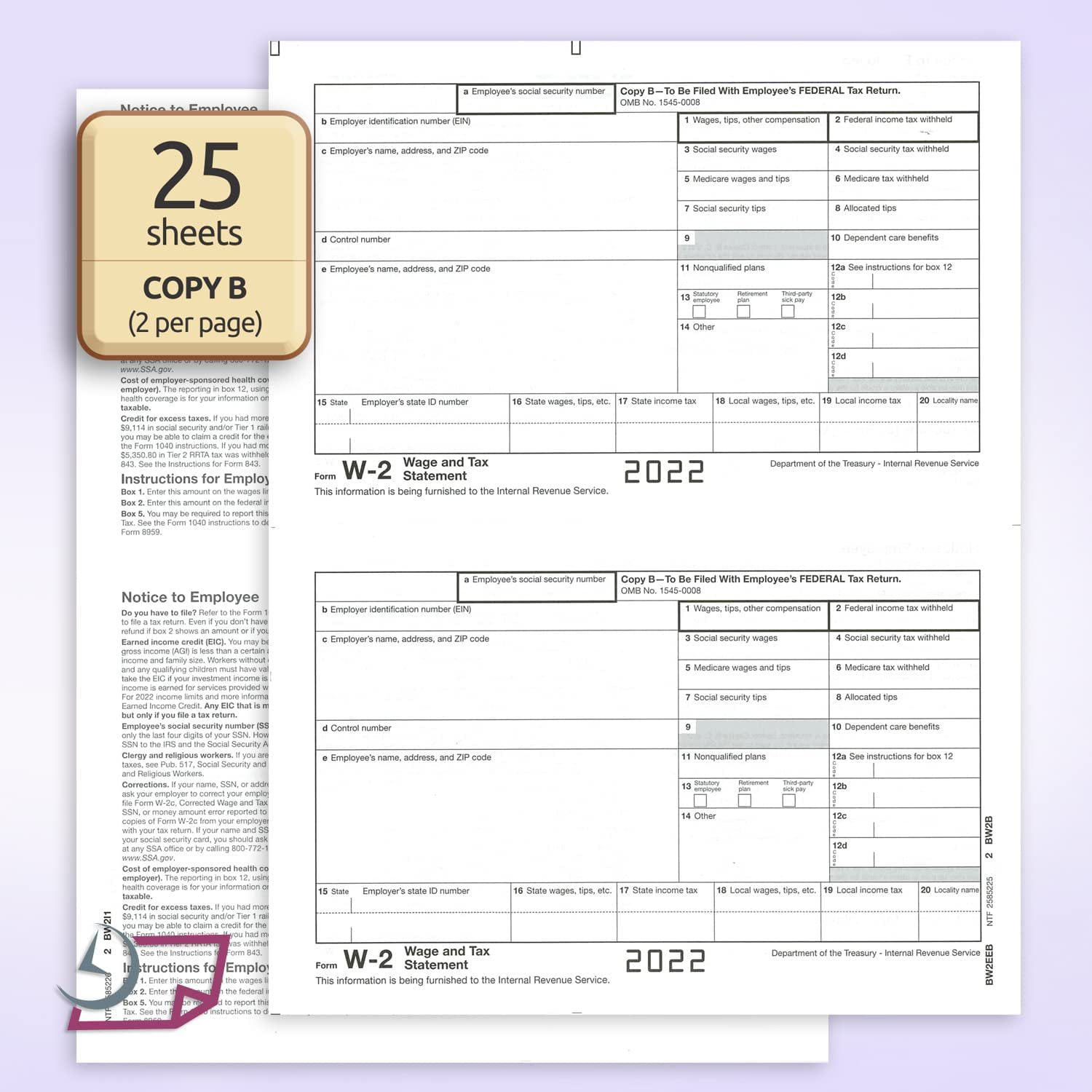

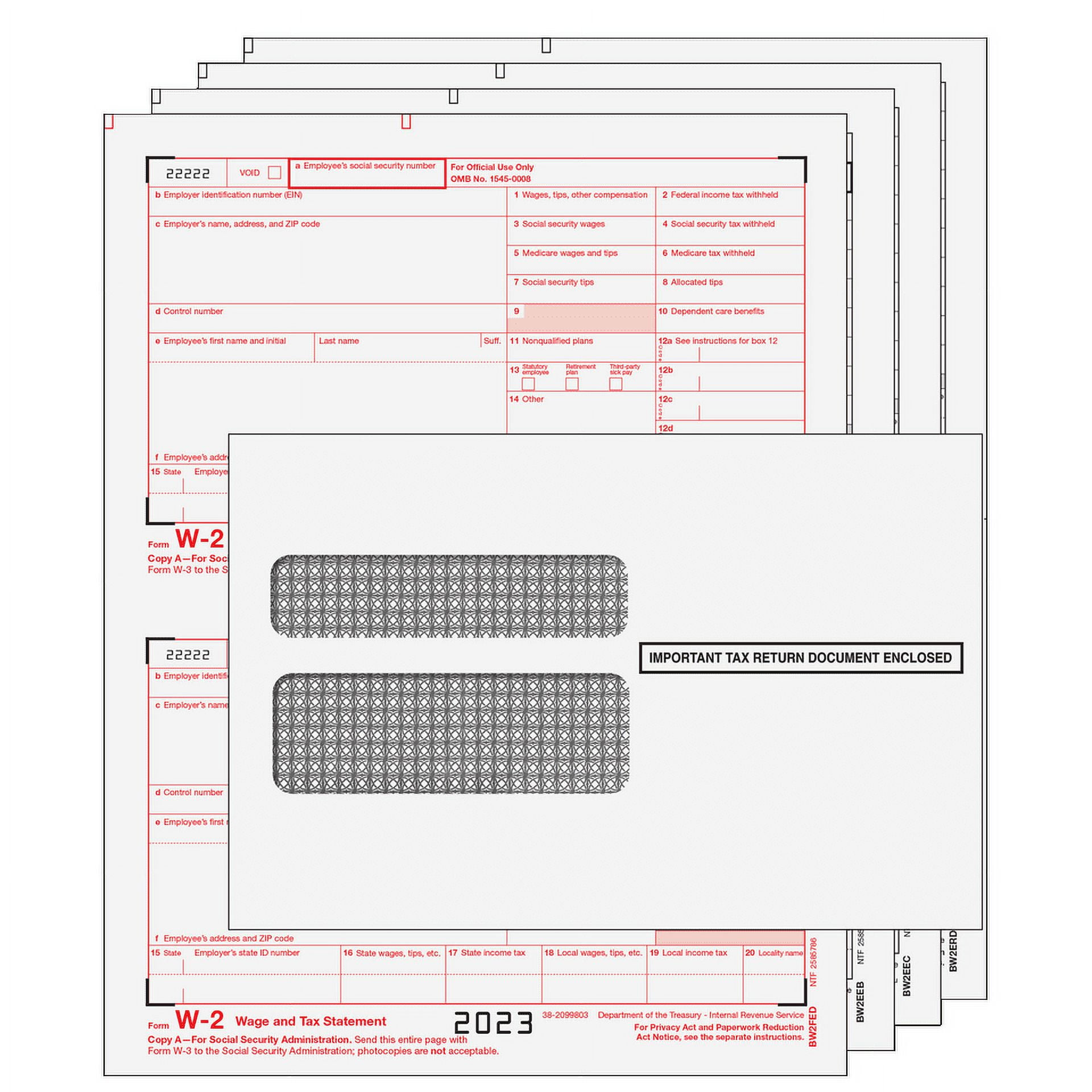

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximize Your Savings!

Are you looking for a way to make the most out of your tax refund this year? Look no further than Walmart’s W2 form! By utilizing this important document, you can unlock the potential for significant savings and maximize your refund. Whether you’re a current or former Walmart employee, this form holds the key to unlocking the tax benefits you deserve. Don’t leave money on the table – make sure you get every penny you’re entitled to by utilizing Walmart’s W2 form to its fullest potential.

When it comes to tax season, every dollar counts. That’s why it’s crucial to get the most out of your tax refund by leveraging Walmart’s W2 form. This document provides vital information about your earnings and taxes withheld throughout the year, giving you the tools you need to ensure you’re taking advantage of all available deductions and credits. With Walmart’s W2 form in hand, you can feel confident that you’re making the most of your tax refund and maximizing your savings.

Don’t let your tax refund slip through your fingers – take control of your financial future with Walmart’s W2 form. By using this important document to its full potential, you can unlock the key to maximizing your savings and ensuring you get the most out of your tax refund. Whether you’re planning to save, invest, or splurge on something special, Walmart’s W2 form can help you achieve your financial goals and make the most of your hard-earned money. Get started today and unlock your tax refund potential with Walmart’s W2 form!

Get the Most out of Your Tax Refund with Walmart’s W2 Form!

Are you ready to supercharge your tax refund and maximize your savings? Look no further than Walmart’s W2 form! This essential document provides a detailed snapshot of your earnings and taxes withheld, giving you the tools you need to unlock your tax refund potential. Whether you’re a part-time cashier or a seasoned manager, Walmart’s W2 form is a valuable resource that can help you make the most of tax season and ensure you’re getting the refund you deserve.

With Walmart’s W2 form in hand, you can take charge of your financial future and make informed decisions about how to use your tax refund. Whether you’re looking to pay off debt, save for a rainy day, or treat yourself to something special, this document can help you achieve your financial goals and get the most out of your refund. By leveraging the information provided in Walmart’s W2 form, you can ensure that you’re maximizing your savings and making the most of your hard-earned money. Don’t let tax season pass you by – unlock your tax refund potential with Walmart’s W2 form today!

In conclusion, Walmart’s W2 form is a powerful tool that can help you unlock your tax refund potential and maximize your savings. Whether you’re a current or former Walmart employee, this document provides essential information about your earnings and taxes withheld, giving you the insight you need to make the most of tax season. By using Walmart’s W2 form to its fullest potential, you can ensure that you’re getting every penny you’re entitled to and making the most of your hard-earned money. Don’t miss out on the opportunity to supercharge your tax refund – get started with Walmart’s W2 form today and unlock your financial potential!

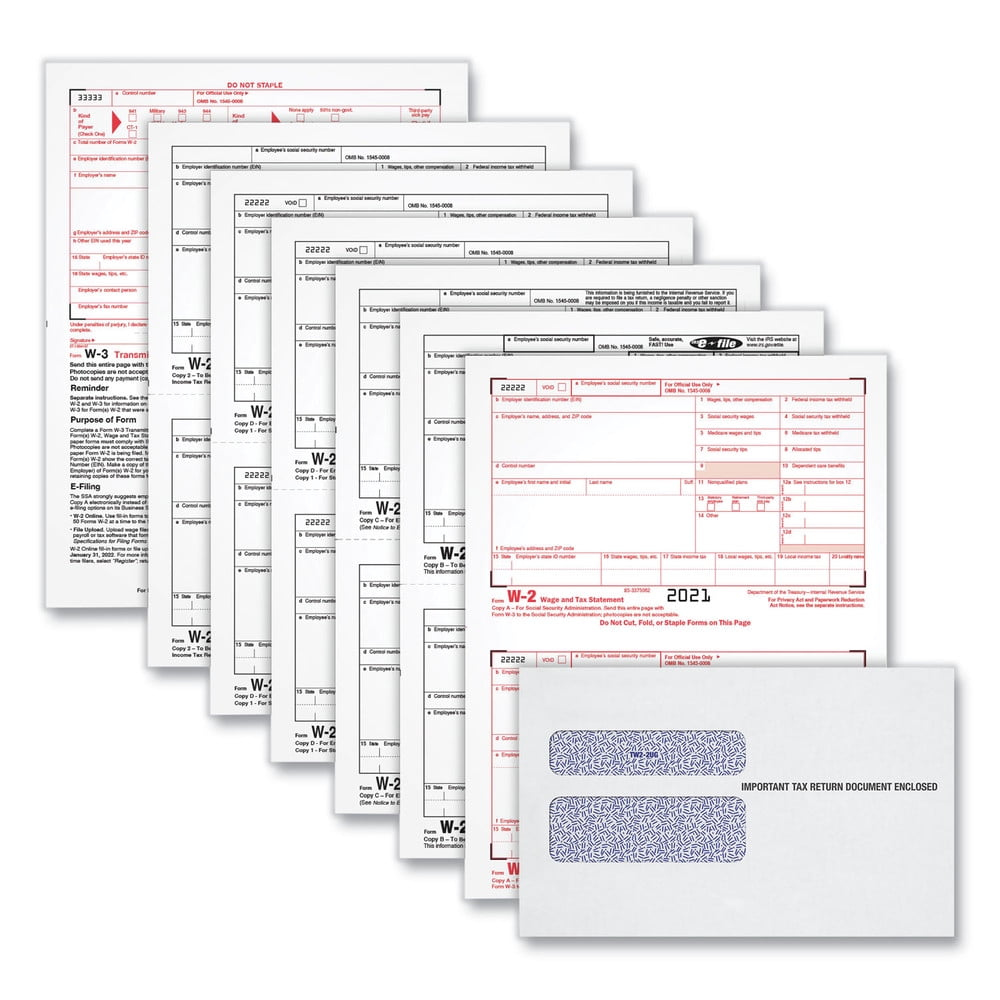

Below are some images related to W2 Form For Walmart Employees

how do i get my w2 from walmart as a former employee, how do walmart employees get their w2, w2 form for walmart employees, , W2 Form For Walmart Employees.

how do i get my w2 from walmart as a former employee, how do walmart employees get their w2, w2 form for walmart employees, , W2 Form For Walmart Employees.