W2 Form Taxes – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

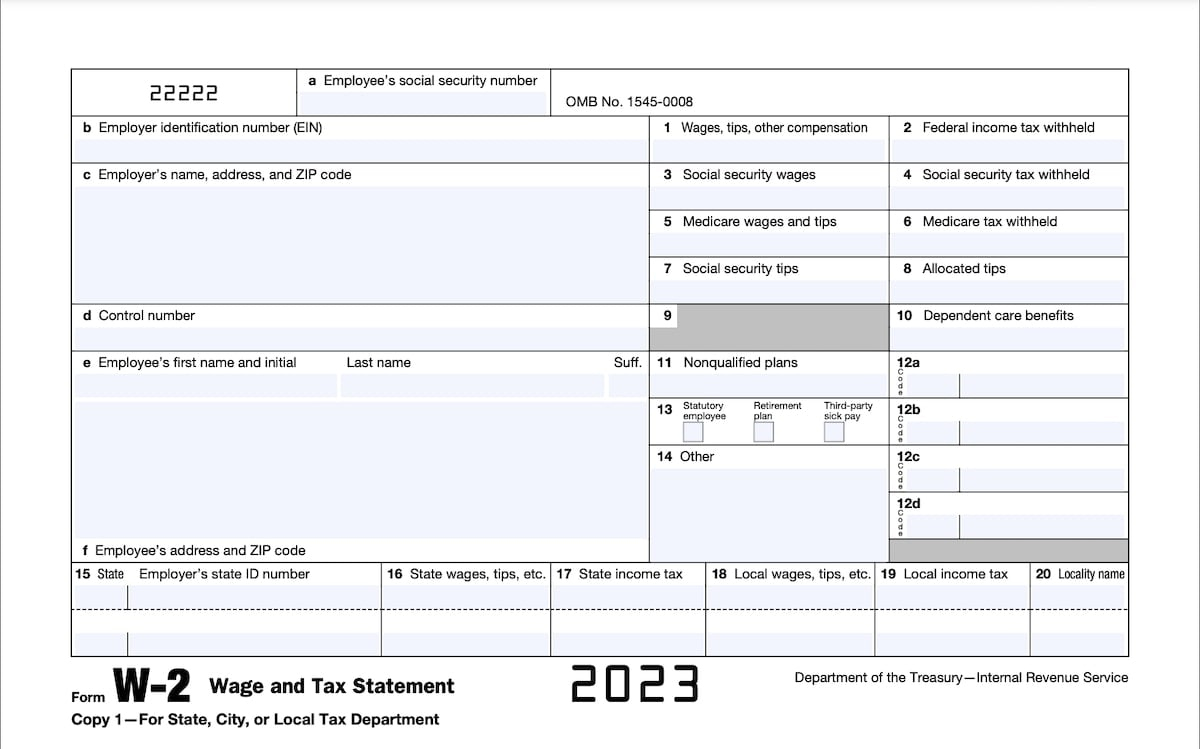

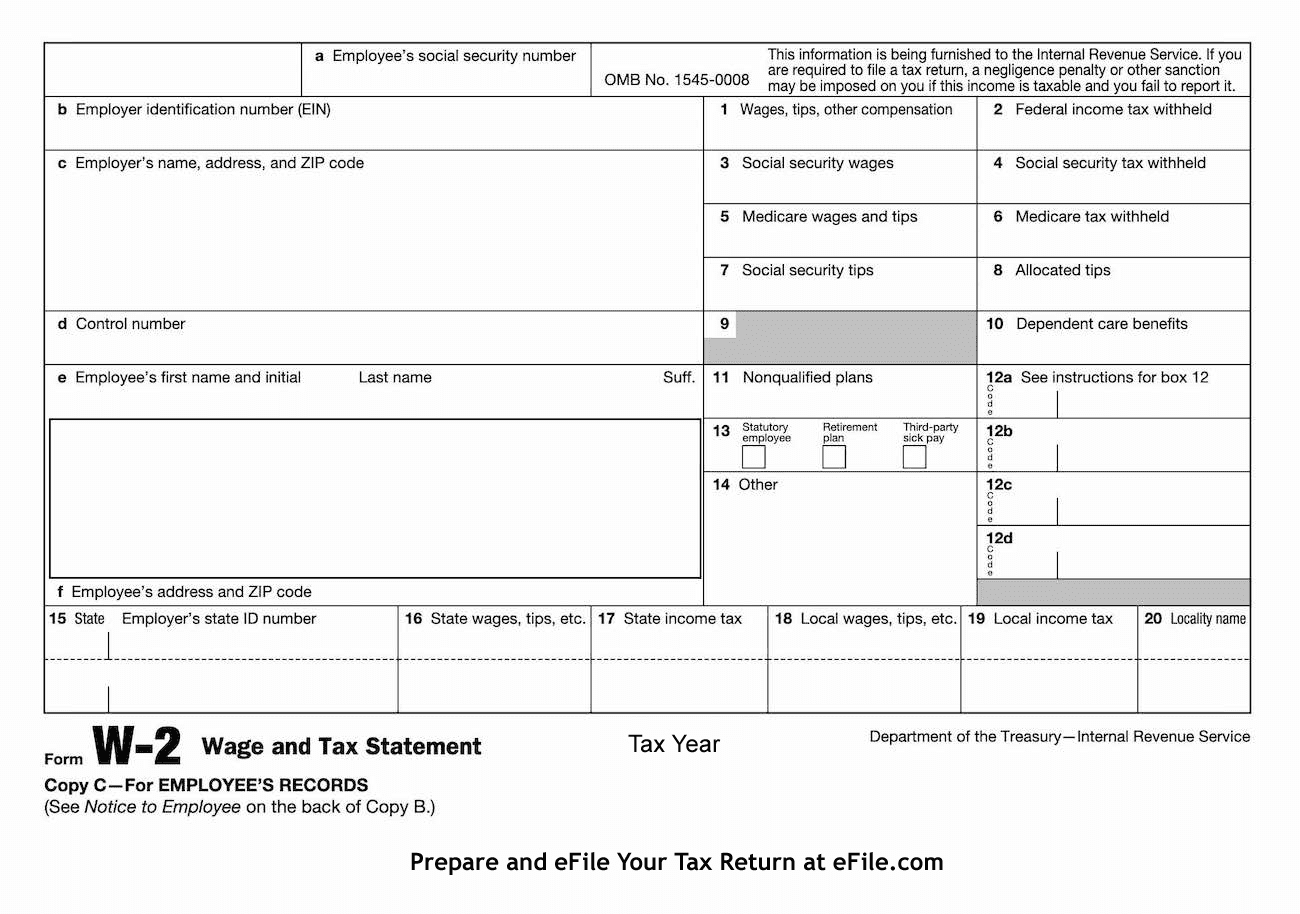

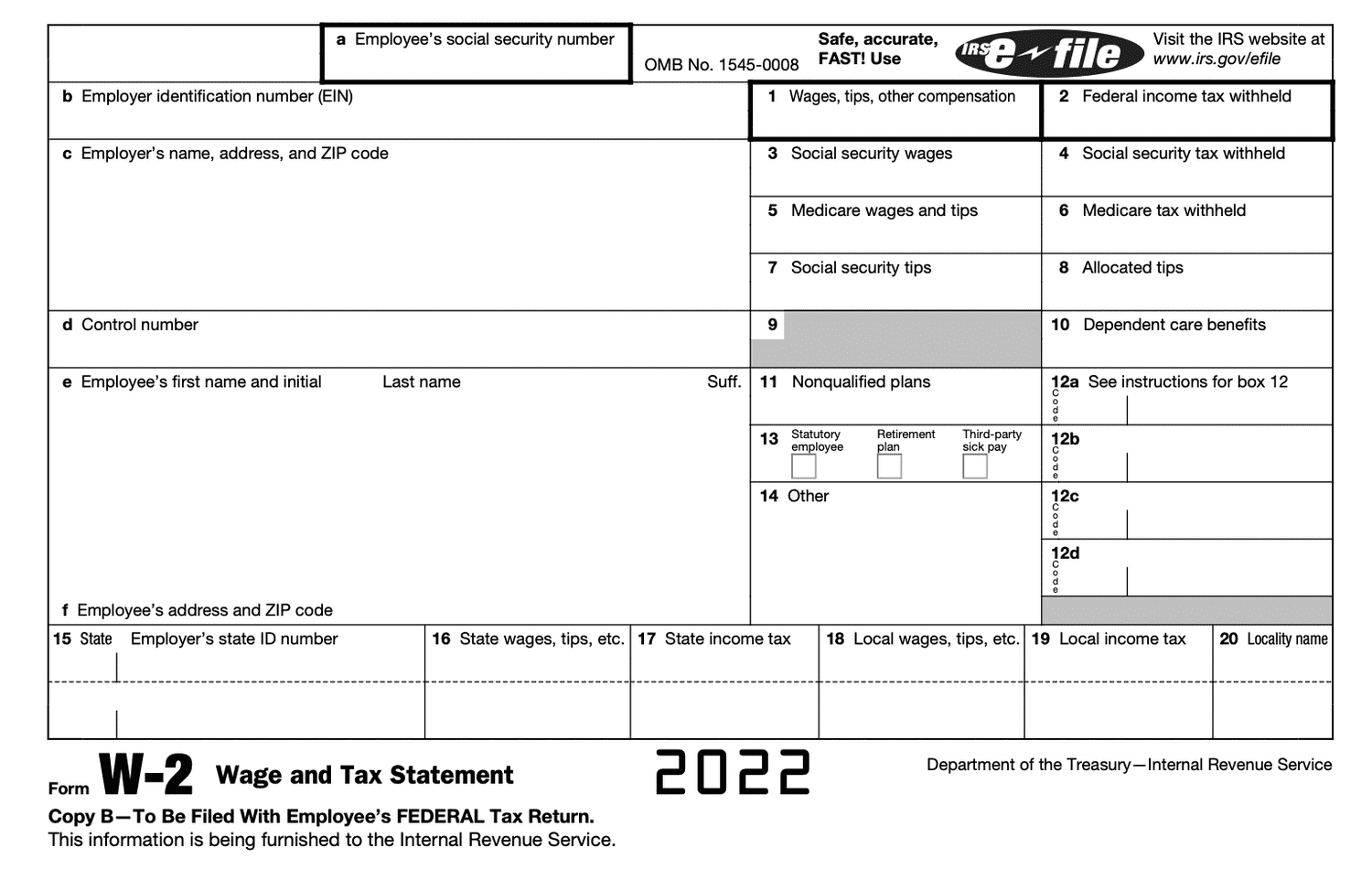

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Crack the Code: W2 Form Taxes Made Easy!

Tax season can be a stressful time for many individuals, especially when it comes to deciphering complicated tax forms like the W2. However, fear not! With a little guidance and understanding, you can easily unravel the mystery of W2 form taxes and simplify the process. Let’s dive in and learn how to crack the code of W2 form taxes with ease!

Unravel the Mystery of W2 Form Taxes!

The W2 form is a crucial document that summarizes an individual’s earnings and taxes withheld by their employer throughout the year. It includes information such as wages, tips, bonuses, and other compensation, as well as tax withholdings for federal, state, and local taxes. Understanding how to read and interpret your W2 form is key to accurately filing your taxes and maximizing your refund. By breaking down each section of the form and familiarizing yourself with the terminology used, you can demystify the W2 form and confidently navigate tax season.

One of the most important sections of the W2 form is Box 1, which displays your total wages for the year before any deductions. Box 2 shows the total federal income tax withheld from your paychecks, while Box 4 includes your Social Security tax contributions. Boxes 12 and 14 may contain additional information such as employer-provided benefits or retirement plan contributions. By carefully reviewing each box and understanding its significance, you can ensure that your tax return is accurate and complete. Remember, the W2 form is your key to unlocking the secrets of your tax obligations and entitlements!

Simplify Tax Season with Easy W2 Forms!

Tax season doesn’t have to be intimidating, especially when you have the right tools and knowledge at your disposal. By simplifying the process of filling out your W2 form and understanding the information it contains, you can breeze through tax season with confidence and ease. Take the time to review your W2 form carefully, ask questions if you’re unsure about any details, and seek assistance from tax professionals if needed. Remember, tax compliance is essential, but it doesn’t have to be overwhelming. With a positive attitude and a willingness to learn, you can conquer your taxes and emerge victorious this tax season!

In conclusion, cracking the code of W2 form taxes doesn’t have to be a daunting task. By taking the time to understand the information presented on your W2 form, you can simplify the tax filing process and ensure that you’re meeting your tax obligations accurately. So, don’t let tax season stress you out – embrace the challenge, empower yourself with knowledge, and tackle your taxes with confidence. With a little effort and a positive attitude, you can navigate the world of W2 form taxes with ease and emerge as a tax-savvy individual. Happy filing!

Below are some images related to W2 Form Taxes

w2 form tax calculator, w2 form tax exemptions, w2 form tax percentage, w2 form tax refund amount, w2 form tax return calculator, , W2 Form Taxes.

w2 form tax calculator, w2 form tax exemptions, w2 form tax percentage, w2 form tax refund amount, w2 form tax return calculator, , W2 Form Taxes.