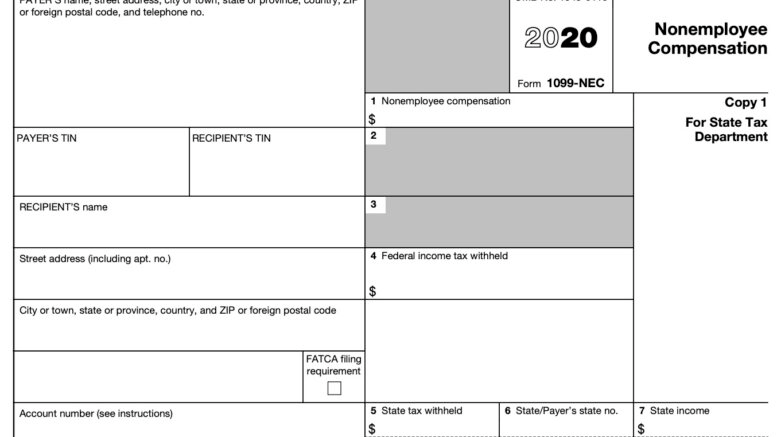

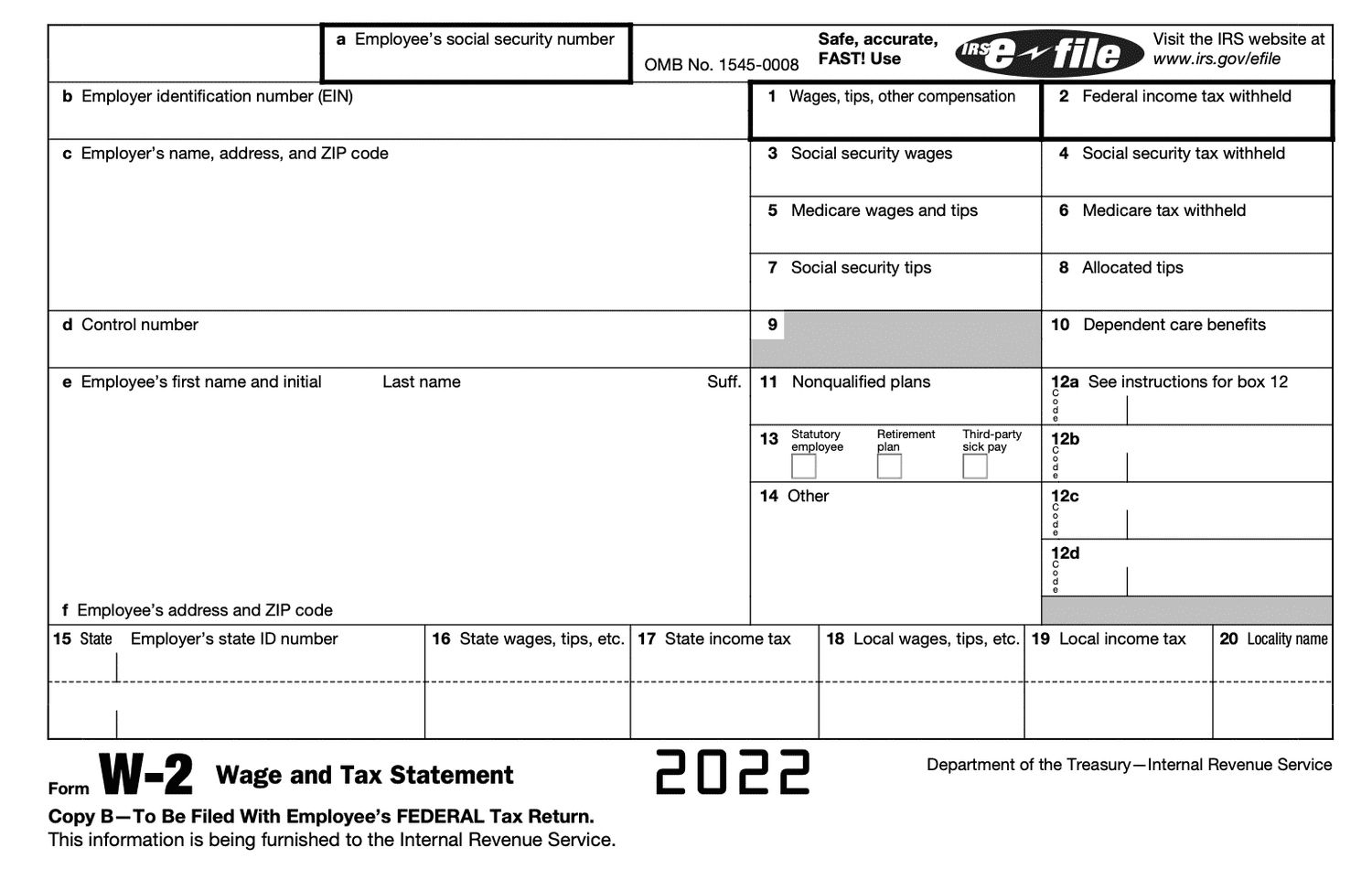

W2 1099 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Wondrous World of W2 1099 Forms

In the realm of taxes and finances, there exists a magical universe of forms that hold the key to understanding your income and reporting it to the government. Among these forms are the mystical W2 and 1099 forms, which may seem daunting at first, but hold enchanting secrets waiting to be discovered. Let’s embark on a journey to unravel the wondrous world of W2 1099 forms and demystify their complexities.

Exploring the Magical Universe of W2 1099 Forms

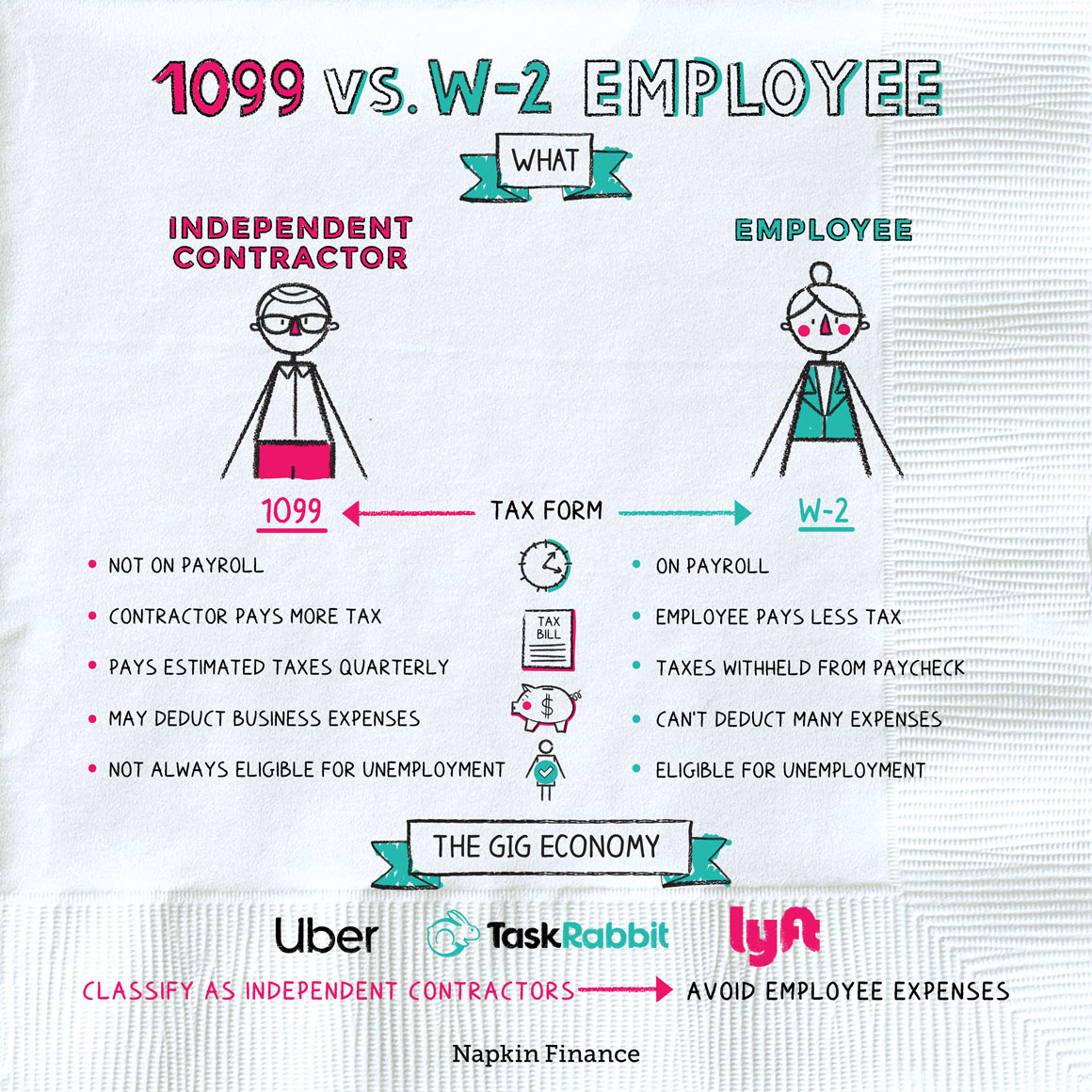

As we delve into the world of W2 1099 forms, we discover that each form serves a unique purpose in the realm of taxes. The W2 form, often associated with traditional employment, provides a detailed summary of an individual’s earnings and withholdings throughout the year. On the other hand, the 1099 form is used for reporting income earned as an independent contractor or freelancer. While these forms may seem like mere pieces of paper, they hold the power to shed light on one’s financial standing and ensure compliance with tax laws.

In this enchanted universe of W2 1099 forms, each line and box tells a story of the individual’s financial journey throughout the year. From wages and salary to bonuses and commissions, the W2 form paints a vivid picture of the individual’s income sources. Meanwhile, the 1099 form reveals the diverse streams of income earned from freelance work, investments, or other independent ventures. By understanding the information presented on these forms, individuals can gain valuable insights into their financial health and make informed decisions regarding their taxes and future financial goals.

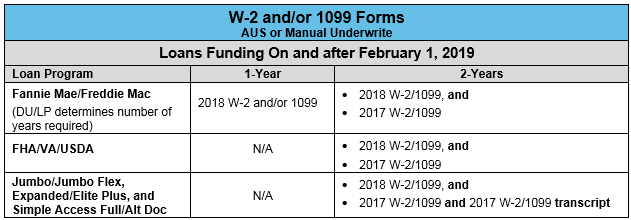

Below are some images related to W2 1099 Form

2019 w-2/1099 form, 2020 w-2/1099 form, 2021 w-2/1099 form, define w2 1099 form, w-2/1099 form download, , W2 1099 Form.

2019 w-2/1099 form, 2020 w-2/1099 form, 2021 w-2/1099 form, define w2 1099 form, w-2/1099 form download, , W2 1099 Form.