When Should W2 Forms Arrive 2022 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

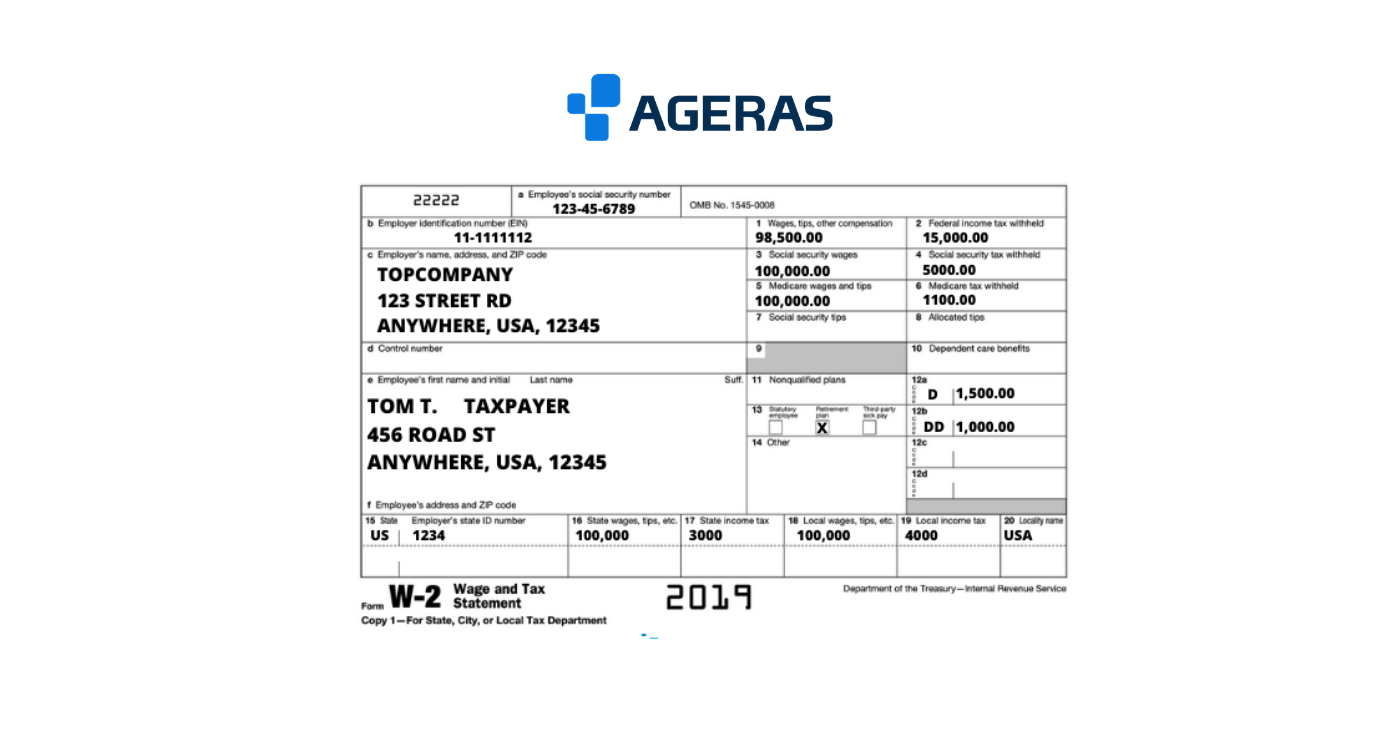

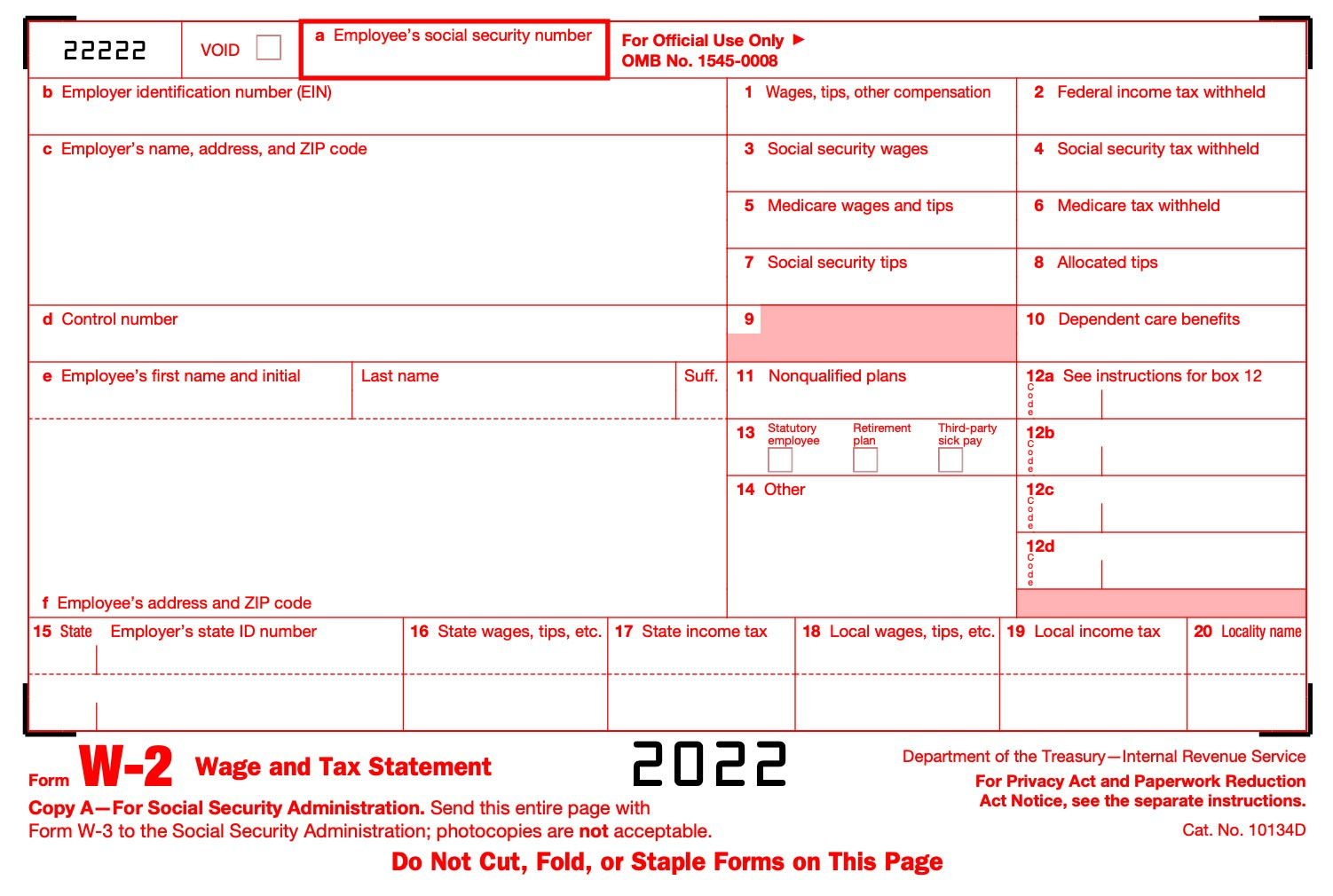

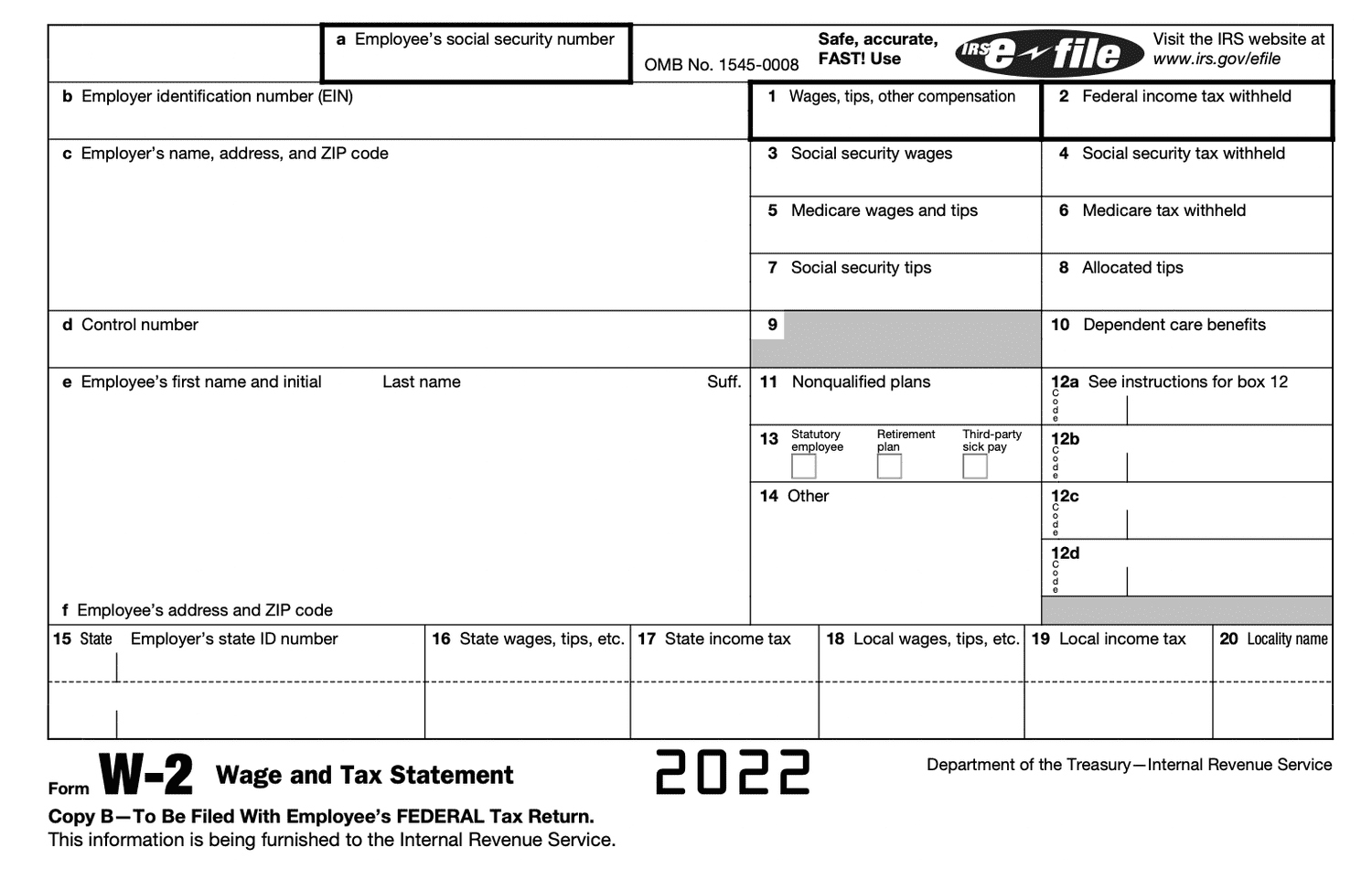

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Exciting News: 2022 W2s Are on the Way!

Are you ready for tax season? Well, get ready to rejoice because the 2022 W2s are on their way! It’s that time of the year when we gather all our financial documents, roll up our sleeves, and dive into the world of taxes. But fear not, because with the arrival of your W2 forms, you’ll be one step closer to getting your taxes in order and maybe even receiving a nice refund. So, get ready to embrace the upcoming tax season with open arms and a positive attitude!

Prepare for Tax Time with These Helpful Tips!

As you eagerly wait for your 2022 W2s to arrive, it’s a good idea to start preparing for tax time. Here are a few helpful tips to get you started:

1. Organize your documents: Gather all your financial documents, including pay stubs, receipts, and any other relevant paperwork.

2. Review last year’s return: Take a look at your previous tax return to refresh your memory on any deductions or credits you may have claimed.

3. Consider hiring a professional: If you’re feeling overwhelmed or unsure about handling your taxes on your own, consider hiring a tax professional to help you navigate the process.

With these tips in mind, you’ll be well-prepared to tackle your taxes and make the most of the upcoming tax season. So, embrace the arrival of your 2022 W2s and get ready to conquer tax time like a pro!

In conclusion, the arrival of your 2022 W2s is a reason to celebrate as it marks the beginning of tax season. With a positive attitude, a bit of organization, and some helpful tips, you’ll be well-equipped to handle your taxes like a champ. So, get ready to embrace the upcoming tax season with confidence and enthusiasm. Here’s to a successful and stress-free tax season ahead!

Below are some images related to When Should W2 Forms Arrive 2022

when does w2 forms come out 2022, when must w2 be received, when should w2 forms arrive 2022, , When Should W2 Forms Arrive 2022.

when does w2 forms come out 2022, when must w2 be received, when should w2 forms arrive 2022, , When Should W2 Forms Arrive 2022.