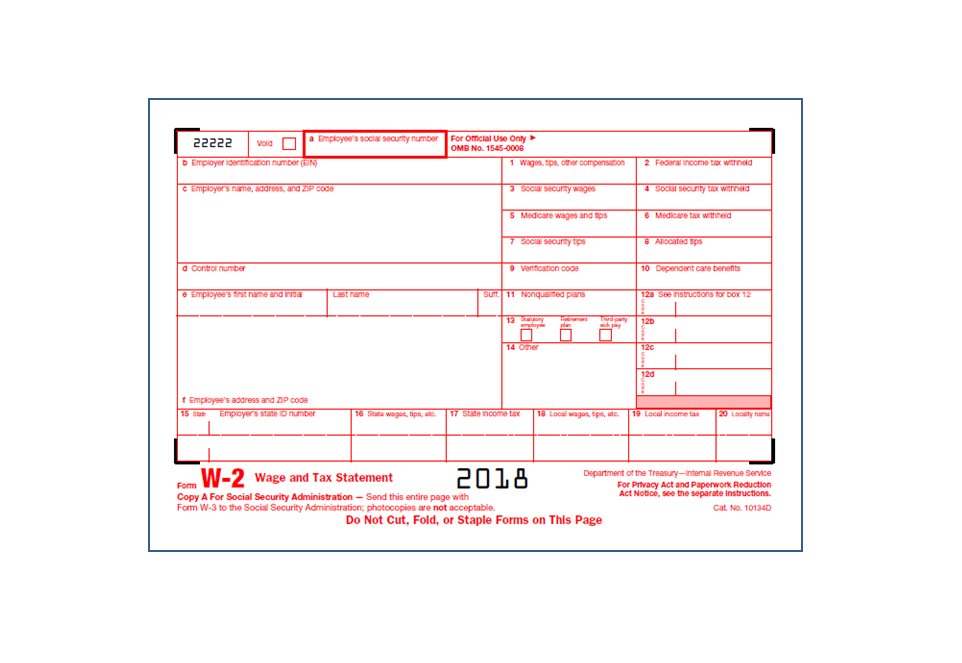

How Do I Get My W2 From My Former Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

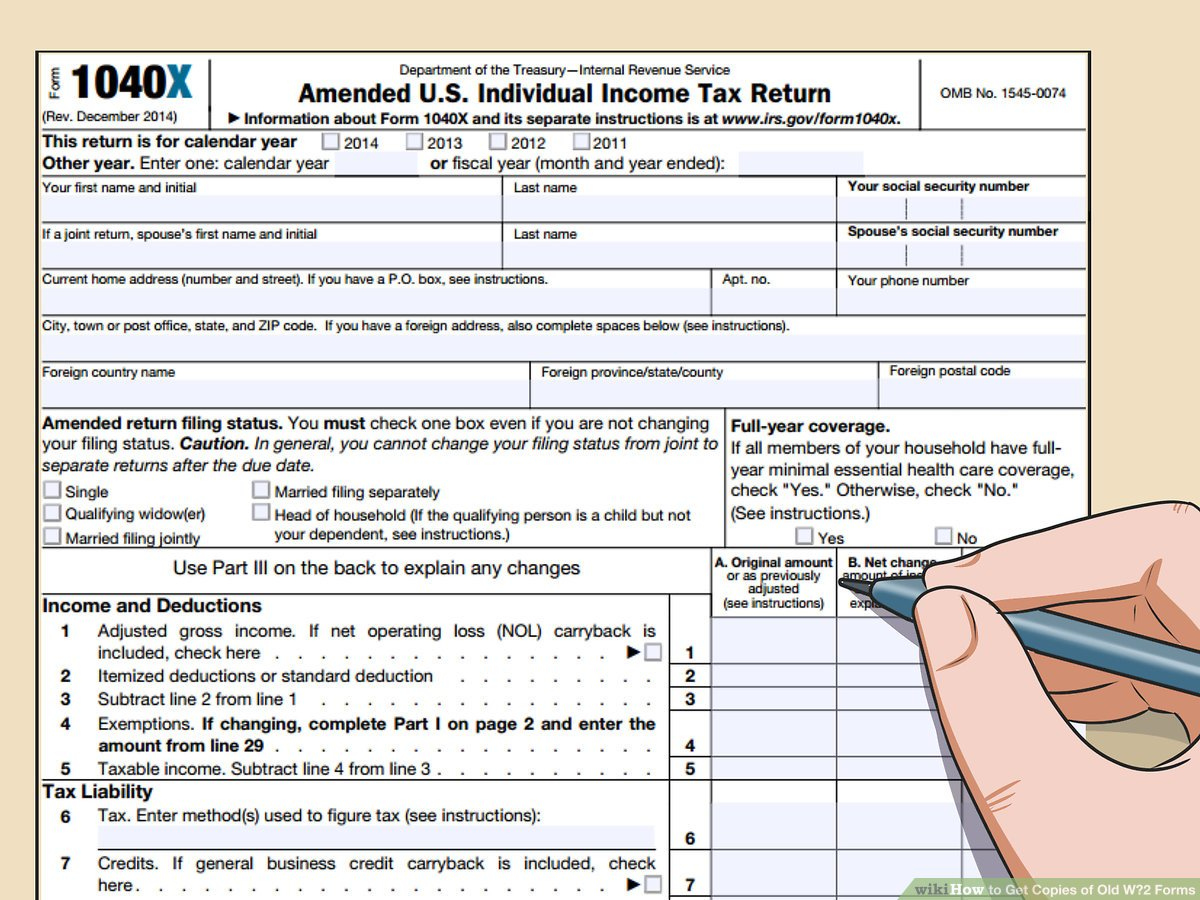

RELATED FORM…

Unlocking the Treasure: Your Guide to Retrieving Your W2!

Are you ready to embark on an exciting adventure to unlock the treasure trove of your W2 form? As tax season approaches, it’s time to uncover the secrets to retrieving this valuable document. Your W2 contains important information about your income and taxes, so it’s essential to track it down and keep it safe. Let’s dive into the process of retrieving your W2 and make it a fun and rewarding experience!

Embark on an Exciting Adventure to Unlock Your W2!

Ahoy, mateys! The quest for your W2 treasure begins with a few simple steps. First, check your mailbox for a physical copy of your W2, as many employers still send them out via mail. If it hasn’t arrived yet, don’t fret! You can also access your W2 online through your employer’s payroll system. Simply log in and navigate to the section where tax documents are stored. Once you’ve located your W2, be sure to download and save it for safekeeping.

Next, if you’ve worked multiple jobs throughout the year, make sure to gather all your W2s in one place. This will ensure that you have a comprehensive view of your income and taxes for accurate filing. Keep in mind that each employer is required to provide you with a W2 by January 31st, so reach out to any missing employers if necessary. By collecting all your W2s, you’ll be well-prepared to tackle your tax return and potentially unlock valuable tax deductions and credits.

In the final stretch of your W2 adventure, double-check the information on your W2 for accuracy. Verify that your name, Social Security number, and wages are correctly reported to avoid any delays or errors in filing your taxes. If you spot any discrepancies, reach out to your employer promptly to have them corrected. With your W2 treasure securely in hand, you’re now ready to set sail into the world of tax preparation and ensure a smooth and successful filing process. Happy tax season, and may your W2 treasure bring you financial peace of mind!

Below are some images related to How Do I Get My W2 From My Former Employer

how do i get my w-2 from previous employer 10 years ago, how do i get my w-2 from previous employer online, how do i get my w-2 from previous employer years ago, how do i get my w2 from a previous employer adp, how do i get my w2 from my employer, , How Do I Get My W2 From My Former Employer.

how do i get my w-2 from previous employer 10 years ago, how do i get my w-2 from previous employer online, how do i get my w-2 from previous employer years ago, how do i get my w2 from a previous employer adp, how do i get my w2 from my employer, , How Do I Get My W2 From My Former Employer.