W2 Form Kroger – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the W2 Magic: A Kroger Employee’s Guide to Tax Triumph!

Are you a proud member of the Kroger family? If so, you hold in your hands the key to unlocking tax success – your W2 form! This magical document holds all the information you need to breeze through tax season with ease. Whether you’re a seasoned tax filer or a newbie to the world of taxes, understanding your Kroger W2 can make a world of difference in maximizing your tax refund and minimizing your tax liability.

Your Kroger W2 is not just a piece of paper – it’s a treasure trove of information that can help you make the most of your tax return. From your total earnings to the taxes withheld from your paycheck, every detail on your W2 plays a crucial role in determining your tax liability. By familiarizing yourself with the contents of your W2, you can ensure that you’re taking advantage of all the tax deductions and credits available to you. So, don’t just file away your W2 – take the time to unravel its secrets and pave the way to tax success!

Unveiling the Secrets: How Your Kroger W2 Can Lead to Tax Success!

Ready to dive into the world of tax triumph? Your Kroger W2 holds the key to unlocking a smooth and stress-free tax season. By understanding the information on your W2, you can ensure that your tax return is accurate and complete. From your wages and tips to your retirement plan contributions, every detail on your W2 plays a crucial role in shaping your tax liability. So, grab your W2 and let’s embark on a journey to tax success together!

One of the most important sections of your Kroger W2 is Box 1, which shows your total wages for the year. This figure is used to calculate your taxable income, so it’s essential to ensure that it’s correct. Additionally, Box 2 shows the federal income tax withheld from your paycheck, while Box 17 details any contributions to retirement plans. By reviewing these sections of your W2, you can ensure that you’re maximizing your tax deductions and credits, ultimately leading to a bigger tax refund or a lower tax bill. So, don’t overlook the power of your Kroger W2 – it’s your ticket to tax success!

In conclusion, your Kroger W2 is more than just a piece of paper – it’s a roadmap to tax triumph. By understanding the information on your W2 and taking advantage of all the deductions and credits available to you, you can ensure that you’re making the most of tax season. So, embrace the W2 magic at Kroger and let it guide you to a successful tax return. Happy filing!

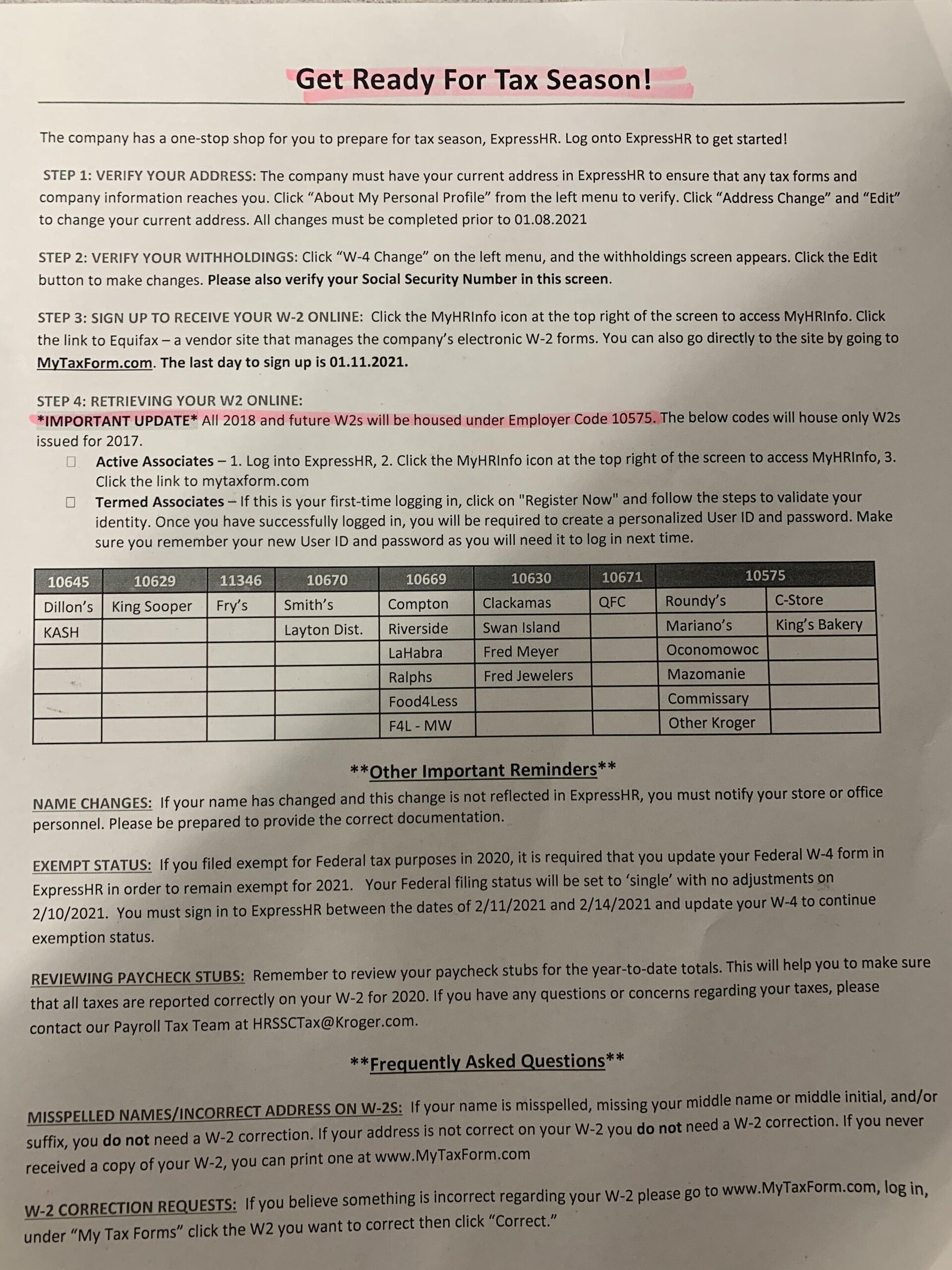

Below are some images related to W2 Form Kroger

how do kroger employees get their w2, how to get kroger w2 online, how to get w2 from kroger, w2 form kroger, where can i get my kroger w2, , W2 Form Kroger.

how do kroger employees get their w2, how to get kroger w2 online, how to get w2 from kroger, w2 form kroger, where can i get my kroger w2, , W2 Form Kroger.