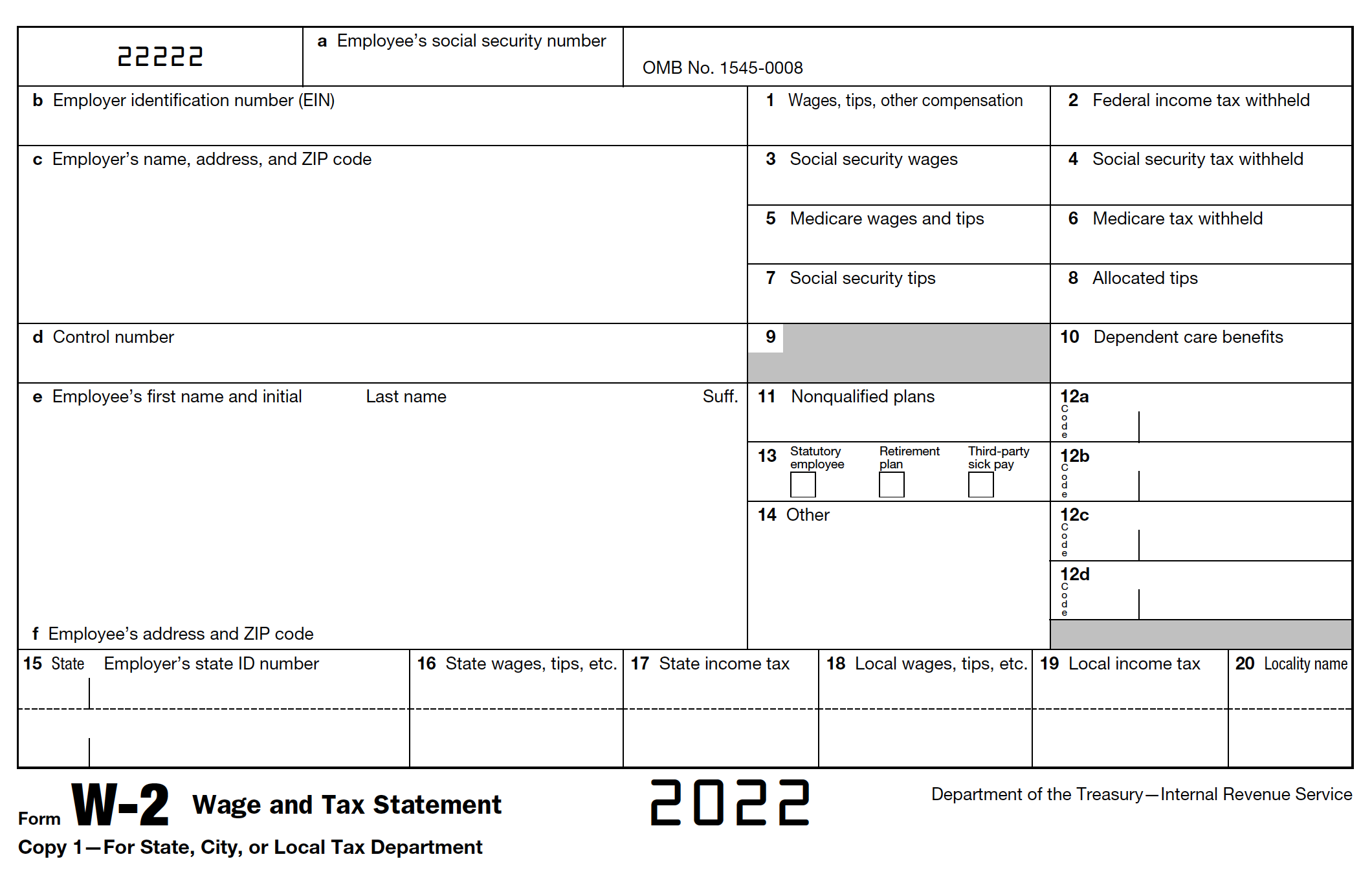

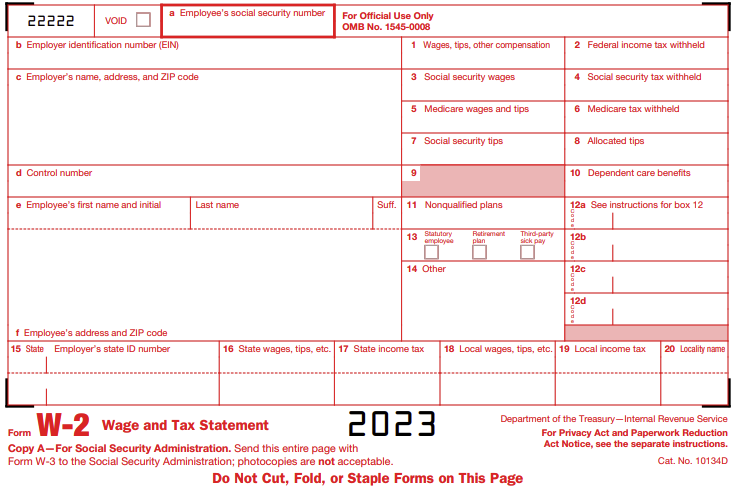

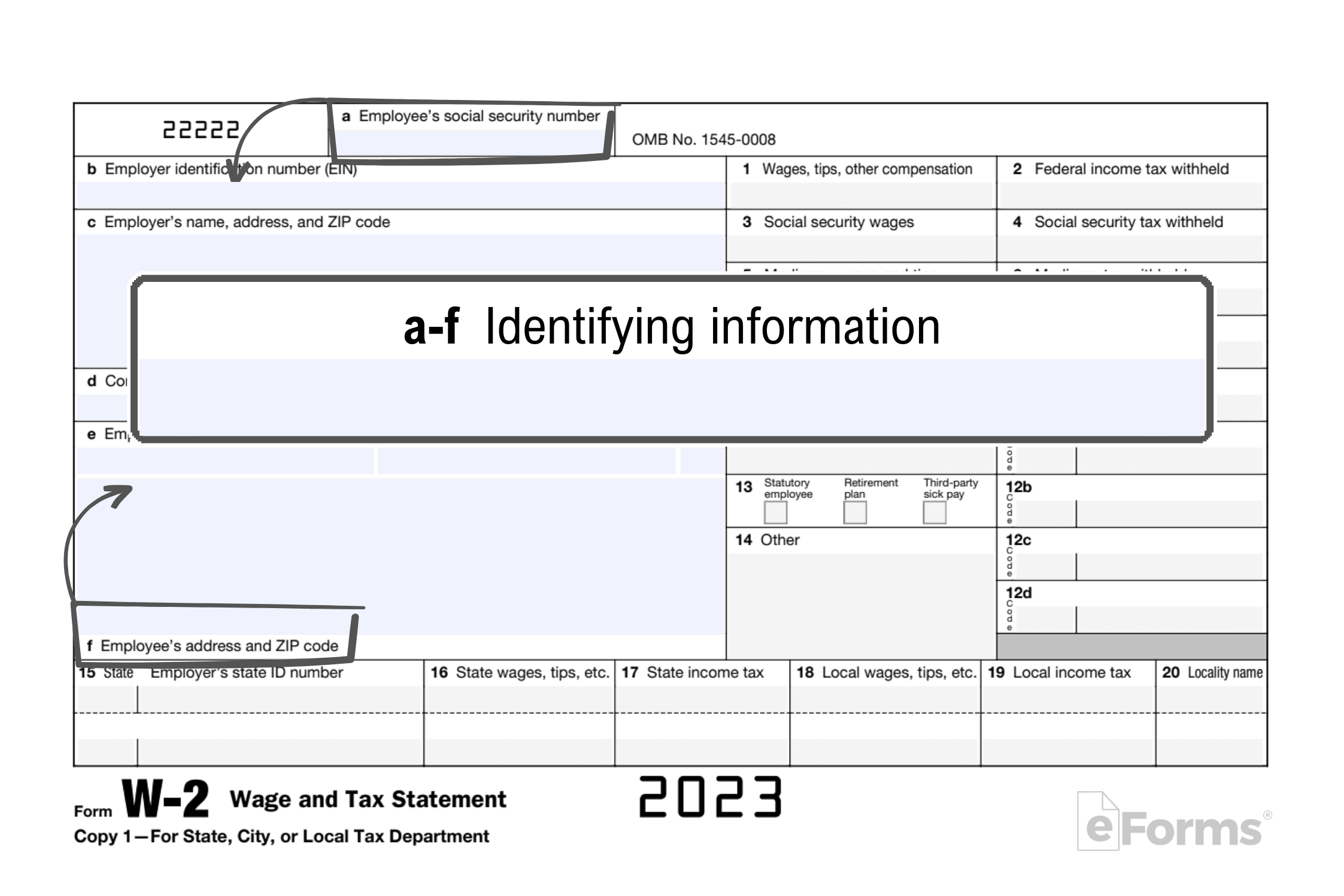

Box 2 W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

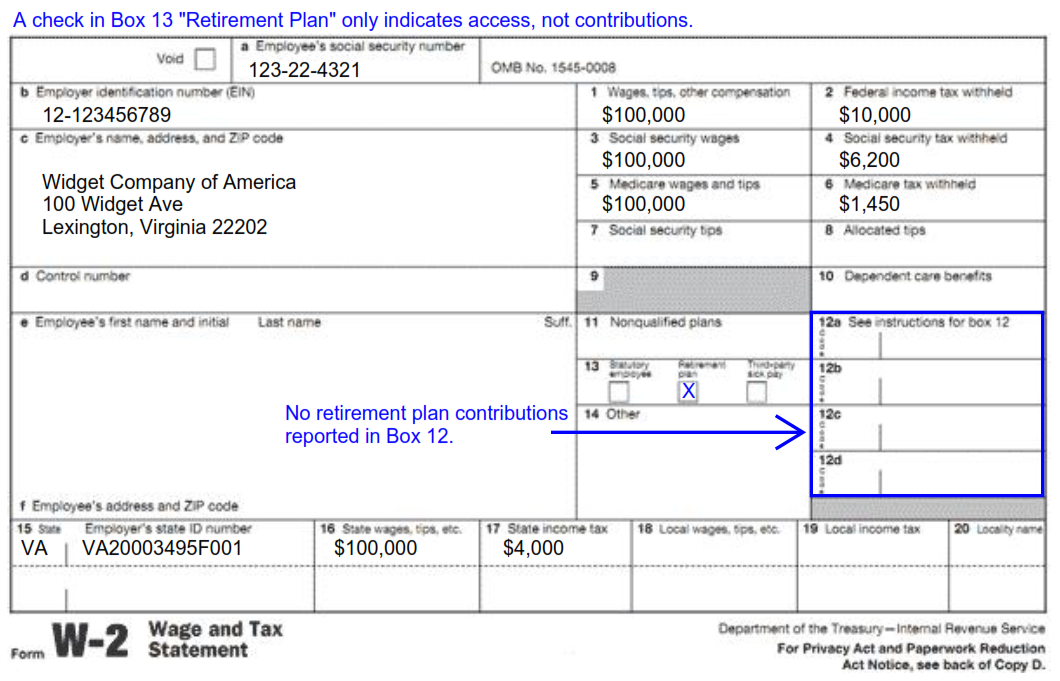

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Mystery of Box 2 on Your W2 Form

Have you ever looked at your W2 form and wondered what all those numbers and boxes mean? Well, today we’re going to dive into the intriguing world of Box 2 – the one that always seems to hold a bit of mystery. Get ready to uncover the hidden gems inside Box 2 and decode the secrets it holds about your taxes!

Decoding Box 2: What You Need to Know

When it comes to Box 2 on your W2 form, the number you see listed is the total amount of federal income tax that was withheld from your pay throughout the year. This amount is crucial for when you file your taxes, as it helps determine whether you owe more money or if you’ll be getting a nice refund. So, if you’re ever wondering why your paycheck seems a little lighter than expected, Box 2 holds the answer!

One important thing to keep in mind is that the amount listed in Box 2 is based on various factors, such as your filing status, number of allowances claimed, and any additional withholding you may have requested. It’s always a good idea to review this information for accuracy, as any mistakes could lead to issues when you file your taxes. So, take a close look at Box 2 and make sure everything adds up!

The Hidden Gems Inside Box 2 of Your W2 Form

Beyond being just a number on a form, Box 2 can actually reveal some interesting insights about your financial situation. For example, if the amount in Box 2 is significantly higher than expected, it could indicate that you had more taxes withheld than necessary. On the flip side, if the amount is lower than expected, you may owe additional taxes when you file. So, by understanding the implications of the number in Box 2, you can better plan for your tax obligations.

Additionally, Box 2 can also shed light on any changes in your financial situation throughout the year. If you received a raise, changed jobs, or had any other significant income adjustments, the amount in Box 2 may reflect these changes. By keeping an eye on Box 2 each year, you can track how your tax withholding has evolved over time and make any necessary adjustments to ensure you’re on the right track financially. So, next time you receive your W2 form, take a moment to appreciate the valuable information that Box 2 provides!

In conclusion, Box 2 on your W2 form may seem like a simple number, but it holds a wealth of information about your tax withholding and financial situation. By decoding the mysteries of Box 2 and understanding its implications, you can better prepare for tax season and stay on top of your financial health. So, don’t let Box 2 remain a mystery – take the time to uncover its hidden gems and ensure that your taxes are in order. Happy tax season!

Below are some images related to Box 2 W2 Form

box 2 w2 form, form w-2 box 2, what is box 2 on w2, what is included in box 2 of w2, why is box 2 on my w2 blank, , Box 2 W2 Form.

box 2 w2 form, form w-2 box 2, what is box 2 on w2, what is included in box 2 of w2, why is box 2 on my w2 blank, , Box 2 W2 Form.