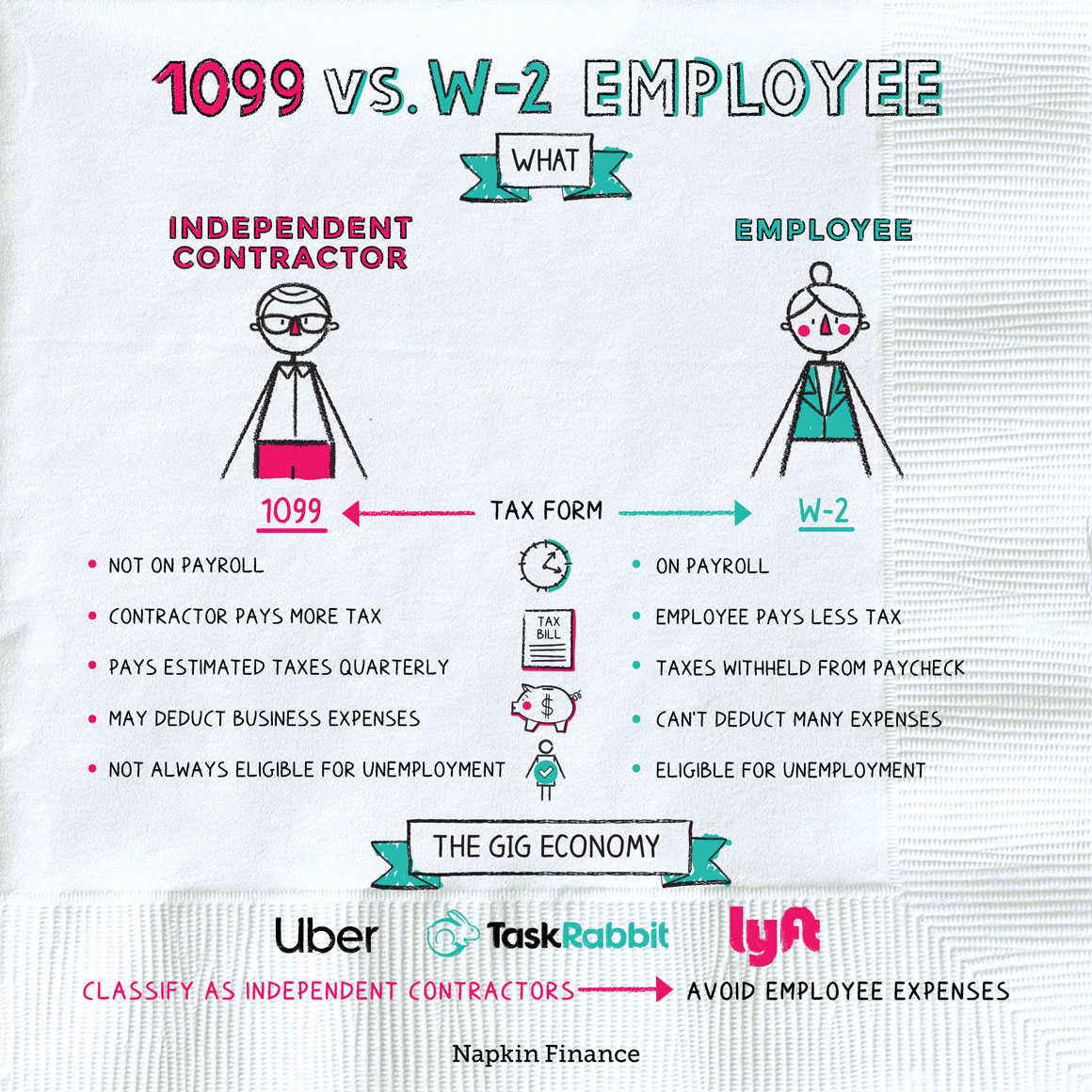

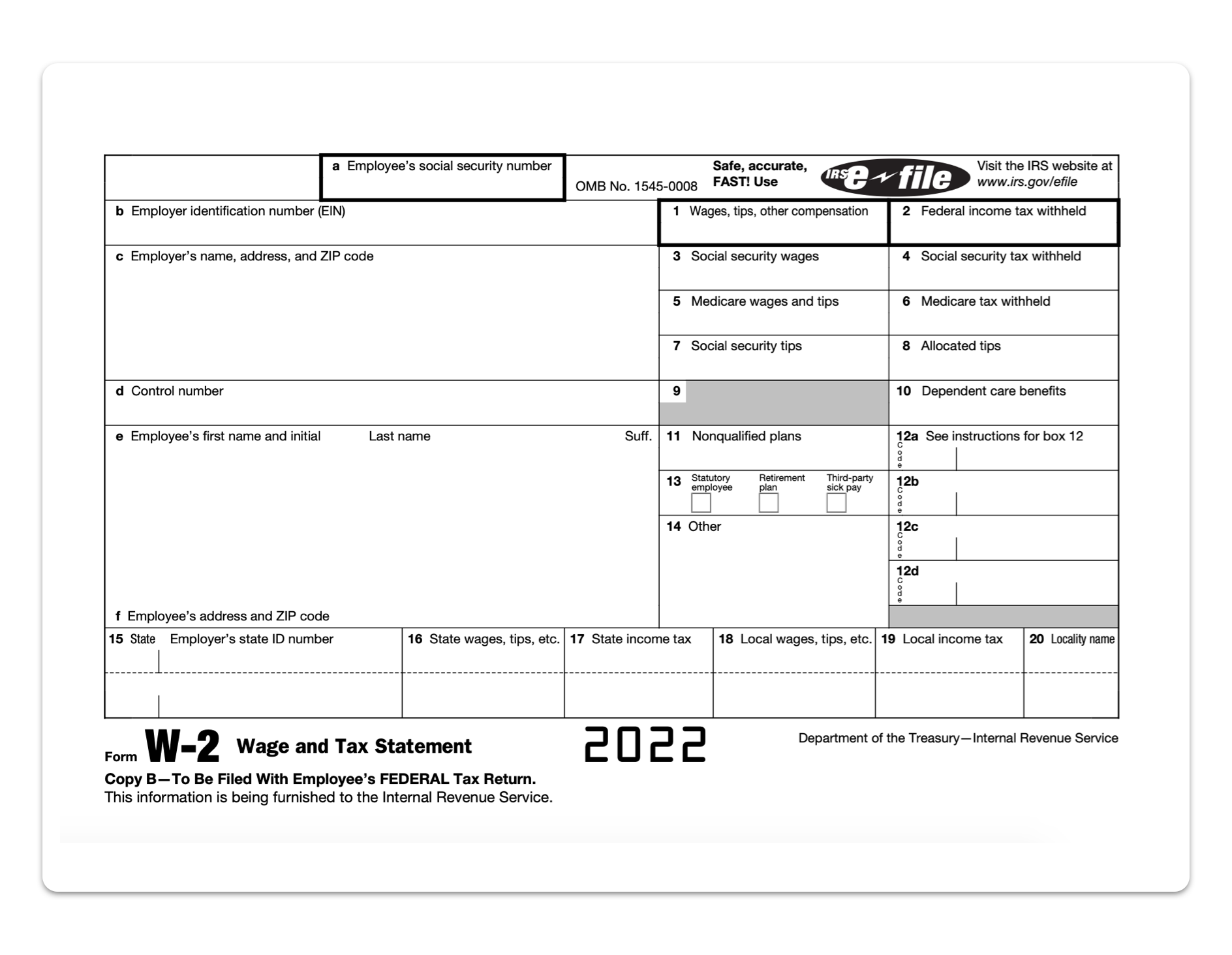

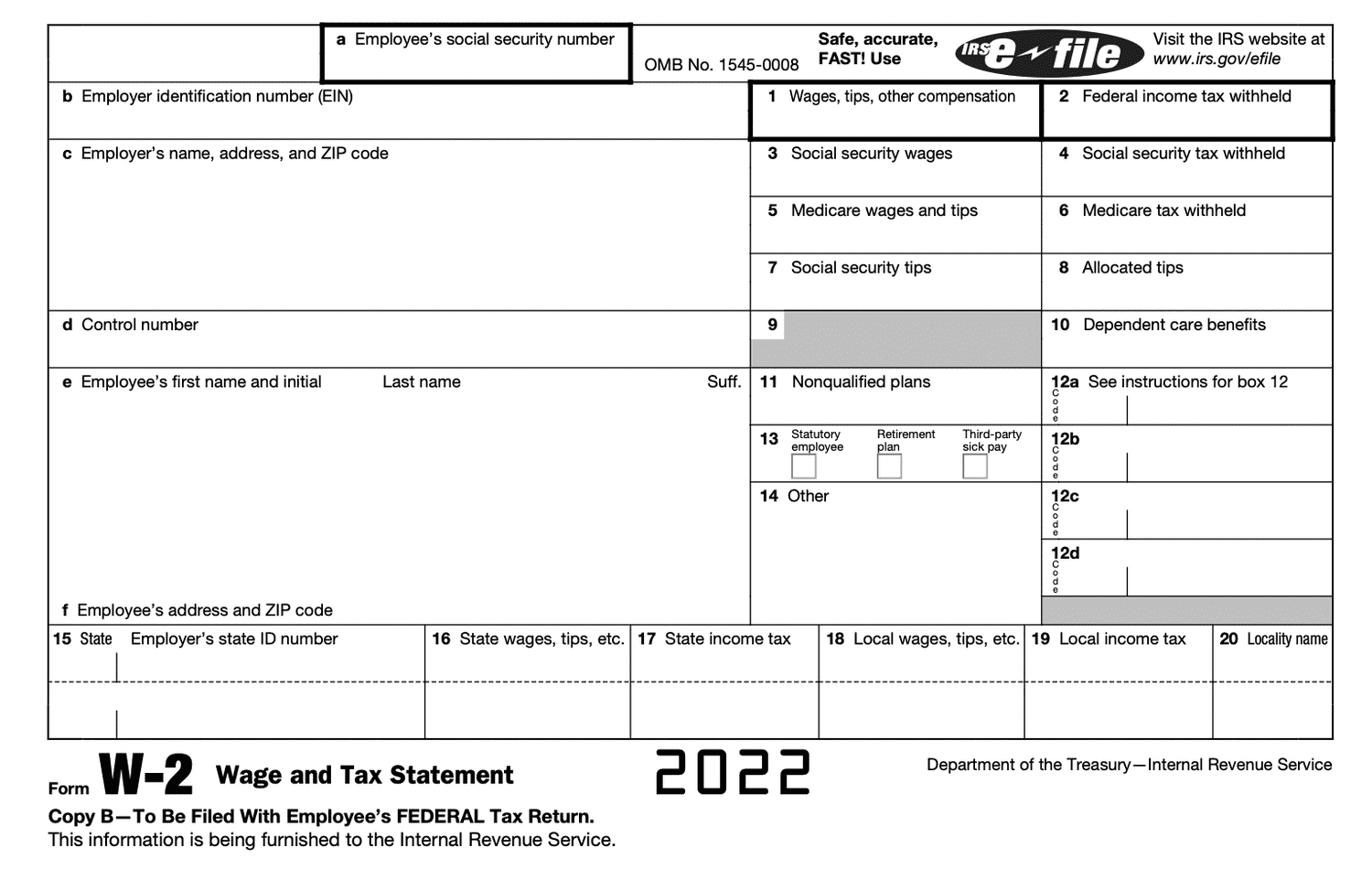

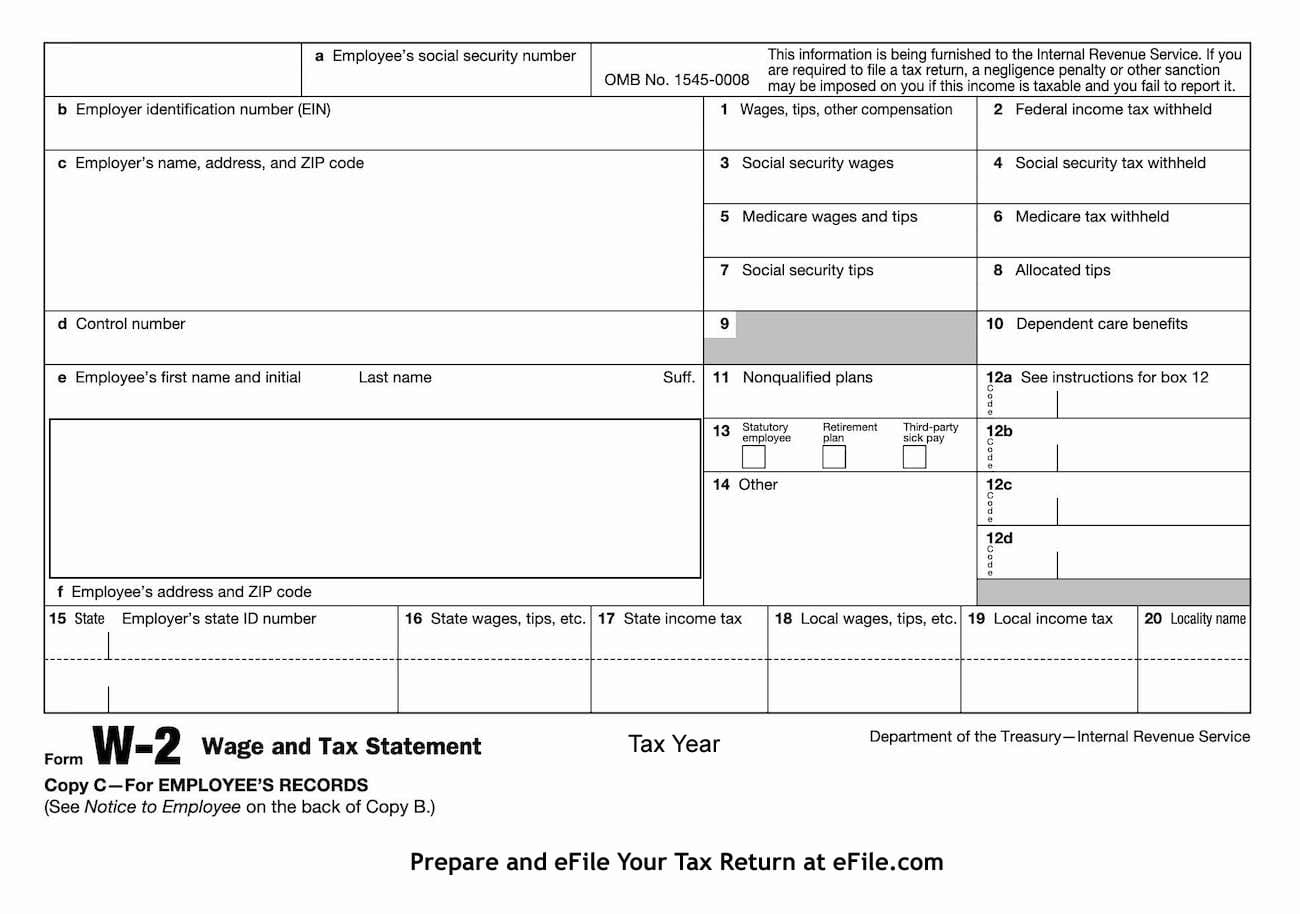

W2 Form For Independent Contractors – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Ready to Tackle Tax Season? Let’s Unwrap the W2!

Tax season can be a daunting time for many, but as a contractor, there are important steps you can take to make the process smoother and stress-free. One of the key documents you’ll need to familiarize yourself with is the W2 form. This form is essential for reporting your income and taxes paid throughout the year. By understanding how to navigate the W2, you’ll be better equipped to tackle your taxes with confidence. So, let’s unwrap the W2 and get ready to conquer tax season!

The Contractor’s Guide to Navigating Taxes with Ease!

As a contractor, your tax situation may be a bit more complex than that of a traditional employee. This is where the W2 form comes into play. The W2 will show your total earnings for the year, as well as any taxes withheld by your clients or employers. It’s important to review this information carefully to ensure accuracy. Additionally, as a contractor, you may have additional deductions and expenses that can help lower your tax liability. By keeping thorough records and working with a tax professional, you can navigate these complexities with ease and maximize your tax savings.

Conclusion

Tax season doesn’t have to be stressful, especially when you’re armed with the right knowledge and tools. By understanding the ins and outs of the W2 form and working with a tax professional, you can confidently tackle your taxes as a contractor. Remember to keep thorough records, take advantage of deductions, and stay organized throughout the year to make tax season a breeze. So, unwrap that W2, embrace tax season, and take control of your financial future!

Below are some images related to W2 Form For Independent Contractors

can you be an independent contractor and get a w2, do independent contractors get w2, w2 form for independent contractors, what is the tax form used for independent contractors, what tax form for independent contractor, , W2 Form For Independent Contractors.

can you be an independent contractor and get a w2, do independent contractors get w2, w2 form for independent contractors, what is the tax form used for independent contractors, what tax form for independent contractor, , W2 Form For Independent Contractors.