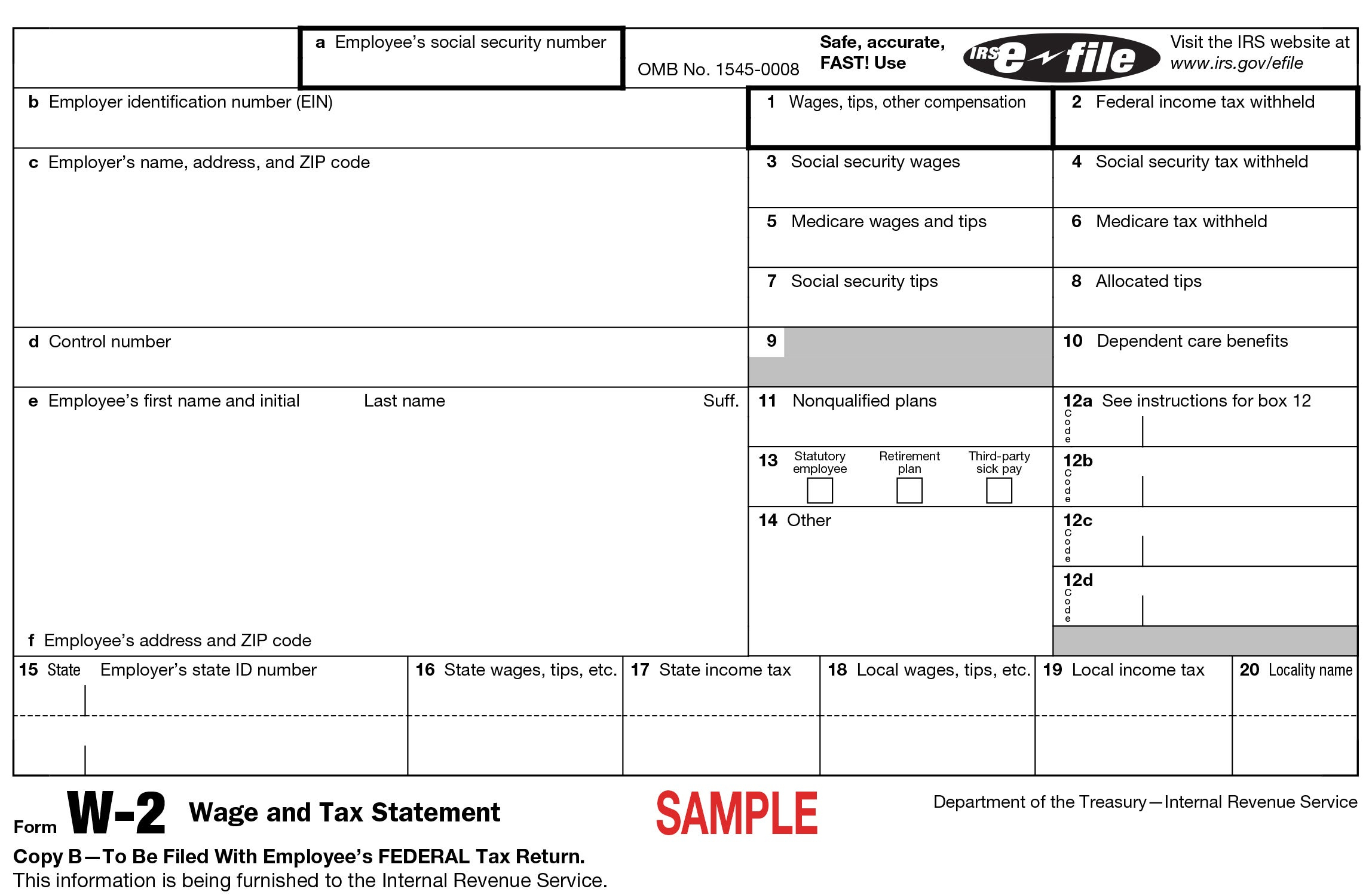

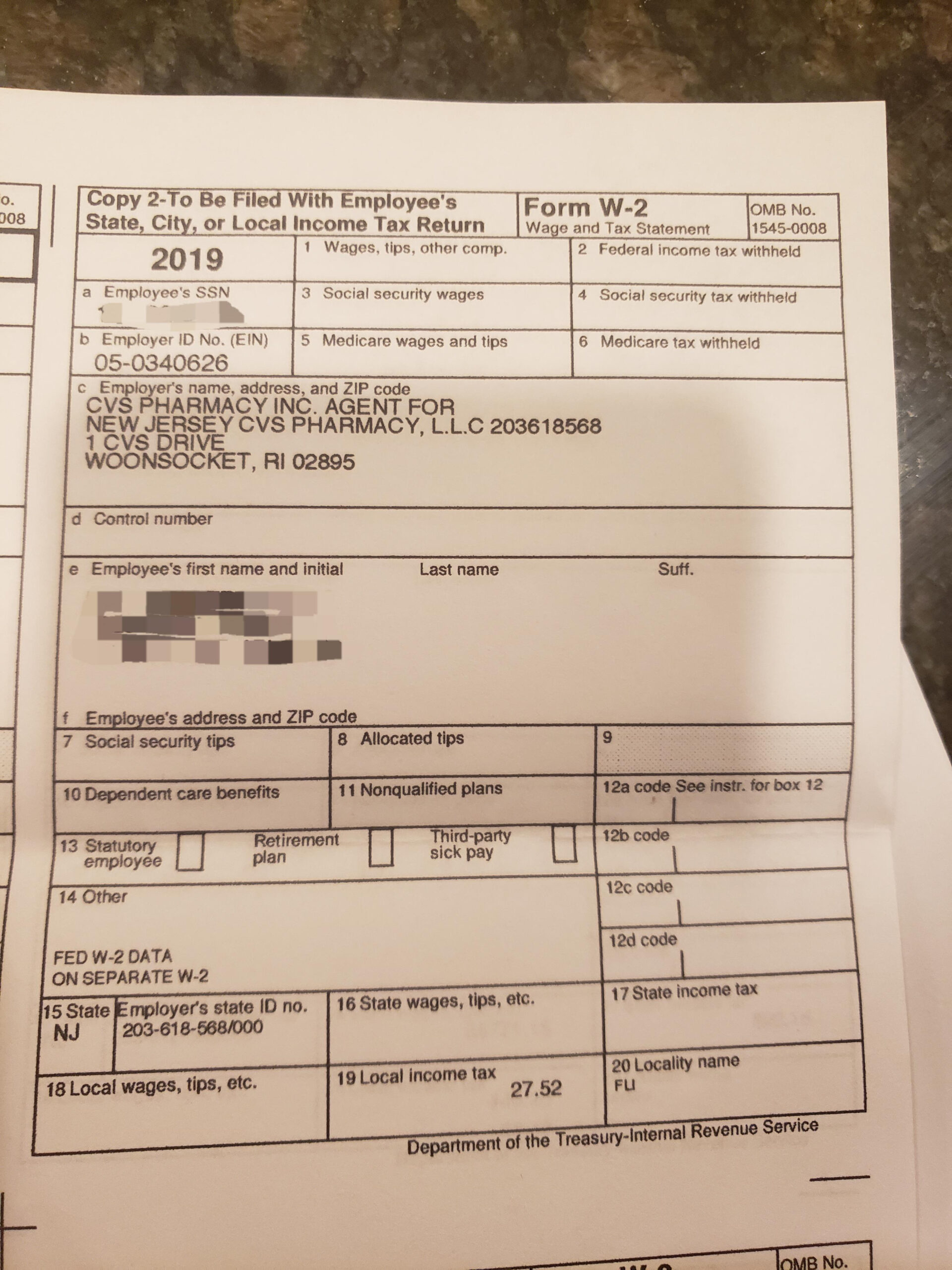

CVS W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

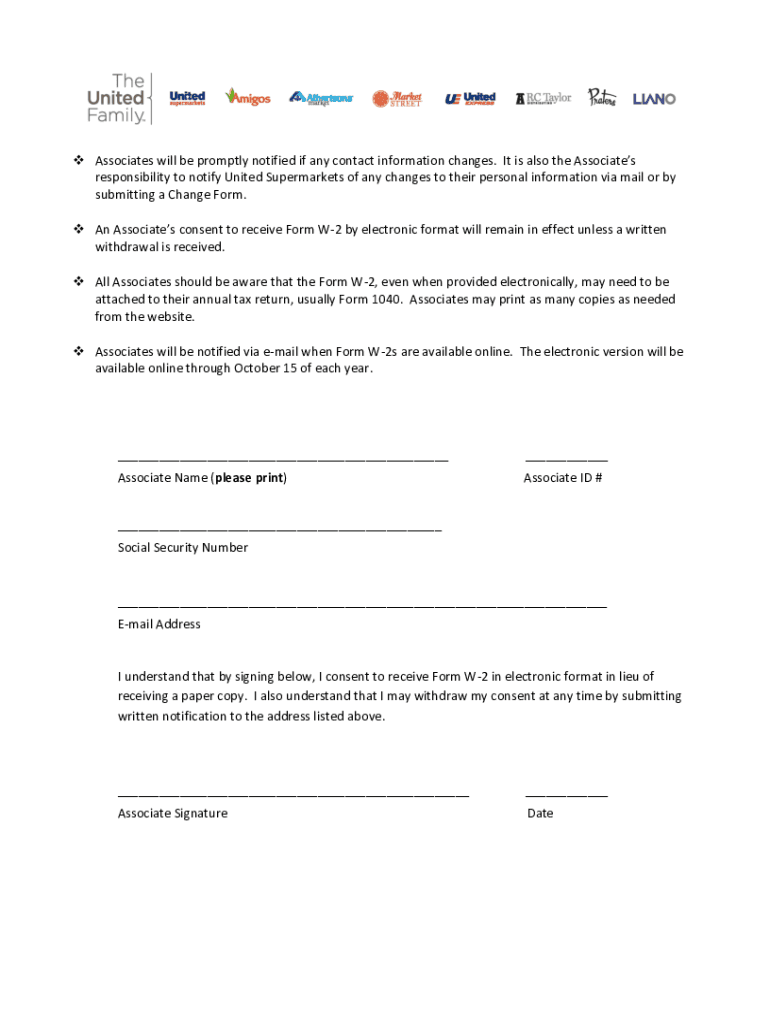

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximize Your Refund with CVS W2 Form Guide

Are you ready to unlock your tax potential and maximize your refund? Look no further than the CVS W2 Form Guide! This comprehensive guide will walk you through everything you need to know to get the most out of your taxes this year. From understanding your W2 form to identifying potential deductions, this guide has got you covered.

One of the key ways to maximize your refund is by ensuring that all the information on your W2 form is accurate. The CVS W2 Form Guide will help you decipher all the numbers and codes on your form, making it easy for you to spot any errors or discrepancies. By double-checking your W2 form with the guide, you can ensure that you are claiming all the credits and deductions you are entitled to, ultimately leading to a bigger refund.

Additionally, the CVS W2 Form Guide provides valuable tips on how to take advantage of tax-saving opportunities. From contributing to retirement accounts to claiming education credits, this guide will help you tap into every possible tax-saving strategy. By following the advice in the guide, you can make sure you are not leaving any money on the table and are getting the most out of your tax return.

Tap into Your Tax Savings with CVS W2 Form 101

If you’re feeling overwhelmed by the prospect of tackling your taxes, fear not! The CVS W2 Form 101 section of the guide breaks down the complex world of tax forms into easy-to-understand terms. Whether you’re a tax-filing novice or a seasoned pro, this section will provide you with all the information you need to confidently navigate your W2 form.

In addition to decoding your W2 form, the CVS W2 Form 101 section also offers insights into commonly overlooked deductions and credits. By familiarizing yourself with these potential savings opportunities, you can ensure that you are not missing out on any chances to reduce your tax bill. With the help of this section, you can unlock your tax-saving potential and keep more money in your pocket.

By utilizing the CVS W2 Form Guide, you can take control of your taxes and unlock your refund potential. With step-by-step instructions, helpful tips, and insightful advice, this guide will empower you to make the most of your tax return. So don’t wait any longer – dive into the guide today and start maximizing your tax savings!

Below are some images related to Cvs W2 Form

cvs w2 form 2024, cvs w2 form former employee, cvs w2 former employee, cvs w2 former employee 2024, cvs w2 former employee login, , Cvs W2 Form.

cvs w2 form 2024, cvs w2 form former employee, cvs w2 former employee, cvs w2 former employee 2024, cvs w2 former employee login, , Cvs W2 Form.