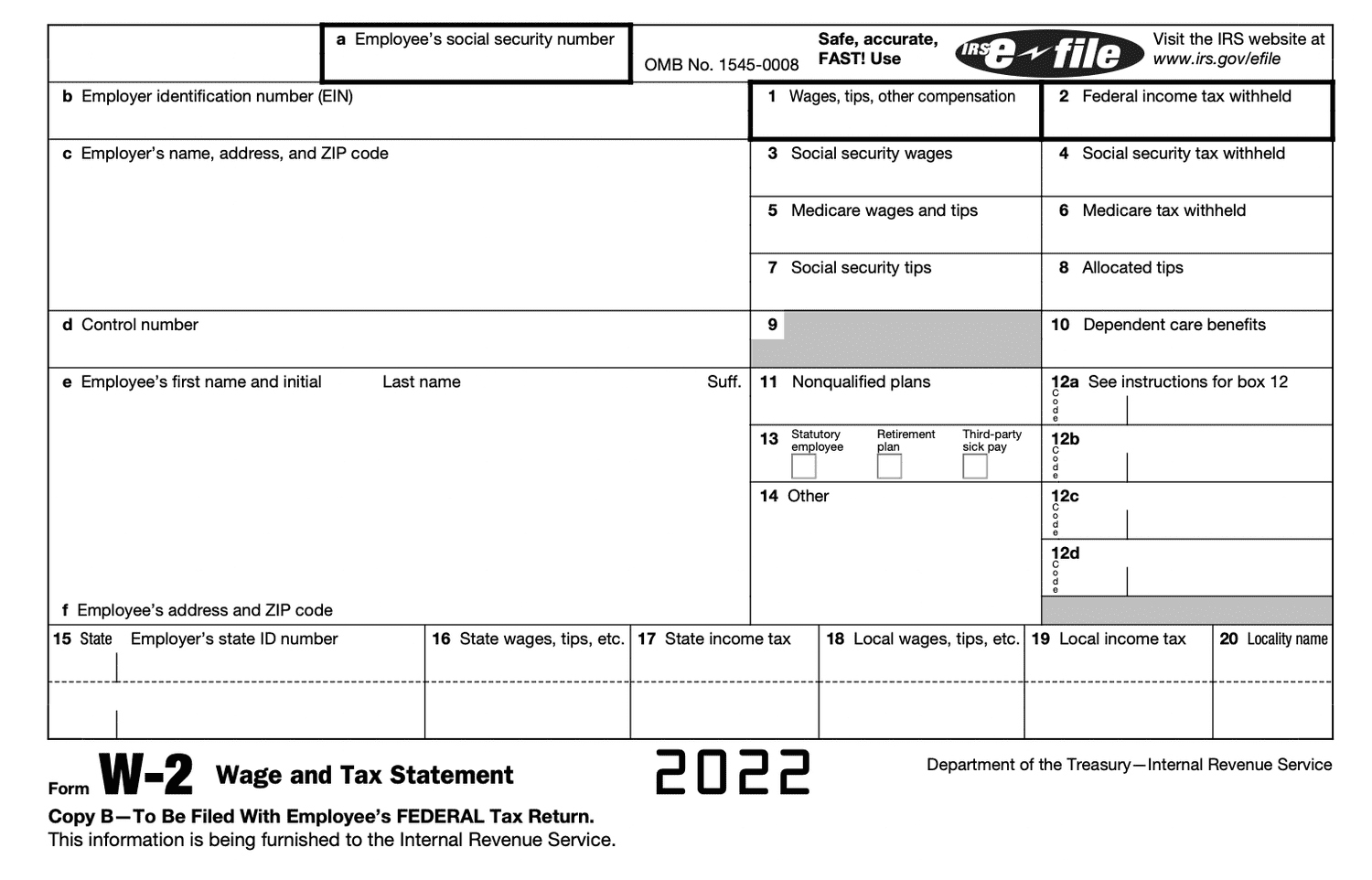

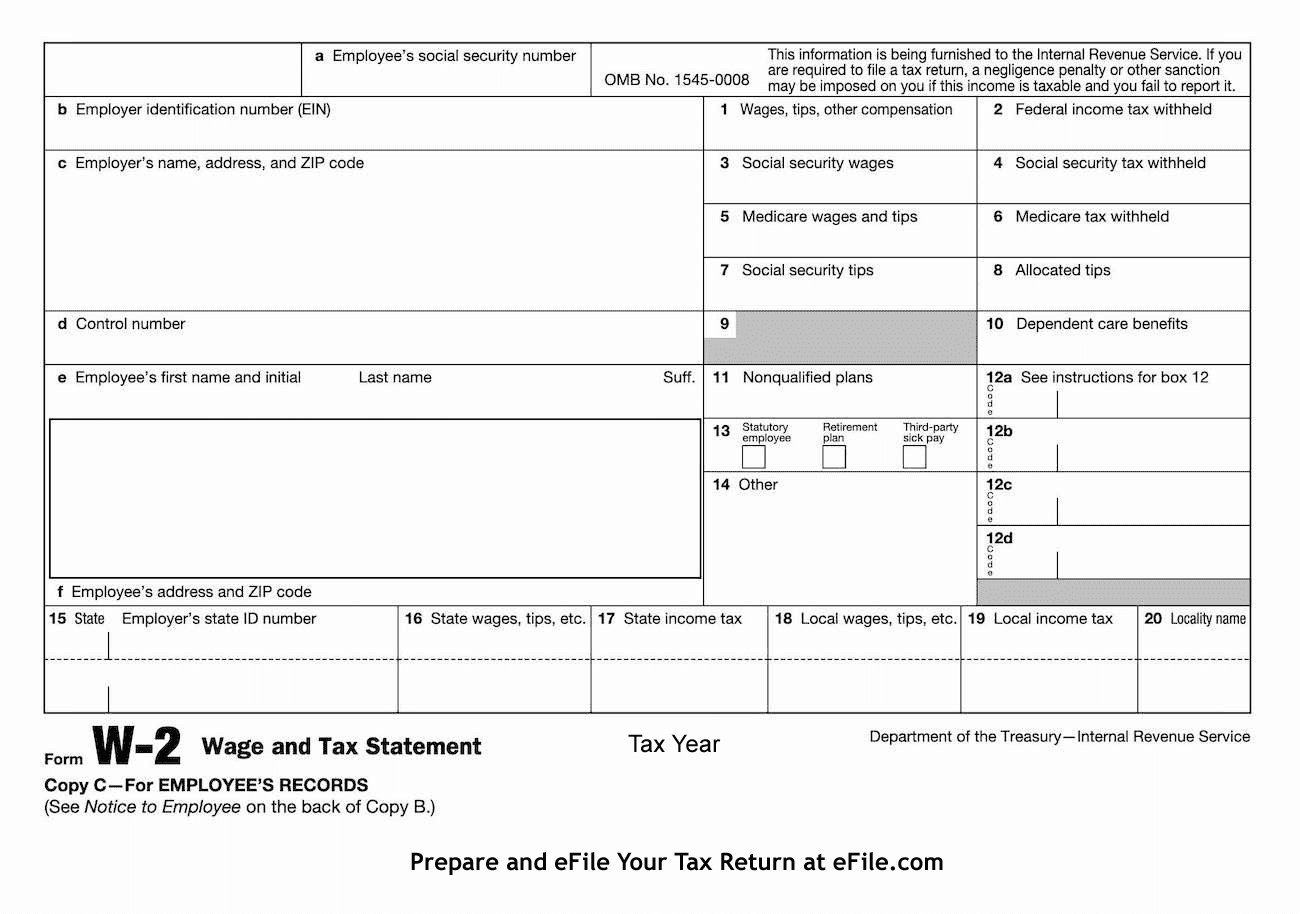

Form W2 Code V – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Cracking the Code: The Joy of Form W2 Code V

Are you ready to embark on a thrilling journey into the world of Form W2 Code V? Get ready to unravel the mystery as we explore the ins and outs of this fascinating code. From deciphering complex codes to understanding the joys of tax season, this article will take you on an exciting adventure you won’t want to miss.

Unveiling the Mystery: Form W2 Code V Explained

Form W2 Code V may seem like a daunting puzzle at first glance, but fear not! This code is simply a way for employers to report the total amount of income deferred in a retirement plan during the tax year. It’s just one piece of the larger tax puzzle, but understanding it can help you make sense of your tax return and ensure you’re maximizing your retirement savings.

So, what exactly does Code V represent? This code is used to report elective deferrals to retirement plans, such as a 401(k) or 403(b). It includes any pre-tax contributions you made to these plans throughout the year, helping you keep track of your retirement savings and plan for the future. By cracking the code of Form W2 Code V, you can gain a better understanding of your overall financial picture and make informed decisions about your retirement goals.

Let’s Dive into the Exciting World of Code V!

Now that you have a better grasp of Form W2 Code V, it’s time to dive into the exciting world of retirement planning and tax savings. By understanding this code, you can take control of your financial future and set yourself up for success in retirement. So, grab your calculator and get ready to crunch some numbers – the world of Code V is waiting for you!

Don’t let the thought of taxes and retirement planning overwhelm you. With a little knowledge and a positive attitude, you can navigate the world of Form W2 Code V with ease. So, embrace the challenge, crack the code, and reap the rewards of your hard work and dedication. The joy of Form W2 Code V is within your reach – all you have to do is take the first step towards a brighter financial future.

Below are some images related to Form W2 Code V

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] in Form W2 Code V](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-in-form-w2-code-v.jpg)

form w-2 box 14 code v, form w-2 box 14 code vpdi, form w-2 code v, form w2 box 12 code v, form w2 example, , Form W2 Code V.

form w-2 box 14 code v, form w-2 box 14 code vpdi, form w-2 code v, form w2 box 12 code v, form w2 example, , Form W2 Code V.