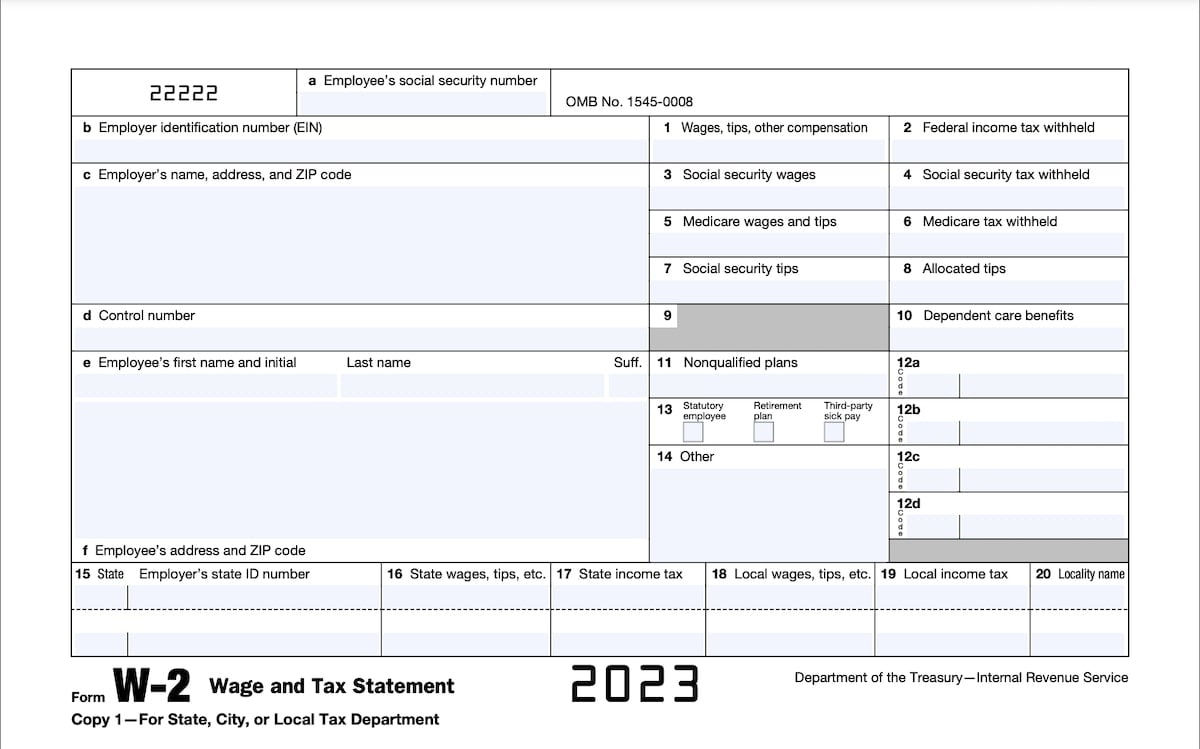

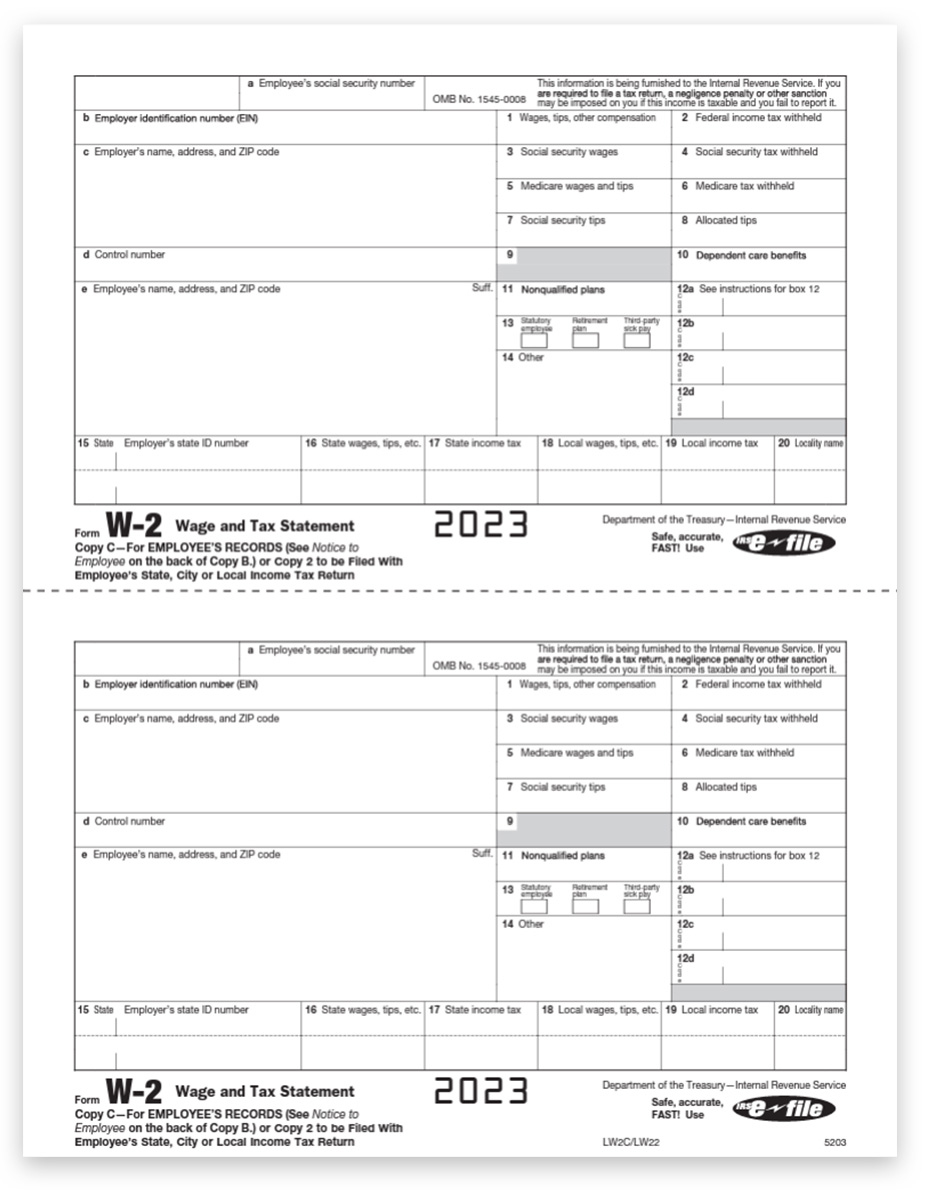

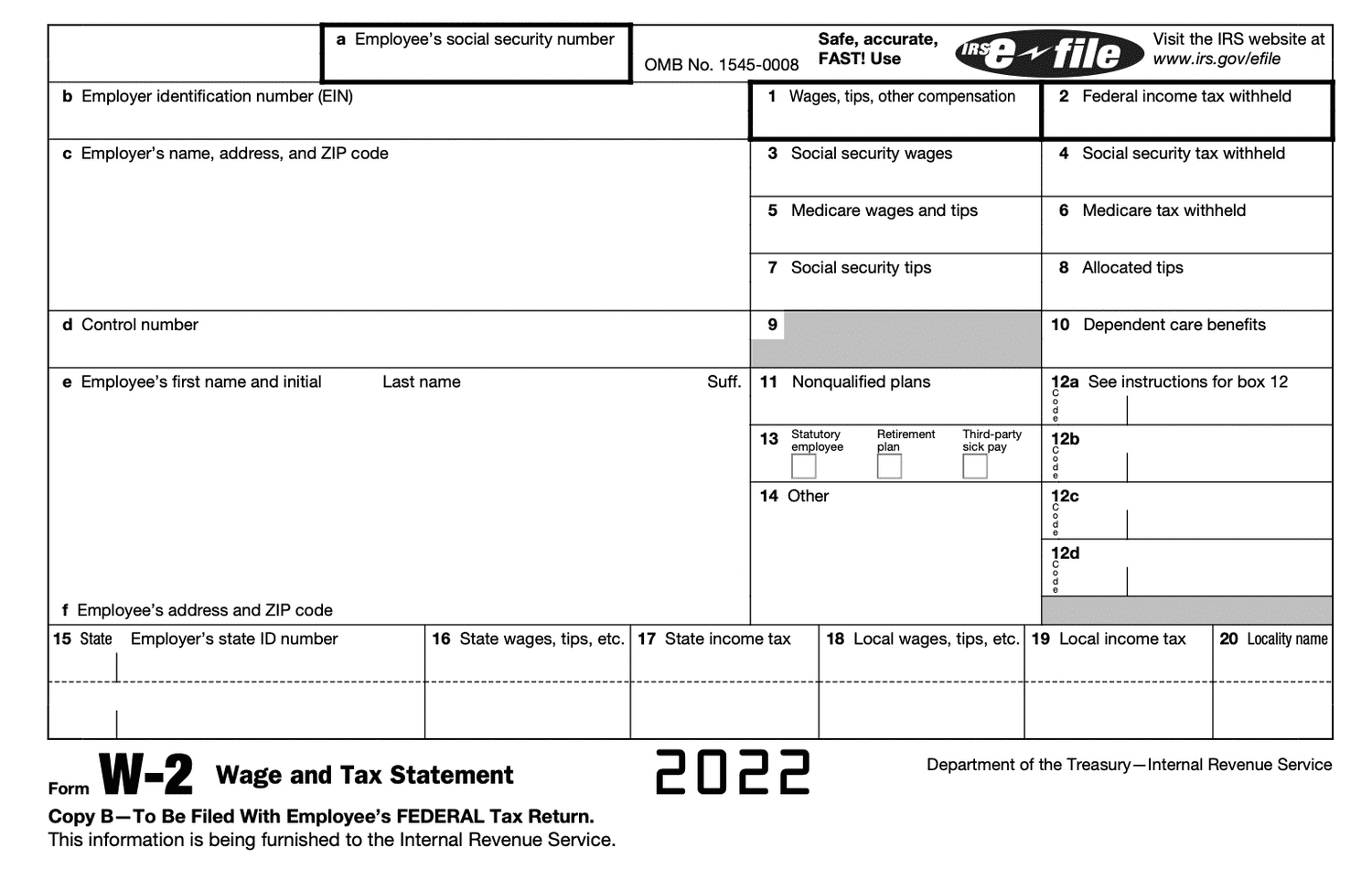

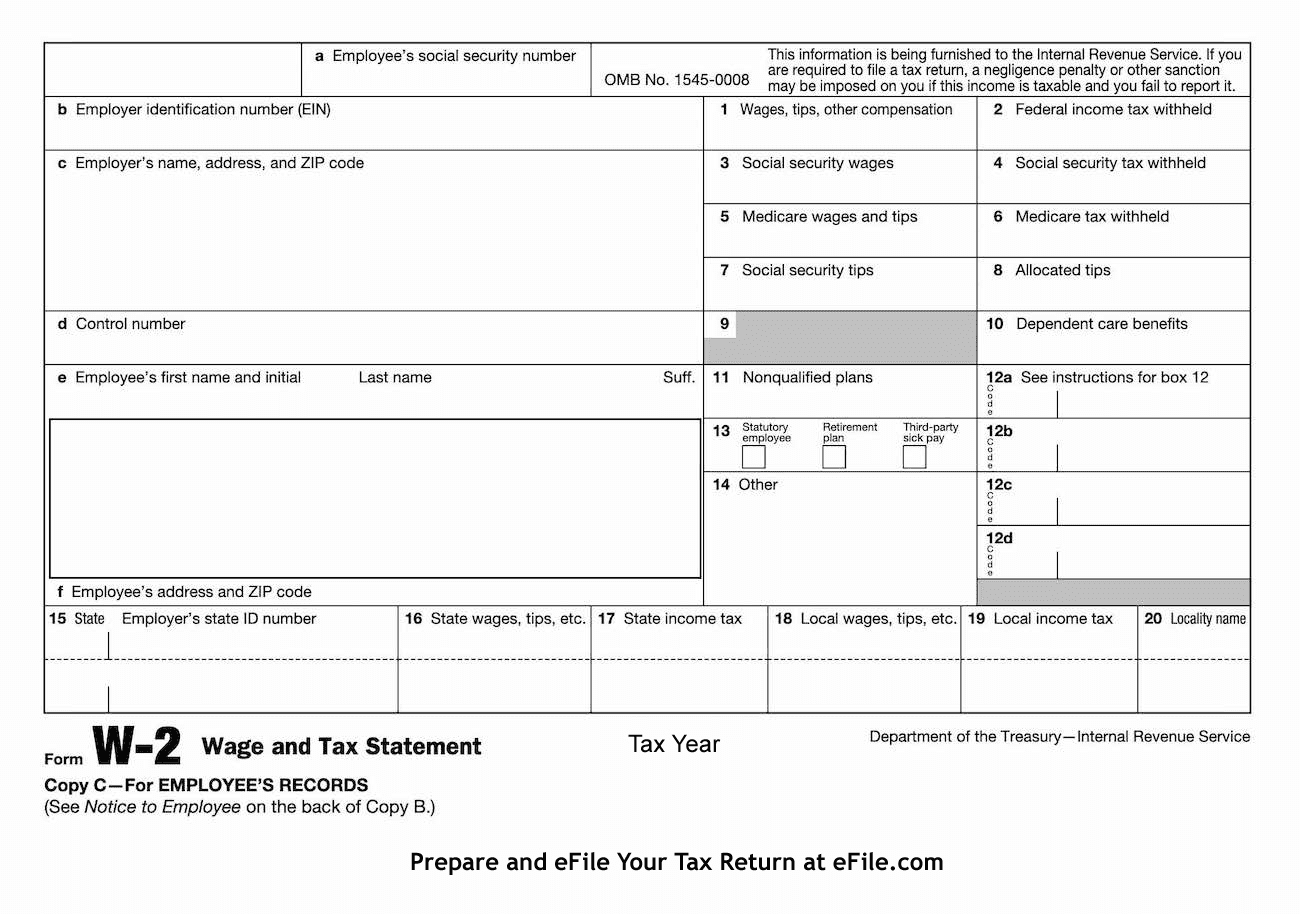

W2 Form Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock the Magic of Your W2 Form with Your Employer!

Do you want to uncover the hidden secrets of your W2 form? Look no further than your employer! Your W2 form holds valuable information about your earnings and taxes, but it also has the power to unlock a world of benefits and opportunities. By working closely with your employer, you can discover hidden treasures that will not only save you money but also enhance your overall financial well-being.

Unleash the Power of Your W2 Form!

Your W2 form is more than just a piece of paper – it is a key to unlocking a host of benefits and opportunities offered by your employer. From retirement savings plans to health insurance options, your W2 form can provide valuable insights into the benefits and perks available to you. By collaborating with your employer, you can maximize the value of your W2 form and take full advantage of the resources at your disposal.

Discover Hidden Treasures with Your Employer!

Don’t let your W2 form collect dust in a drawer – unleash its magic by working closely with your employer! By engaging in open communication and proactive discussions with your employer, you can discover hidden treasures that will enhance your financial well-being and overall job satisfaction. Whether it’s exploring new benefits or uncovering potential tax deductions, your employer is there to help you navigate the complexities of your W2 form and ensure that you are making the most of your earnings. Unlock the magic of your W2 form today and watch as new opportunities and benefits unfold before your eyes!

Below are some images related to W2 Form Employer

form w-2 employer instructions, w2 form employer, w2 form employer deadline, w2 form employer name, w2 form employer requirements, , W2 Form Employer.

form w-2 employer instructions, w2 form employer, w2 form employer deadline, w2 form employer name, w2 form employer requirements, , W2 Form Employer.