12b W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Magic of the 12b W2 Form

Do you ever feel like your W2 form is full of magic and mystery, especially when you come across the elusive 12b box? Fear not, for we are here to decode the secrets of the 12b W2 form and help you uncover its hidden enchantment. From understanding the purpose of this box to discovering how it can benefit you, let’s embark on a journey to unwrap the magic of the 12b W2 form.

Decoding the Mysteries of the 12b W2 Form

The 12b box on your W2 form may seem like a puzzling code at first glance, but it actually holds a simple explanation. This box is used to report the cost of employer-sponsored health coverage, such as medical, dental, and vision insurance. By including this information on your W2 form, your employer is providing you with a valuable benefit: the ability to see the total cost of your health coverage for the year.

Furthermore, the 12b W2 form can provide you with important information for tax purposes. While the amount reported in box 12b is not taxable income, it can still be useful for determining your eligibility for certain tax credits or deductions related to health insurance. Understanding the significance of this box can help you make informed decisions when filing your taxes and ensure that you are taking full advantage of any available benefits.

Discovering the Enchantment Within: A Guide to the 12b W2 Form

Delving deeper into the magic of the 12b W2 form, you may find that it offers more than meets the eye. By taking the time to review this box on your W2 form, you can gain valuable insights into your employer-sponsored health coverage and better understand the benefits provided to you. This information can not only help you make informed decisions about your healthcare but also empower you to take control of your financial well-being.

In addition, the 12b W2 form serves as a reminder of the importance of employer-provided benefits and the value they bring to your overall compensation package. By recognizing and appreciating the benefits included in box 12b, you can develop a deeper appreciation for the support and resources provided by your employer. So, the next time you come across the 12b box on your W2 form, remember to embrace the magic within and make the most of the enchantment it has to offer.

In conclusion, the 12b W2 form may seem like a mysterious symbol at first, but with a little guidance and understanding, you can unlock its hidden magic and discover the valuable insights it holds. By decoding the mysteries of this box and exploring the enchantment within, you can gain a deeper appreciation for your employer-sponsored health coverage and the benefits it provides. So, embrace the magic of the 12b W2 form and let it guide you on a journey to financial empowerment and well-being.

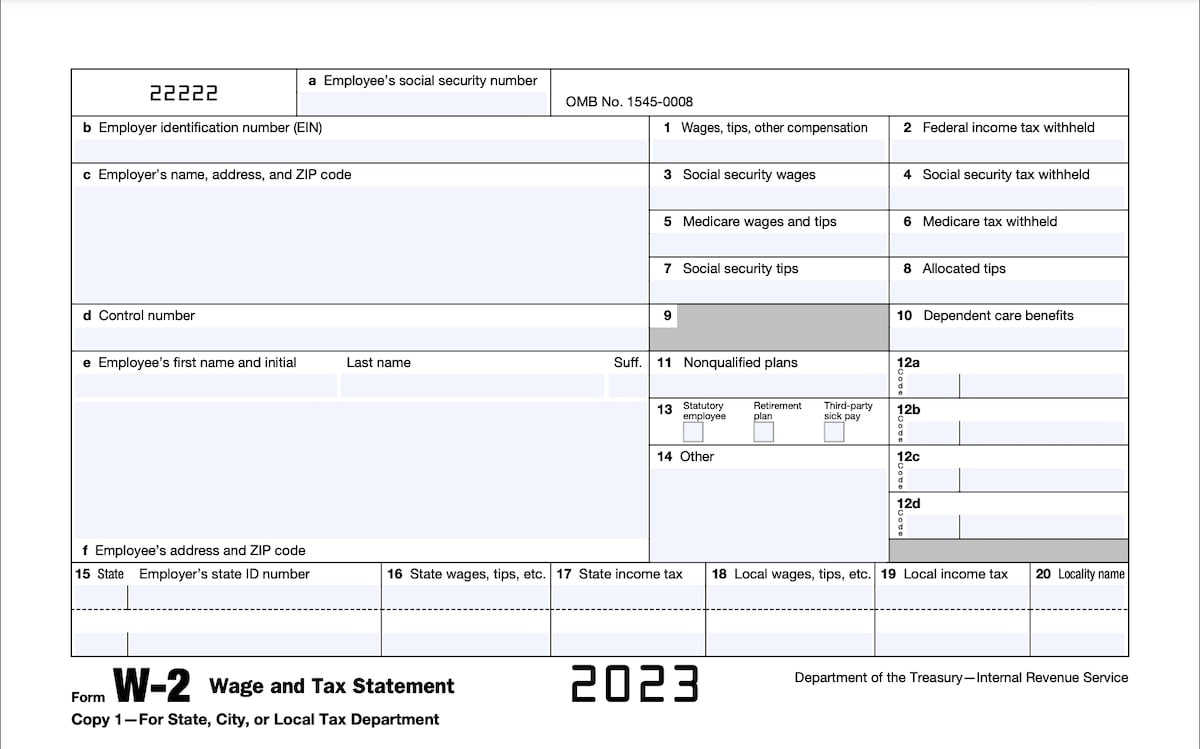

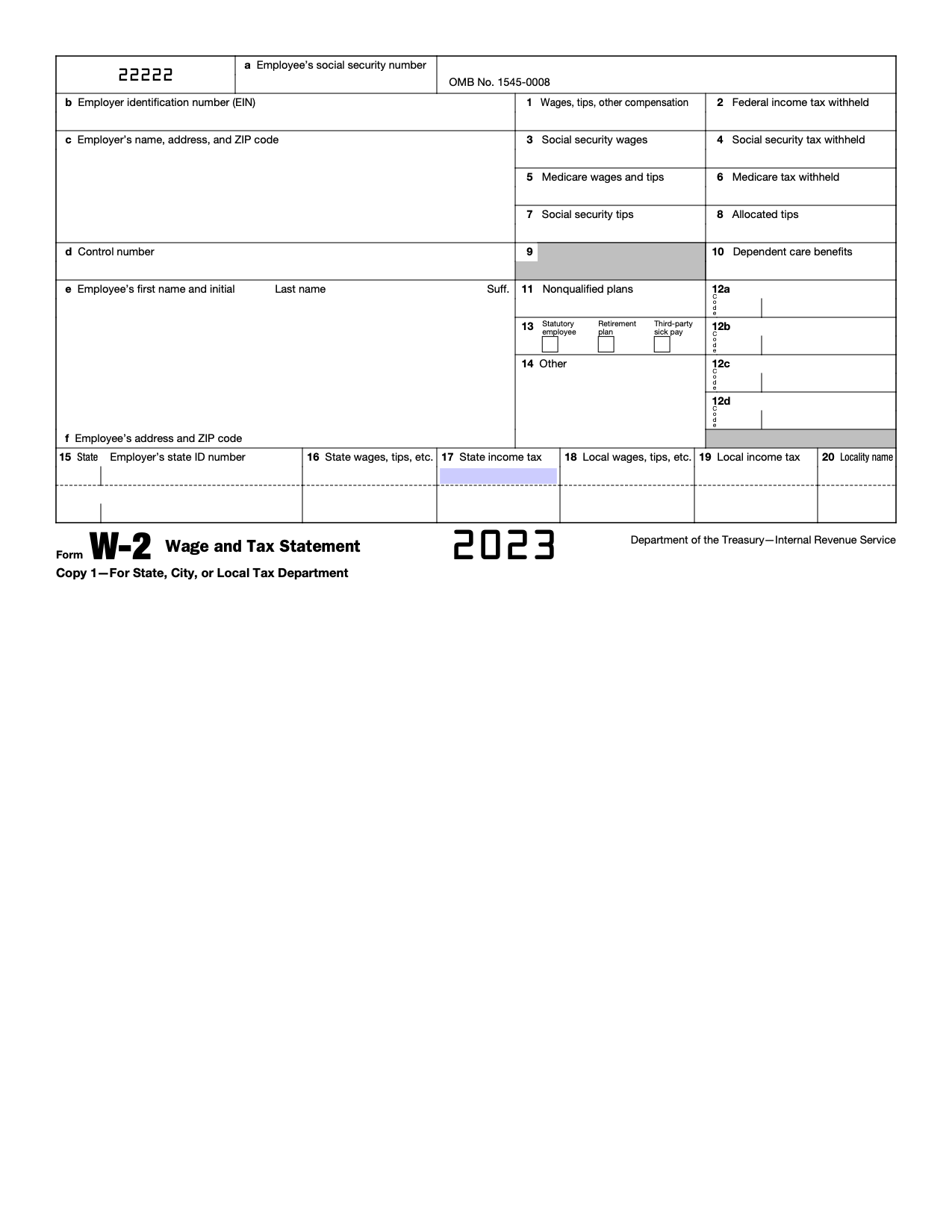

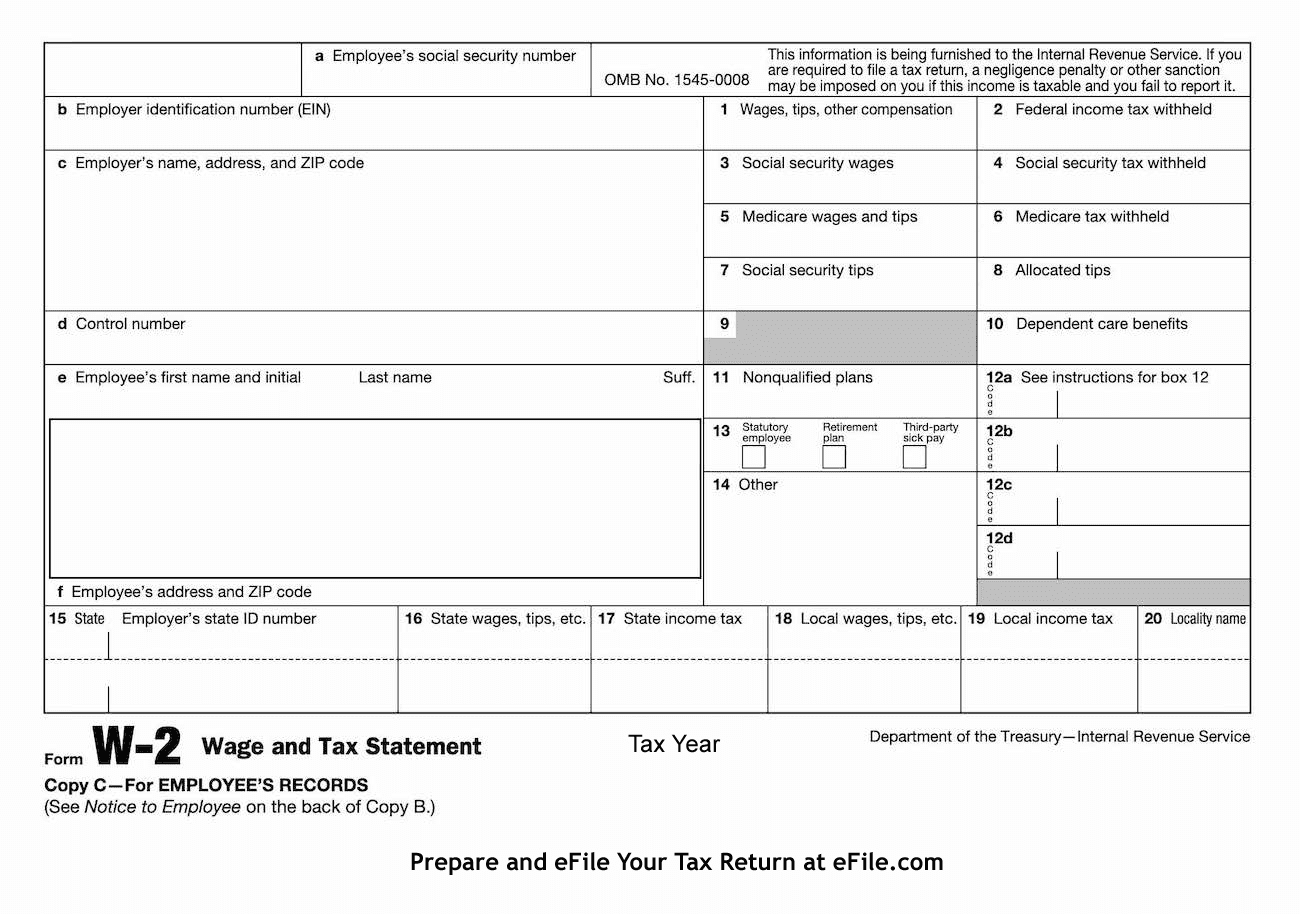

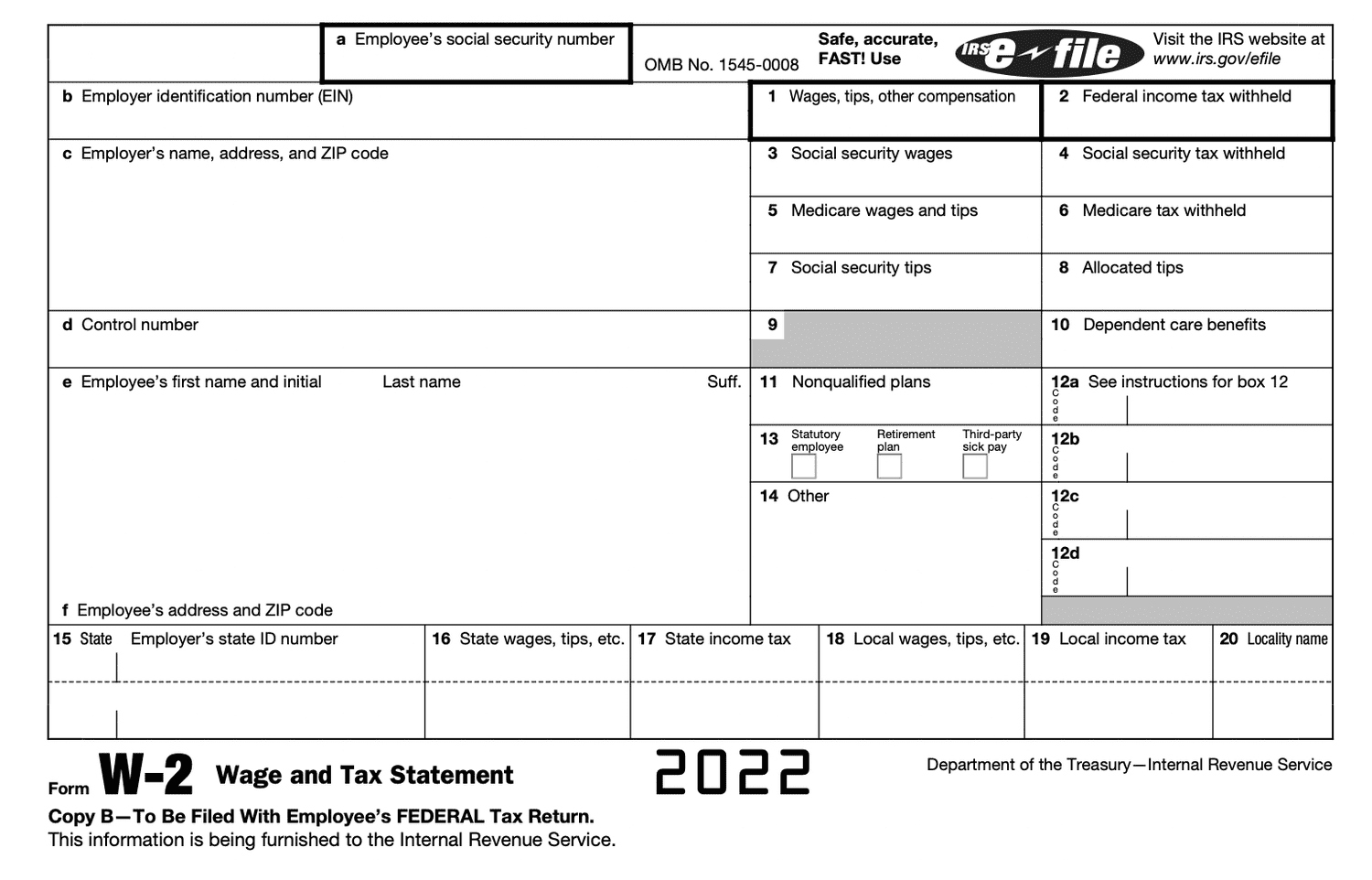

Below are some images related to 12b W2 Form

12b dd w2 form, 12b w2 form, w2 form 12b code dd, w2 form 12b code w, w2 form 12b w, , 12b W2 Form.

12b dd w2 form, 12b w2 form, w2 form 12b code dd, w2 form 12b code w, w2 form 12b w, , 12b W2 Form.