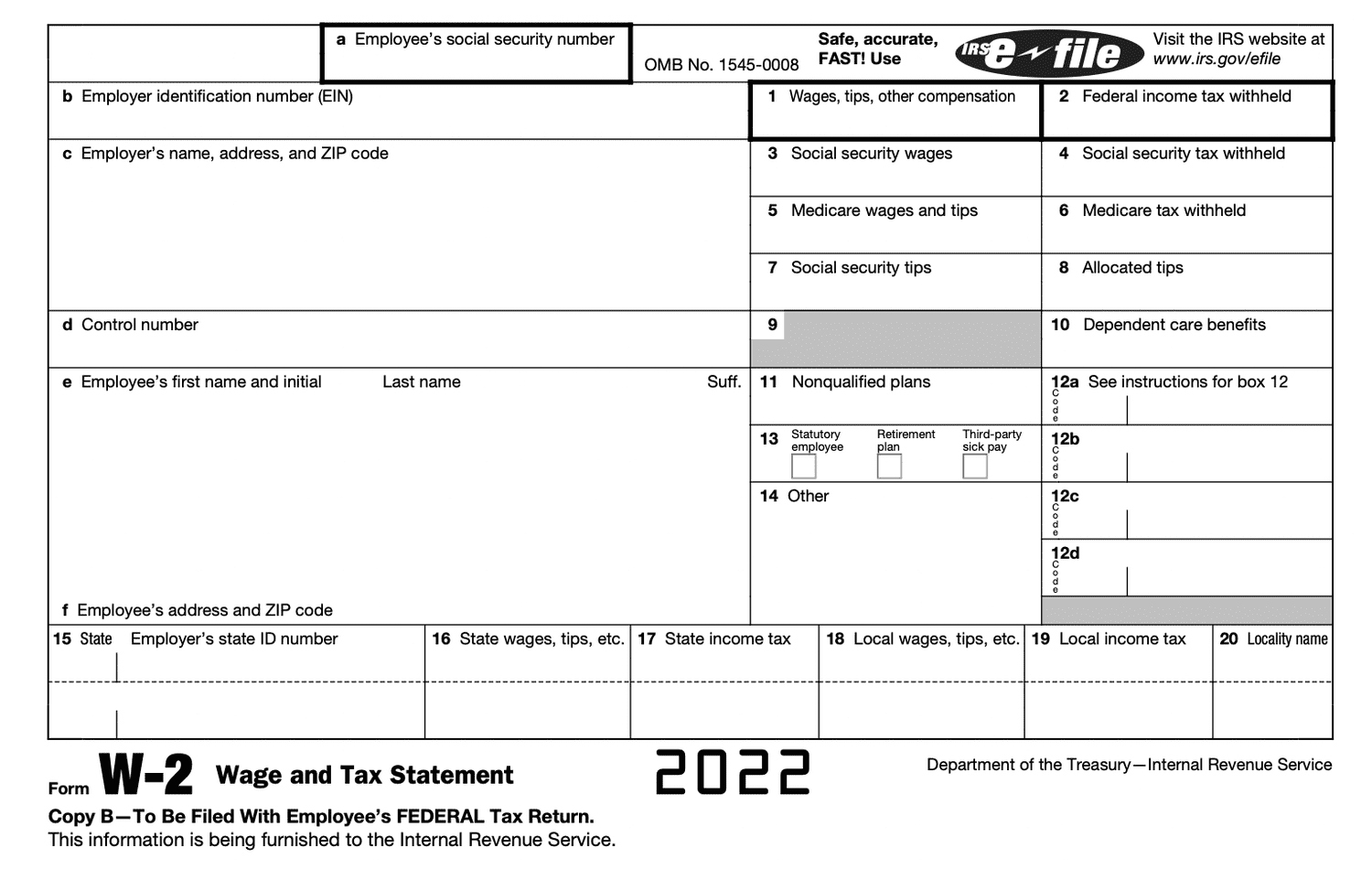

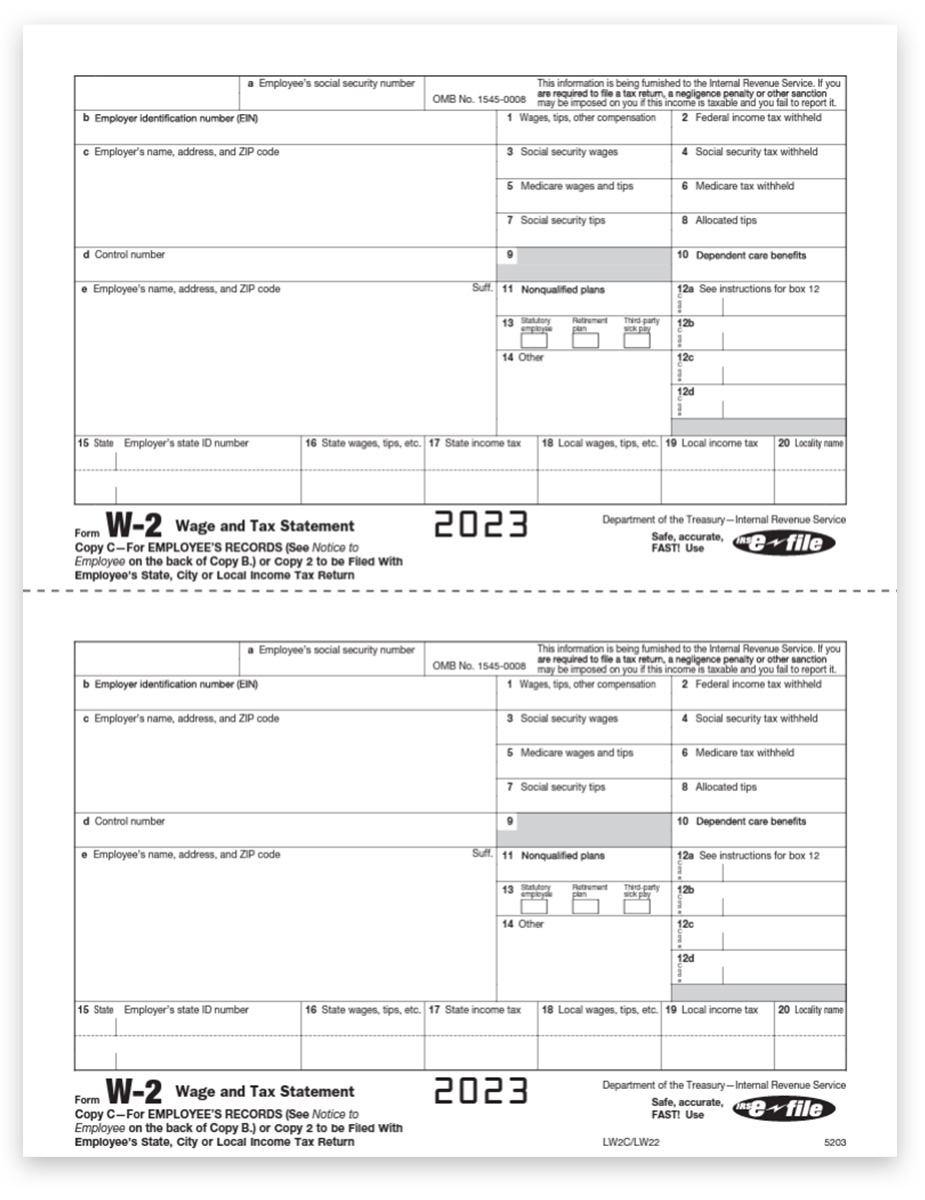

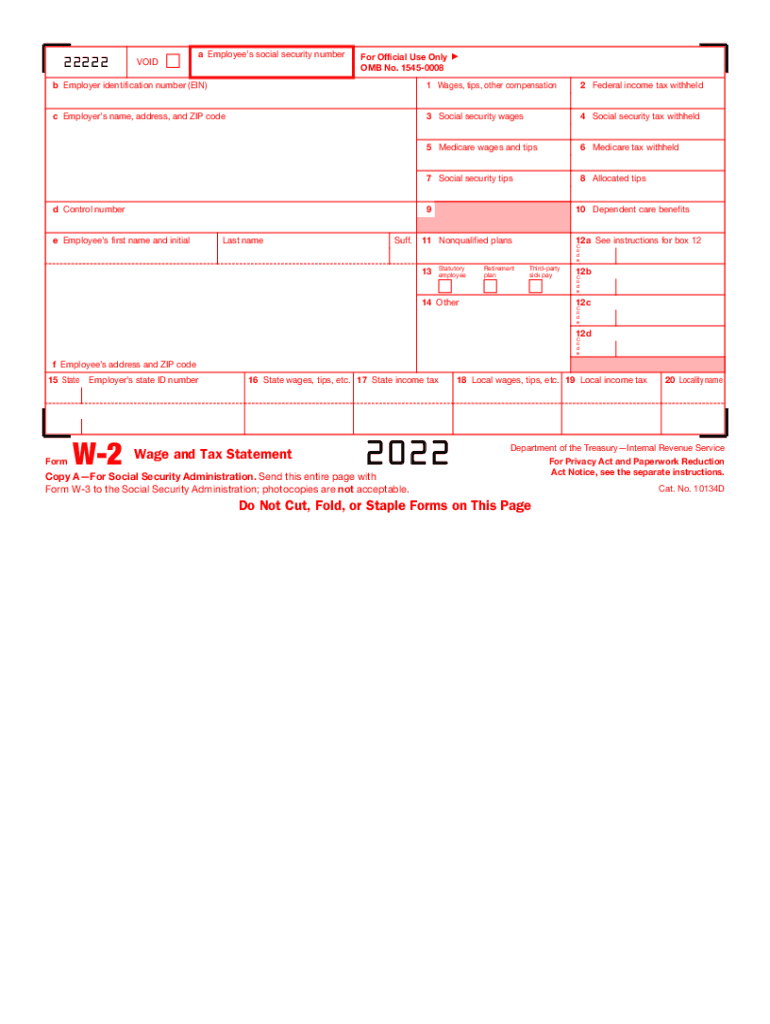

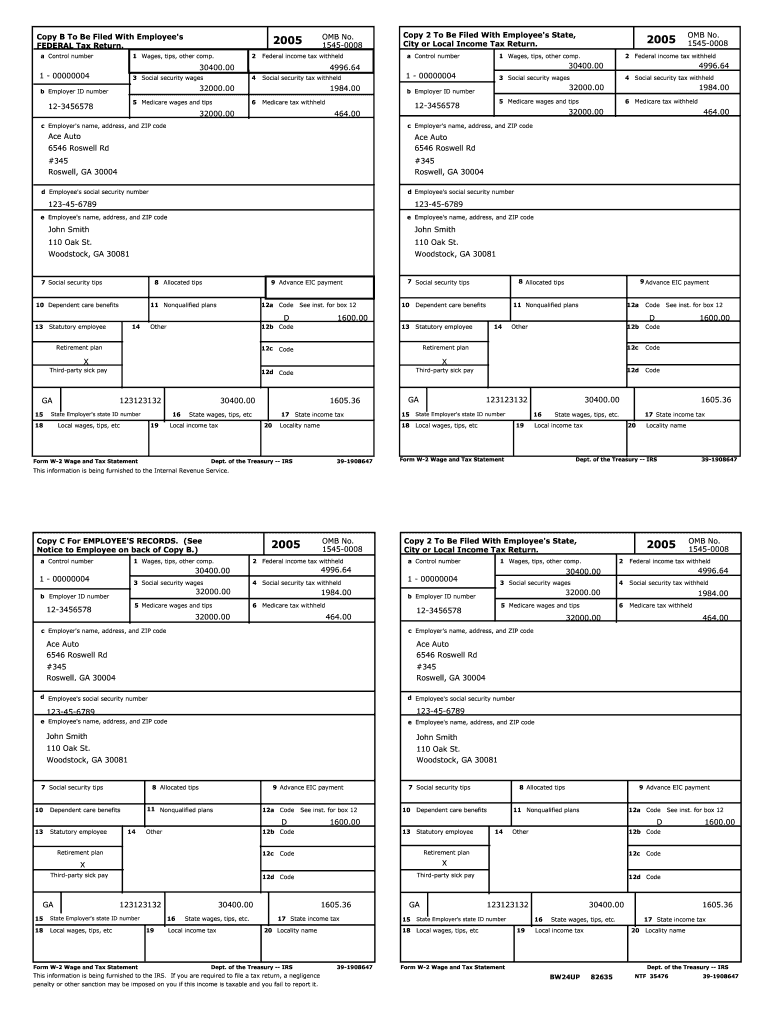

Blank 2022 W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Get Excited: Fill Out Your Blank 2022 W2 Form!

Are you ready to tackle tax season head-on? Well, get excited because it’s time to fill out your blank 2022 W2 form! This important document is essential for reporting your earnings and taxes withheld to the IRS. But don’t worry, we’re here to make the process as easy and stress-free as possible. So grab your favorite pen, brew a cup of coffee, and let’s get started on filling out that blank form!

Whether you’re a seasoned pro or a first-time filer, there’s no need to be intimidated by the W2 form. With a little bit of guidance and attention to detail, you’ll have it filled out in no time. So put on your favorite playlist, find a comfy spot to work, and let’s simplify tax season together. By the time you’re done, you’ll feel like a tax-filing rockstar!

As you sit down to fill out your blank 2022 W2 form, remember that you’re not alone. There are plenty of resources available to help you along the way, including online guides, tax professionals, and even helpful friends or family members. So don’t be afraid to ask questions if you get stuck or need clarification on any part of the form. With a positive attitude and a willingness to learn, you’ll have your W2 form completed and ready to go in no time!

Simplify Tax Season: Your Guide to Completing the W2 Form

The W2 form may seem daunting at first glance, but with a little bit of organization and patience, you’ll be able to breeze through it in no time. Start by gathering all of the necessary information, including your personal details, employer information, and income and tax withholding amounts. Once you have everything you need, it’s time to start filling out the form section by section. Take your time, double-check your entries, and don’t be afraid to ask for help if you need it.

One of the most important parts of the W2 form is Box 1, which reports your total wages, tips, and other compensation for the year. Make sure to carefully review this section and ensure that all of your earnings are accurately reported. Next, move on to Boxes 2 through 6, which detail your federal income tax withholding, Social Security and Medicare taxes, and other important information. Again, take your time and make sure that each box is completed correctly to avoid any issues down the line.

As you near the end of the W2 form, don’t forget to sign and date it before submitting it to the IRS. This final step is crucial to ensure that your form is processed properly and that you are in compliance with all tax regulations. Once you’ve completed and signed your form, make a copy for your records and keep it in a safe place for future reference. Now that you’ve successfully filled out your blank 2022 W2 form, take a deep breath, pat yourself on the back, and enjoy the peace of mind that comes with knowing your taxes are in order.

In conclusion, filling out your blank 2022 W2 form doesn’t have to be a stressful or confusing process. With a positive attitude, a little bit of organization, and a willingness to learn, you’ll be able to tackle tax season with confidence and ease. So grab that pen, get comfortable, and let’s get started on completing your W2 form together. Happy tax-filing!

Below are some images related to Blank 2022 W2 Form

blank 2022 w2 form, can i print a blank w2 form, where to get blank w2 forms, why did i get a blank w2, , Blank 2022 W2 Form.

blank 2022 w2 form, can i print a blank w2 form, where to get blank w2 forms, why did i get a blank w2, , Blank 2022 W2 Form.