W2 Form Box 2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

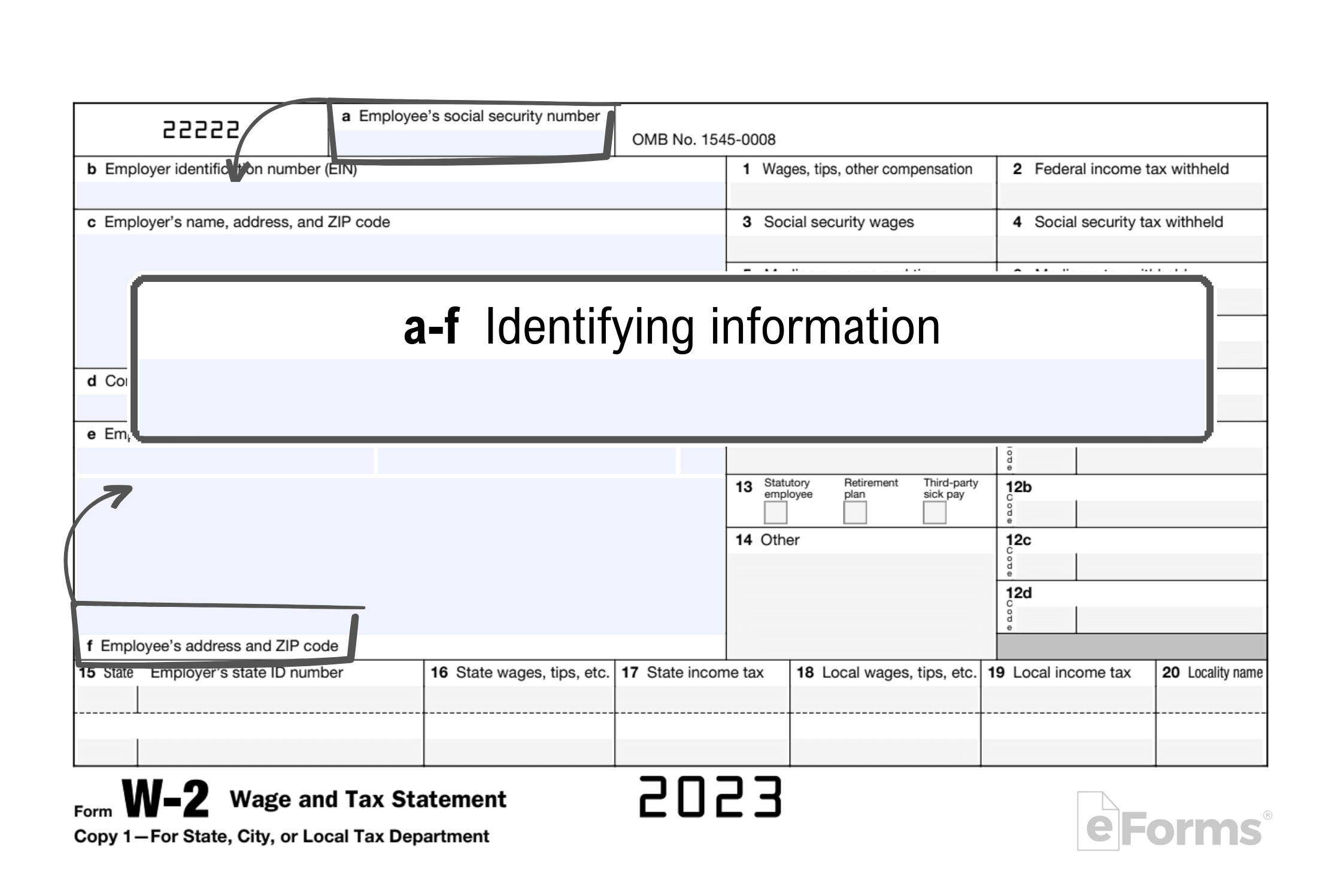

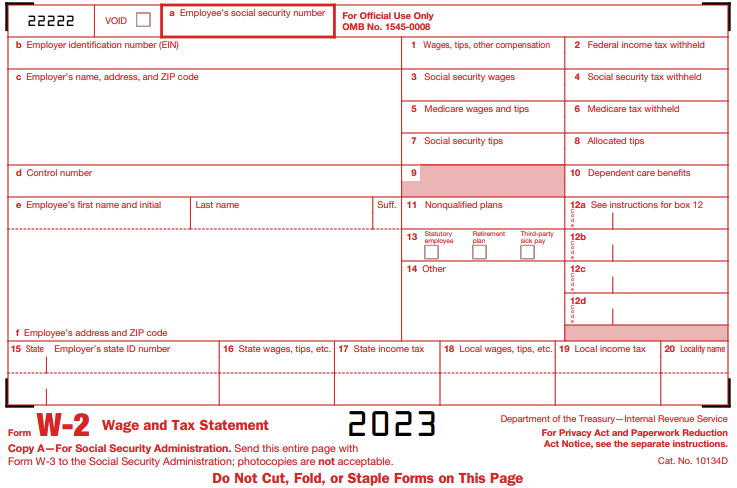

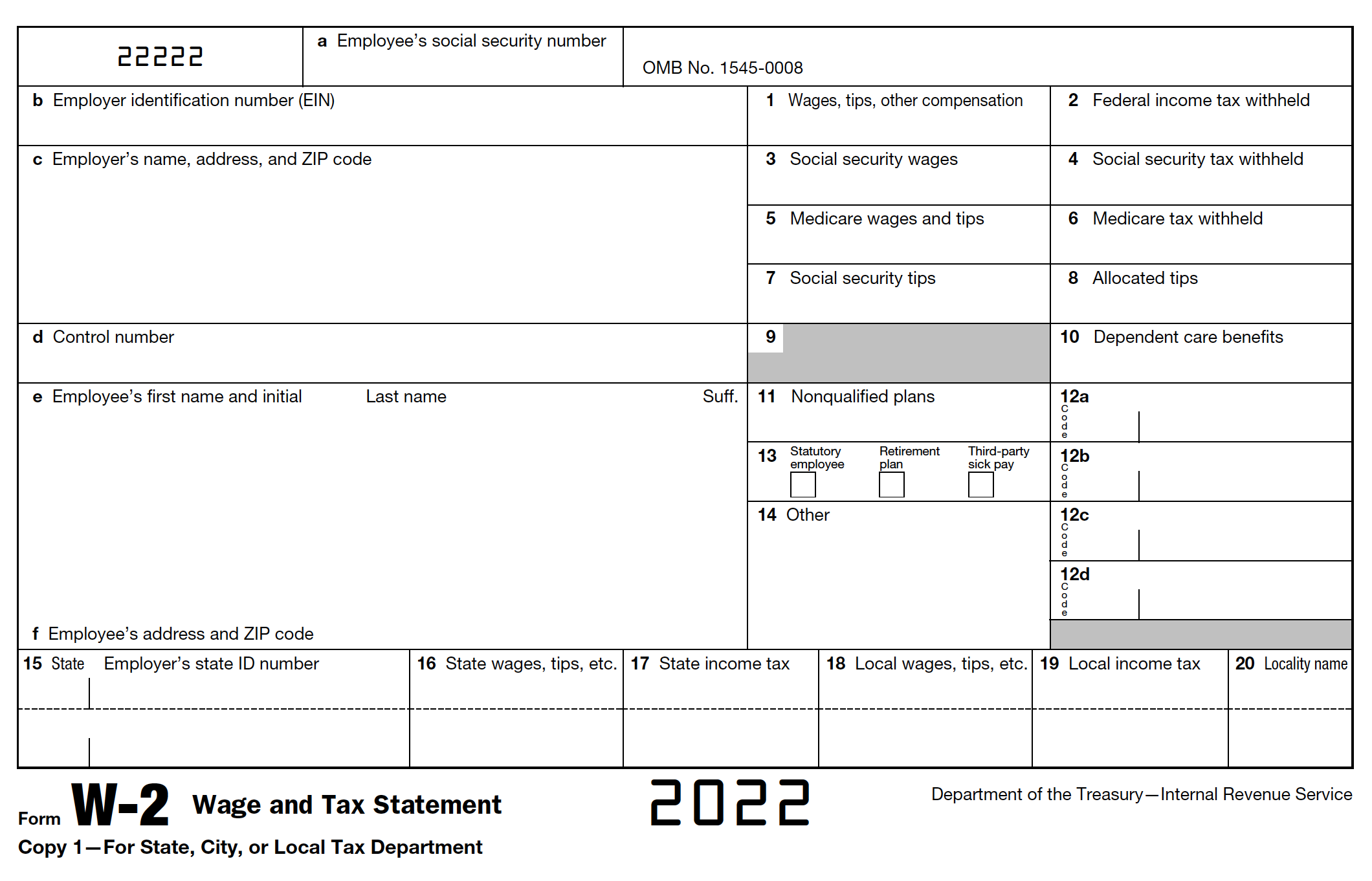

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2 Form Box 2: Your Ticket to Tax Time Bliss!

Tax season can sometimes feel like a daunting puzzle, with endless forms and numbers to sort through. But fear not, for hidden within your W2 form lies a magical treasure that can simplify the entire process: Box 2! This often overlooked section holds the key to unlocking tax time bliss, and with a little know-how, you can harness its power to breeze through your taxes like a pro.

Discover the Hidden Treasure: Box 2 of Your W2 Form!

Box 2 of your W2 form contains the total amount of federal income tax withheld from your paychecks throughout the year. This number represents the taxes you’ve already paid, making it a crucial piece of the puzzle when it comes to filing your taxes. By understanding and utilizing the information in Box 2, you can ensure that you’re not overpaying or underpaying your taxes, ultimately saving yourself time, money, and stress in the long run.

But Box 2 is more than just a number – it’s a tool that can help you maximize your tax refund or minimize any taxes owed. By comparing the amount in Box 2 to your total tax liability for the year, you can determine if you’re due a refund or if you owe additional taxes. Armed with this knowledge, you can make informed decisions when it comes to tax planning and ensure that you’re taking full advantage of any available deductions or credits. So don’t let Box 2 go unnoticed – it’s your ticket to tax time bliss!

Simplify Tax Season with the Power of Box 2: A How-To Guide!

Now that you’ve uncovered the hidden treasure that is Box 2 of your W2 form, it’s time to put its power to good use. Start by gathering all your tax documents, including your W2 form, and locate Box 2. Take note of the amount listed, and use it as a starting point for calculating your total tax liability for the year. This will give you a clear picture of where you stand financially and help you make any necessary adjustments before filing your taxes.

Next, use the information in Box 2 to determine if you’re entitled to a tax refund or if you owe additional taxes. If the amount in Box 2 is greater than your total tax liability, congratulations – you’re due a refund! On the other hand, if the amount in Box 2 falls short of your total tax liability, you may owe additional taxes. By understanding how to interpret and utilize the information in Box 2, you can navigate tax season with confidence and ease, ensuring that you’re making the most of your hard-earned money.

In conclusion, don’t let tax season overwhelm you – embrace the magic of Box 2 and let it guide you to tax time bliss. By understanding and utilizing the information contained in this hidden treasure, you can simplify the process, maximize your refund, and make informed financial decisions. So grab your W2 form, locate Box 2, and unlock the power within – your stress-free tax season awaits!

Below are some images related to W2 Form Box 2

2022 form w-2 box 11, 2023 form w2 box 12 codes, form w-2 box 12 code d 21, w-2 form 2022 box 12 codes, w-2 form 2023 box 12 codes, , W2 Form Box 2.

2022 form w-2 box 11, 2023 form w2 box 12 codes, form w-2 box 12 code d 21, w-2 form 2022 box 12 codes, w-2 form 2023 box 12 codes, , W2 Form Box 2.