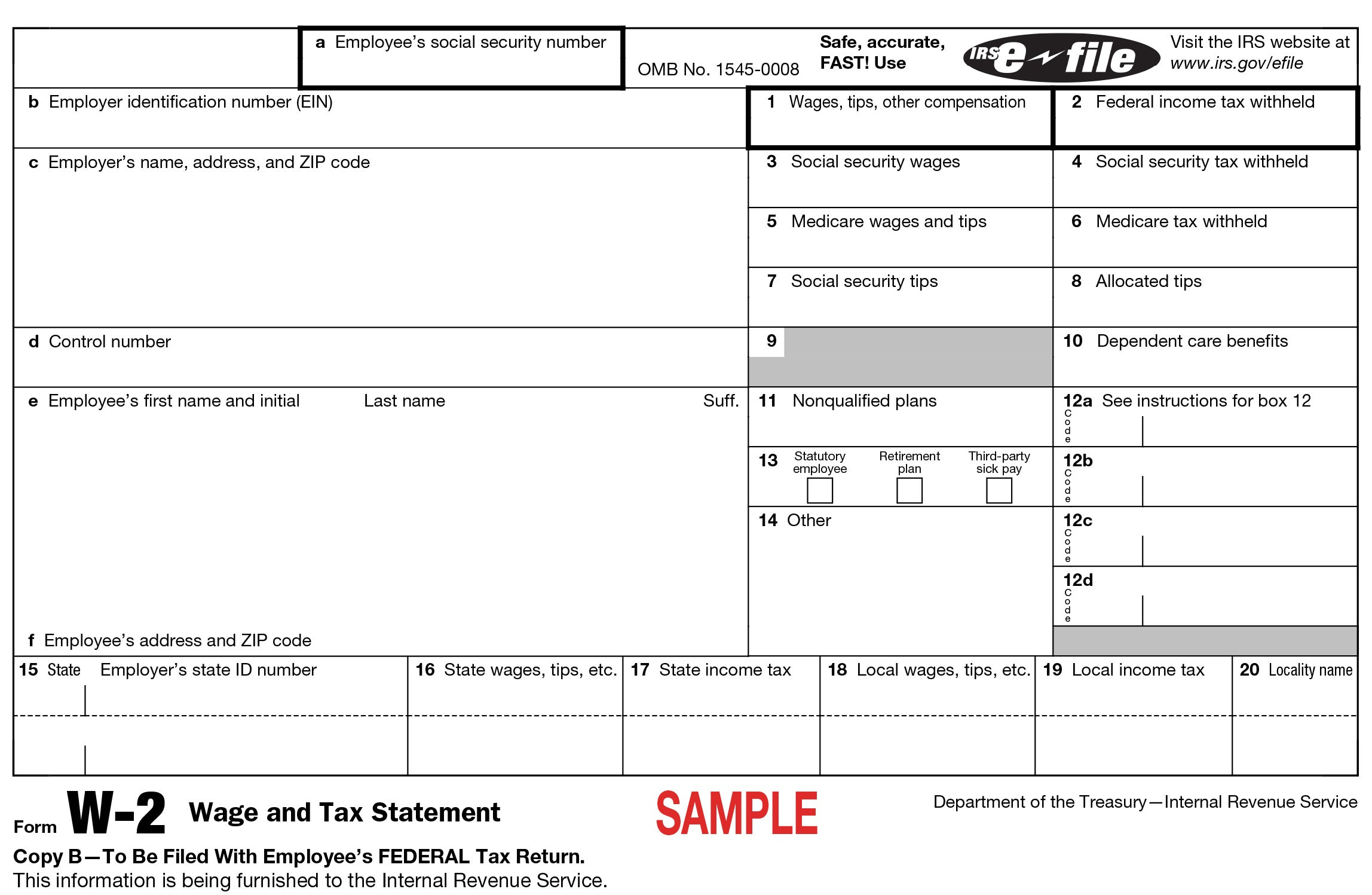

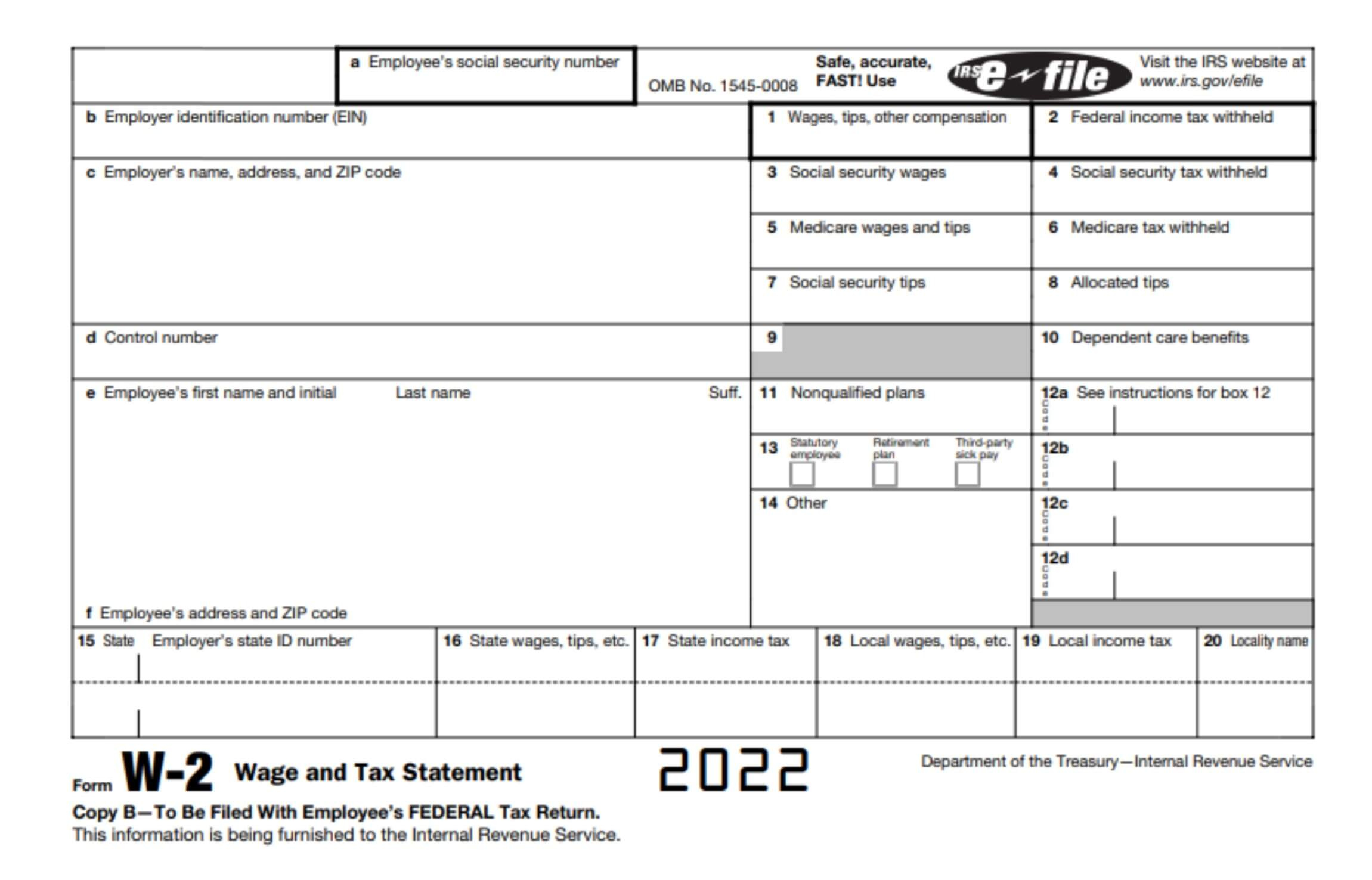

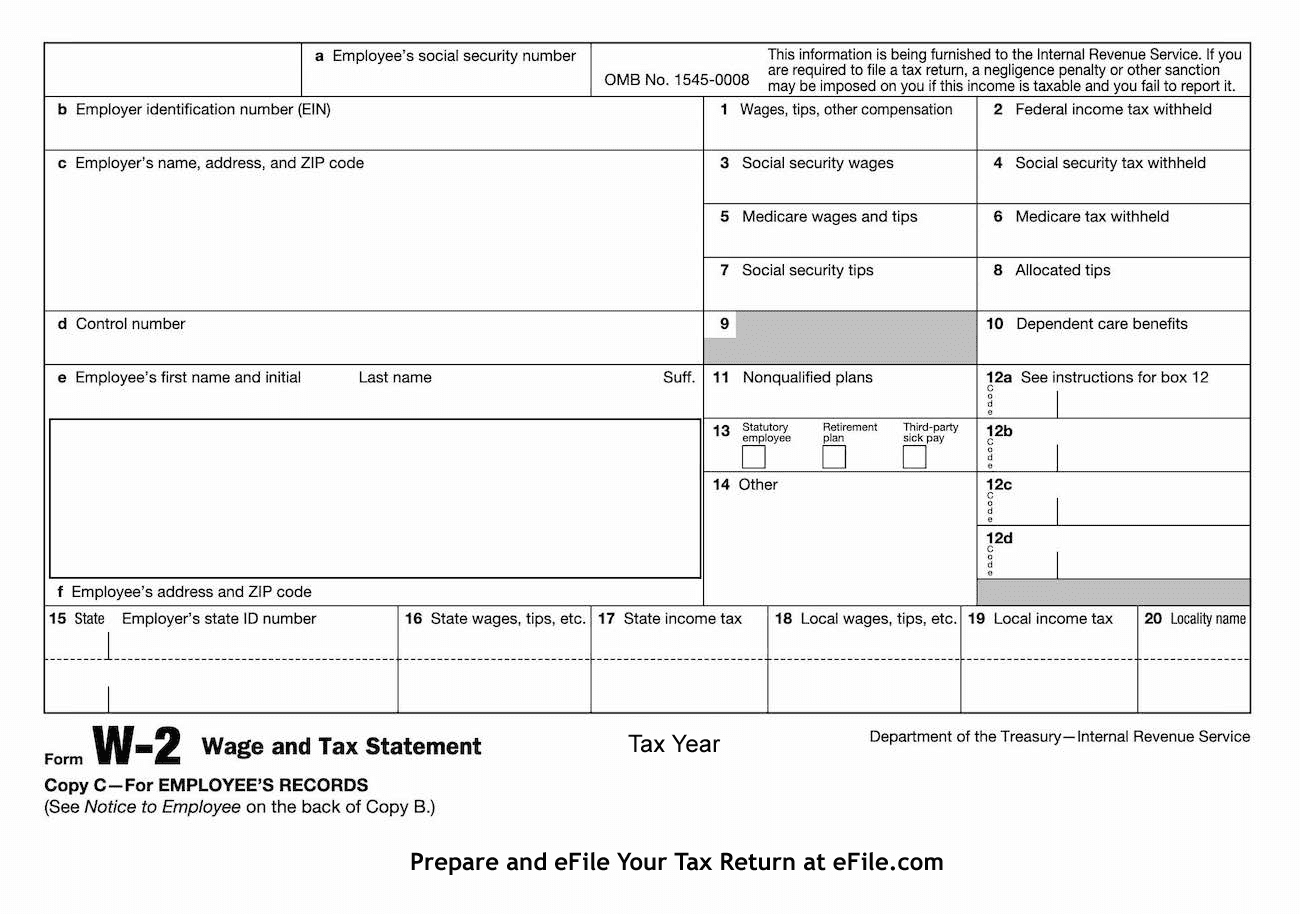

W2 Form Box 12 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of W2 Form Box 12: Your Ticket to Tax Season Success!

Tax season is upon us, and for many individuals, deciphering the various boxes on their W2 form can feel like navigating a maze of numbers and codes. One particular box that often leaves taxpayers scratching their heads is Box 12. What does it mean? What significance does it hold in relation to your taxes? Fear not, for we are here to unravel the mystery of W2 Form Box 12 and help you make sense of it all!

Decoding the Enigma: What Does Box 12 on Your W2 Form Really Mean?

Box 12 on your W2 form is where your employer reports various types of compensation and benefits that you may have received throughout the year. The codes used in Box 12 correspond to different types of income, such as retirement plan contributions, health insurance premiums, and other fringe benefits. Understanding these codes is crucial for accurately filing your taxes and ensuring that you are taking advantage of all the deductions and credits available to you.

So, what do these codes mean for you? Let’s take a look at a few examples. Code D represents elective deferrals to a 401(k) plan, while Code DD signifies the cost of employer-sponsored health coverage. Code E, on the other hand, stands for elective deferrals to a 403(b) plan. By deciphering the codes in Box 12, you can gain valuable insights into your income and benefits, allowing you to make informed decisions when it comes to your taxes and financial planning.

Maximize Your Tax Season Triumph with a Closer Look at Box 12!

Now that you have a better understanding of what Box 12 on your W2 form represents, you can use this knowledge to your advantage during tax season. By carefully reviewing the information in Box 12, you can ensure that you are accurately reporting all sources of income and taking advantage of any tax breaks or credits that may be available to you. This can help you maximize your tax refund or minimize the amount you owe, making tax season a little less stressful and a lot more rewarding.

In conclusion, don’t let Box 12 on your W2 form remain a mystery any longer. Take the time to decode the codes, understand the implications for your taxes, and use this information to your advantage. By unraveling the mystery of W2 Form Box 12, you can navigate tax season with confidence and set yourself up for success. So, grab your W2 form, crack the code in Box 12, and watch as your tax season triumph unfolds!

Below are some images related to W2 Form Box 12

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] in W2 Form Box 12](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-in-w2-form-box-12.jpg)

w2 form box 12, w2 form box 12 code d, w2 form box 12 code dd, w2 form box 12 code w, w2 form box 12 codes, , W2 Form Box 12.

w2 form box 12, w2 form box 12 code d, w2 form box 12 code dd, w2 form box 12 code w, w2 form box 12 codes, , W2 Form Box 12.