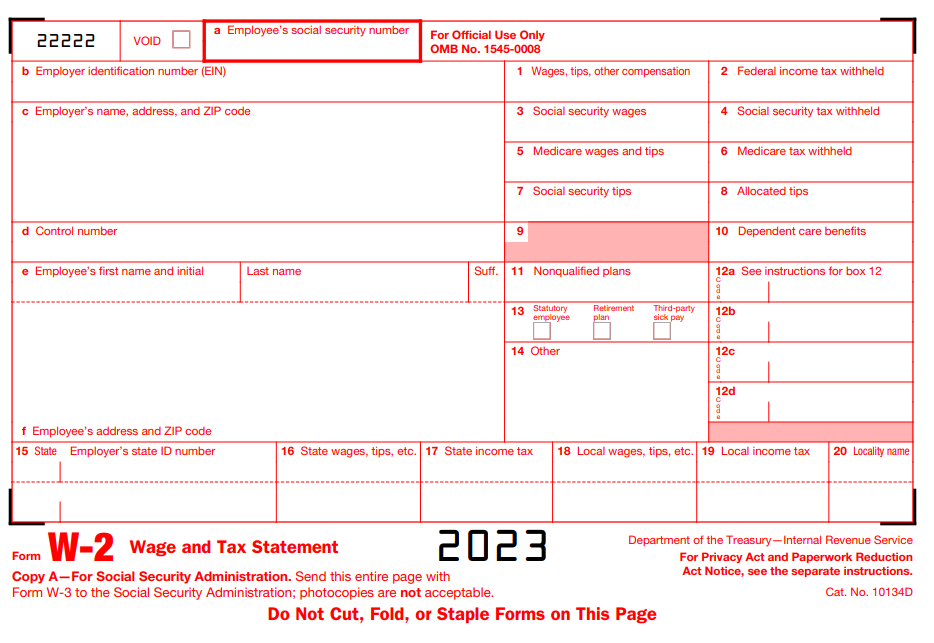

How To File Taxes Without W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Tricks: Filing Without W2s!

Are you feeling stressed about filing your taxes without your W2s? Don’t worry, there are unconventional ways to tackle this challenge! With a bit of creativity and resourcefulness, you can still submit your tax return without the traditional forms. Let’s explore some tricks to make tax time a breeze, even without your W2s!

Unconventional Ways to File Taxes!

One clever trick is to use your last pay stub of the year to estimate your annual income. Most pay stubs include year-to-date earnings, which can give you a rough idea of how much you made throughout the year. While this method may not be 100% accurate, it can help you get a ballpark figure to input on your tax return. Just make sure to keep your pay stub handy in case the IRS requests it later on.

Another option is to reach out to your employer or former employer to request a copy of your W2. They are required by law to provide this form to you by January 31st, so if you haven’t received it by then, don’t hesitate to follow up. If you still can’t get your hands on your W2, you can fill out Form 4852, which is a substitute for the W2. This form allows you to estimate your income and taxes withheld, giving you a way to file your taxes without the official W2.

Get Creative: Filing Without W2s!

If all else fails, you can always use online tax software to help you navigate the process of filing without your W2. Many platforms have tools and resources to guide you through inputting your income and deductions, even if you don’t have all the necessary forms. Just make sure to double-check your entries and review your return before submitting to ensure accuracy.

Remember, the key to filing your taxes without your W2s is to stay organized and resourceful. Don’t let a missing form hold you back from completing your tax return on time. With a little creativity and determination, you can conquer tax time without the traditional W2 form. So roll up your sleeves, gather your information, and tackle your taxes with confidence!

In conclusion, filing your taxes without your W2s may seem daunting, but it’s not impossible. By exploring unconventional methods, such as using your last pay stub or reaching out to your employer, you can still submit your tax return accurately and on time. Remember to stay proactive and resourceful, and don’t hesitate to seek assistance from online tax software if needed. With a positive attitude and a bit of creativity, you can conquer tax time like a pro!

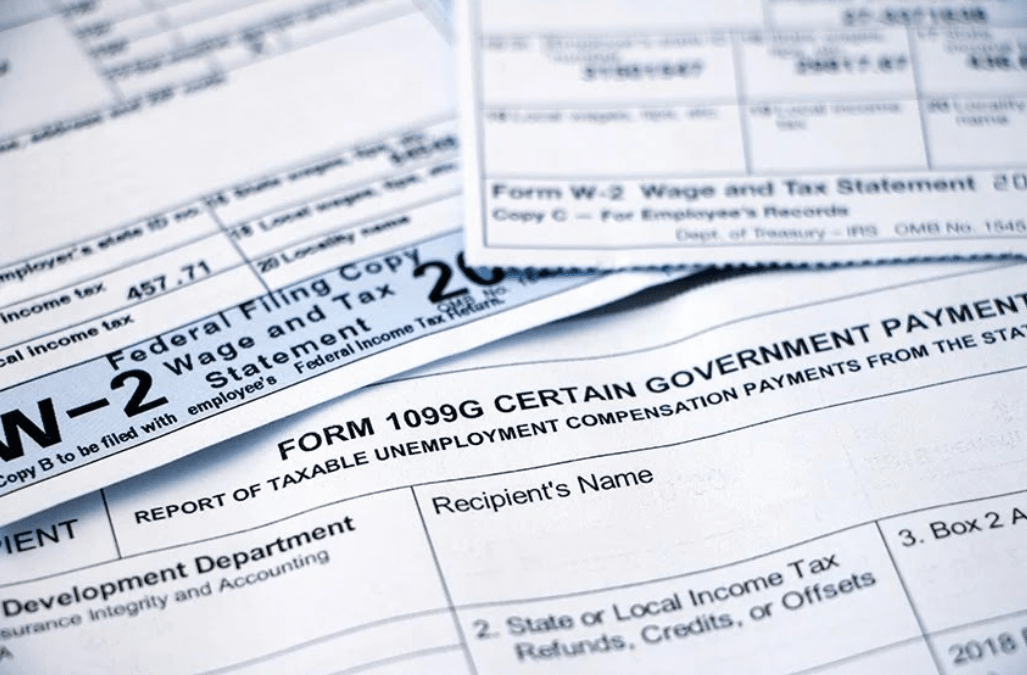

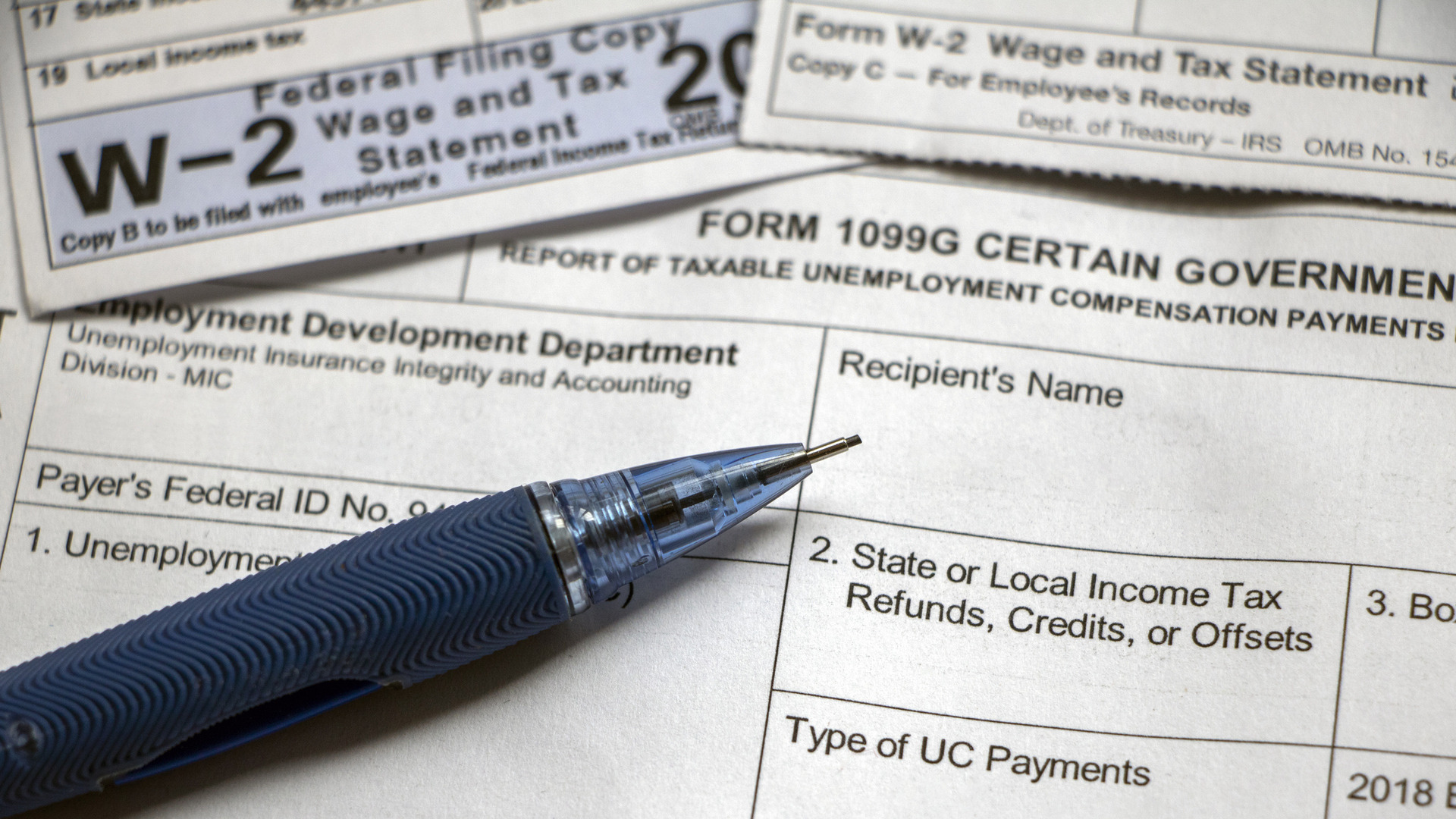

Below are some images related to How To File Taxes Without W2 Form

can i file taxes without w-2, how to file taxes w2 form, how to file taxes with two w2 forms, how to file taxes without w2 form, , How To File Taxes Without W2 Form.

can i file taxes without w-2, how to file taxes w2 form, how to file taxes with two w2 forms, how to file taxes without w2 form, , How To File Taxes Without W2 Form.