W2 Form 401k – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximizing Your Savings: The Joy of W2 Form 401k

Do you want to supercharge your savings and watch your nest egg grow? Look no further than your trusty W2 Form 401k! This often overlooked tool can be a powerhouse when it comes to maximizing your savings and securing a bright financial future. With a little know-how and some strategic planning, you can unleash the full potential of your W2 Form 401k and watch your savings soar to new heights.

Unleash the Power of Your W2 Form 401k

Your W2 Form 401k is more than just a simple retirement savings account – it’s a powerful tool that can help you build wealth and secure your financial future. By contributing a portion of your pre-tax income to your 401k, you can take advantage of tax-deferred growth and potentially lower your taxable income. This means more money in your pocket now and a larger nest egg for the future. Plus, many employers offer matching contributions to your 401k, essentially giving you free money just for saving for retirement.

But don’t stop at just contributing the minimum to your W2 Form 401k – to truly maximize your savings, consider increasing your contributions over time. Even small increases in your contributions can have a big impact on your overall savings, especially when you factor in compound interest. By consistently increasing your contributions, you can accelerate the growth of your retirement savings and set yourself up for a comfortable retirement. So don’t be afraid to bump up your contributions and watch your savings grow exponentially.

Watch Your Savings Soar with this Simple Trick!

One simple trick to maximize your savings with your W2 Form 401k is to automate your contributions. By setting up automatic contributions from your paycheck, you can ensure that you consistently save for retirement without having to think about it. This not only helps you build the habit of saving, but it also takes the guesswork out of managing your savings. Plus, automating your contributions can help you avoid the temptation to spend your savings elsewhere, ensuring that your retirement fund continues to grow steadily over time.

In conclusion, your W2 Form 401k is a powerful tool that can help you maximize your savings and secure a bright financial future. By taking advantage of tax-deferred growth, employer matching contributions, and automating your contributions, you can watch your savings soar to new heights. So don’t wait – start maximizing your savings with your W2 Form 401k today and enjoy the joy of watching your nest egg grow!

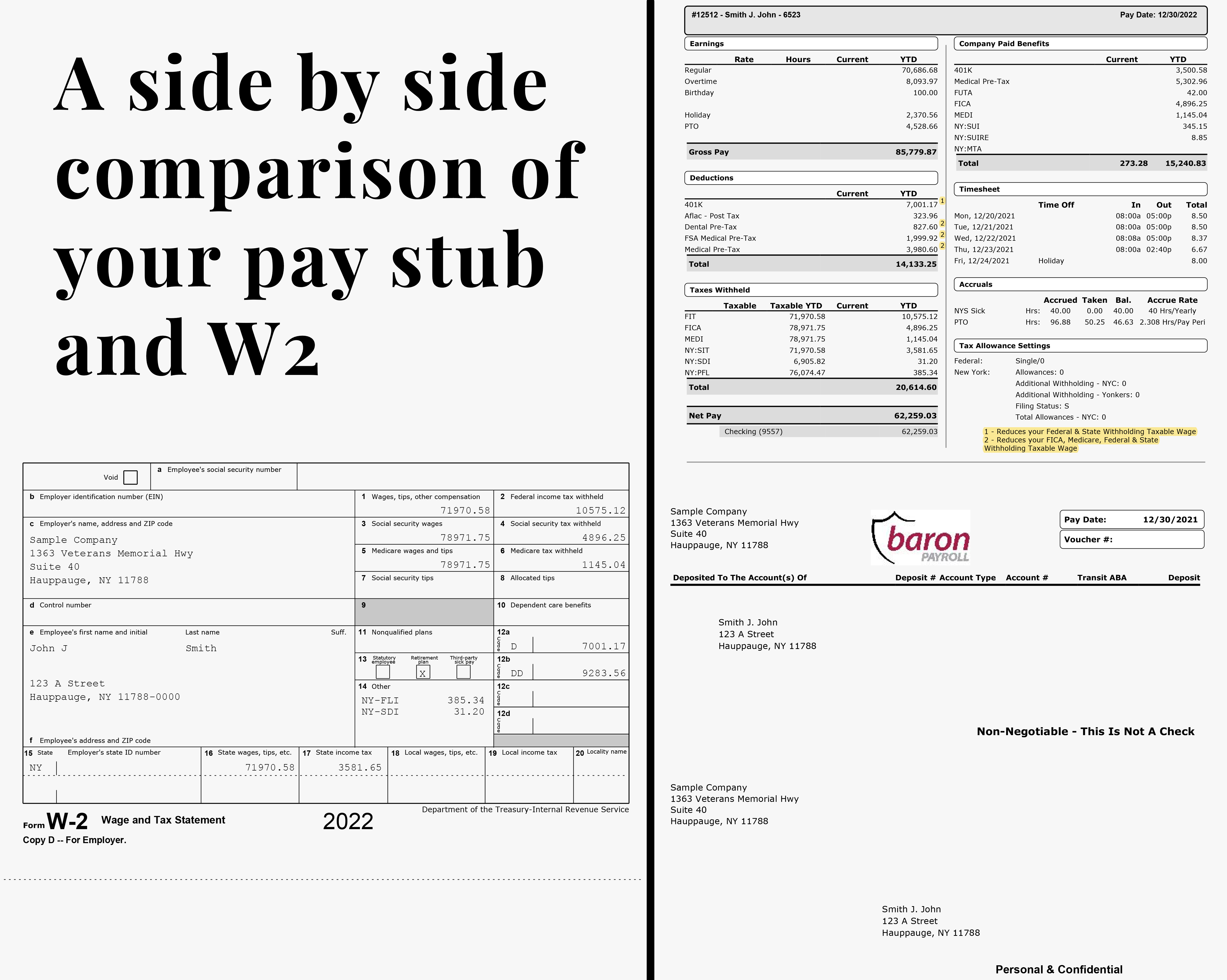

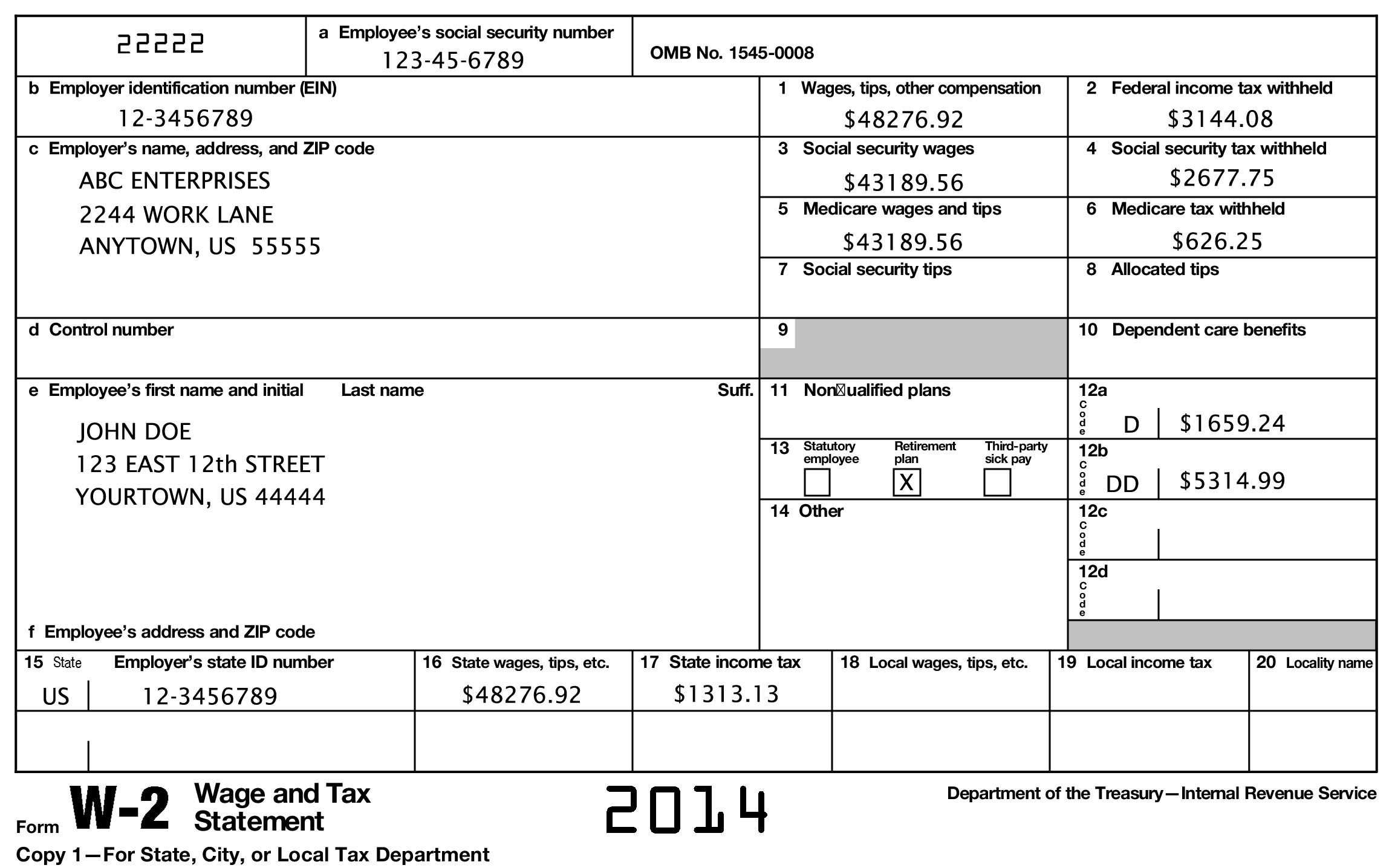

Below are some images related to W2 Form 401k

do i get a w2 for 401k withdrawal, does w2 include 401k, w2 form 401k, w2 form 401k box, what is 401k on w2, , W2 Form 401k.

do i get a w2 for 401k withdrawal, does w2 include 401k, w2 form 401k, w2 form 401k box, what is 401k on w2, , W2 Form 401k.