W2 W3 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2 W3 Forms: Your Guide to Tax Season Success

Tax season is upon us, and for many, the mere thought of navigating through a sea of forms can be daunting. However, fear not! With a little bit of know-how and some guidance, you can unlock the magic of W2 W3 forms and breeze through tax season with confidence and ease. In this guide, we will unveil the secrets of these forms and provide you with tips and tricks to ensure your tax season is a success.

Unveiling the Secrets of W2 W3 Forms

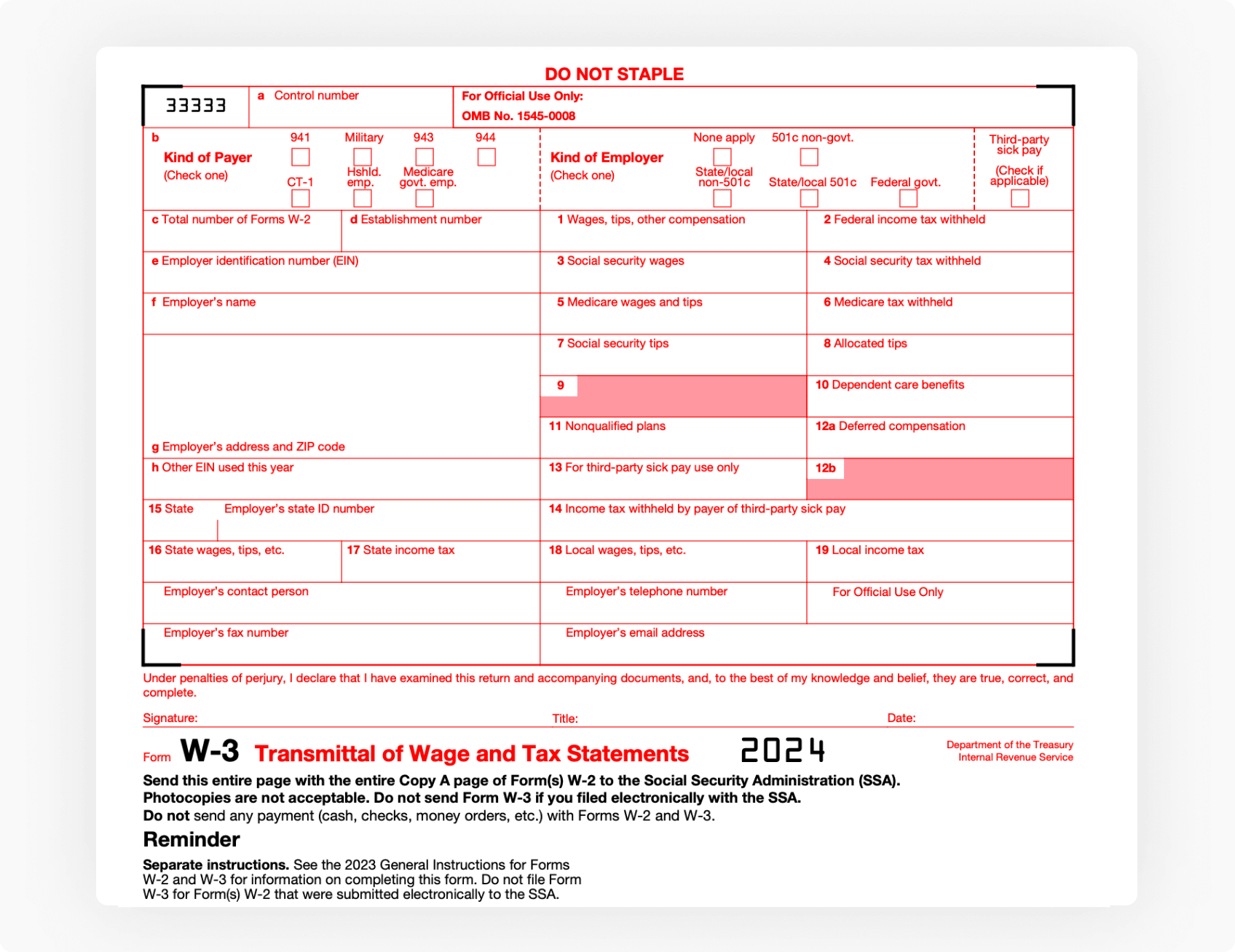

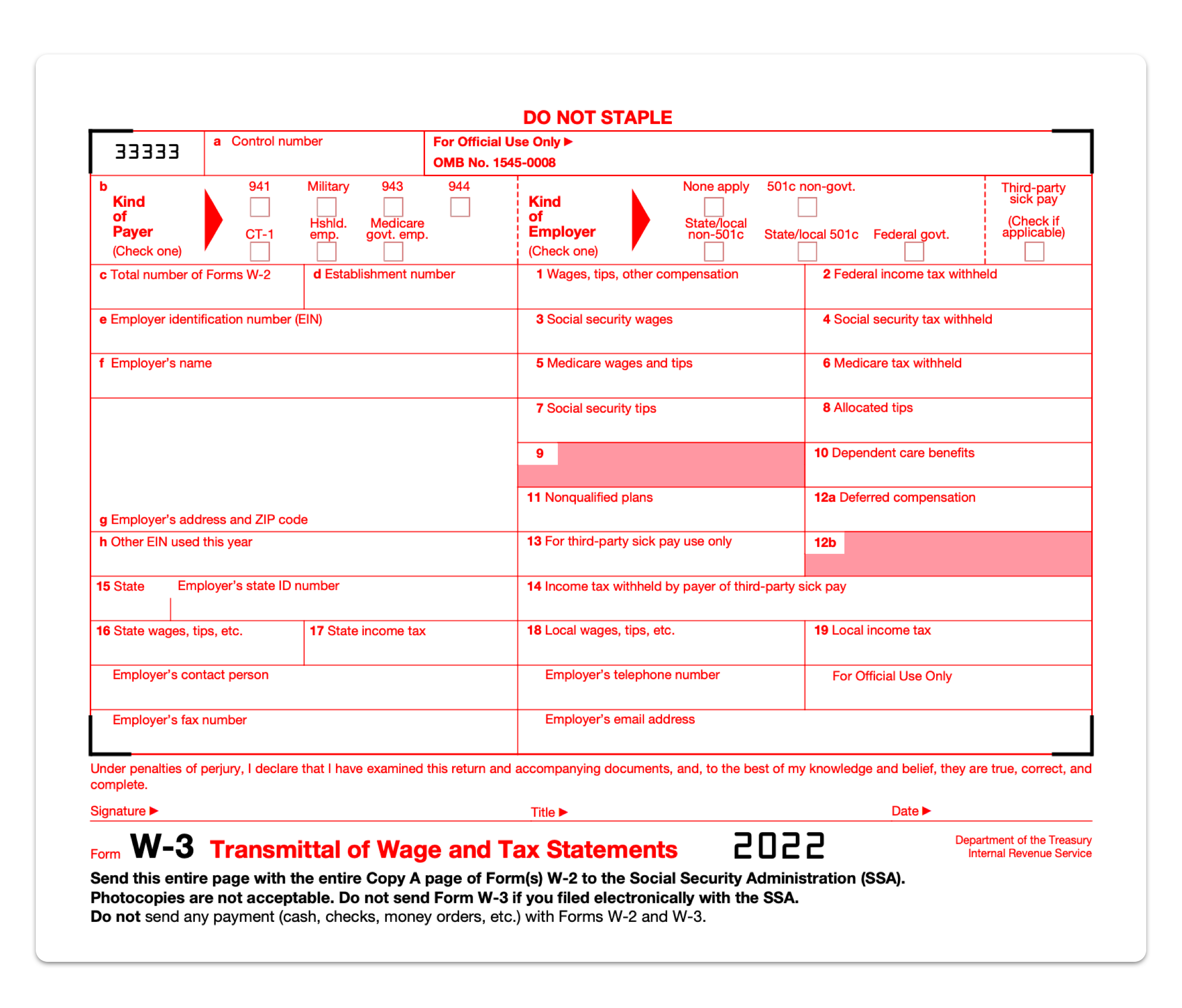

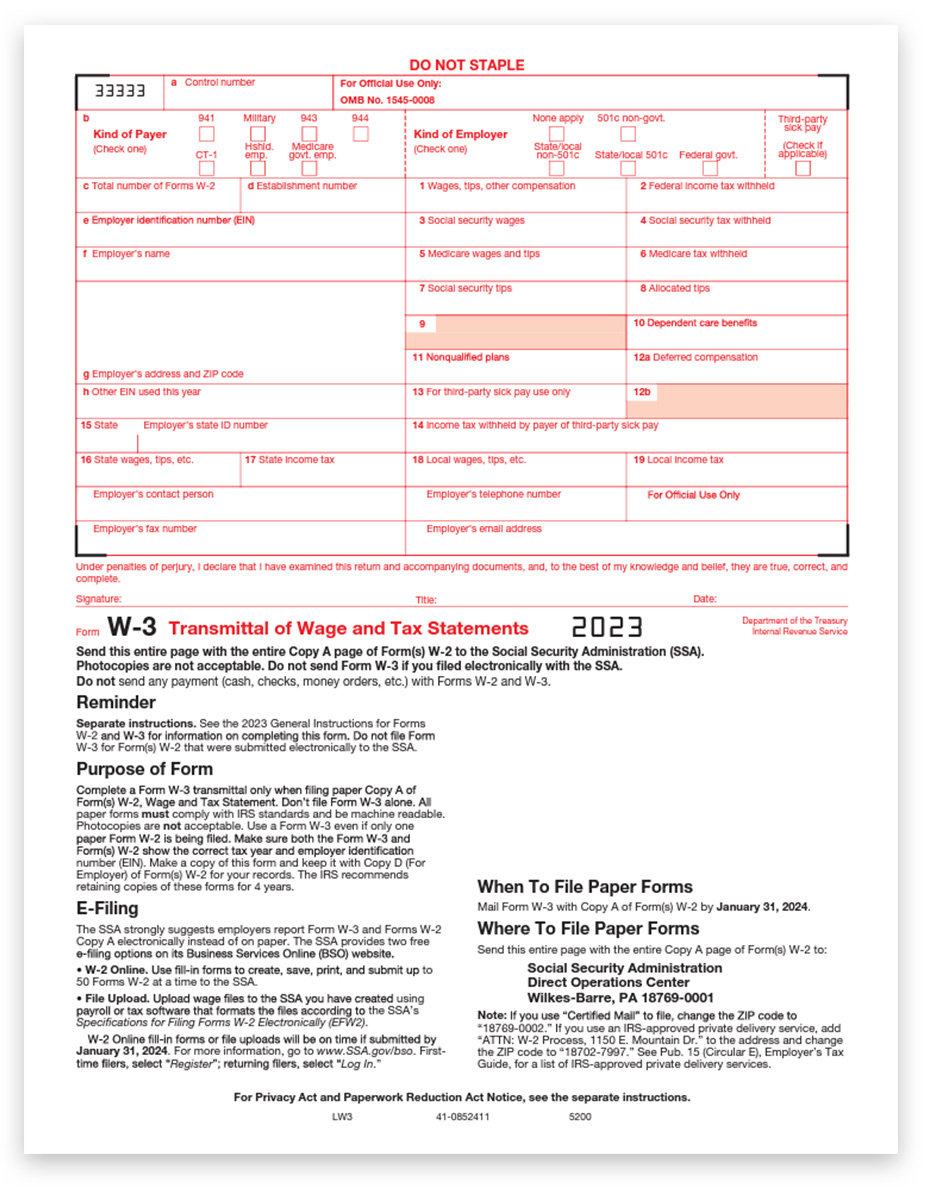

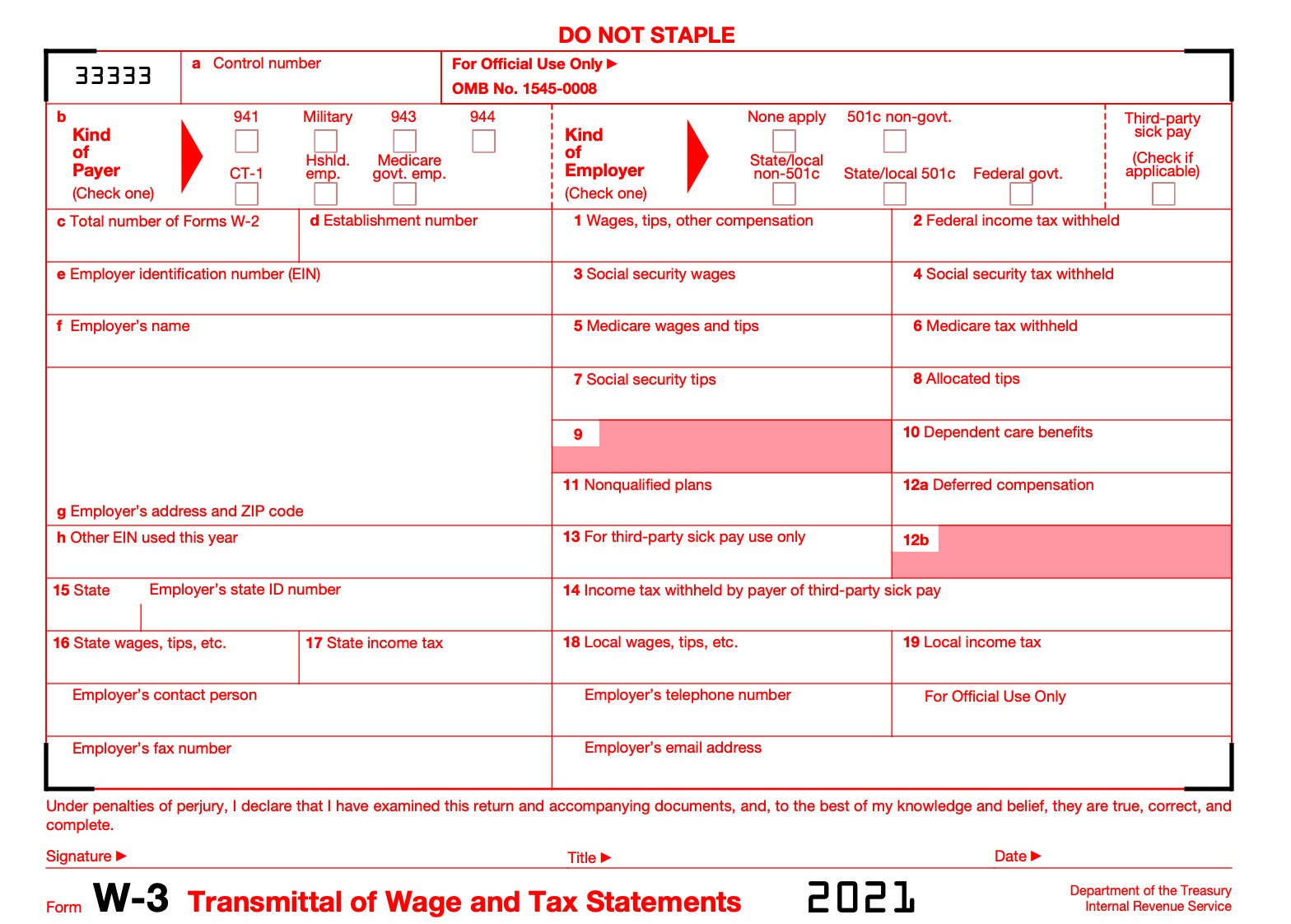

The W2 form is a critical document that summarizes an employee’s earnings and taxes withheld by their employer throughout the year. It is essential for filing your taxes accurately and efficiently. Understanding each section of the W2 form, from Box 1 (Wages, tips, other compensation) to Box 20 (Locality name), is crucial for ensuring your tax return is error-free. Additionally, the W3 form is a transmittal form that summarizes all the W2 forms submitted by an employer to the Social Security Administration. By familiarizing yourself with these forms and their intricacies, you can navigate tax season with confidence.

When it comes to deciphering your W2 form, pay close attention to Box 1, as it represents your total taxable wages for the year. Boxes 3 and 5, on the other hand, show your Social Security and Medicare wages, respectively. It is essential to ensure that these figures are accurate, as any discrepancies could result in penalties from the IRS. Moreover, don’t forget to review Boxes 12 and 14 for any additional information, such as retirement plan contributions or health insurance premiums. By carefully reviewing your W2 form and understanding each box, you can avoid common tax filing errors and maximize your tax refund.

Navigate Tax Season with Confidence and Ease

As you embark on your tax-filing journey, remember that knowledge is power. Take the time to review your W2 form thoroughly, ensuring all information is accurate and up to date. If you have multiple W2 forms from different employers, consolidate them and double-check for any discrepancies. Additionally, don’t hesitate to seek assistance from a tax professional or use online tax preparation software to guide you through the process. By staying organized and proactive, you can navigate tax season with confidence and ease.

In conclusion, unlocking the magic of W2 W3 forms is the key to a successful tax season. By familiarizing yourself with these forms, understanding their nuances, and staying organized throughout the process, you can file your taxes accurately and efficiently. Remember, tax season doesn’t have to be daunting – with the right tools and knowledge, you can breeze through it with confidence. So, take a deep breath, grab your W2 form, and embark on your tax-filing journey with a smile. You’ve got this!

Below are some images related to W2 W3 Forms

order w2 w3 forms, w2 vs w3, w2 vs w3 forms, w2 w3 forms, w2 w3 forms 2023, , W2 W3 Forms.

order w2 w3 forms, w2 vs w3, w2 vs w3 forms, w2 w3 forms, w2 w3 forms 2023, , W2 W3 Forms.