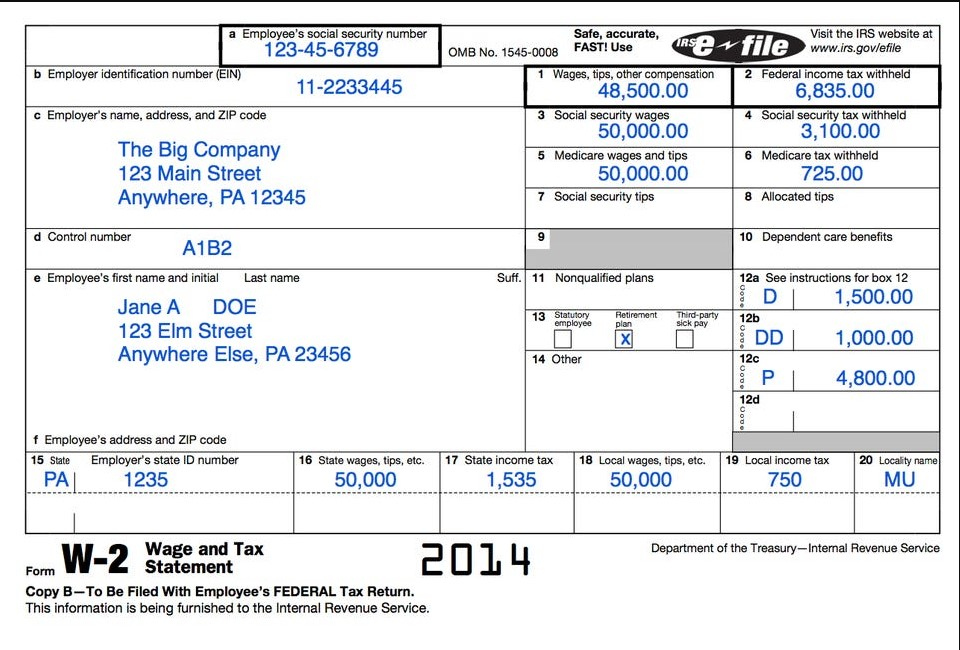

Gross Pay On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Earnings Potential: Demystifying Gross Pay on Your W2!

Do you ever look at your W2 form and wonder what all those numbers mean? Are you curious about how your gross pay is calculated and how it impacts your overall earnings potential? Well, fear not! In this article, we will demystify the secrets behind your gross pay on your W2 and show you how understanding it can supercharge your earnings potential.

Discover the Secrets Behind Your Gross Pay on Your W2!

Your gross pay on your W2 is essentially the total amount of money you earned before any deductions or taxes are taken out. It includes not only your regular wages but also any bonuses, commissions, and overtime pay you may have received throughout the year. Understanding your gross pay is crucial because it gives you a clear picture of how much money you actually earned, allowing you to make informed decisions about your finances.

Furthermore, your gross pay is used to calculate important figures such as your net pay (the amount you actually take home after deductions) and your taxable income. By knowing how your gross pay is calculated and what factors contribute to it, you can better negotiate your salary, seek opportunities for bonuses or raises, and ultimately maximize your earning potential.

Supercharge Your Earnings Potential by Understanding Your W2!

By taking the time to unravel the mysteries behind your gross pay on your W2, you can unlock a world of possibilities when it comes to increasing your earnings potential. Armed with this knowledge, you can set realistic financial goals, track your income more effectively, and make strategic decisions about your career and finances. So, the next time you receive your W2 form, don’t be intimidated by all those numbers. Instead, embrace them as tools to help you reach new heights of financial success!

In conclusion, understanding your gross pay on your W2 is essential for maximizing your earnings potential. By demystifying the secrets behind those numbers, you can gain valuable insights into your income, make informed decisions about your finances, and ultimately take control of your financial future. So, go ahead and unlock the power of your earnings potential – your bank account will thank you!

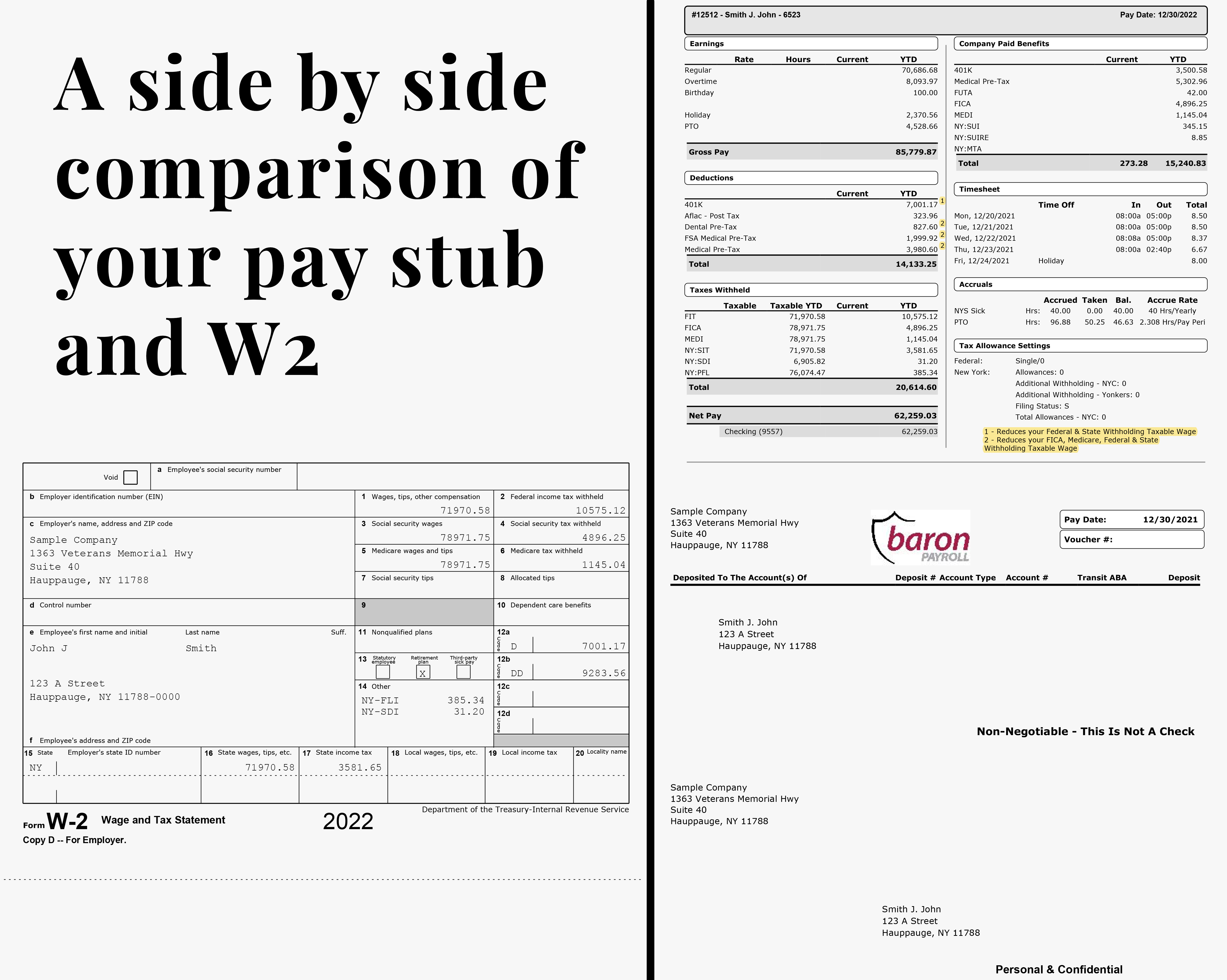

Below are some images related to Gross Pay On W2 Form

adjusted gross income on w2 form, gross income on w2 form, gross pay on w2 form, gross wages on w2 form, is wages on w2 gross or net, , Gross Pay On W2 Form.

adjusted gross income on w2 form, gross income on w2 form, gross pay on w2 form, gross wages on w2 form, is wages on w2 gross or net, , Gross Pay On W2 Form.