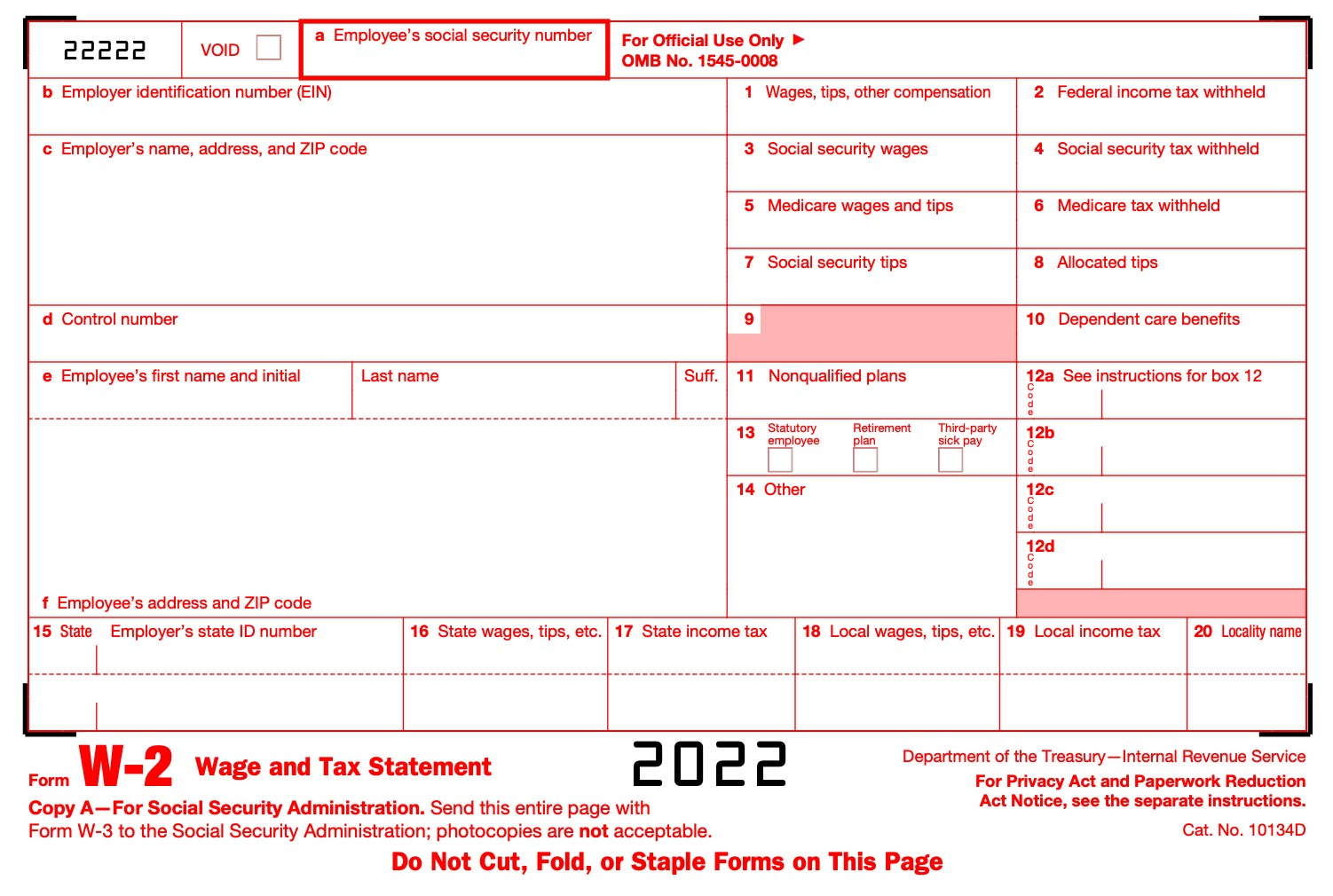

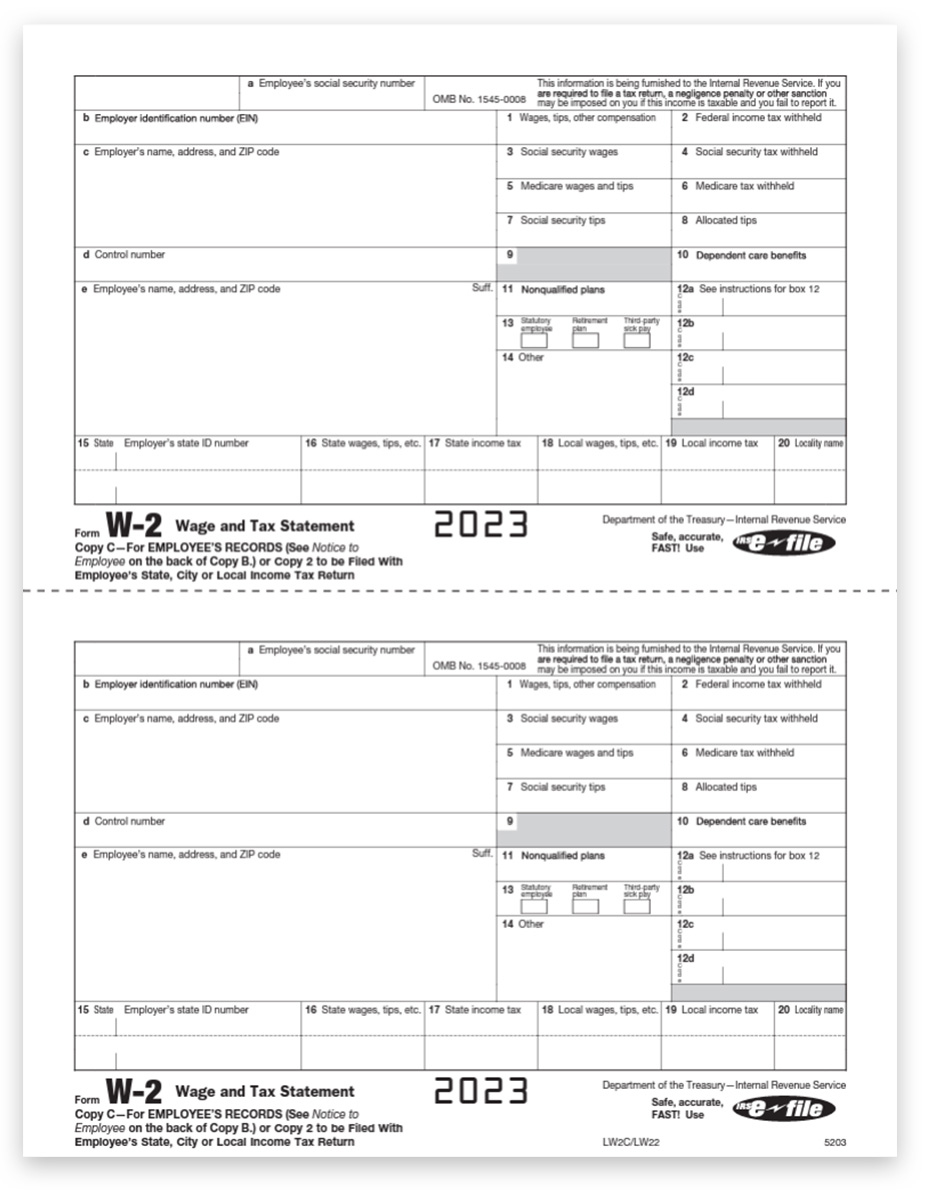

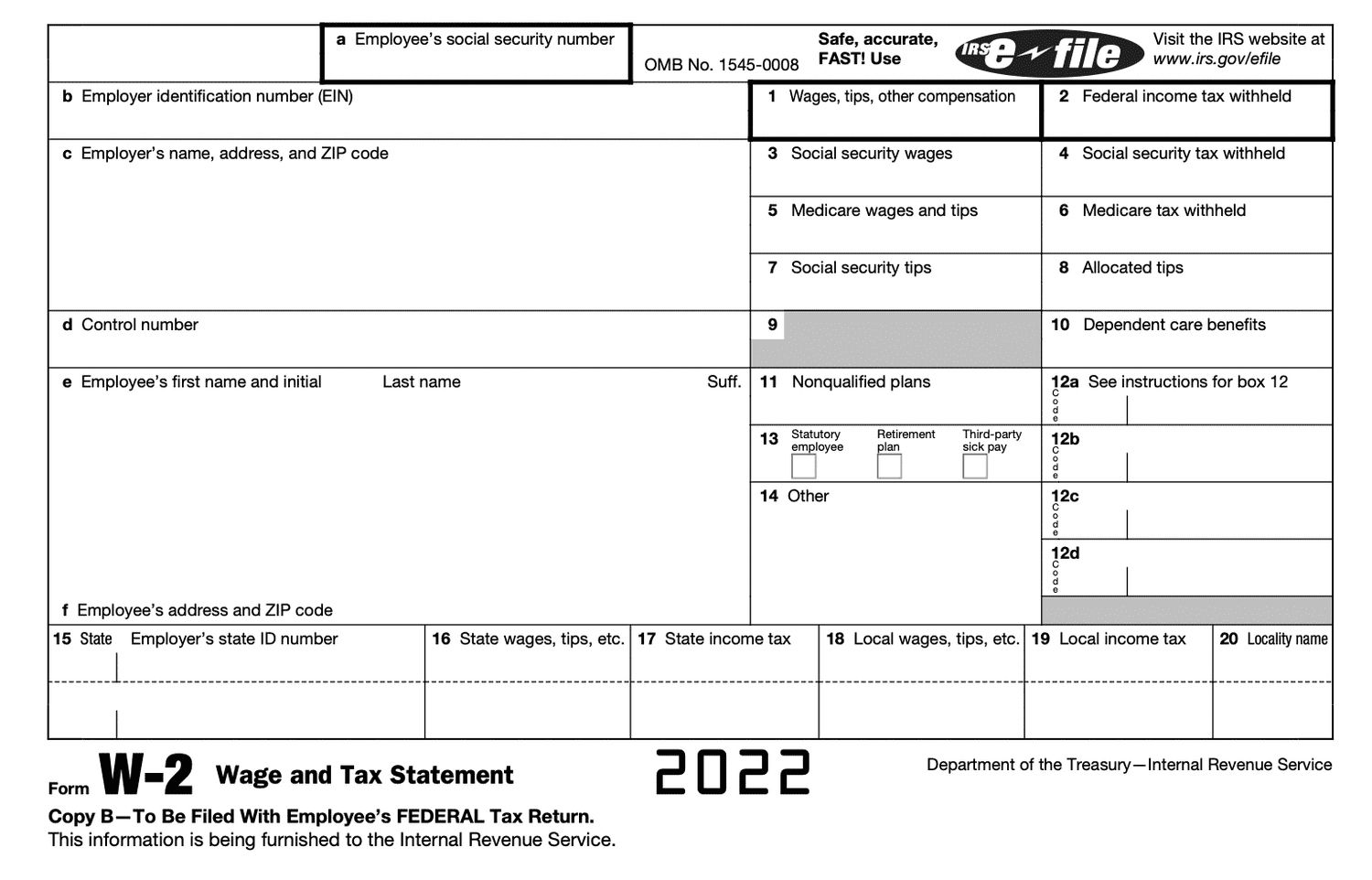

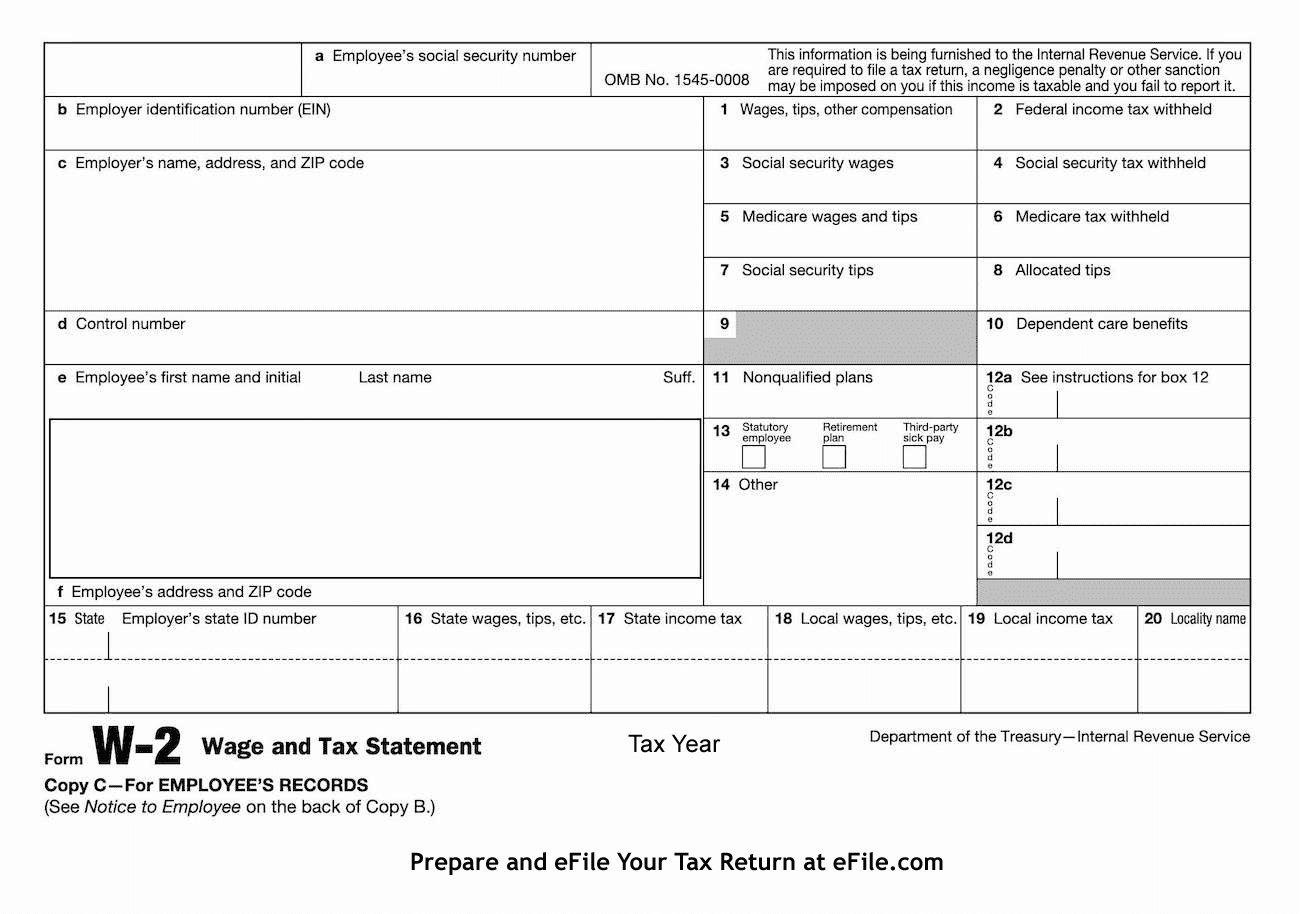

When Are W2 Forms Due – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Countdown to Tax Day: W2 Form Deadline Approaching!

As April 15th approaches, it’s time to start thinking about filing your taxes. One of the most important documents you’ll need is your W2 form, which outlines the wages you earned and the taxes withheld by your employer. The deadline for employers to send out W2 forms is January 31st, so if you haven’t received yours yet, be sure to follow up with your employer. Remember, without your W2 form, you won’t be able to accurately file your taxes and may risk facing penalties for filing late.

Tax Time Fun: Get Organized and Don’t Miss the Deadline!

Filing your taxes doesn’t have to be a daunting task. In fact, with a little organization and preparation, it can actually be quite fun! Start by gathering all your necessary documents, including your W2 form, receipts for deductible expenses, and any other relevant paperwork. Create a checklist to ensure you have everything you need before sitting down to file. Consider making a tax preparation playlist to keep you motivated and on track as you work through your taxes. And don’t forget to reward yourself with a treat once you’ve successfully filed!

Conclusion

Tax time may not be everyone’s favorite time of year, but with a positive attitude and a little creativity, you can make the process more enjoyable. Remember, the deadline for submitting your W2 form and filing your taxes is fast approaching, so don’t procrastinate! Take the time to get organized, gather your documents, and file your taxes accurately and on time. And who knows, you may even find some tax time fun along the way!

Below are some images related to When Are W2 Forms Due

are w2 forms late this year, when are w2 forms due, when are w2 forms due from employers, when are w2 forms due to ssa, when are w2 forms sent out, , When Are W2 Forms Due.

are w2 forms late this year, when are w2 forms due, when are w2 forms due from employers, when are w2 forms due to ssa, when are w2 forms sent out, , When Are W2 Forms Due.