Social Security Wages On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mystery of Social Security on Your W2

Are you puzzled by the numbers and abbreviations on your W2 form? Do you find yourself scratching your head when it comes to understanding the details of your Social Security contributions? Fear not! We are here to help you decode the enigma and unveil the secrets of Social Security on your W2.

Decoding the Enigma: Your Social Security on Your W2

When you look at your W2 form, you may notice a box labeled Social Security wages. This represents the amount of your earnings that are subject to Social Security taxes. The Social Security tax rate is set at 6.2% for employees, meaning that 6.2% of your Social Security wages will be withheld from your paycheck to fund the Social Security program. Additionally, your employer will match this contribution, bringing the total to 12.4%.

Another important figure you will find on your W2 is the Social Security tax withheld box. This shows the total amount of Social Security taxes that have been withheld from your paychecks throughout the year. This information is crucial for calculating your total Social Security contributions and ensuring that you have paid the correct amount in taxes.

Unveiling the Secrets: What You Need to Know

It’s important to understand that Social Security taxes are only withheld on a certain portion of your earnings, known as the Social Security wage base. In 2021, the Social Security wage base is set at $142,800, meaning that any earnings above this amount will not be subject to Social Security taxes. This limit is adjusted each year to account for inflation.

Additionally, it’s worth noting that your contributions to Social Security will determine your future benefits when you retire. The more you contribute over your working years, the higher your benefits will be in retirement. Understanding how Social Security works and keeping track of your contributions can help you plan for a secure financial future.

In conclusion, deciphering the mysteries of Social Security on your W2 may seem daunting at first, but with a little guidance, you can unlock the secrets and gain a better understanding of your contributions to this important program. By staying informed and proactive about your Social Security taxes, you can ensure that you are on the right track towards a comfortable retirement. So, don’t be intimidated by the numbers on your W2 – embrace them and take control of your financial future!

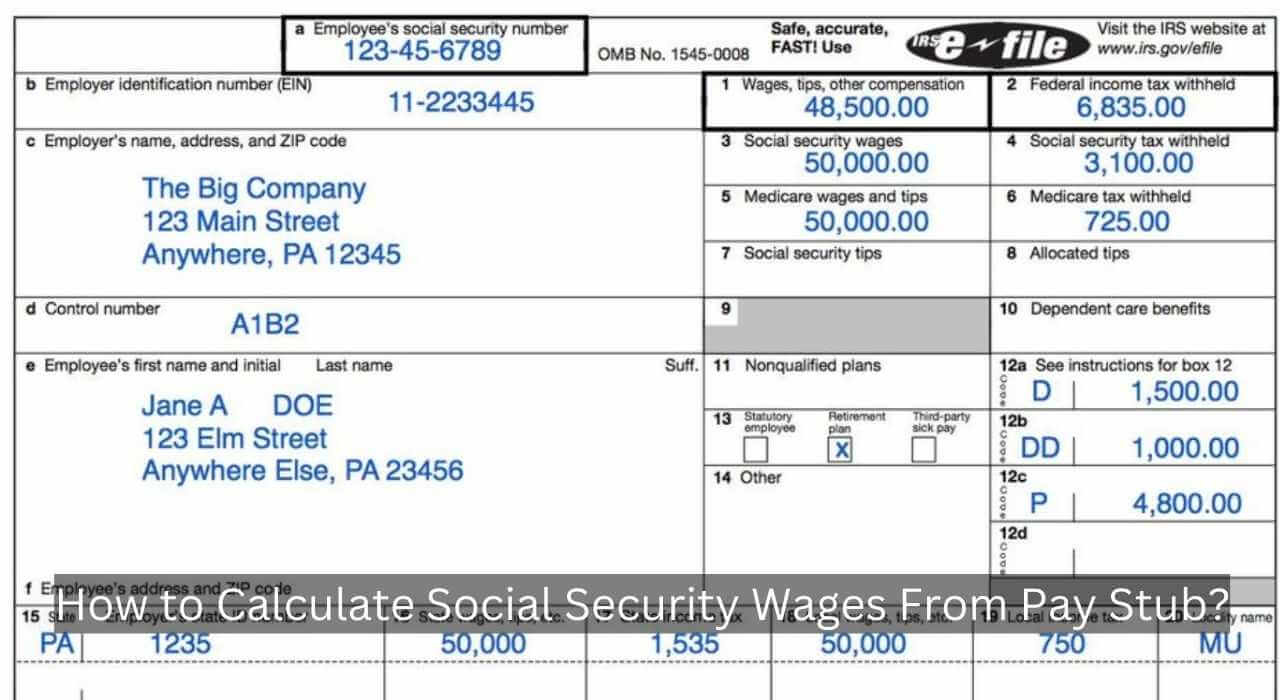

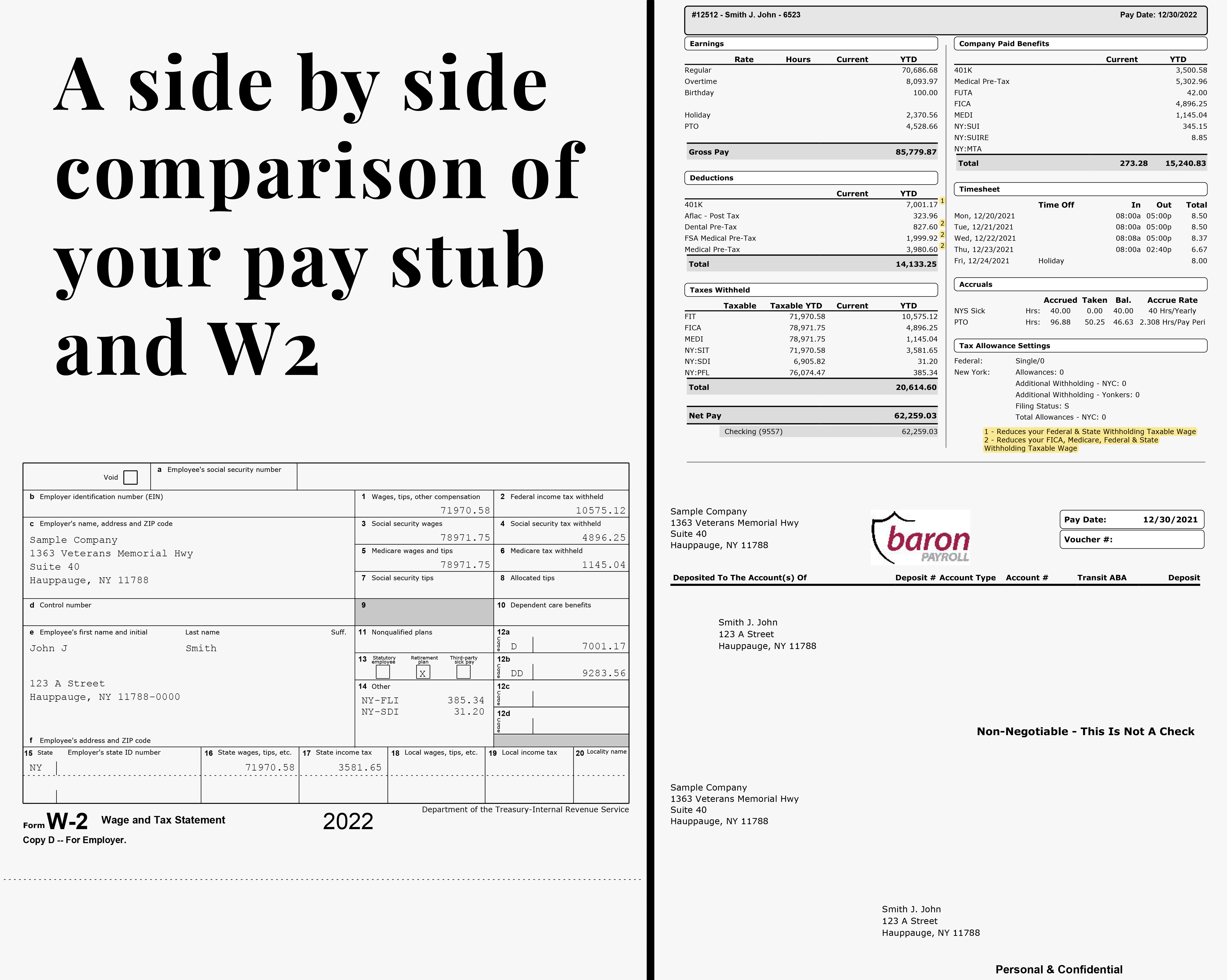

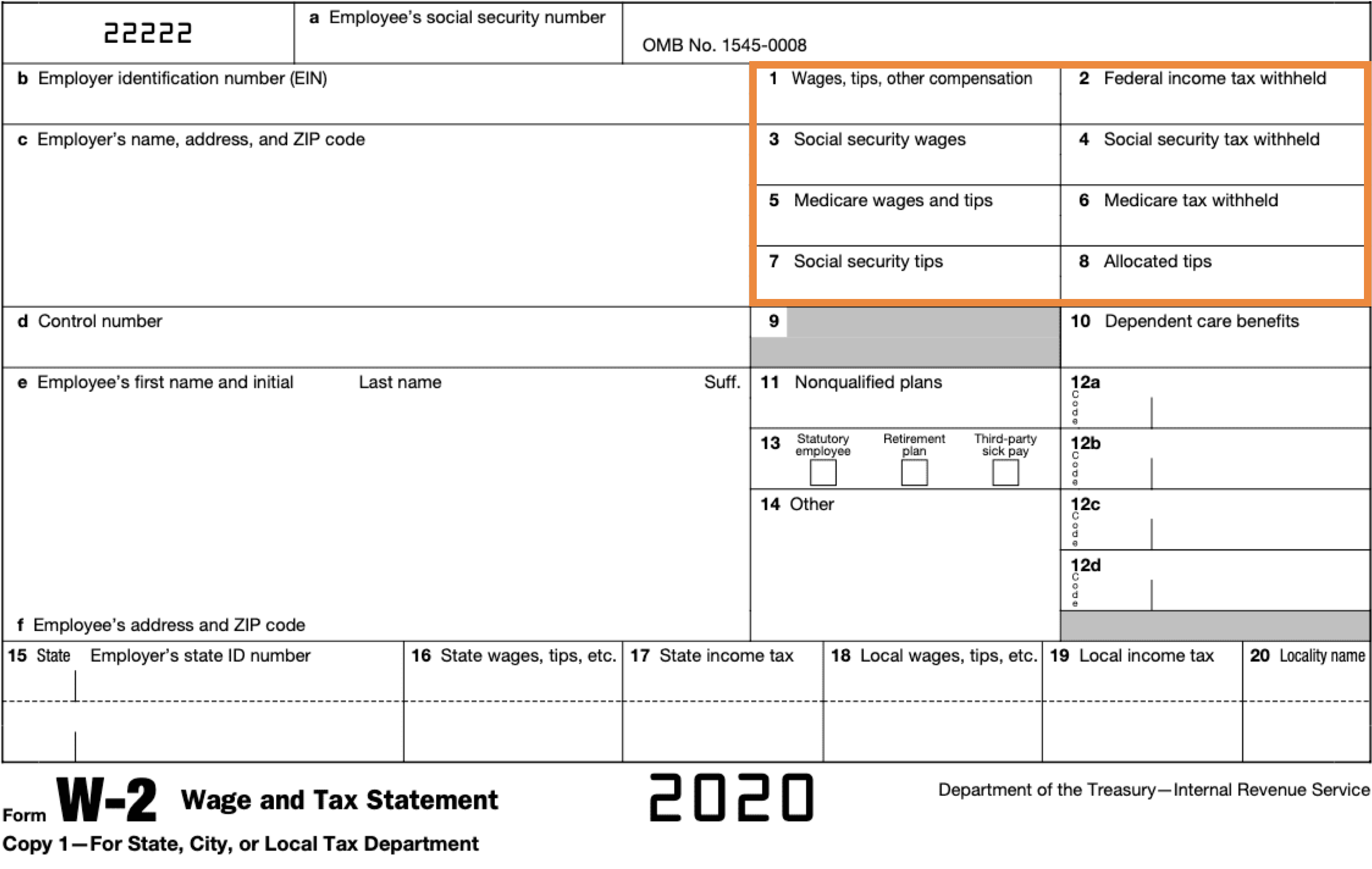

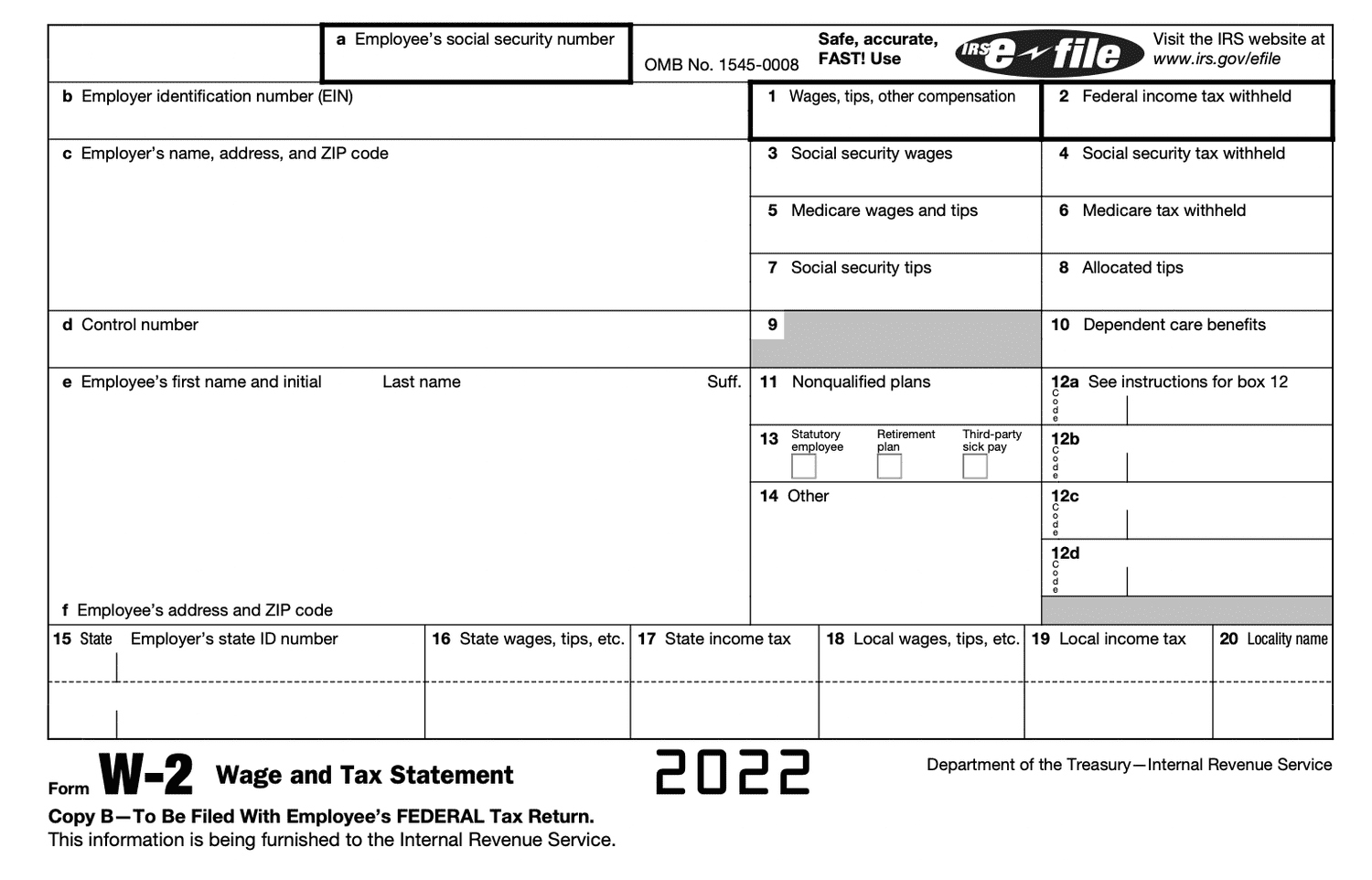

Below are some images related to Social Security Wages On W2 Form

how are ss wages calculated on w2, how calculate social security wages on w2, social security wages on w2 form, what does social security wages mean on w2, what is social security wages on w2, , Social Security Wages On W2 Form.

how are ss wages calculated on w2, how calculate social security wages on w2, social security wages on w2 form, what does social security wages mean on w2, what is social security wages on w2, , Social Security Wages On W2 Form.