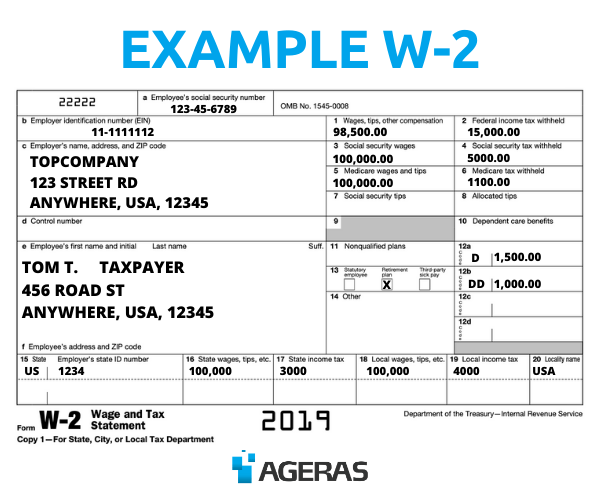

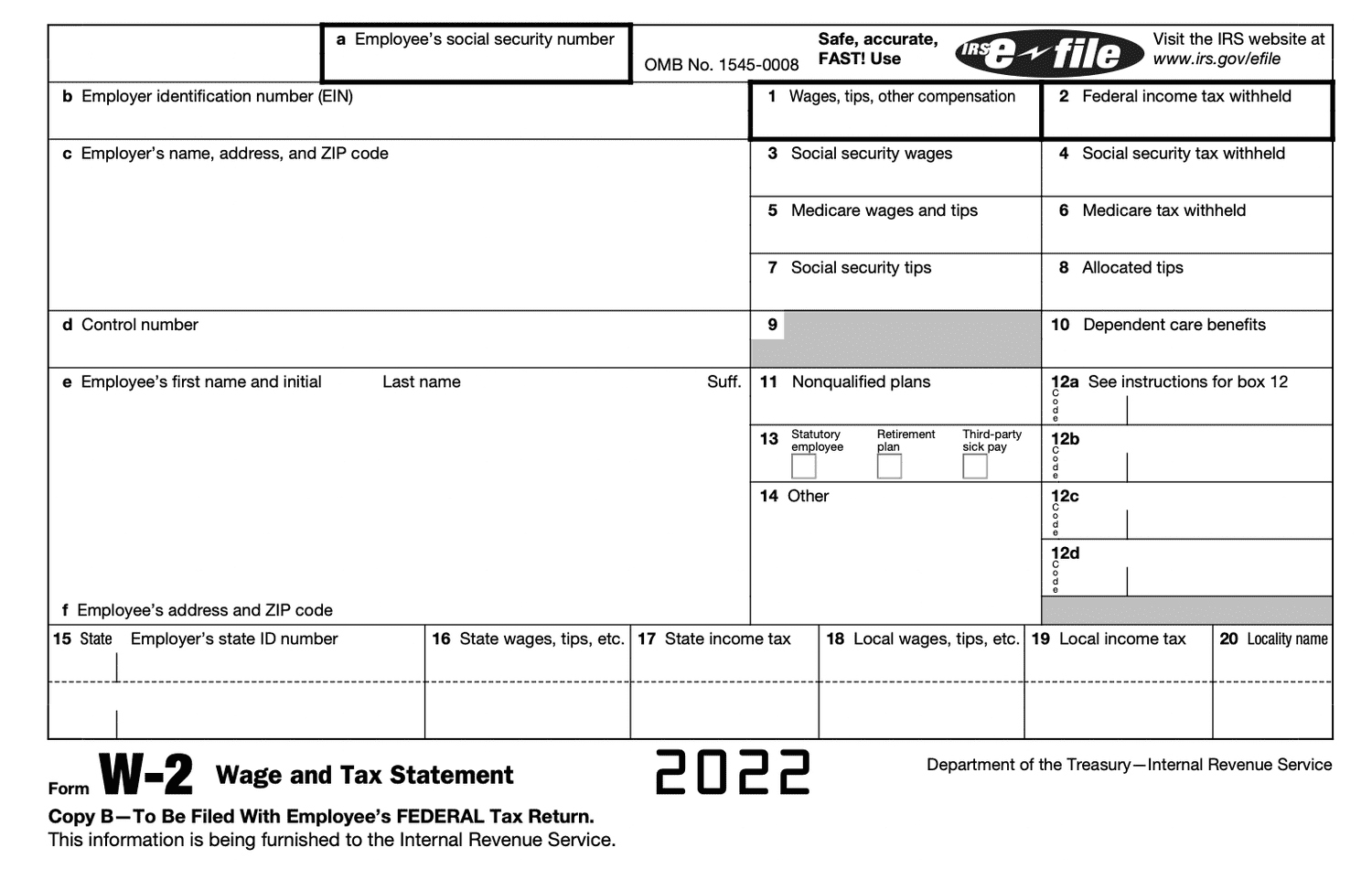

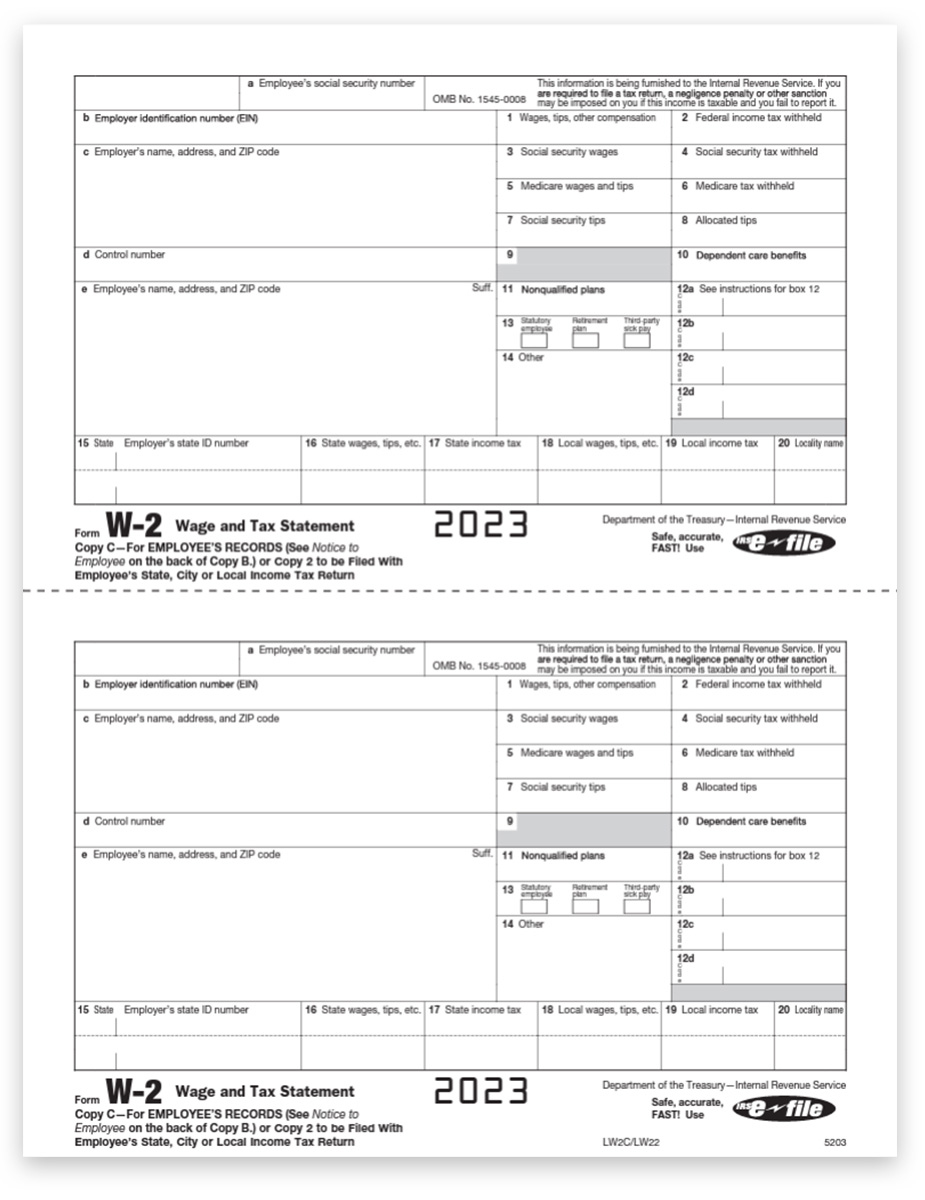

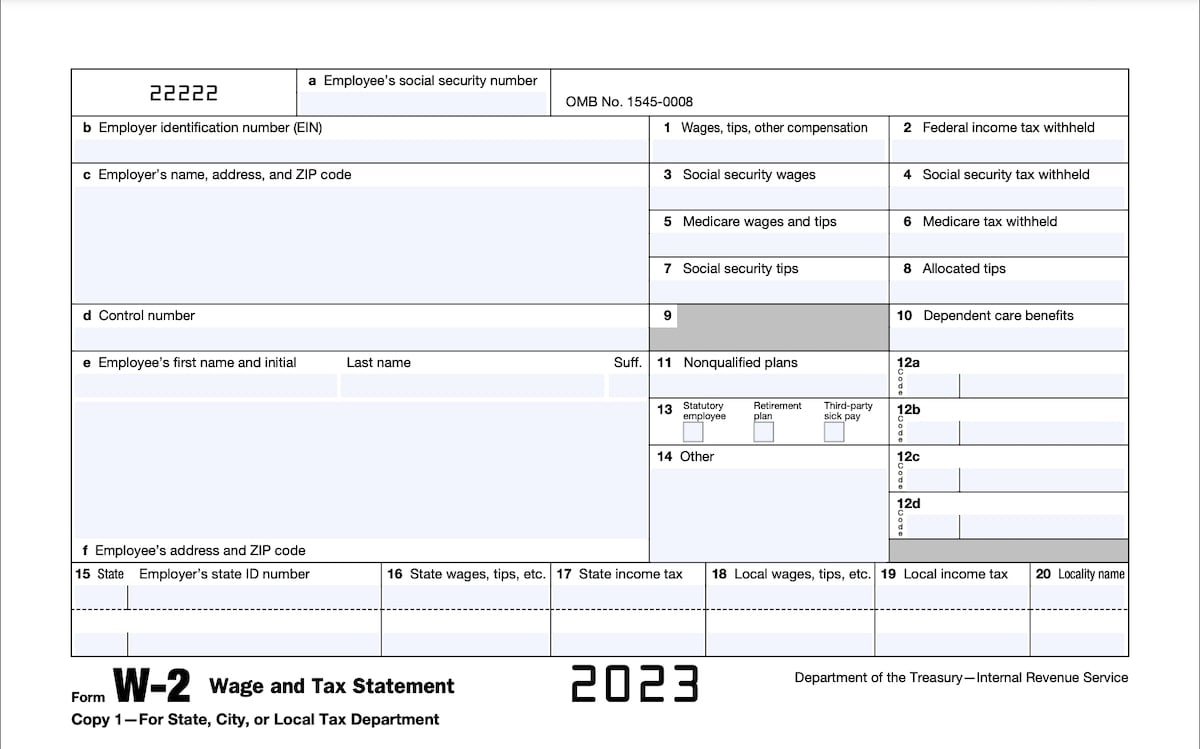

Tax W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Welcome to Wacky W2 Wonderland!

Welcome to the whimsical world of tax forms, where numbers and calculations come alive in a colorful array of boxes and lines. As tax season approaches, many of us are faced with the daunting task of deciphering our W2 forms. But fear not, for in this delightful Wacky W2 Wonderland, we will explore some tips and tricks to help you navigate through your tax forms with a smile!

Tips and Tricks for Navigating Tax Forms with a Smile

1. **Organize Your Documents:** Before diving into the sea of numbers on your W2 form, take a moment to gather all the necessary documents. This includes your W2 form, any additional income statements, and receipts for deductions. By organizing your documents beforehand, you can streamline the process and ensure that you don’t miss any important information.

2. **Break it Down:** Tax forms can be overwhelming, but remember to take it one step at a time. Start by reviewing each section of your W2 form, such as your personal information, wages, and tax withholdings. As you go through each section, make sure to double-check your entries for accuracy. Breaking down the form into smaller, manageable sections can make the process less intimidating and more manageable.

3. **Seek Help if Needed:** If you find yourself stuck or confused while filling out your W2 form, don’t hesitate to seek help. Whether it’s reaching out to a tax professional, using tax preparation software, or consulting the IRS website for guidance, there are plenty of resources available to assist you. Remember, it’s okay to ask for help, and getting the support you need can help you navigate through your tax forms with ease.

In conclusion, tax season doesn’t have to be a stressful or daunting experience. By approaching your W2 forms with a positive attitude and utilizing these tips and tricks, you can navigate through tax season with a smile. So embrace the wackiness of W2 Wonderland and tackle your tax forms with confidence and cheer!

Below are some images related to Tax W2 Forms

income tax w2 forms, tax w2 forms, tax w2 online, turbo tax w2 forms, w2 tax form canada, , Tax W2 Forms.

income tax w2 forms, tax w2 forms, tax w2 online, turbo tax w2 forms, w2 tax form canada, , Tax W2 Forms.