Penalties For Late W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Don’t Let Late W2 Forms Ruin Your Day!

Are you anxiously waiting for your W2 form to arrive in the mail, only to be met with dreaded delays? Don’t let the stress get to you! Late W2 forms can be a headache, but with the right mindset and some helpful tips, you can power through and stay on top of your tax game. Say goodbye to stress and say hello to a smoother tax season!

Say Goodbye to Stress!

Late W2 forms can definitely throw a wrench in your tax planning, but there’s no need to panic. Take a deep breath and remember that you’re not alone in this situation. The IRS understands that delays happen, and they have provisions in place to help you navigate through the process. Stay calm and trust that everything will work out in the end.

While waiting for your W2 form to arrive, take this time to gather any other financial documents you may need for tax filing. Organize your receipts, bank statements, and any other relevant paperwork to ensure a smooth filing process once your W2 does arrive. By staying proactive and prepared, you’ll be ready to tackle your taxes as soon as you have all the necessary information in hand.

If you find yourself getting anxious or overwhelmed by the delay, don’t hesitate to reach out for help. Consult with a tax professional who can provide guidance and support during this time. They can offer valuable advice on how to proceed with filing your taxes without your W2 form and help alleviate any concerns you may have. Remember, you’ve got this!

Power Through W2 Delays with These Tips

One way to navigate through W2 delays is to contact your employer or payroll department for assistance. They may be able to provide you with a digital copy of your W2 form, allowing you to proceed with filing your taxes in a timely manner. Keep in mind that employers are required to send out W2 forms by January 31st, so if you still haven’t received yours by then, it’s important to take action.

Another option is to file for an extension if you anticipate delays in receiving your W2 form. This will give you extra time to gather all the necessary information and ensure that your tax return is accurate and complete. Keep in mind that while an extension grants you more time to file, it does not extend the deadline for paying any taxes owed. Be sure to make any estimated payments to avoid penalties and interest.

Finally, stay positive and keep a can-do attitude throughout the process. Remember that delays happen, but they don’t have to ruin your day. By staying proactive, organized, and seeking help when needed, you can power through W2 delays and come out on top. Keep calm, stay focused, and tackle your taxes with confidence. You’ve got this!

In conclusion, don’t let late W2 forms dampen your spirits or ruin your day. With the right mindset and a few helpful tips, you can navigate through the process with ease. Stay proactive, reach out for support when needed, and power through the delays with confidence. Tax season may be stressful, but with a positive attitude and a can-do spirit, you can conquer any challenges that come your way. Here’s to a smooth tax season and a stress-free filing process!

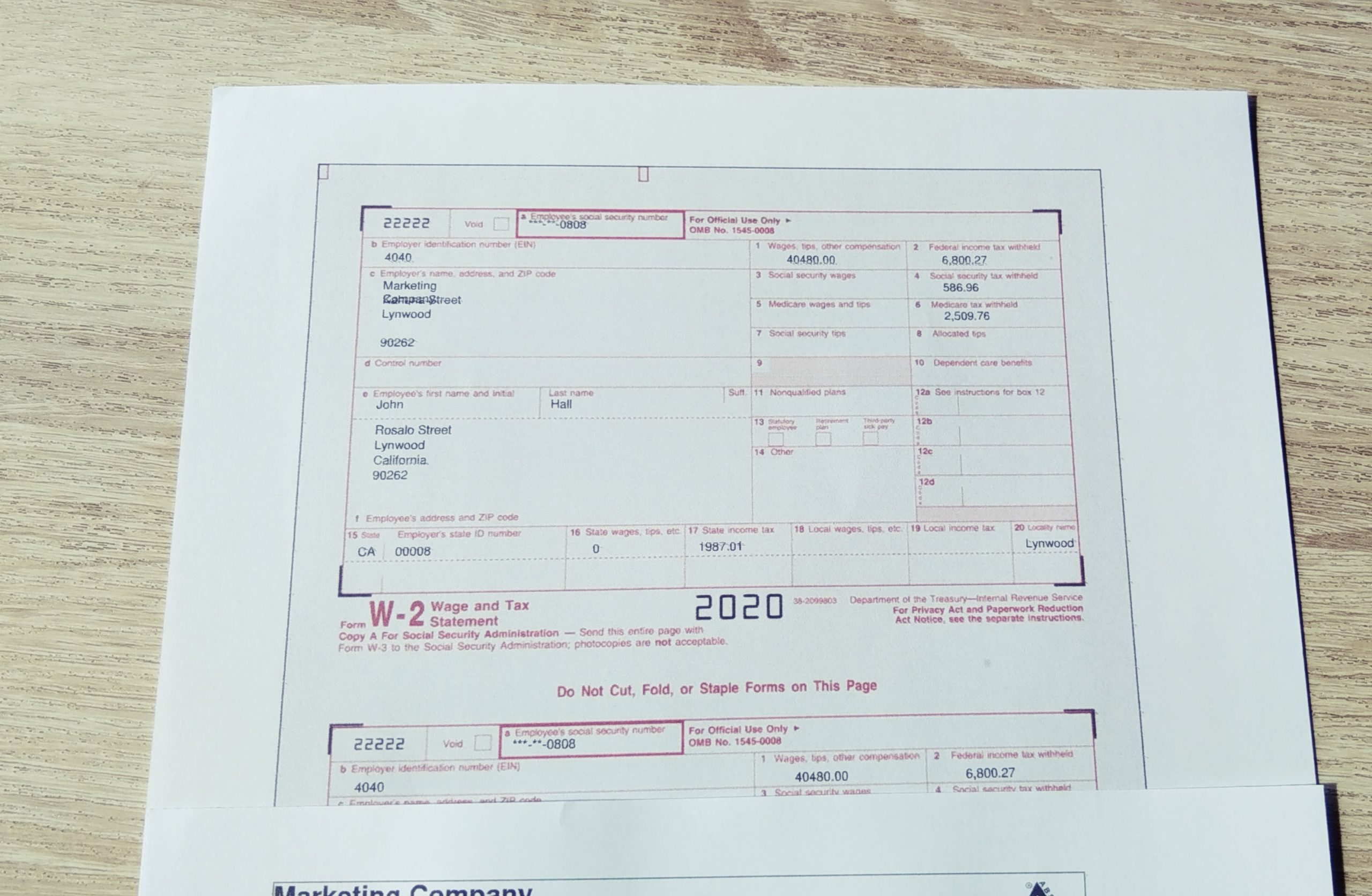

Below are some images related to Penalties For Late W2 Forms

can i file a late w2 next year, penalties for late w2, penalties for late w2 forms, what is the penalty for sending w2 late, who do you report late w2 forms to, , Penalties For Late W2 Forms.

can i file a late w2 next year, penalties for late w2, penalties for late w2 forms, what is the penalty for sending w2 late, who do you report late w2 forms to, , Penalties For Late W2 Forms.