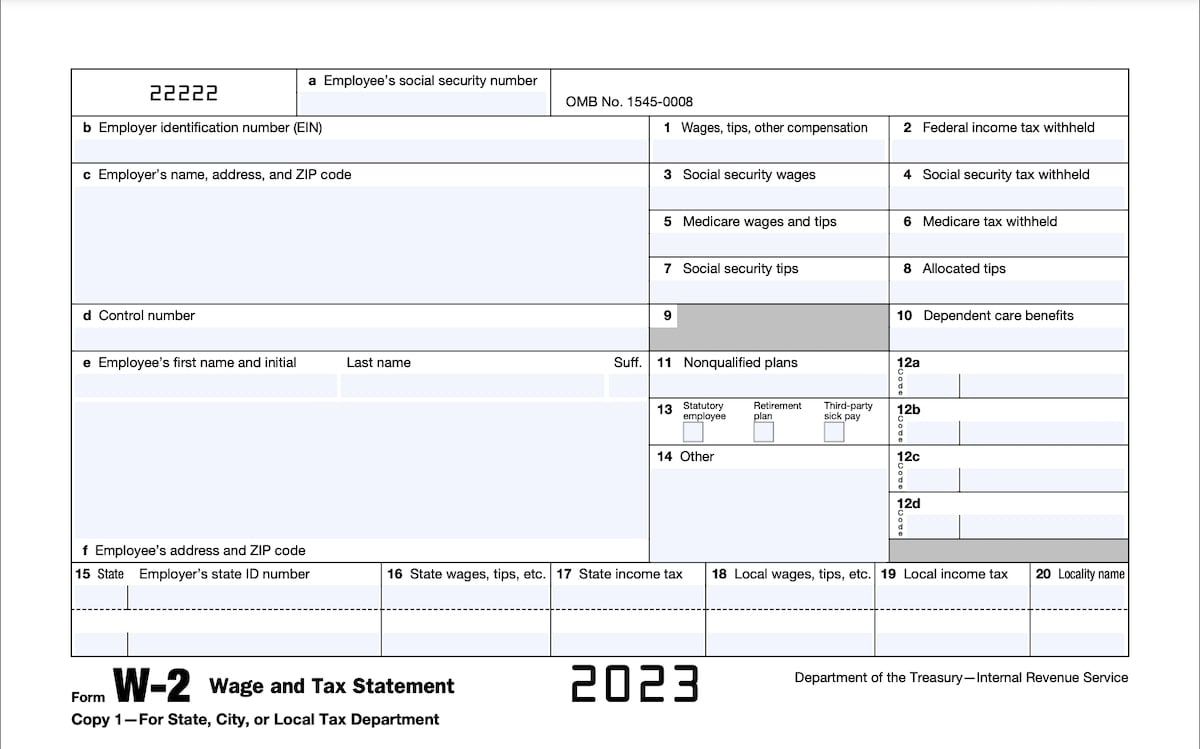

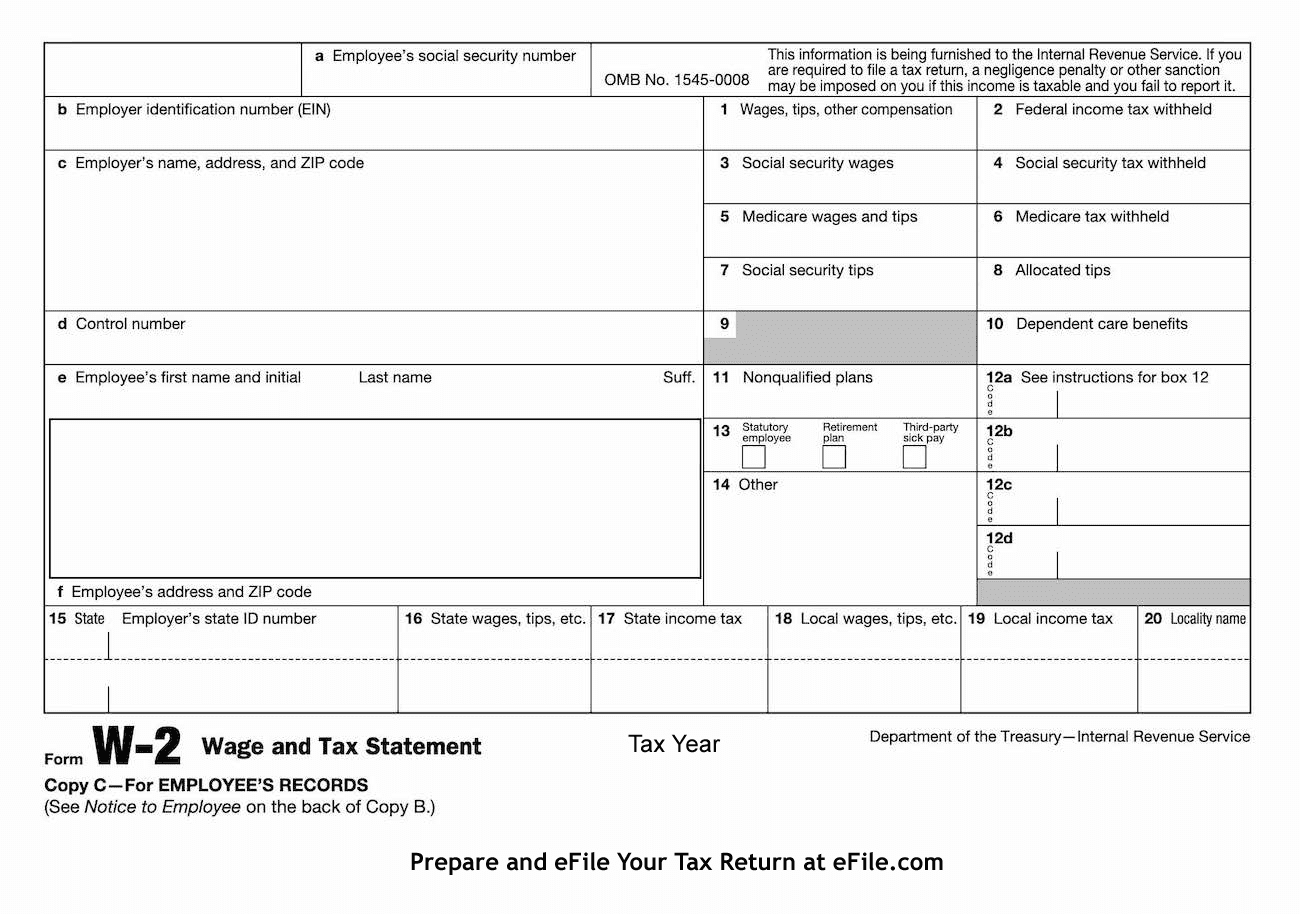

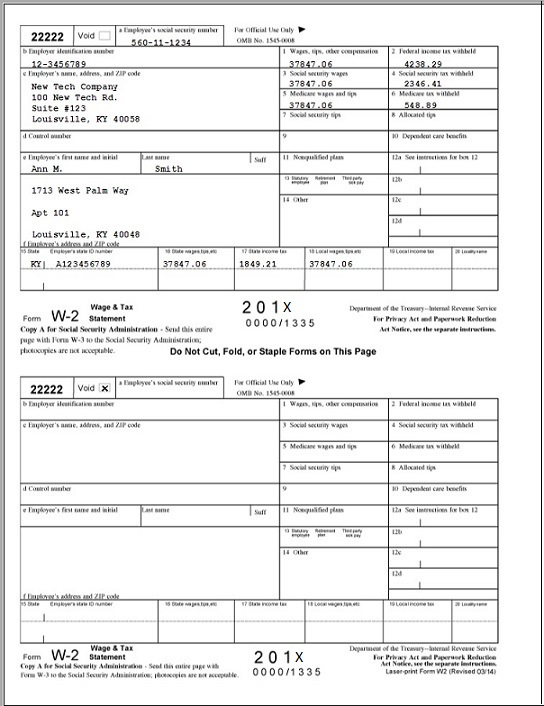

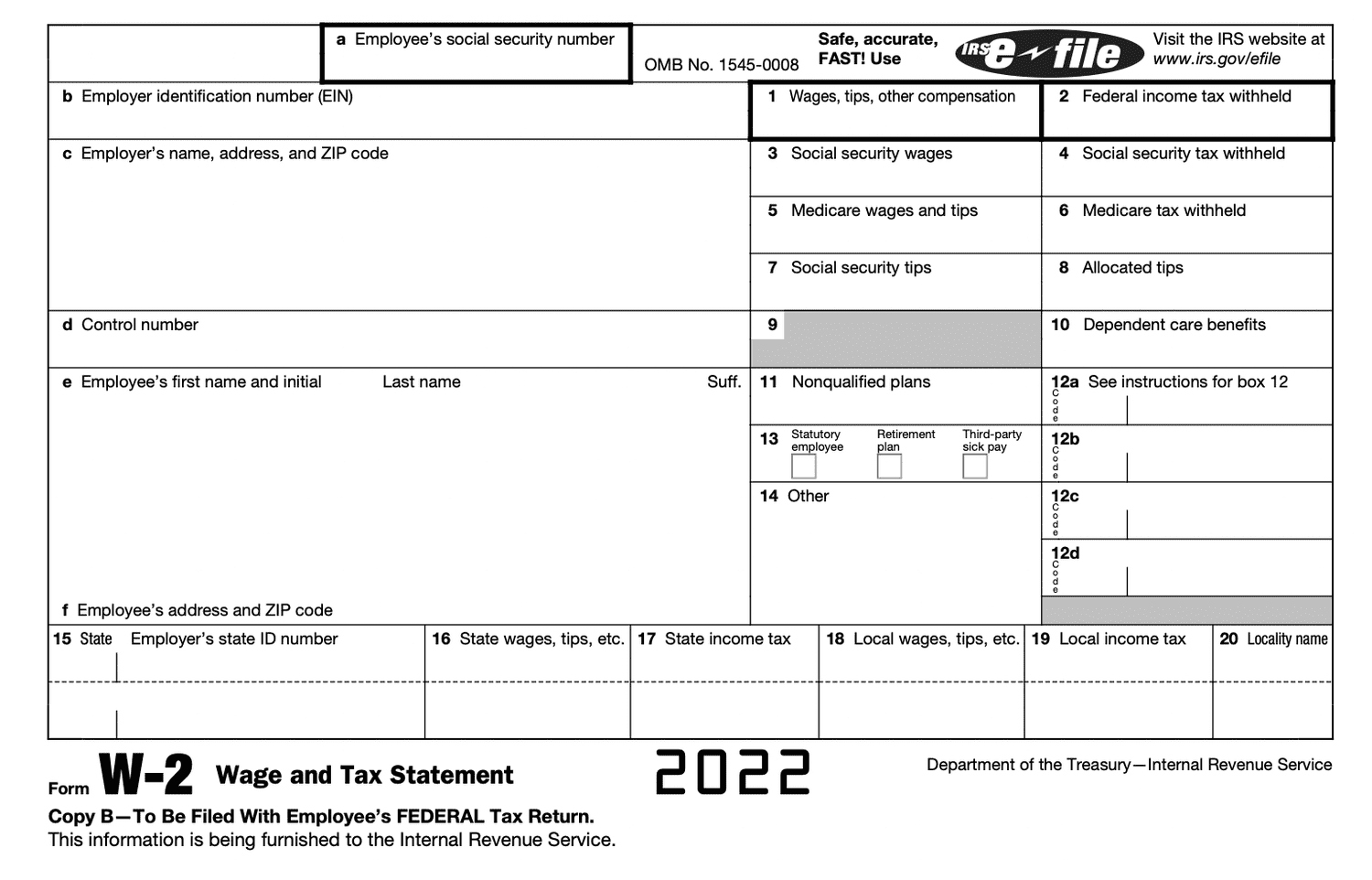

W2 Form Is For What – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Deciphering the W2 Form: A Beginner’s Guide

Welcome to the world of tax season, where the W2 form reigns supreme as one of the most important documents you’ll receive all year. But fear not, for we’re here to help you unravel the mystery of this seemingly complex form. The W2 form is a vital piece of paperwork that your employer provides you with, detailing your earnings and the taxes withheld from your paychecks throughout the year. It’s essentially a snapshot of your financial activity for the year, and understanding it is key to filing your taxes accurately and on time.

One of the first things you’ll see on your W2 form is your personal information, including your name, address, and Social Security number. This section is crucial for ensuring that the information on the form matches your records, so be sure to double-check for any errors. Next, you’ll find your earnings for the year, broken down into different categories such as wages, tips, and other compensation. This section gives you a clear picture of how much you earned throughout the year and is essential for calculating your tax liability.

Moving on, you’ll see the taxes that were withheld from your paychecks, including federal income tax, Social Security tax, and Medicare tax. These withholdings are deducted from your gross earnings to determine your net pay, which is the amount you actually take home. Understanding how these taxes are calculated and withheld is key to managing your finances and planning for any potential tax liabilities. By taking the time to decipher your W2 form, you’ll be better equipped to navigate the tax season with confidence and ease.

Unraveling the Enigma: Understanding Your W2 Form

Now that you’ve tackled the basics of the W2 form, let’s dive deeper into understanding the nuances of this essential document. One important section to pay attention to is the box labeled Box 12 – Codes, which details any additional compensation or benefits you may have received throughout the year. This could include items such as retirement plan contributions, health insurance premiums, or other fringe benefits provided by your employer. Understanding these codes can help you maximize your tax deductions and ensure you’re not missing out on any potential tax savings.

Another crucial aspect of the W2 form is the section that details any state and local taxes withheld from your paychecks. Depending on where you live and work, you may be subject to additional taxes at the state or local level, which can vary widely depending on your location. By reviewing this section of your W2 form, you can ensure that the correct amount of taxes was withheld and avoid any surprises when it comes time to file your state and local tax returns.

In conclusion, the W2 form may seem like a daunting document at first glance, but with a little patience and understanding, you can unlock its secrets and use it to your advantage during tax season. By familiarizing yourself with the various sections of the form, double-checking for accuracy, and seeking help from a tax professional if needed, you can ensure that you’re in good standing with the IRS and have a clear picture of your financial situation for the year. So don’t let the W2 form intimidate you – embrace it as a tool to help you navigate the world of taxes with confidence and ease.

Below are some images related to W2 Form Is For What

w2 form is for what, w2 form what do i get back, w2 form what to do, w2 form whataburger, what are w-2 forms used for, , W2 Form Is For What.

w2 form is for what, w2 form what do i get back, w2 form what to do, w2 form whataburger, what are w-2 forms used for, , W2 Form Is For What.