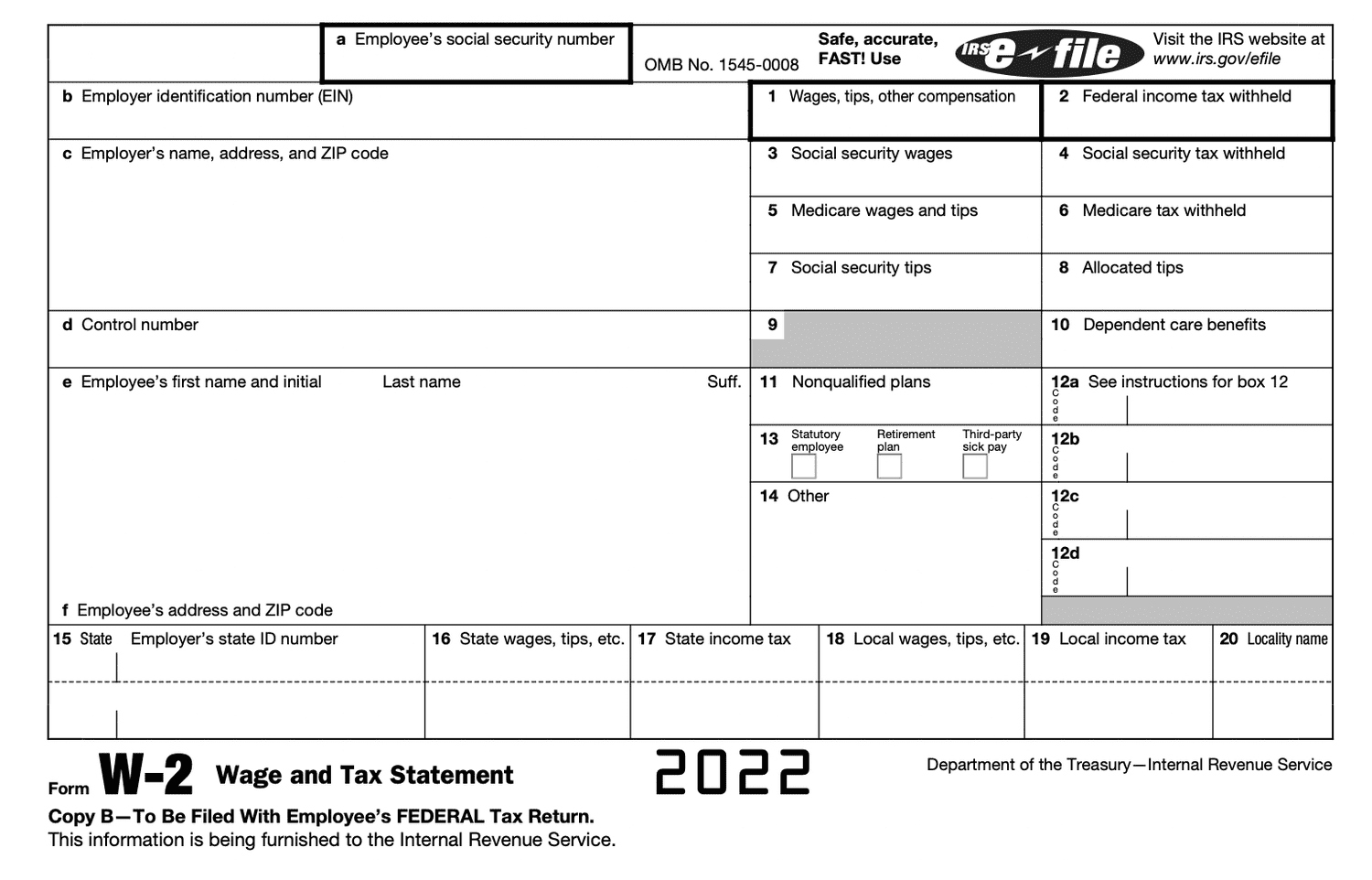

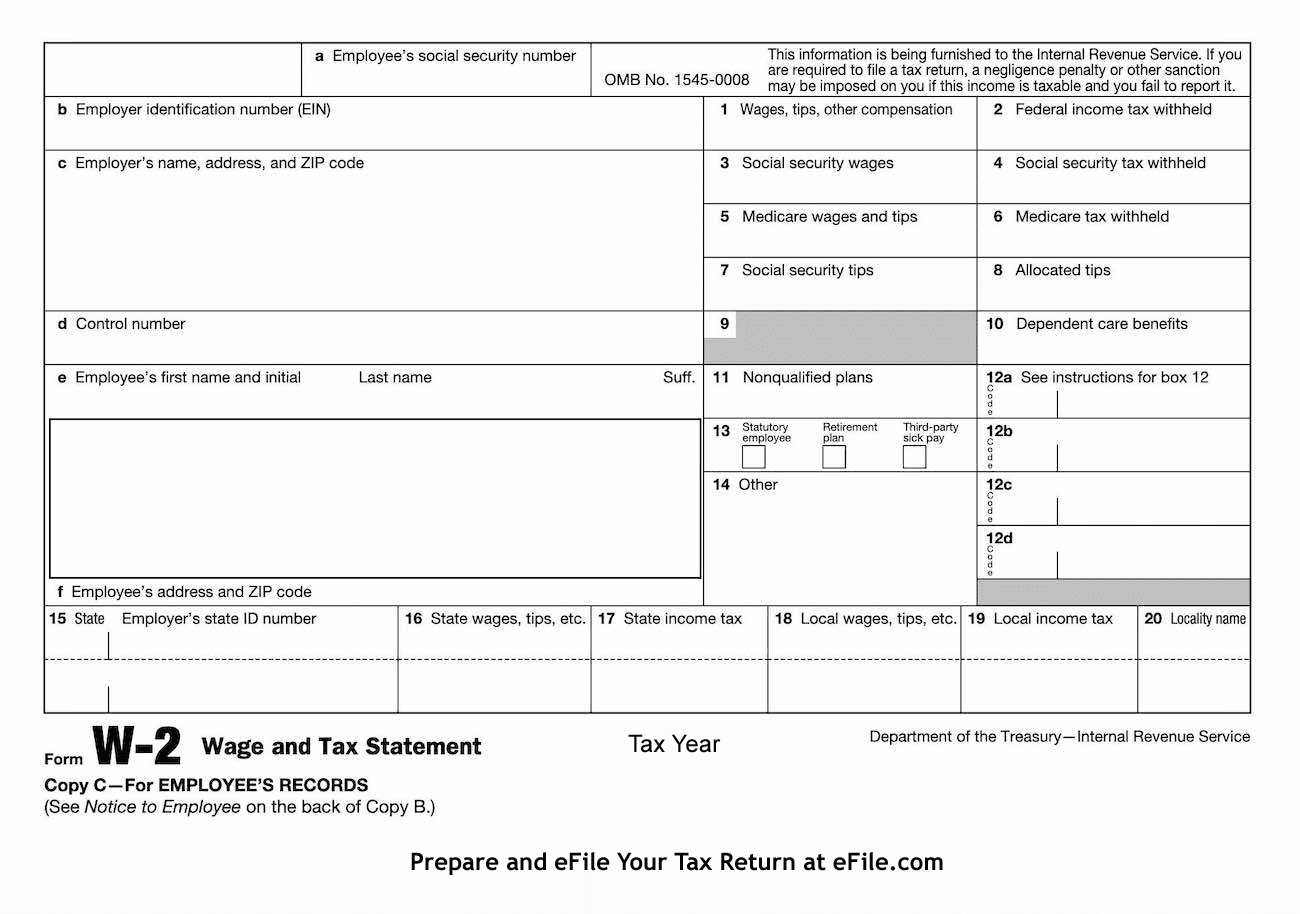

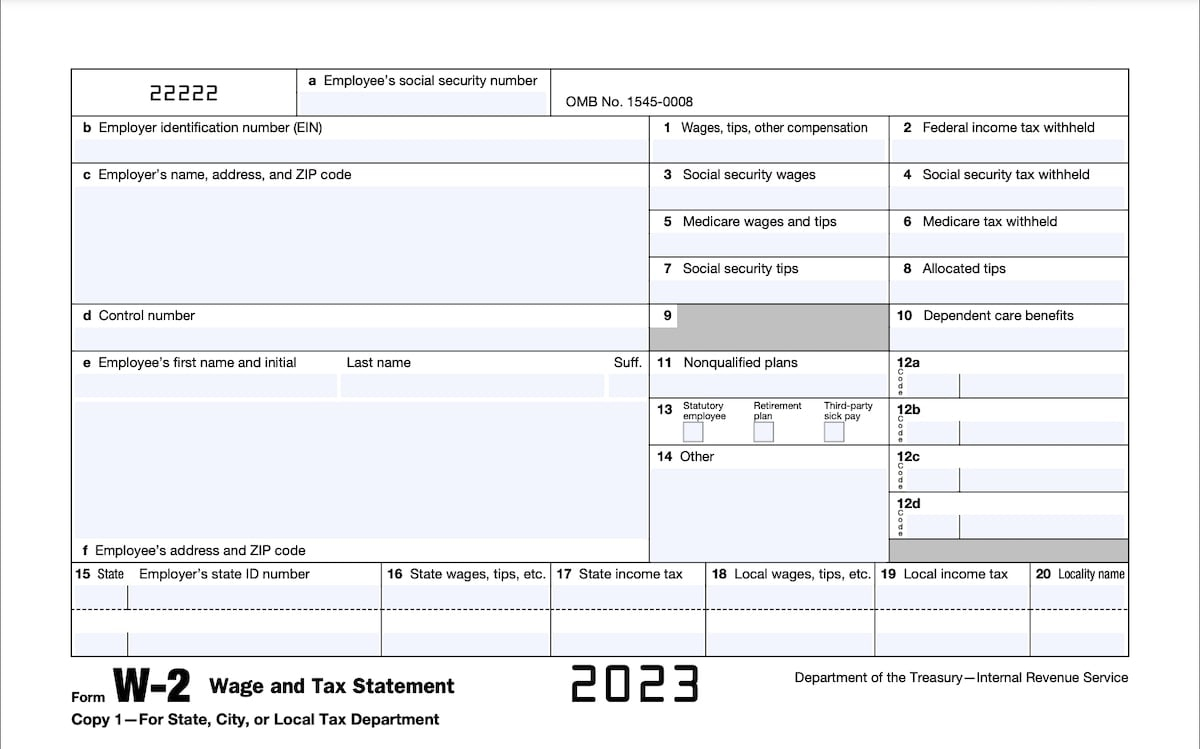

Obtain W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Tax Potential: How to Obtain Your W2 Form

Are you ready to unlock your tax potential and get one step closer to filing your taxes? The key to getting started is obtaining your W2 form from your employer. This crucial document contains all the information you need to accurately report your income and taxes paid throughout the year. Don’t let the process overwhelm you – follow these simple steps to obtain your W2 form today!

Discover the Key to Unlocking Your Tax Potential!

The first step in obtaining your W2 form is to reach out to your employer. Most employers are required by law to provide employees with their W2 forms by the end of January. If you haven’t received yours yet, don’t panic! Start by contacting your HR department or payroll administrator to request a copy. They should be able to either mail it to you or provide you with access to an online portal where you can download it.

Once you have contacted your employer and received your W2 form, take a moment to review it carefully. Make sure all the information is accurate, including your name, social security number, and wages earned. If you notice any discrepancies or missing information, reach out to your employer to have it corrected. It’s important to ensure that your W2 form is complete and accurate before using it to file your taxes.

Follow These Simple Steps to Obtain Your W2 Form Today!

Now that you have your W2 form in hand, you are one step closer to unlocking your tax potential! If you are ready to file your taxes, gather all your financial documents, including your W2 form, and start the process. Whether you choose to file online or seek assistance from a tax professional, having your W2 form readily available will make the process smooth and efficient. Remember, the key to maximizing your tax potential is having all the necessary documentation in order.

In conclusion, obtaining your W2 form is the first step towards unlocking your tax potential and ensuring a successful tax filing season. By following these simple steps and staying organized, you can take control of your finances and make the most out of your tax return. Don’t let the process intimidate you – with the right tools and information, you can navigate through tax season with ease. So, what are you waiting for? Get your W2 form today and start on the path to unlocking your tax potential!

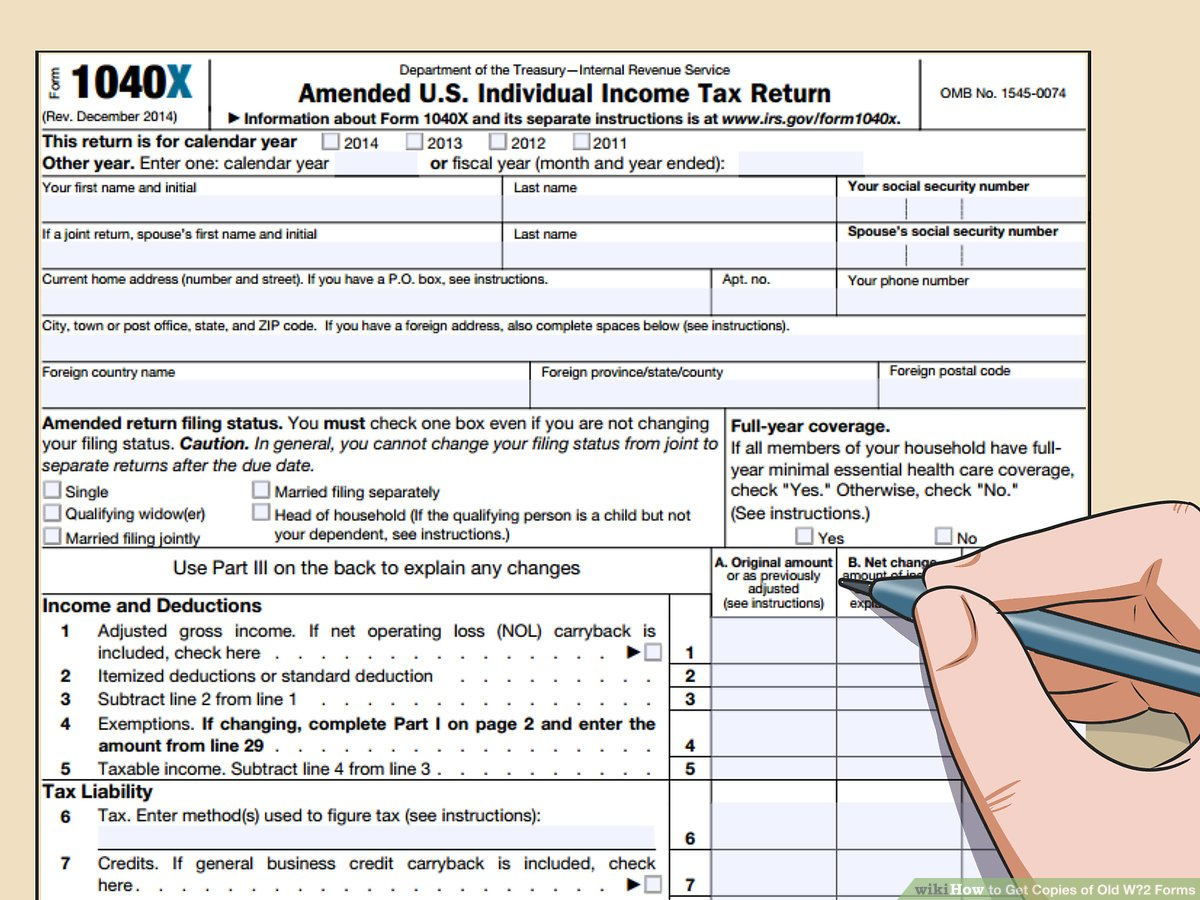

Below are some images related to Obtain W2 Form

get w2 form, get w2 former employer, how to find w2 form, obtain w2 form, , Obtain W2 Form.

get w2 form, get w2 former employer, how to find w2 form, obtain w2 form, , Obtain W2 Form.