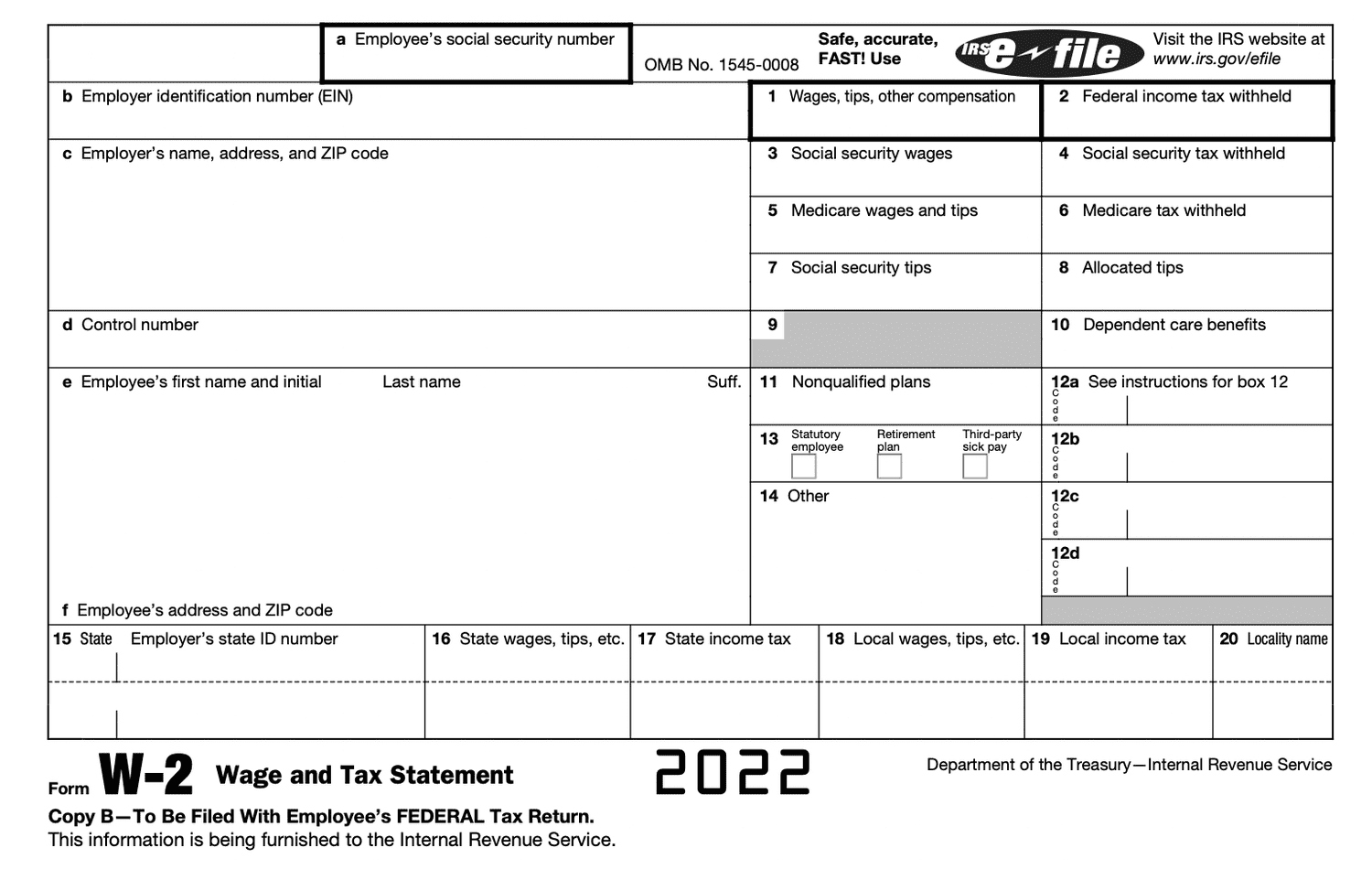

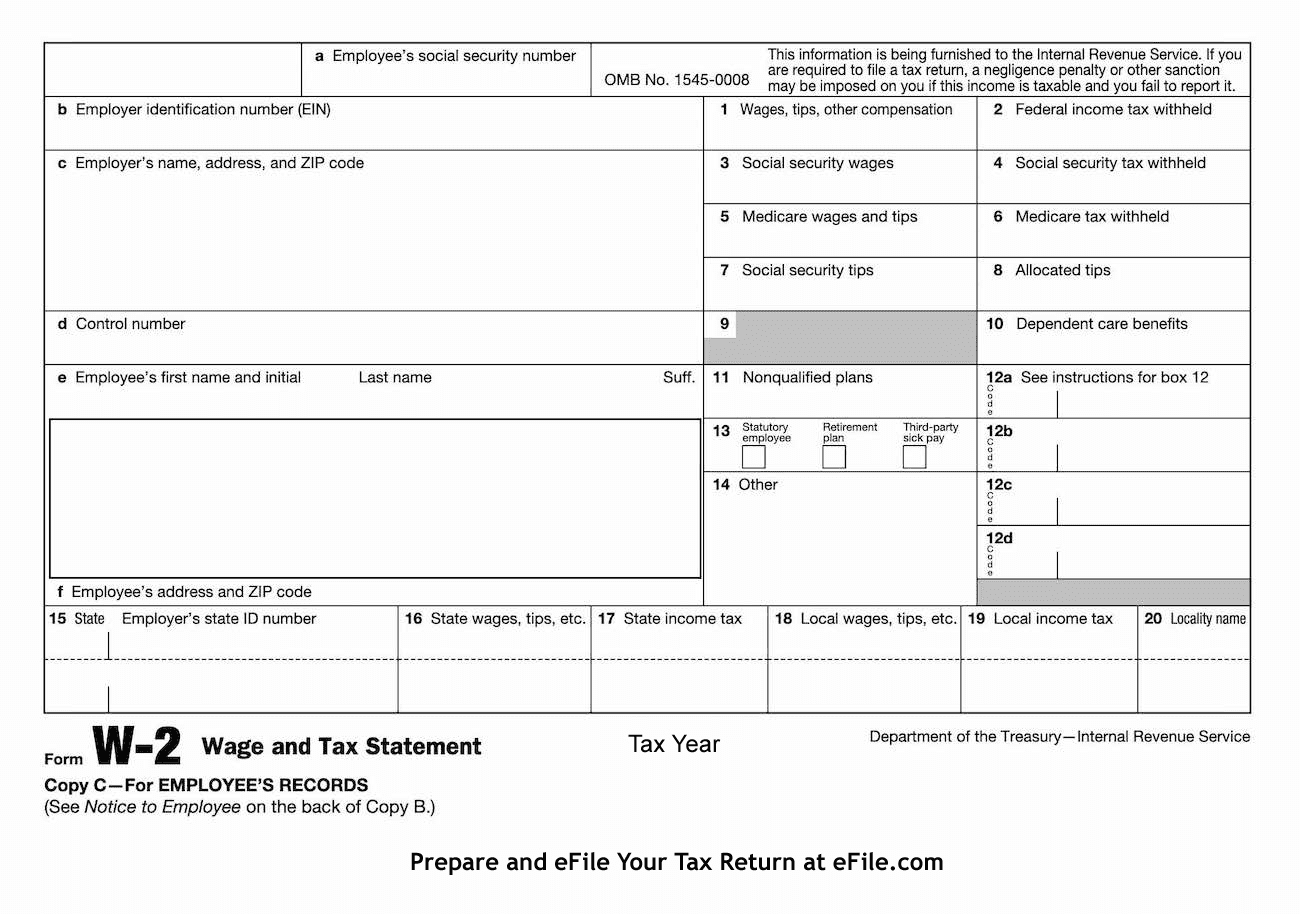

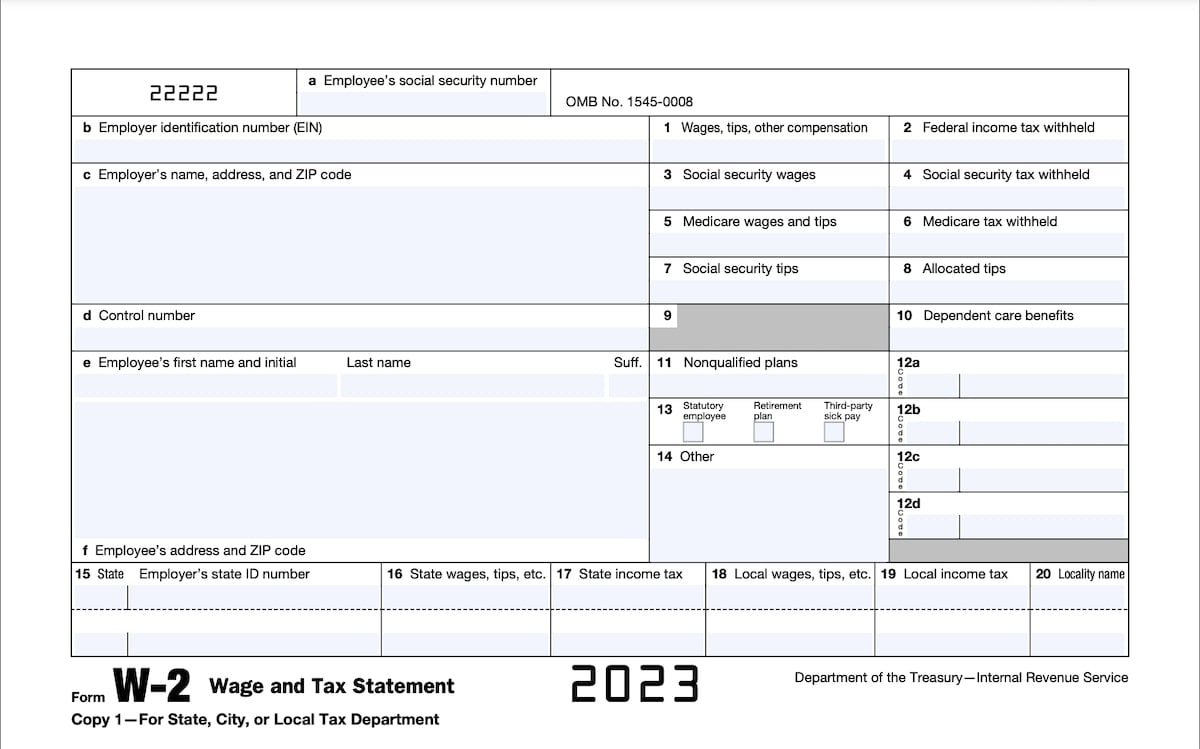

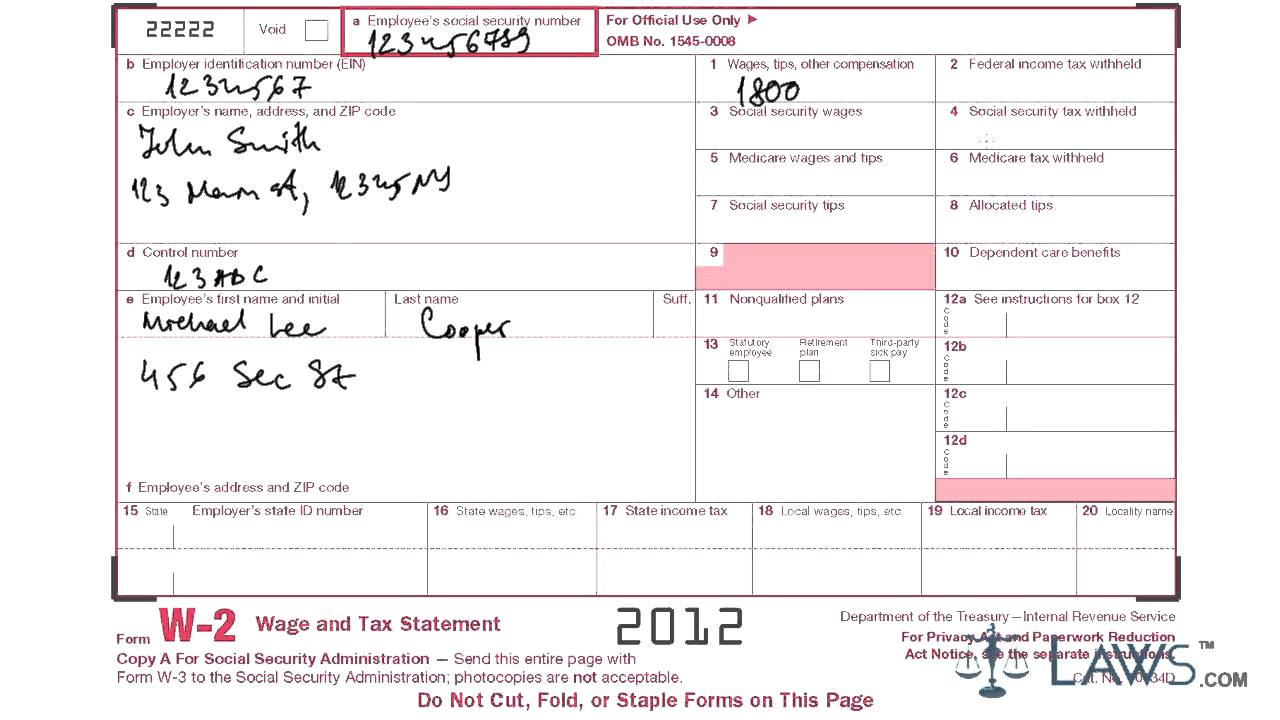

W2 Form Employees Fill Out – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Exciting Season: Time to Unwrap Your W2!

As the end of the year approaches, employees all around the country are gearing up for one of the most exciting times of the year – tax season! It’s time to dust off your calculators, sharpen your pencils, and get ready to dive into the world of employee tax time fun. The anticipation builds as you eagerly await the arrival of your W2 form in the mail, ready to unwrap it like a kid on Christmas morning.

The moment you hold that envelope in your hands, there’s a sense of thrill and excitement. You carefully tear it open, revealing the precious document that holds all the information about your earnings from the past year. As you scan through the numbers and figures, you can’t help but feel a sense of accomplishment for all your hard work throughout the year. It’s a moment of reflection and gratitude, as you realize just how far you’ve come since the last tax season.

Now comes the fun part – crunching numbers, filling out forms, and making sense of it all. While some may find the thought of taxes daunting, true tax warriors see it as a challenge to conquer. With a cup of coffee in hand and your favorite tax software at the ready, you dive headfirst into the world of deductions, credits, and refunds. It’s a puzzle to solve, a game to play, and an opportunity to maximize your savings. So embrace the season with open arms and let the tax time fun begin!

Dive into the World of Employee Tax Time Fun!

As you navigate through the labyrinth of tax forms and documents, remember that you’re not alone in this journey. Reach out to your colleagues, friends, or tax professionals for guidance and support. Share your experiences, tips, and tricks for a stress-free tax season. Turn it into a bonding experience and make the most out of this time of year.

Take this opportunity to educate yourself about the tax laws, deductions, and credits that could benefit you. With a little bit of research and effort, you may uncover hidden gems that could save you money and boost your refund. Remember, knowledge is power, and the more you know about your taxes, the better equipped you’ll be to navigate through the process with confidence.

And don’t forget to reward yourself for a job well done once you’ve completed your taxes. Whether it’s treating yourself to a nice dinner, indulging in a spa day, or planning a well-deserved vacation, celebrate your tax time triumphs in style. After all, you’ve earned it! So embrace the fun, stay positive, and make the most out of this tax season. Happy filing!

In conclusion, tax season may not be everyone’s idea of fun, but with the right attitude and approach, it can be a rewarding and even enjoyable experience. So unwrap your W2 with excitement, dive into the world of tax time fun, and make the most out of this season. Remember, it’s not just about crunching numbers and filling out forms – it’s a chance to reflect on your achievements, educate yourself, and celebrate your hard work. So embrace the season with open arms and let the tax time fun begin!

Below are some images related to W2 Form Employees Fill Out

w-2 form for employee to fill out, w2 form 2022 for employee to fill out, w2 form 2023 for employee to fill out, w2 form employees fill out, what form do w2 employees fill out, , W2 Form Employees Fill Out.

w-2 form for employee to fill out, w2 form 2022 for employee to fill out, w2 form 2023 for employee to fill out, w2 form employees fill out, what form do w2 employees fill out, , W2 Form Employees Fill Out.