Do I Need W2 From Former Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

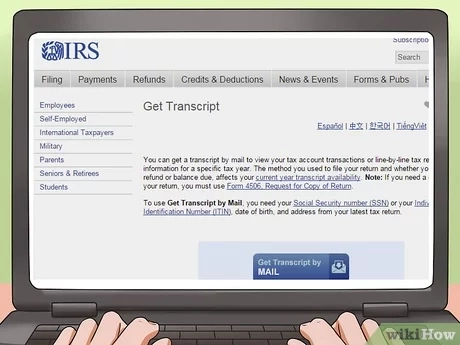

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Demystifying Your W2 Form: Everything You Need to Know

Have you ever received your W2 form in the mail and been left scratching your head, wondering what all those numbers and codes mean? Fear not, because we are here to demystify the W2 form for you! Your W2 form is a crucial document that summarizes your earnings and tax withholdings for the year. It includes information such as your total wages, tips, and other compensation, as well as the amount of federal, state, and other taxes withheld from your paycheck. Understanding your W2 form is essential for filing your taxes accurately and maximizing your refund.

One of the most important sections of your W2 form is Box 1, which shows your total taxable wages for the year. This is the amount that is used to calculate how much income tax you owe. If you have multiple jobs or sources of income, make sure to add up all the amounts in Box 1 from each W2 form you receive. Another key section is Box 2, which displays the total federal income tax withheld from your paychecks throughout the year. This amount is credit towards your total tax liability and can help determine if you will receive a refund or owe additional taxes.

In addition to federal taxes, your W2 form may also include information on state and local taxes withheld, as well as contributions to retirement accounts or other benefits. It’s essential to review your W2 form carefully for accuracy and report any discrepancies to your employer as soon as possible. By understanding the information on your W2 form, you can take control of your finances and feel more confident when filing your taxes.

Get Ready to Master Your W2: A Complete Guide for You

Now that you have a better understanding of your W2 form, it’s time to take charge and master this important document. Start by gathering all your W2 forms from each employer or source of income you had during the tax year. Make sure to keep them in a safe place where you can easily access them when it’s time to file your taxes. Next, review each W2 form carefully to ensure that all the information is correct and matches your records. If you notice any errors or discrepancies, reach out to your employer for clarification and corrections.

Once you have verified the accuracy of your W2 forms, you can use them to prepare and file your taxes. You can either manually input the information from your W2 forms into tax preparation software or provide them to a tax professional to handle on your behalf. Be sure to keep a copy of your W2 forms for your records and follow up with your employer to ensure that they have been submitted to the IRS. By mastering your W2 forms, you can navigate the tax filing process with ease and confidence.

In conclusion, your W2 form is more than just a piece of paper – it’s a valuable tool that can help you understand your earnings, taxes, and financial situation. By demystifying the information on your W2 form and mastering the filing process, you can take control of your taxes and make informed decisions about your finances. So the next time you receive your W2 form, don’t be intimidated – embrace it as a key to unlocking your financial success!

Below are some images related to Do I Need W2 From Former Employer

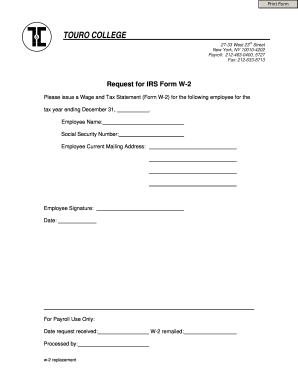

can you get w2 from previous employer, do former employers have to mail w2, do i need w2 from former employer, how can i get my w2 from former employer, need w2 from former employer, , Do I Need W2 From Former Employer.

can you get w2 from previous employer, do former employers have to mail w2, do i need w2 from former employer, how can i get my w2 from former employer, need w2 from former employer, , Do I Need W2 From Former Employer.