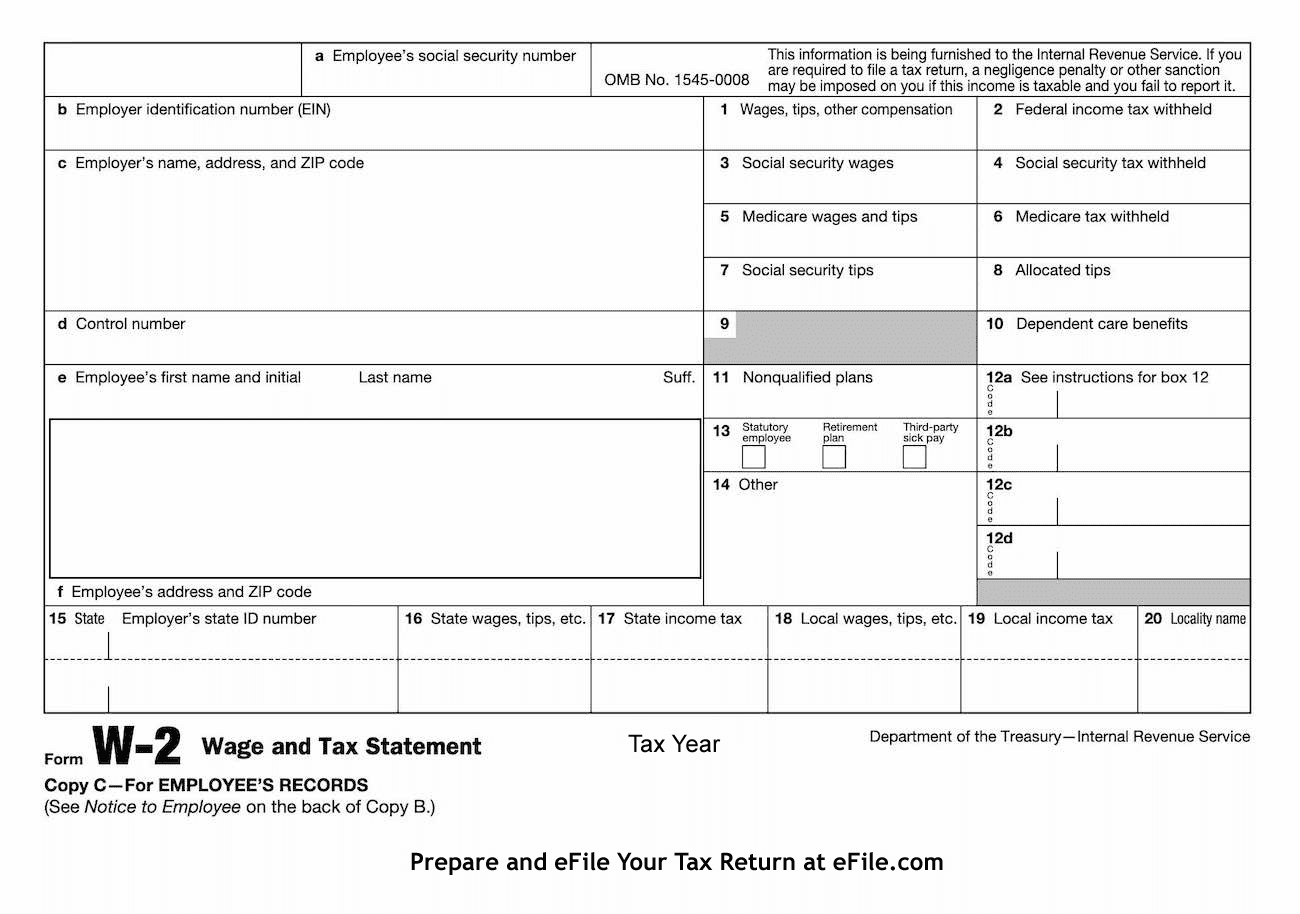

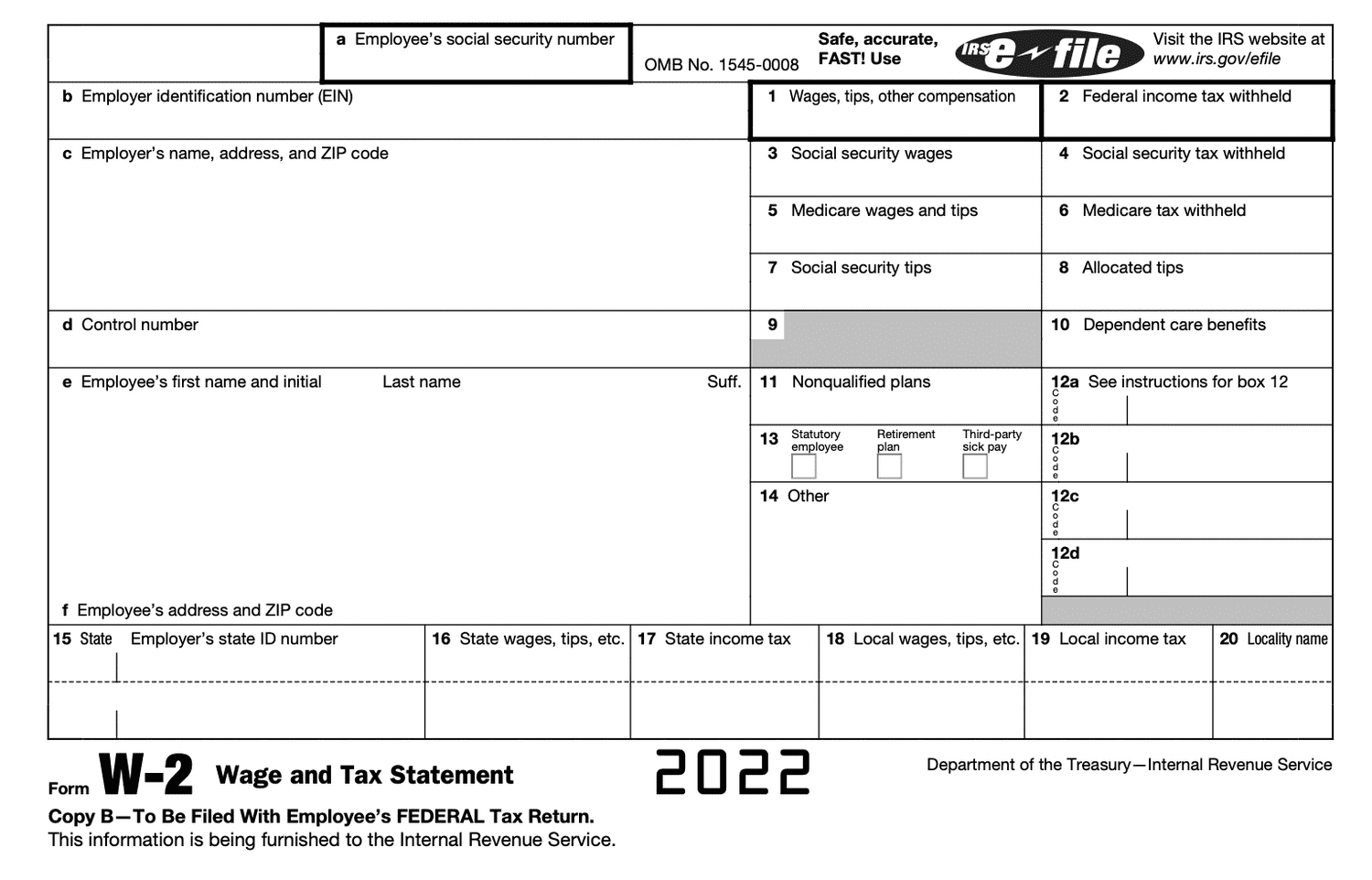

I Have Two W2 Forms From Different Employers – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Mastering the Art of Balancing Two Jobs

Are you juggling two jobs and feeling overwhelmed by the amount of paperwork that comes with it? Fear not, because with a little bit of organization and planning, you can easily navigate the world of dual W2 forms. First and foremost, make sure to keep track of your hours worked at both jobs to ensure accuracy when filing your taxes. It’s also helpful to create a schedule that allows you to dedicate equal time and energy to each job, preventing burnout and maximizing productivity.

Additionally, communication is key when managing two jobs. Make sure to keep your employers informed about your availability and any potential conflicts that may arise. This will help you avoid any misunderstandings or scheduling issues down the road. Remember, it’s important to prioritize your mental and physical well-being while balancing two jobs, so don’t be afraid to seek support from friends, family, or even a therapist if needed.

Lastly, don’t forget to take advantage of any resources or tools provided by your employers to help streamline the process of managing two jobs. Whether it’s online scheduling platforms, payroll systems, or tax assistance programs, these tools can make your life much easier and more efficient. By staying organized, communicating effectively, and utilizing available resources, you can successfully navigate the world of dual W2 forms and thrive in your double-job lifestyle.

Maximize Your Tax Refund with Two W2 Forms

Having two W2 forms may seem daunting at first, but it can actually work to your advantage when it comes to tax season. By combining the incomes from both jobs, you may qualify for additional tax deductions or credits that can increase your overall refund. Make sure to take advantage of any tax breaks available to you, such as the Earned Income Tax Credit or the Child and Dependent Care Credit, to maximize your refund.

Additionally, having multiple W2 forms allows you to compare the withholding amounts from each job and adjust your tax withholding accordingly. By ensuring that the correct amount of taxes is being withheld from each paycheck, you can avoid owing money at the end of the year or receiving a smaller refund than expected. Consider consulting with a tax professional to help you navigate the process and ensure that you are optimizing your tax situation.

In conclusion, juggling two W2 forms may require a bit of extra effort and organization, but it can ultimately lead to a larger tax refund and a more financially secure future. By mastering the art of balancing two jobs, communicating effectively with your employers, and maximizing your tax deductions, you can make the most out of having dual sources of income. So embrace the challenge, stay positive, and double the fun of managing two W2 forms!

Below are some images related to I Have Two W2 Forms From Different Employers

can you get two w2 from same employer, can you have two w2s from the same employer, i have 2 w2 forms from different employers, i have two w2 forms from different employers, i have two w2 forms from different employers do i have to file both, , I Have Two W2 Forms From Different Employers.

can you get two w2 from same employer, can you have two w2s from the same employer, i have 2 w2 forms from different employers, i have two w2 forms from different employers, i have two w2 forms from different employers do i have to file both, , I Have Two W2 Forms From Different Employers.