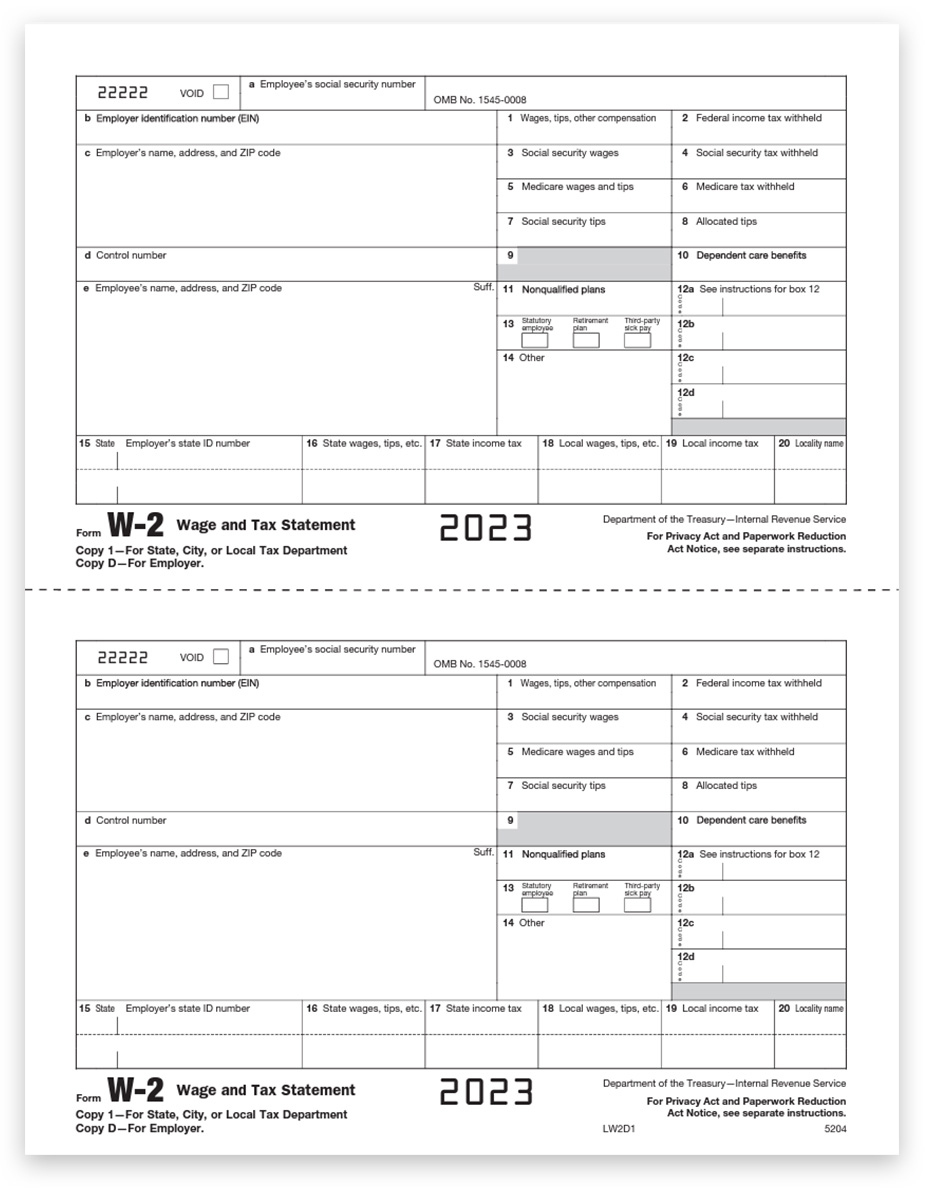

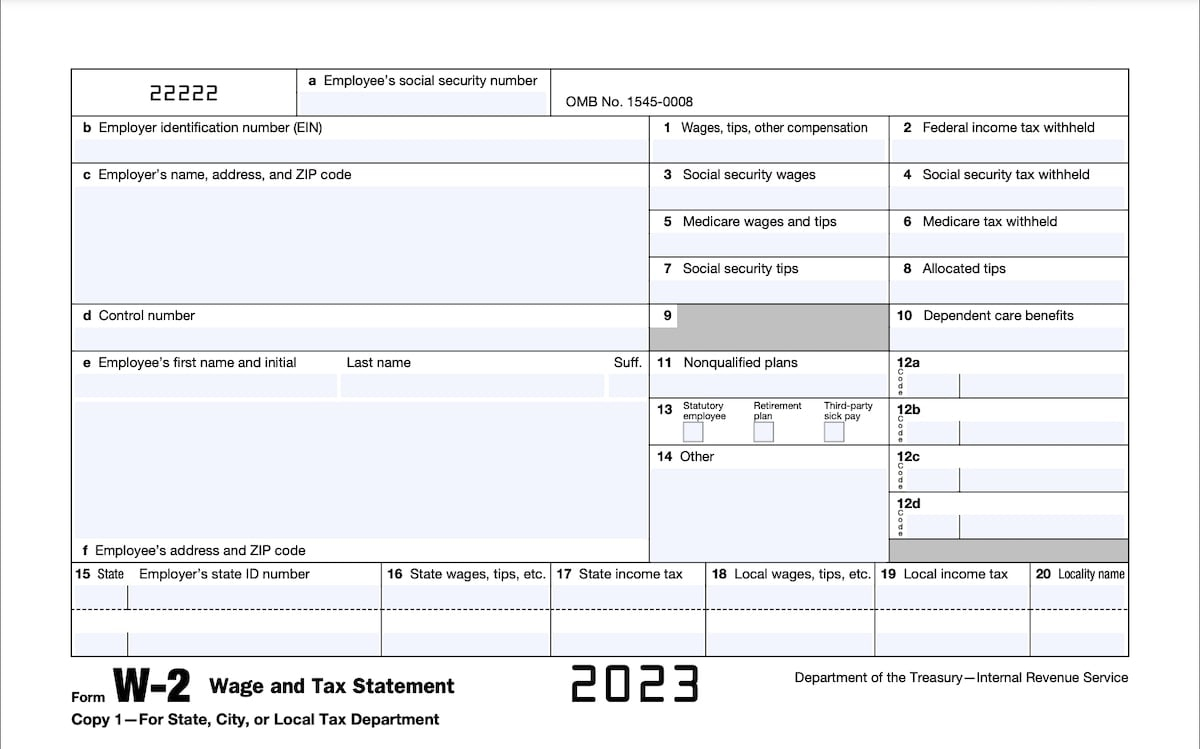

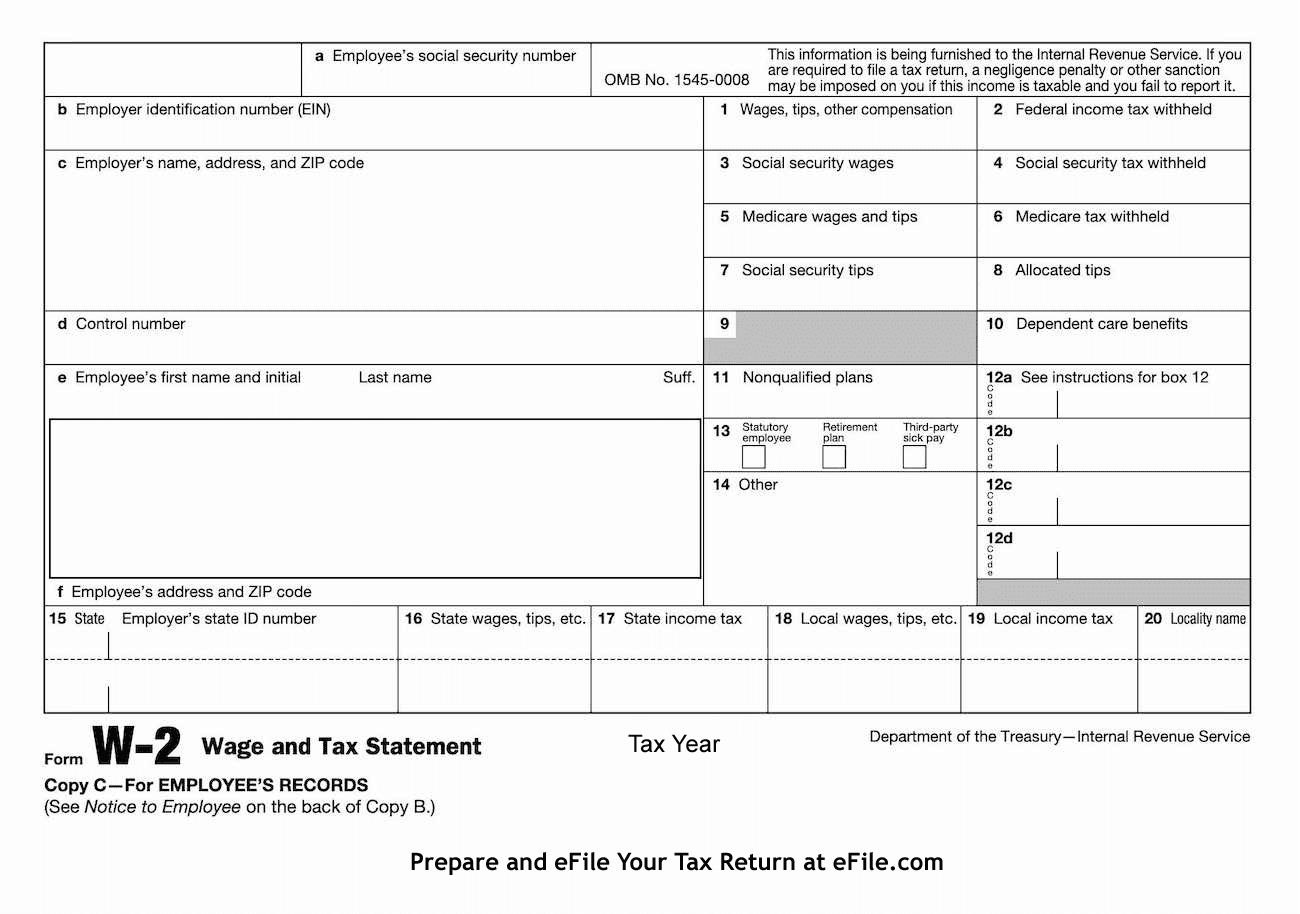

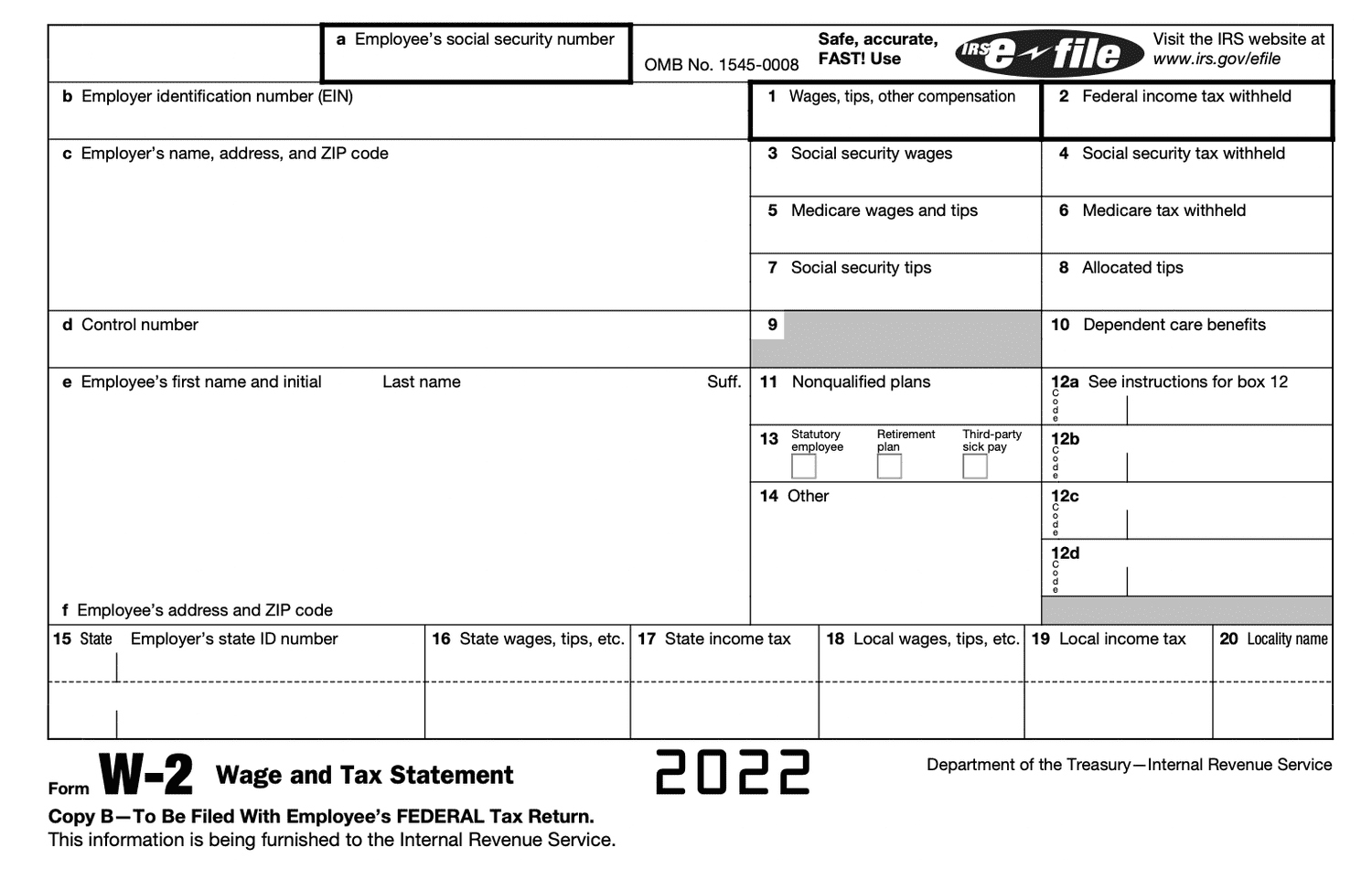

W2 Forms Due – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

It’s that Time of Year Again: W2 Forms are Due!

As the end of January approaches, it’s time to dust off those W2 forms and get them ready for submission. For many people, this may seem like a daunting task, but it’s also a reason to celebrate! The deadline for W2 forms is a sign that tax season is in full swing, and soon enough, you’ll be able to file your taxes and (hopefully) receive a refund. So put on your favorite playlist, grab a cup of coffee, and let’s get those W2 forms in order!

The process of gathering all your W2 forms from various employers and ensuring they are accurate can be a bit tedious, but it’s an important step in ensuring you file your taxes correctly. Once you have all your forms in hand, you can start the exciting task of crunching numbers and determining if you owe money or will be getting a nice refund. It’s a time to reflect on your earnings from the past year and take pride in the hard work you’ve put in.

Let’s Party: Celebrating the Deadline for W2 Forms!

Once you’ve successfully gathered and organized all your W2 forms, it’s time to celebrate! Throw a mini dance party in your living room, treat yourself to a delicious meal, or simply pat yourself on the back for completing this important task. While tax season can be stressful for many, it’s also an opportunity to showcase your financial responsibility and diligence. So why not take a moment to revel in the accomplishment of meeting the W2 form deadline?

As you prepare to submit your W2 forms and file your taxes, remember that this process is a necessary step in maintaining your financial health. By staying on top of your tax obligations, you can avoid penalties and ensure you are in good standing with the IRS. So go ahead, raise a glass to yourself for getting those W2 forms in on time, and look forward to the peace of mind that comes with knowing you’ve fulfilled your tax responsibilities. Cheers to you!

In conclusion, while the deadline for W2 forms may seem like just another task on your to-do list, it’s also a reason to celebrate. Embrace the opportunity to showcase your financial responsibility and take pride in the hard work you’ve put in over the past year. So go ahead, gather your forms, complete your taxes, and enjoy the sense of accomplishment that comes with meeting the W2 form deadline. It’s time to celebrate!

Below are some images related to W2 Forms Due

w2 forms due, w2 forms due date, when should i get my w2 forms, who sends out w2 forms, , W2 Forms Due.

w2 forms due, w2 forms due date, when should i get my w2 forms, who sends out w2 forms, , W2 Forms Due.