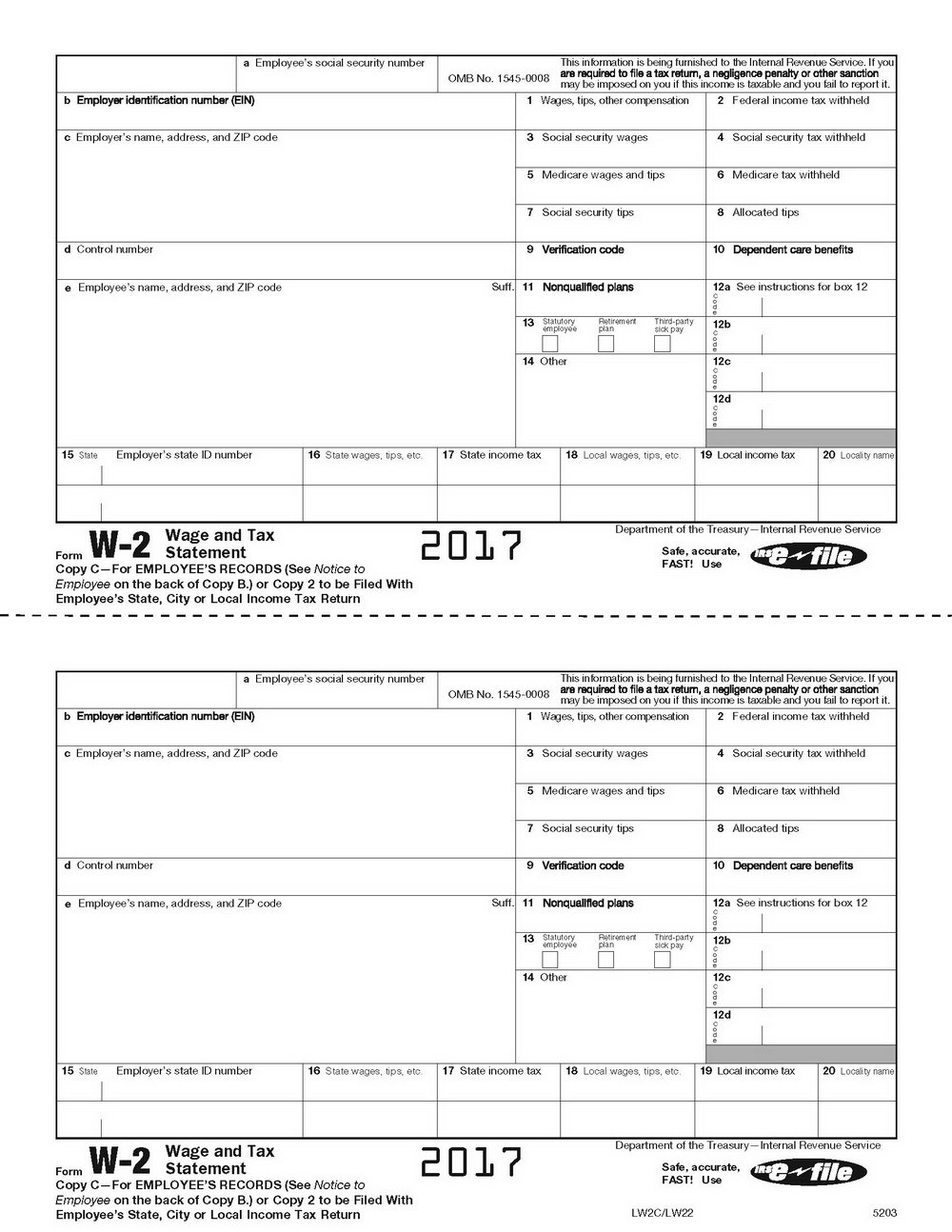

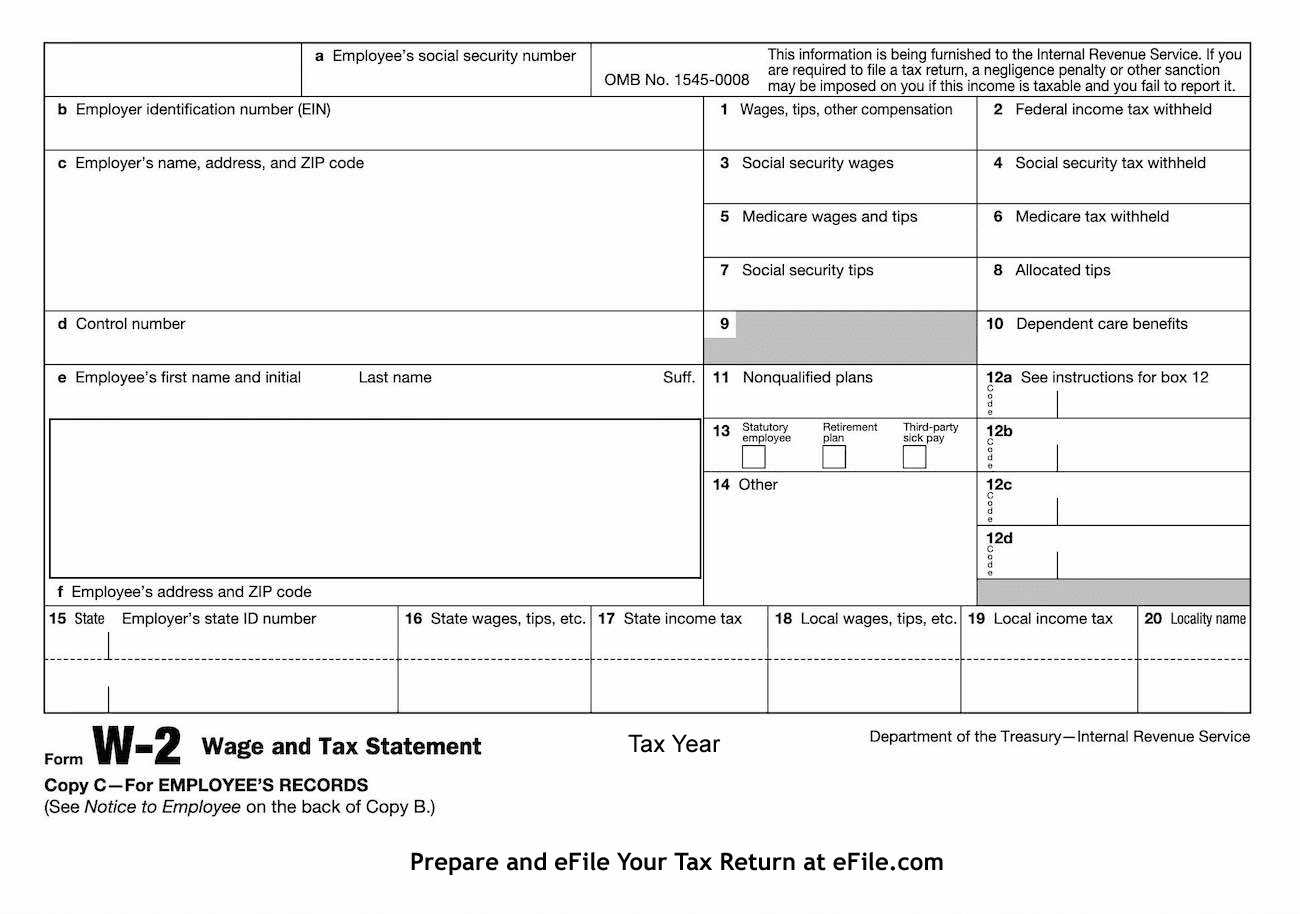

Missing W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Lost Your W2 Form? No Problem!

Oh no, it’s tax season and you can’t seem to find your W2 form! Don’t panic, because we’ve got you covered. Losing your W2 form can be stressful, but with a little bit of organization and some handy tips, you’ll be back on track in no time. So take a deep breath, grab a cup of tea, and let’s get this sorted out together!

Stay Calm and Follow These Steps

The first step when you realize you’ve lost your W2 form is to reach out to your employer. They are required to provide you with a copy of your W2, so don’t hesitate to ask for a duplicate. They may be able to email it to you, or you may need to pick it up in person. If you’ve moved and your W2 was sent to an old address, make sure to update your information with your employer as well.

If you can’t get ahold of your employer or they are unable to provide you with a copy of your W2, don’t worry! You can always contact the IRS for assistance. They can help you obtain a copy of your W2 from previous years, which may take a little longer but is definitely doable. Just make sure to have all your personal information and details about your employer handy when you reach out to the IRS.

Once you have a copy of your W2 in hand, it’s important to double-check all the information before filing your taxes. Make sure your name, Social Security number, and income are all accurate. If you notice any discrepancies, reach out to your employer or the IRS for clarification. It’s always better to address any errors sooner rather than later to avoid any potential issues down the road.

Conclusion

Losing your W2 form may seem like a daunting task, but with a little patience and perseverance, you’ll be able to sort it out in no time. Remember to stay calm, reach out to your employer or the IRS for assistance, and double-check all the information once you have a copy of your W2. Tax season can be stressful, but with the right resources and a positive attitude, you’ll be able to tackle anything that comes your way. So don’t panic – you’ve got this!

Below are some images related to Missing W2 Form

how can i get my missing w2, how do i find a missing w2, irs missing w2 form, losing w2 form, lost w2 form, , Missing W2 Form.

how can i get my missing w2, how do i find a missing w2, irs missing w2 form, losing w2 form, lost w2 form, , Missing W2 Form.