When Do Companies Send Out W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

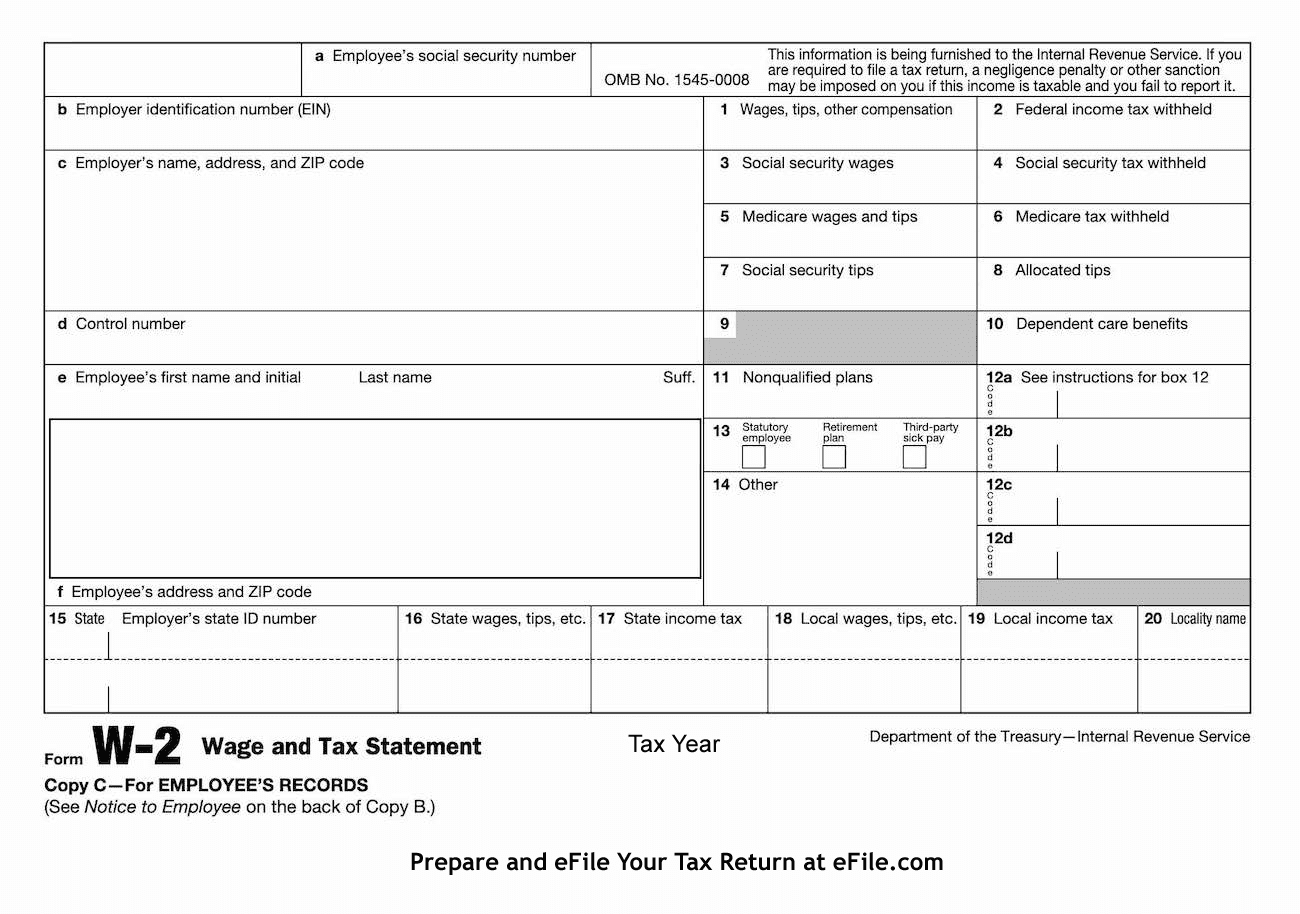

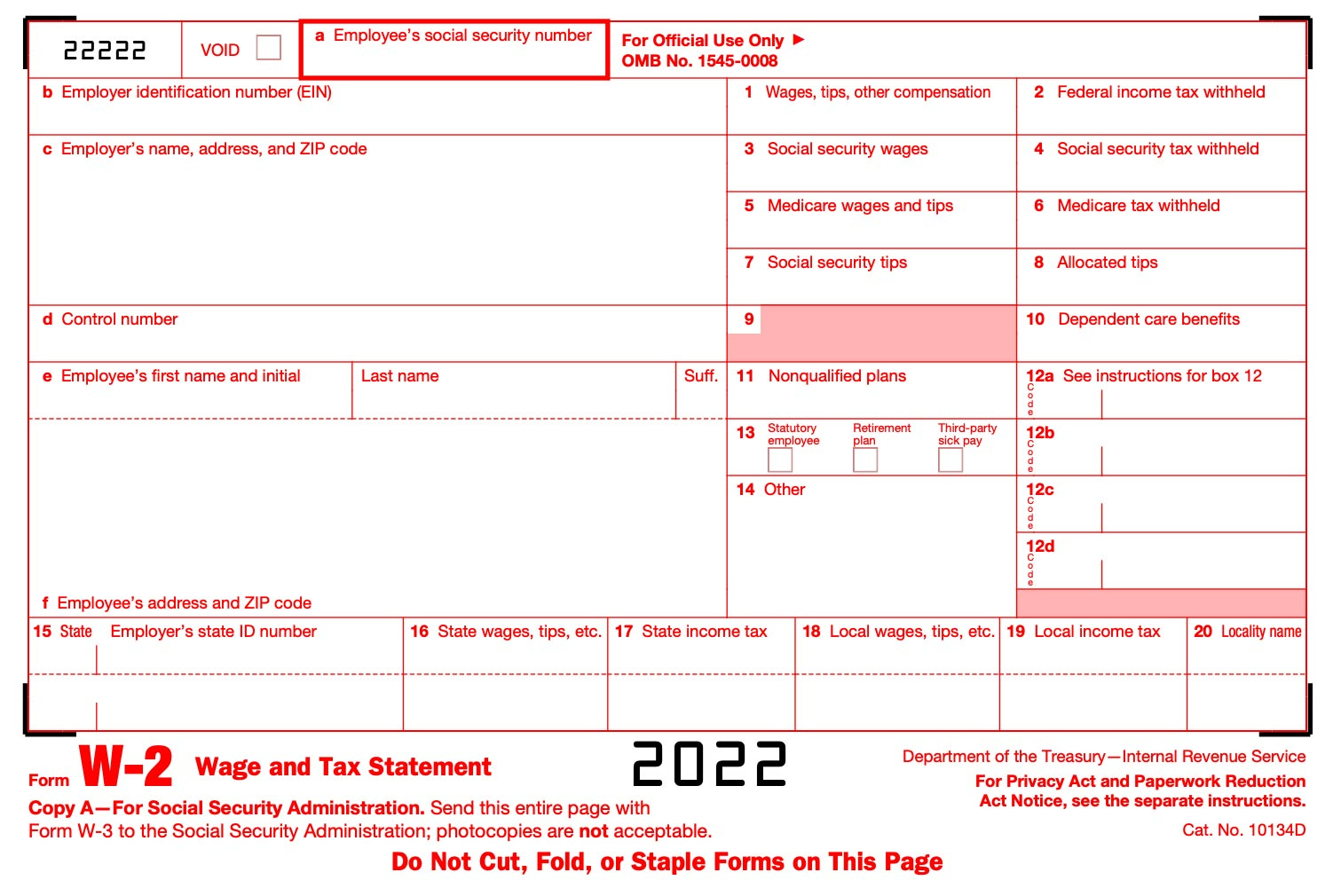

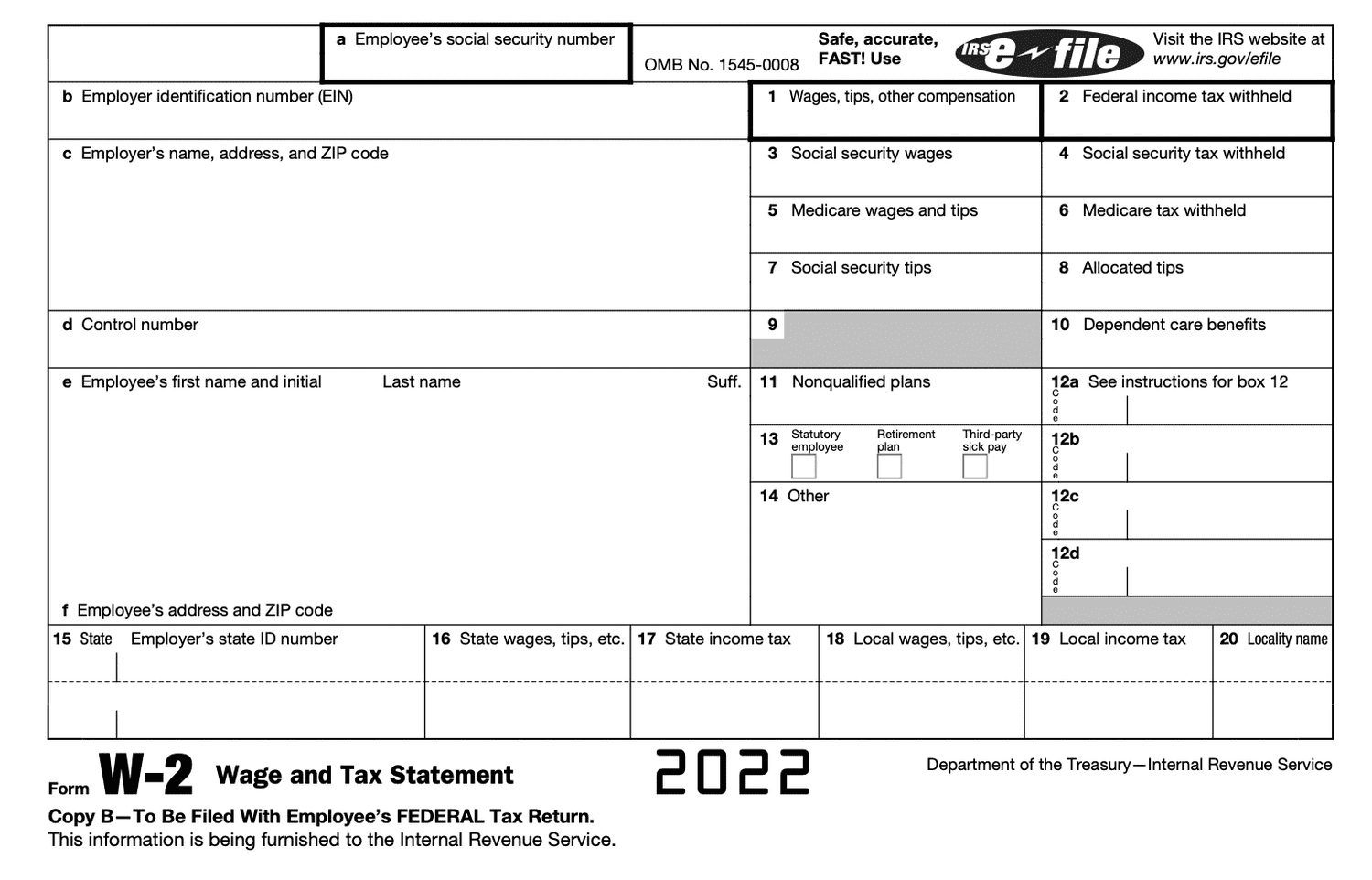

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Joy of Tax Time!

Ah, tax time! The time of year when we gather our financial documents, crunch numbers, and eagerly await that coveted tax refund. While some may dread the thought of taxes, there is actually a bit of joy that can come from the process. It’s a time to reflect on the past year, celebrate accomplishments, and maybe even discover some unexpected deductions. So, let’s embrace the cheer that comes with tax time and get ready to tackle those W2 forms with a smile!

Ready, Set, W2 Forms!

As we gear up for tax season, one of the first things on our to-do list is to track down our W2 forms. These forms, provided by employers, detail our earnings and taxes withheld for the year. They are crucial for accurately filing our tax returns and ensuring we get any refunds we are owed. So, make sure to keep an eye out for those W2 forms in the mail or online portal from your employer. Once you have them in hand, you’ll be well on your way to completing your taxes and potentially receiving a nice refund check.

Get organized and gather all the necessary documents you’ll need to complete your tax return, including any additional income sources, receipts for deductions, and other relevant paperwork. Having everything in one place will make the process go much smoother and reduce the likelihood of errors. With a positive attitude and a bit of organization, tax time can actually be a fun and rewarding experience. So, let’s get ready to tackle those W2 forms and embrace the cheer that comes with tax season!

In conclusion, tax time doesn’t have to be a dreaded chore. With the right mindset and a little preparation, it can actually be a time of joy and celebration. So, let’s approach tax season with a smile on our faces, ready to tackle those W2 forms and potentially receive a nice refund check. Remember, the sooner you get organized and file your taxes, the sooner you can enjoy the peace of mind that comes with knowing your financial affairs are in order. Cheers to tax time and the opportunities it brings for financial success!

Below are some images related to When Do Companies Send Out W2 Forms

are w2 forms mailed out, what day do employers send out w2, when do companies send out w2 forms, when do companies send w2 forms, when do employers have to send out w2 forms, , When Do Companies Send Out W2 Forms.

are w2 forms mailed out, what day do employers send out w2, when do companies send out w2 forms, when do companies send w2 forms, when do employers have to send out w2 forms, , When Do Companies Send Out W2 Forms.