Instructions For Form W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Tax Potential!

Are you ready to take control of your finances and maximize your tax potential? Say goodbye to feeling overwhelmed by your W2 form and hello to mastering it like a pro! By understanding the ins and outs of your W2, you can unlock valuable tax deductions and credits that could save you money. So, let’s dive in and unleash your tax potential together!

First things first, familiarize yourself with the different sections of your W2 form. From Box 1 (wages, tips, and other compensation) to Box 6 (Medicare tax withheld), each box contains important information that will impact your tax return. Make sure to review each box carefully and double-check for accuracy. Once you have a clear understanding of your W2, you can start to identify potential deductions and credits that you may qualify for.

Next, take advantage of tax software or online tools to help you navigate your W2 with ease. These resources can guide you through the process of entering your W2 information and help you calculate your tax liability. Additionally, they can provide valuable tips and advice on maximizing your tax refund. By utilizing these tools, you can streamline the tax-filing process and ensure that you are taking full advantage of all available tax benefits.

Lastly, don’t be afraid to seek help from a professional tax advisor if you have any questions or concerns about your W2. They can provide personalized guidance based on your individual tax situation and help you optimize your tax return. Remember, mastering your W2 is all about empowering yourself with knowledge and taking control of your financial future. With the right tools and resources at your disposal, you can navigate your W2 with confidence and unlock your tax potential like never before!

Navigate Your W2 with Ease!

In conclusion, mastering your W2 doesn’t have to be a daunting task. By taking the time to understand your W2 form, utilizing tax software or online tools, and seeking help from a tax professional if needed, you can navigate your W2 with ease and confidence. So, roll up your sleeves, grab your W2, and get ready to unleash your tax potential like a boss! Remember, the more you know about your finances, the better equipped you will be to make informed decisions and secure your financial future. Here’s to mastering your W2 and taking control of your taxes once and for all!

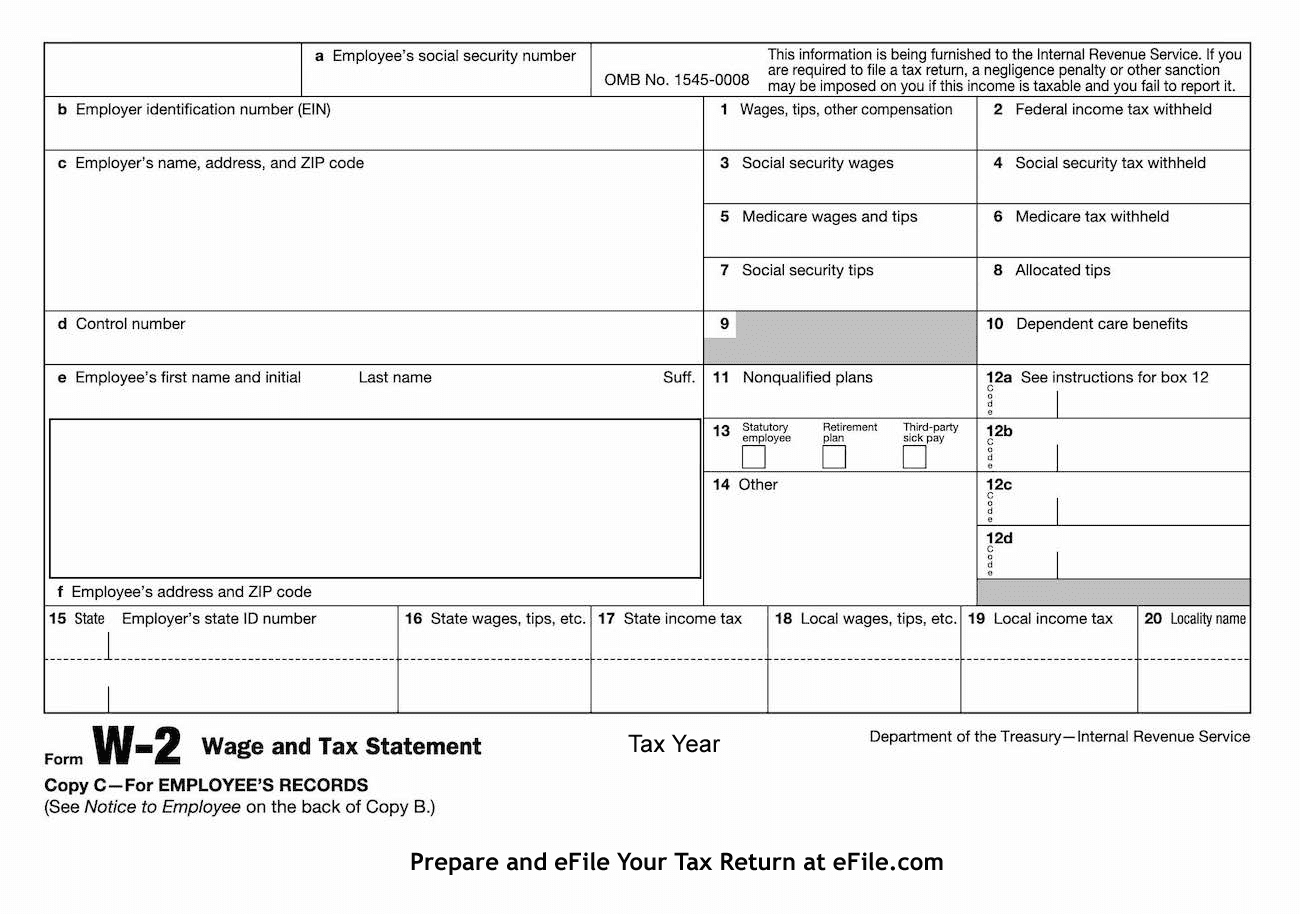

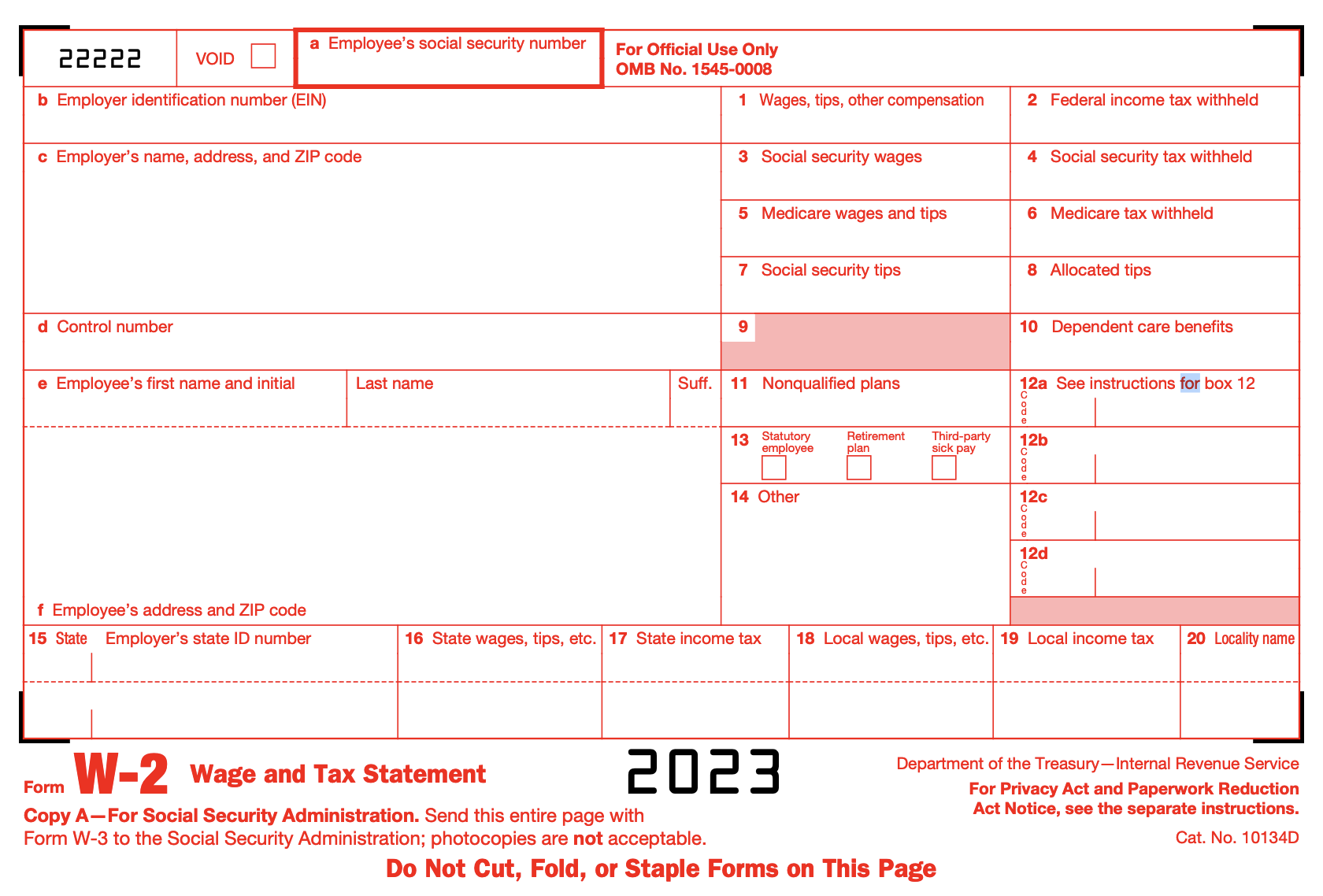

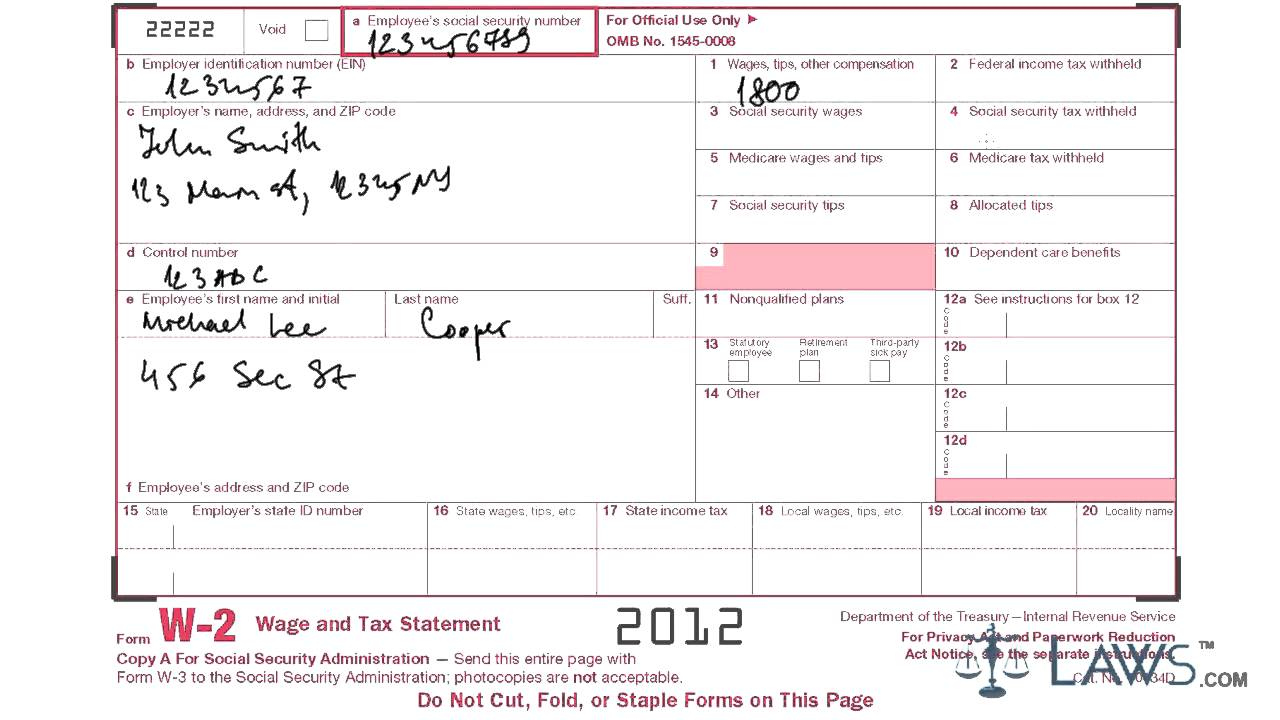

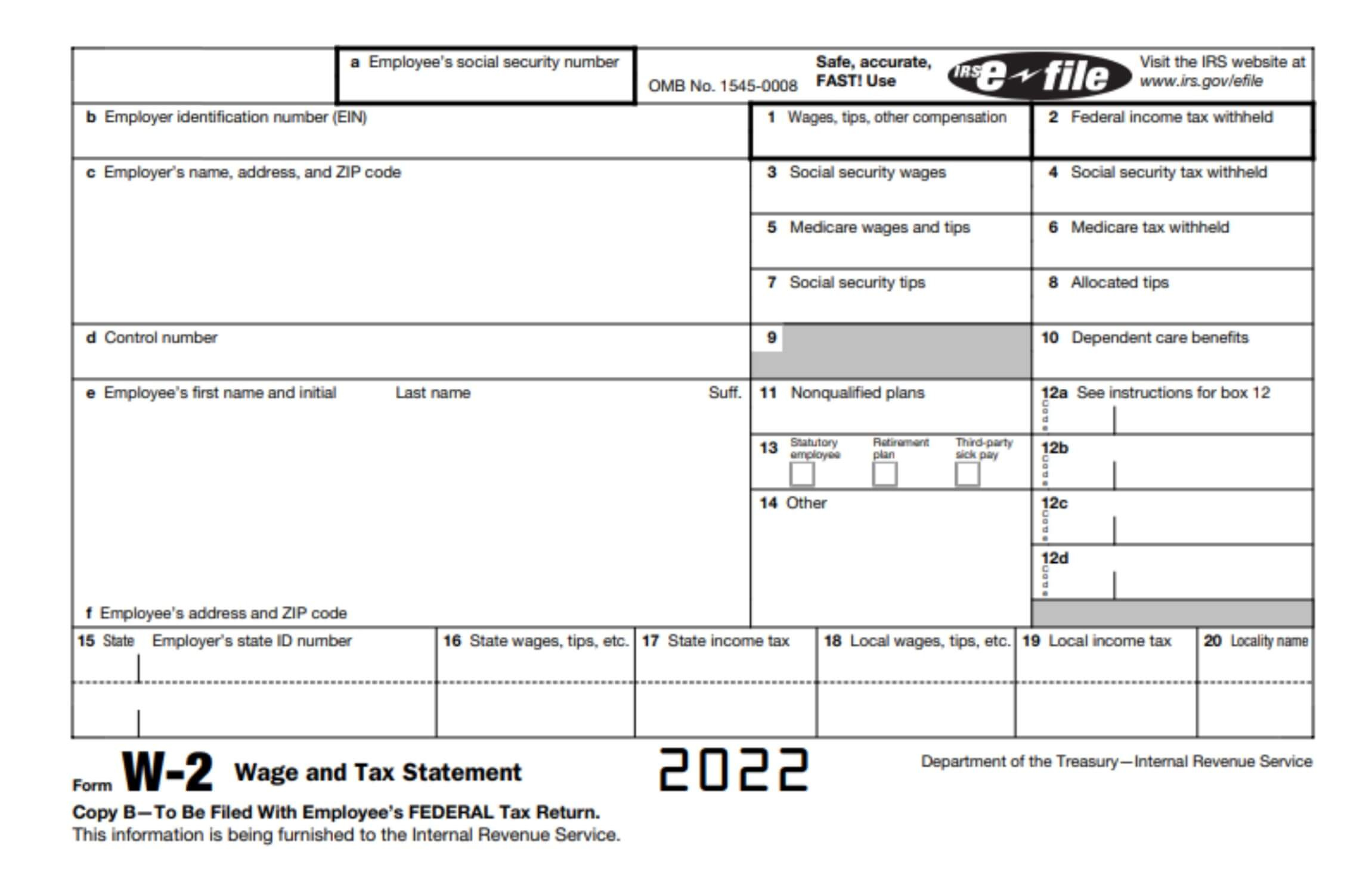

Below are some images related to Instructions For Form W2

general instructions for forms w2, instructions for box 12a on w2 form, instructions for form w2, instructions for form w2 2022, instructions for form w2 2023, , Instructions For Form W2.

general instructions for forms w2, instructions for box 12a on w2 form, instructions for form w2, instructions for form w2 2022, instructions for form w2 2023, , Instructions For Form W2.