What Is A Form W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

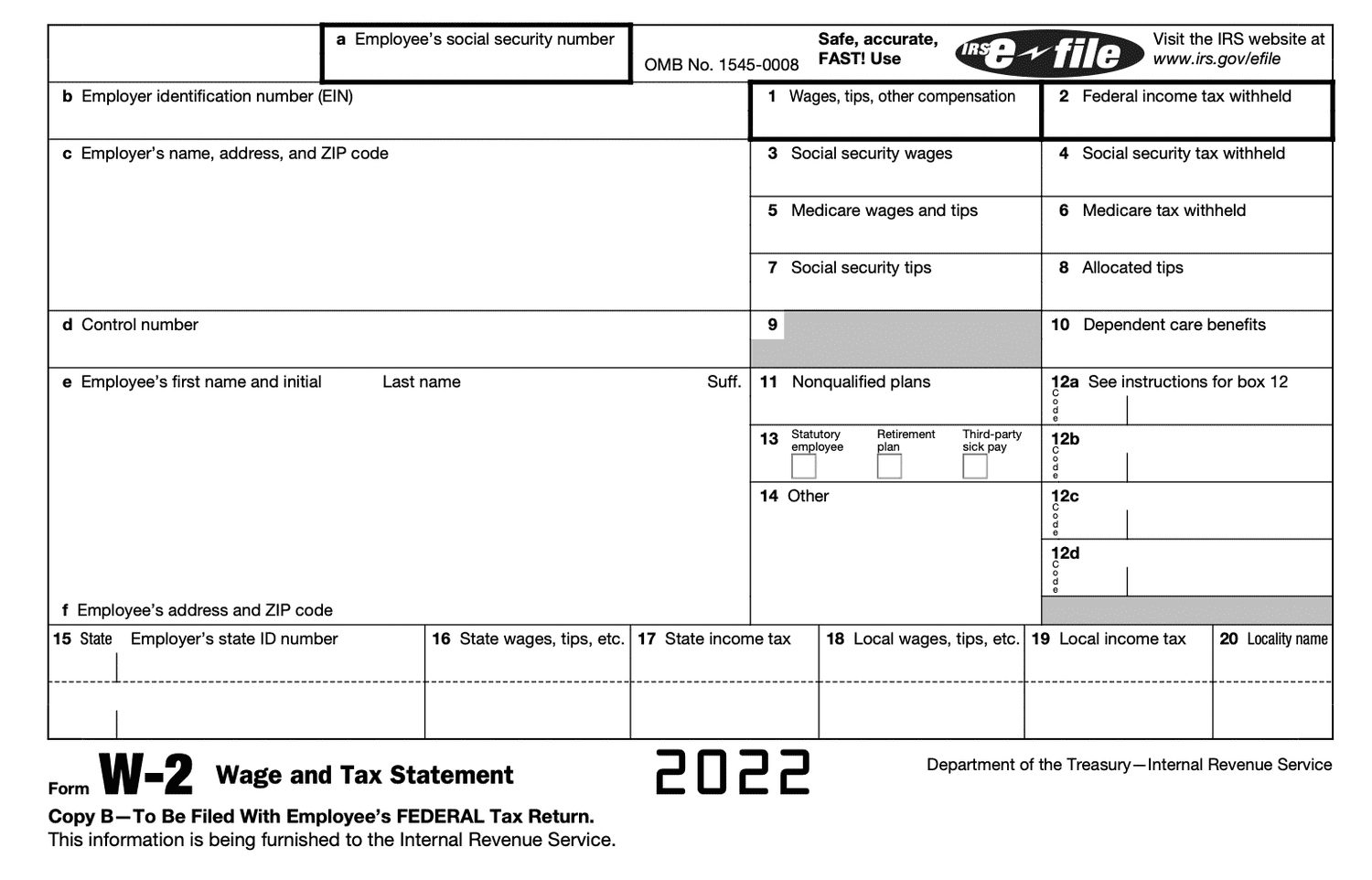

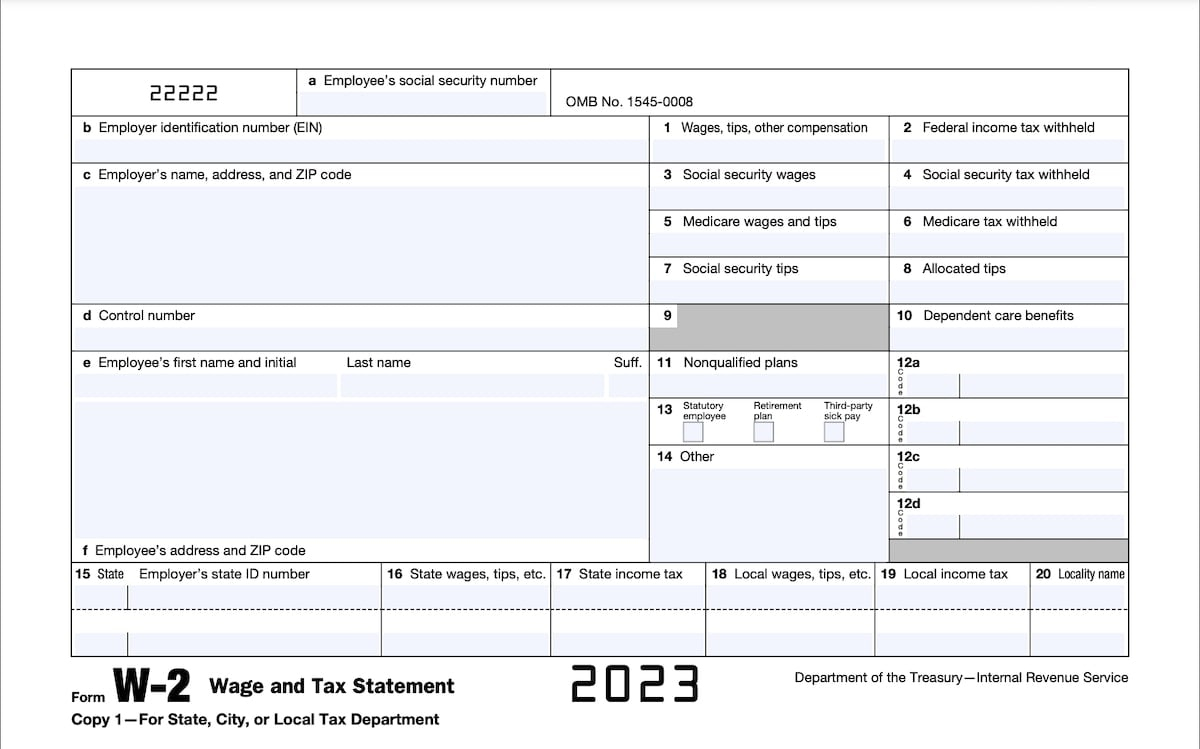

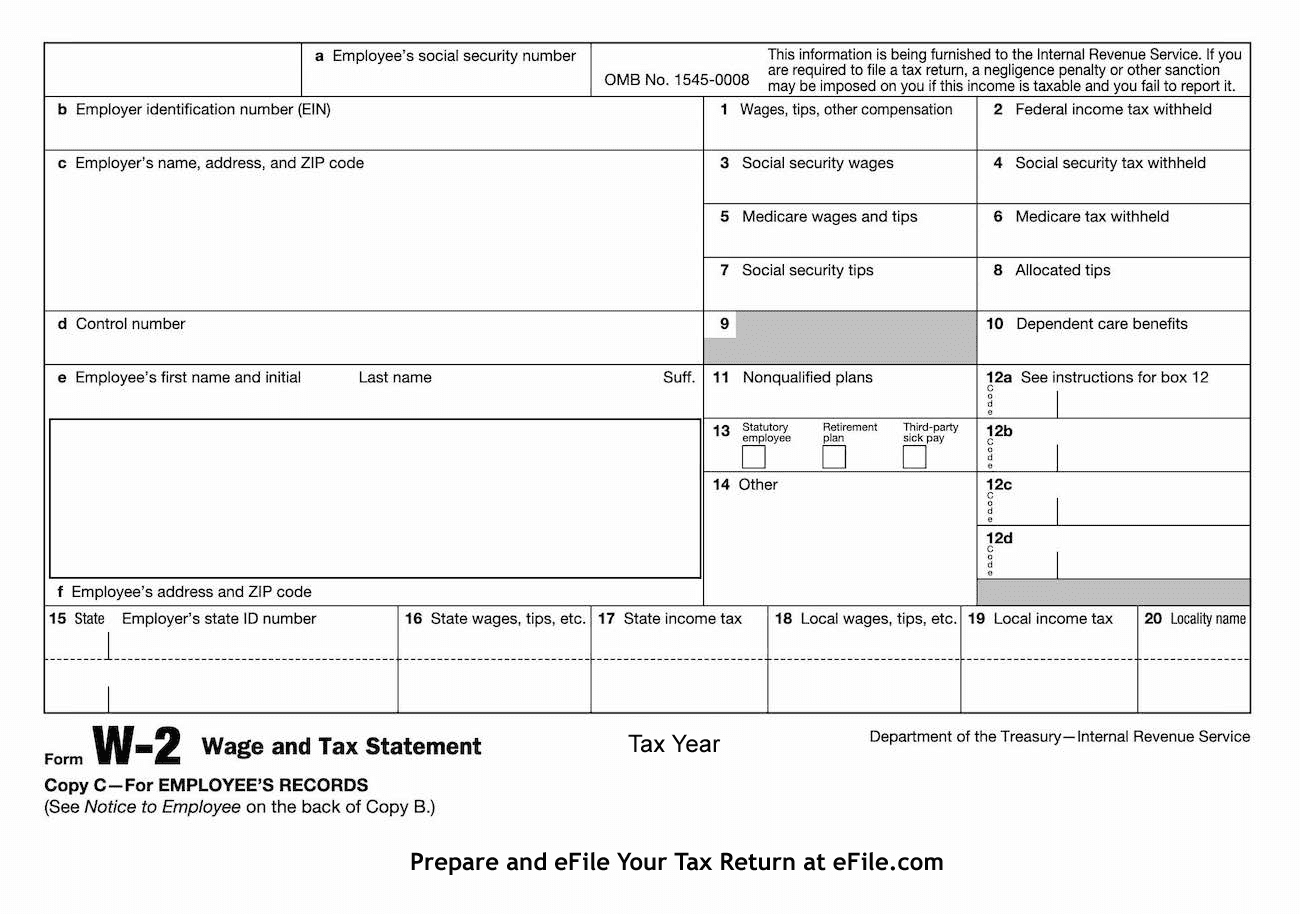

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Mystery of Form W2

Have you ever received your Form W2 in the mail and felt completely lost? Don’t worry, you’re not alone! The infamous Form W2 can seem like a daunting puzzle at first glance, but fear not – we’re here to help you crack the code and unravel its secrets. In this article, we’ll take you on a journey to unlock the mysteries of your W2 form, so you can file your taxes with confidence and clarity.

Cracking the Code: Form W2 Explained

So, what exactly is Form W2? Your W2 is a crucial document that your employer provides you with every year, detailing your earnings and taxes withheld. It’s essentially a snapshot of your financial activity for the past year, and is essential for filing your taxes accurately. The form is divided into various boxes, each containing important information such as your wages, tips, and any additional income you may have received. By understanding the contents of each box, you can ensure that you’re reporting all your income correctly to the IRS.

Navigating through the different boxes on your W2 can feel like deciphering a complex code, but fear not – with a little guidance, you’ll be able to make sense of it all. For example, Box 1 shows your total wages for the year, while Box 2 displays the federal income tax withheld from your paycheck. Boxes 3 and 5 show your Social Security and Medicare wages, respectively, while Boxes 4 and 6 detail the corresponding taxes withheld. By carefully reviewing each box and understanding its purpose, you can ensure that you’re accurately reporting your income and taxes to the IRS.

Unlocking the Secrets of Your W2 Form

Now that you’ve decoded the basics of your W2 form, let’s dive deeper into some of its lesser-known secrets. For instance, did you know that Box 12 can contain a variety of codes that represent different types of income, deductions, and benefits? From retirement plan contributions to educational assistance, Box 12 can provide valuable insights into additional aspects of your financial situation. Additionally, Box 14 is a catch-all for any other information that your employer wants to include, such as union dues or health insurance premiums. By exploring these hidden gems on your W2, you can gain a more comprehensive understanding of your overall financial picture.

In conclusion, Form W2 may seem like a mystery at first, but with a little guidance and patience, you can unravel its secrets and file your taxes with ease. By understanding the various boxes and codes on your W2, you can ensure that you’re accurately reporting your income and taxes to the IRS. So, the next time you receive your W2 in the mail, don’t be intimidated – embrace the challenge and let the adventure of tax season begin!

Below are some images related to What Is A Form W2

what is a 1099 form w2, what is a form w2, what is a form w2c, what is a form w2g, what is a w2 form definition, , What Is A Form W2.

what is a 1099 form w2, what is a form w2, what is a form w2c, what is a form w2g, what is a w2 form definition, , What Is A Form W2.