ADP W2 Former Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

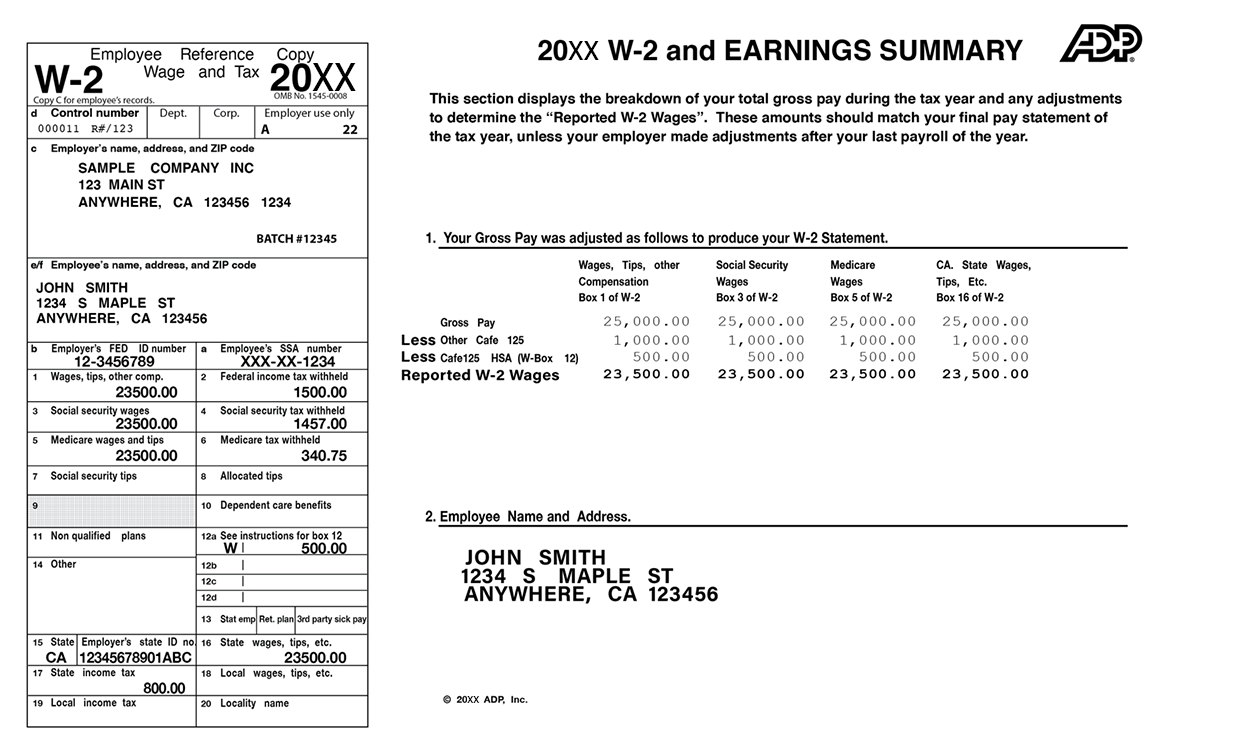

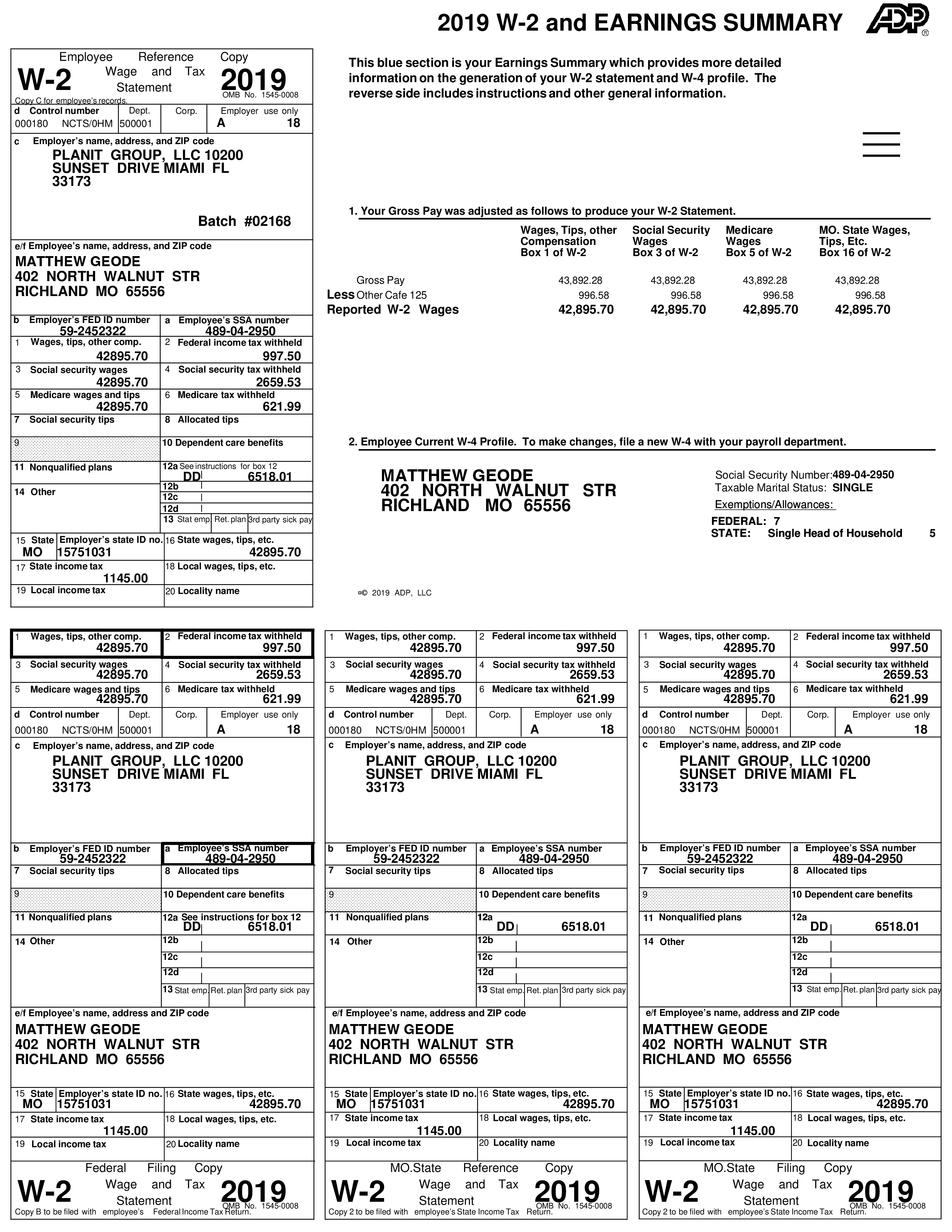

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Secrets of Your ADP W2 from Your Past Employer!

Have you ever wondered what hidden gems lie within your old ADP W2 from a previous employer? Your ADP W2 holds valuable information about your past employment, and by unlocking its secrets, you can gain insight into your earnings, taxes, and benefits during that time. Let’s delve into the mysteries of your ADP W2 and discover the treasures that await!

Discover the Hidden Gems in Your Old ADP W2!

Your ADP W2 is like a treasure map that can lead you to a wealth of information about your past employment. From your total earnings and deductions to your tax withholdings and contributions to retirement accounts, your W2 provides a snapshot of your financial history with that employer. By carefully examining each section of your W2, you can uncover valuable insights that may help you better understand your past financial situation and plan for the future.

In addition to financial details, your ADP W2 also provides important information about your employer, such as their name, address, and Employer Identification Number (EIN). This information can be useful for filing taxes, applying for loans, or verifying your employment history. By familiarizing yourself with the contents of your W2, you can ensure that you have all the necessary information at your fingertips whenever you need it.

Unravel the Mysteries of Your Past Employment with ADP W2!

As you unravel the mysteries of your past employment with your ADP W2, you may come across terms and codes that seem unfamiliar. Don’t worry – there are resources available to help you decipher these codes and understand their significance. By reaching out to your former employer or consulting with a tax professional, you can gain a deeper understanding of the information contained in your W2 and how it may impact your current financial situation.

In conclusion, your ADP W2 is a valuable document that holds the key to unlocking the secrets of your past employment. By taking the time to explore its contents and understand its significance, you can gain valuable insights into your financial history and make informed decisions about your future. So dust off that old W2, grab a cup of coffee, and get ready to uncover the hidden gems that await you!

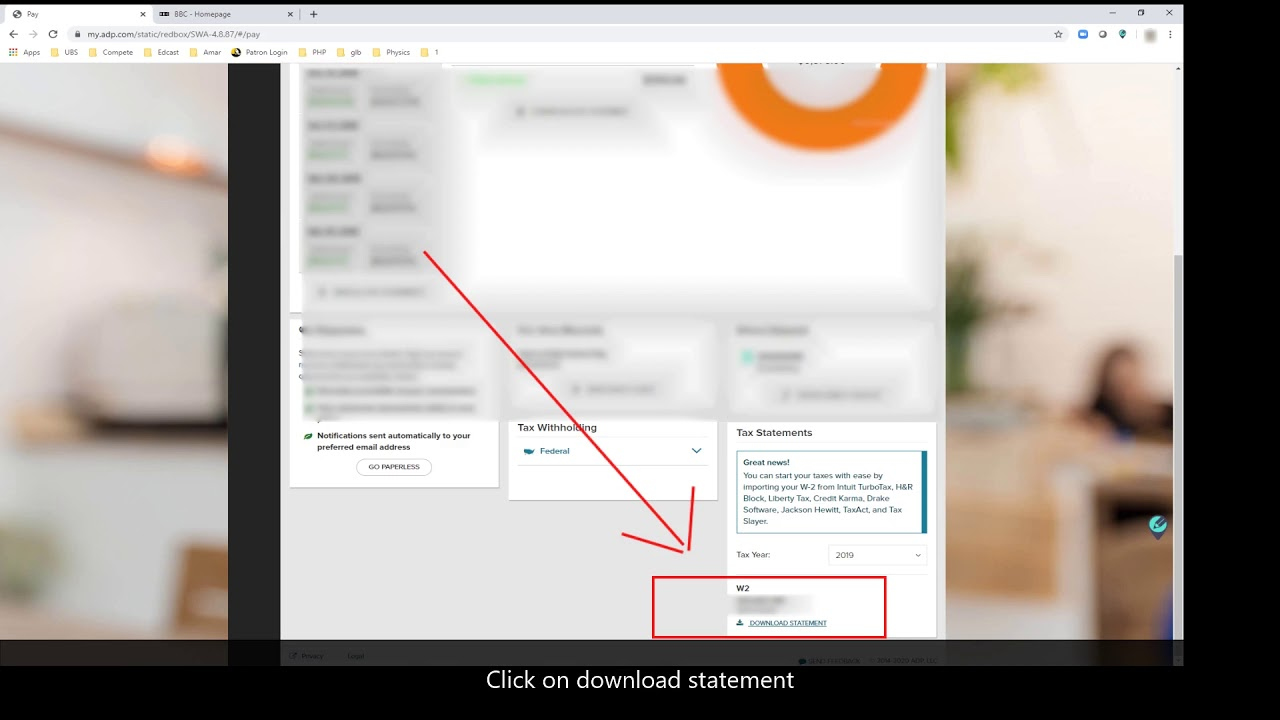

Below are some images related to Adp W2 Former Employer

adp w2 former employer, do i need w2 from former employer, how can i get my w2 from former employer, how do i find my employee w2 on adp, how to get w2 from adp previous employer, , Adp W2 Former Employer.

adp w2 former employer, do i need w2 from former employer, how can i get my w2 from former employer, how do i find my employee w2 on adp, how to get w2 from adp previous employer, , Adp W2 Former Employer.