How To Get The W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

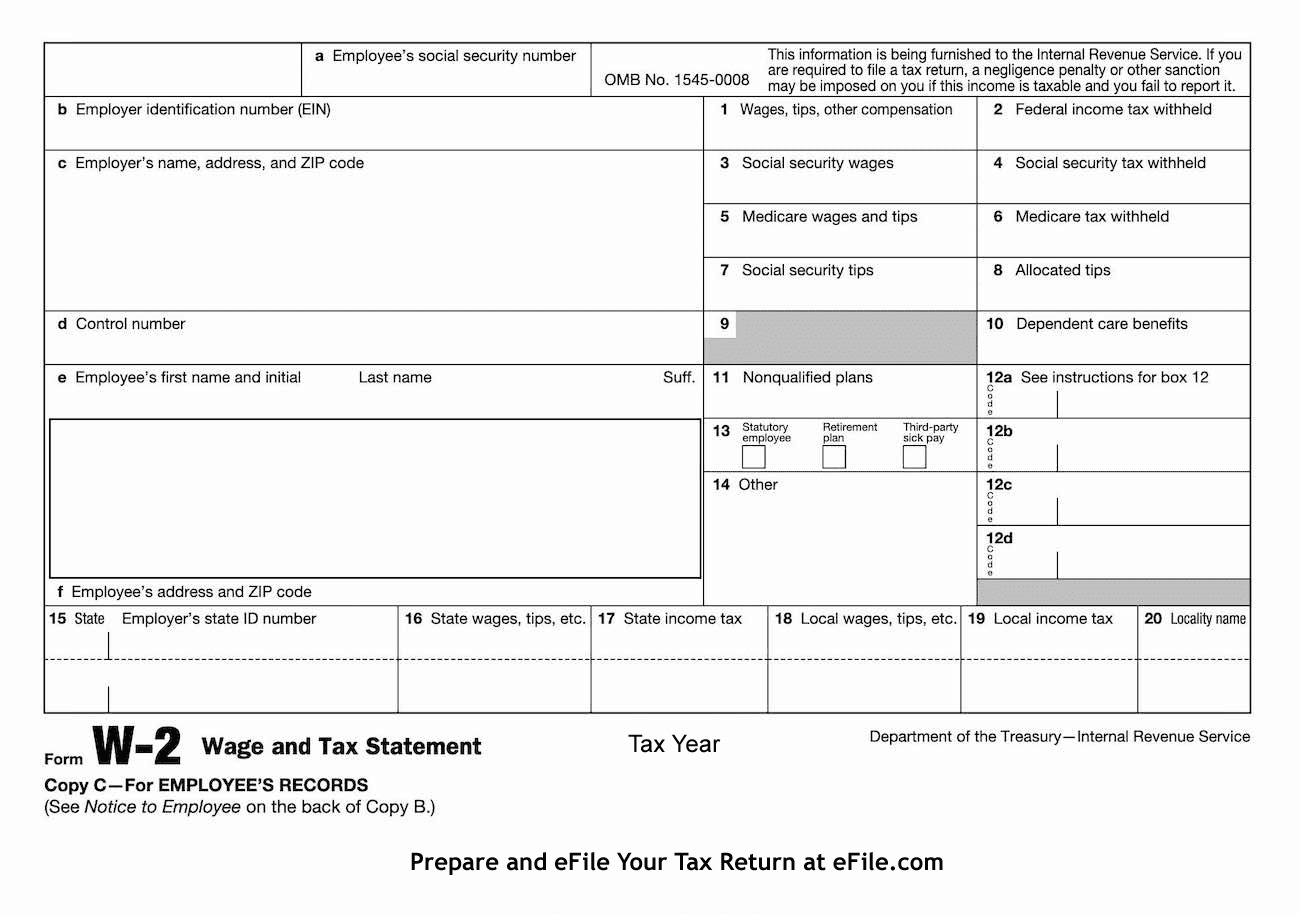

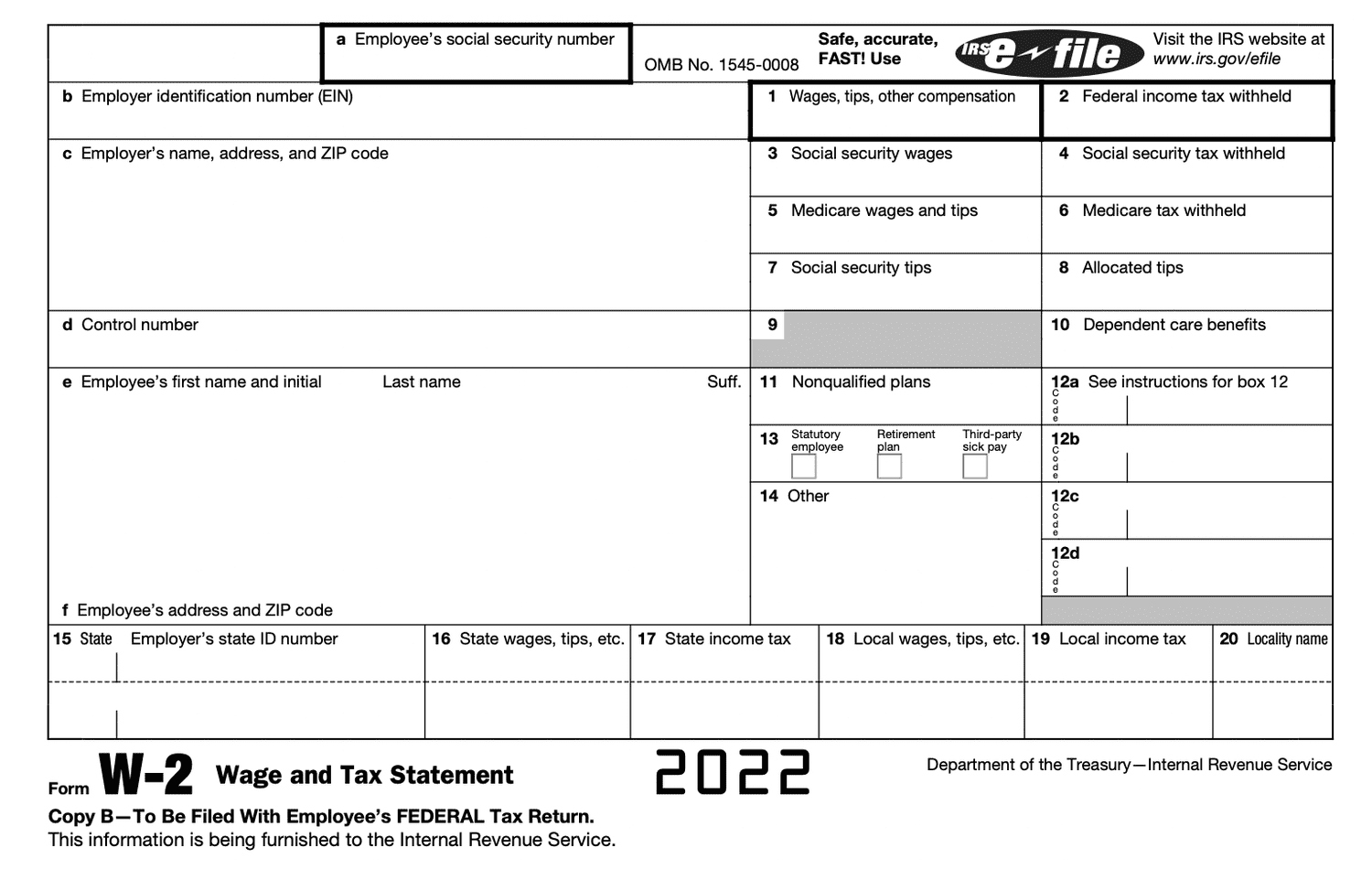

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

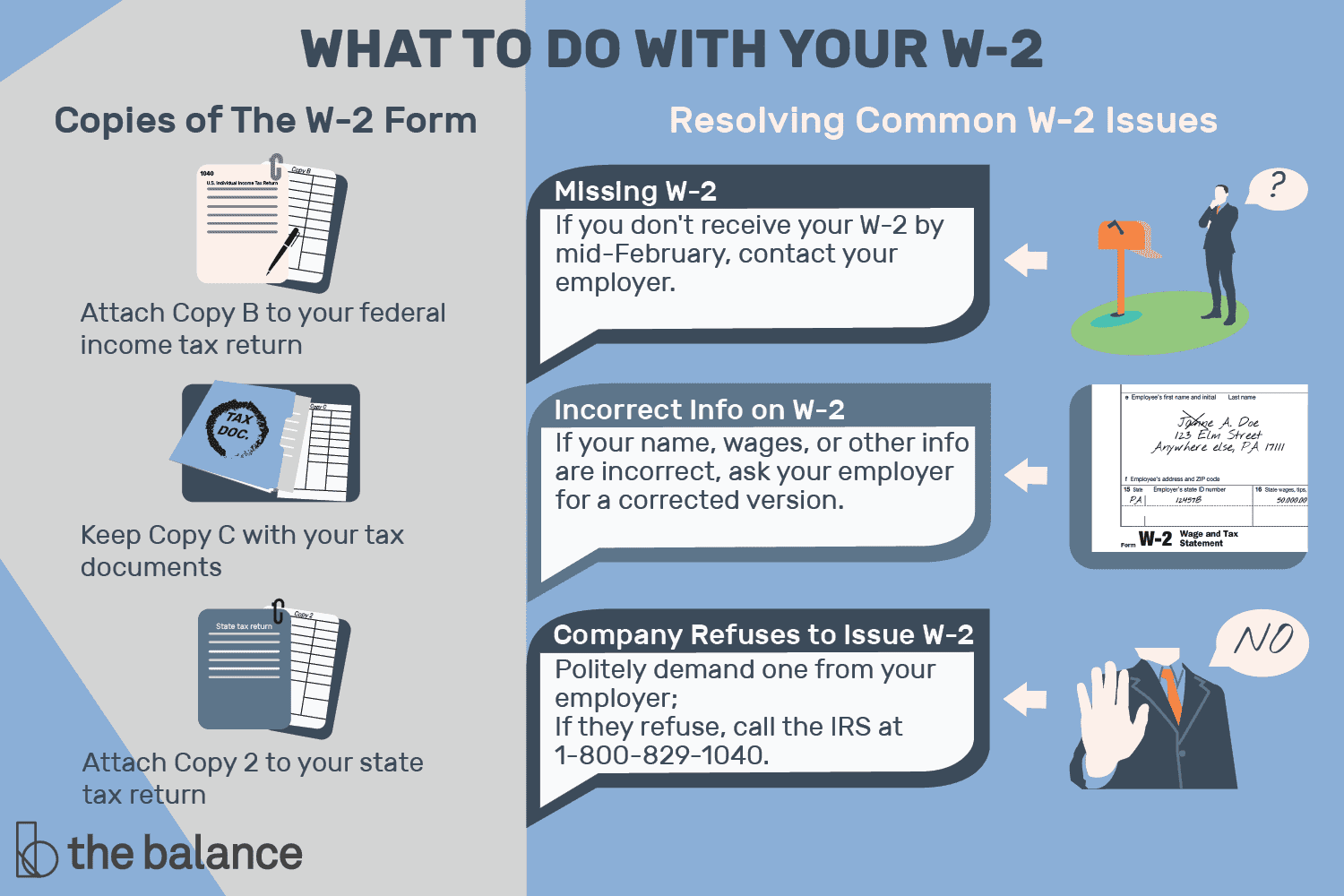

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Magic of Your W2 Form!

Ah, the elusive W2 form – a document that holds the key to unlocking your financial potential. It may seem intimidating at first glance, but fear not! With a little guidance, you’ll soon see that your W2 form is not just a piece of paper, but a treasure trove of valuable information. From your total earnings to the taxes you’ve paid, your W2 form is a window into your financial health. So, let’s embark on a journey to discover the magic of your W2 form together!

Easy Steps to Unlocking Your Financial Potential

Step 1: Locate your W2 form. This may seem like a no-brainer, but sometimes this important document can get lost in the shuffle of paperwork. Your employer is required to provide you with your W2 form by January 31st, so keep an eye out for it in your mailbox or email inbox. Once you have your W2 form in hand, take a moment to marvel at its significance – this piece of paper holds the key to understanding your earnings and taxes for the year.

Step 2: Review your W2 form carefully. Take a closer look at the numbers and ensure that all the information is accurate. Your W2 form should include details such as your total earnings, taxes withheld, and any other deductions. If you spot any errors, be sure to contact your employer to get them corrected. It’s crucial to have accurate information on your W2 form to avoid any issues when filing your taxes.

Step 3: Use your W2 form to make informed financial decisions. Armed with the knowledge of your earnings and taxes, you can now take control of your financial future. Whether you’re planning for retirement, budgeting for expenses, or setting financial goals, your W2 form can provide valuable insights to help you make smart choices. So, embrace the power of your W2 form and unlock your financial potential today!

In conclusion, your W2 form is more than just a piece of paperwork – it’s a roadmap to your financial well-being. By taking the time to understand and utilize your W2 form, you can make informed decisions that will pave the way for a secure financial future. So, don’t let your W2 form gather dust in a drawer – unlock its magic and take control of your financial destiny!

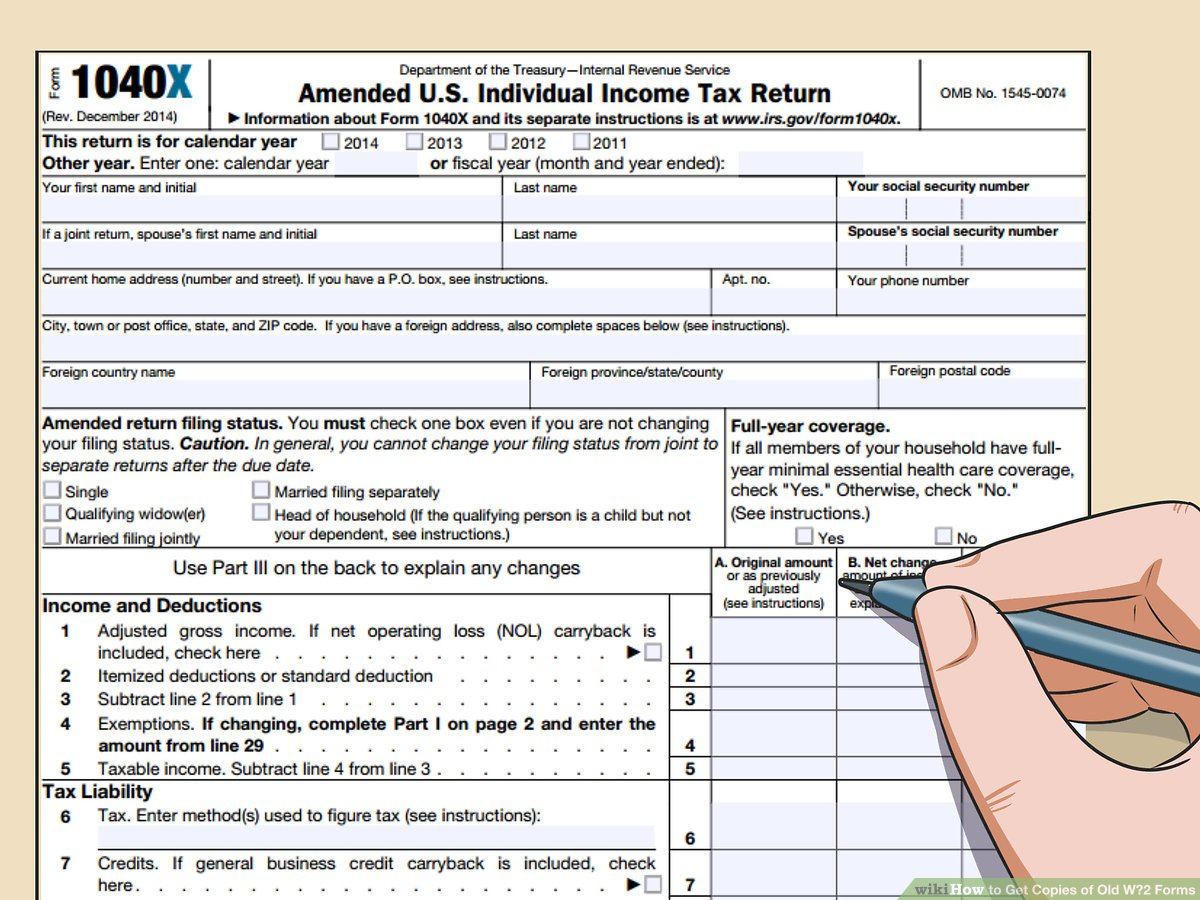

Below are some images related to How To Get The W2 Form

how to get the w2 form, how to get the w2 form online, how to get w-2 form from adp, how to get w2 form from amazon, how to get w2 form from doordash, , How To Get The W2 Form.

how to get the w2 form, how to get the w2 form online, how to get w-2 form from adp, how to get w2 form from amazon, how to get w2 form from doordash, , How To Get The W2 Form.