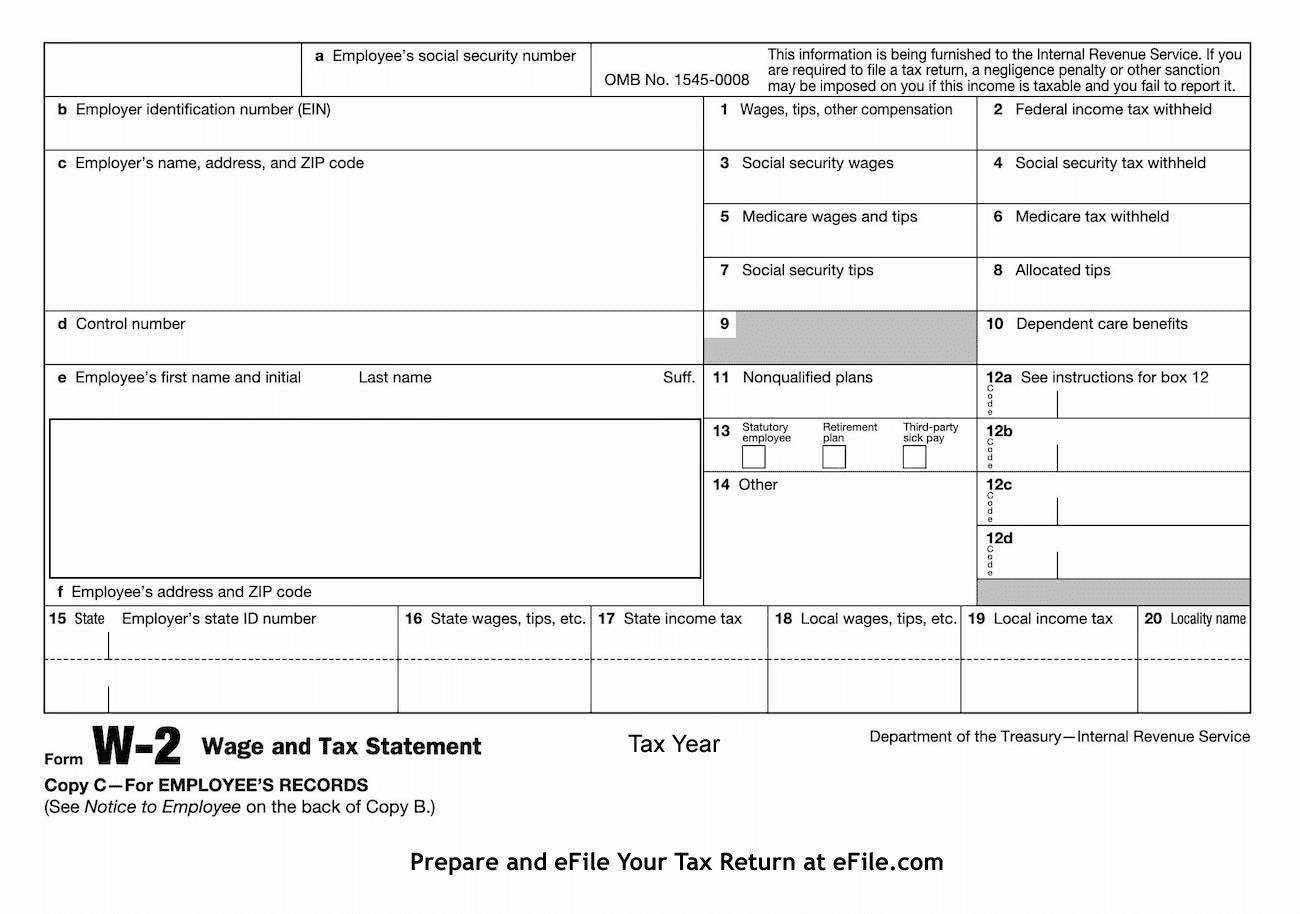

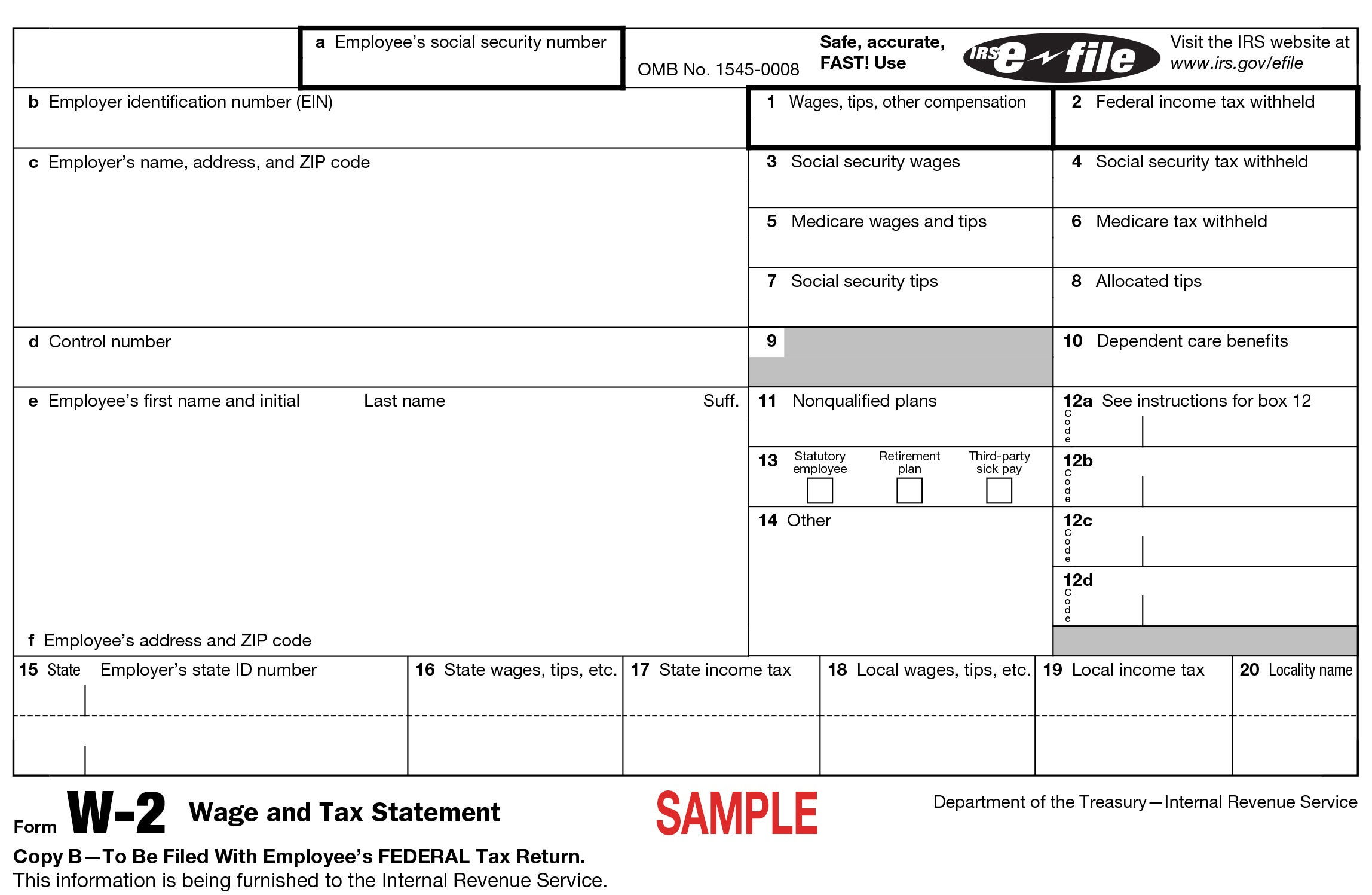

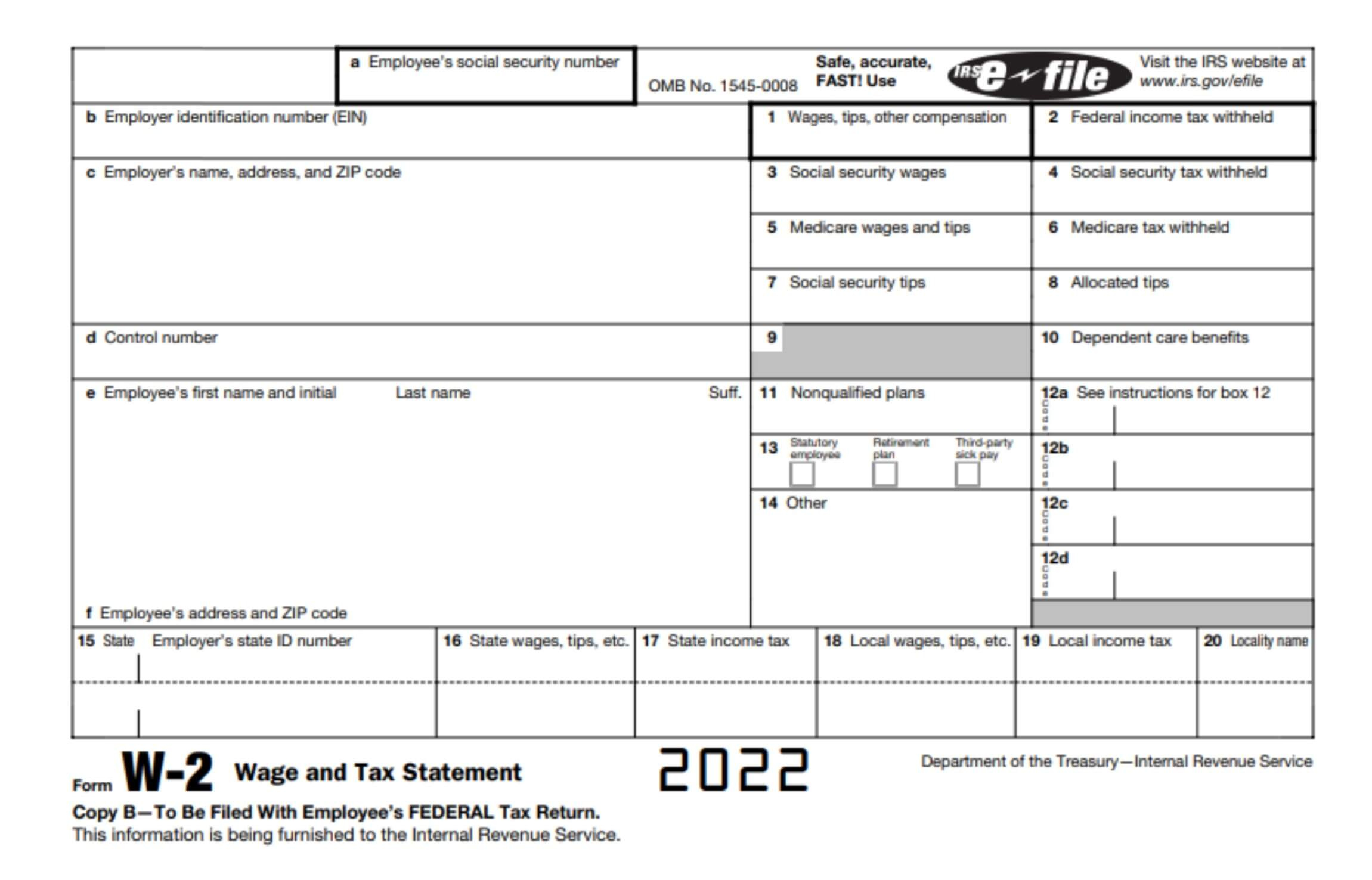

Box 12b On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unboxing the Magic: Decoding Box 12b on Your W2 Form

So you’ve received your W2 form and are ready to tackle the task of deciphering all those cryptic boxes and numbers. But fear not, for hidden within the seemingly mundane Box 12b lies a treasure trove of information just waiting to be uncovered. Let’s embark on a journey to unlock the mystery of Box 12b and discover the hidden gems it holds.

Unlock the Mystery of Box 12b on Your W2 Form

Box 12b on your W2 form may appear daunting at first glance, but with a little bit of guidance, you’ll soon realize that it’s not as intimidating as it seems. This box is where your employer reports any additional compensation or benefits that don’t fit neatly into the other boxes on the form. This could include things like contributions to a retirement plan, the cost of employer-sponsored health coverage, or even educational assistance provided by your employer. By understanding what each code in Box 12b represents, you can gain valuable insight into the various perks and benefits you received throughout the year.

Decoding Box 12b is like uncovering a hidden treasure map that leads you to a better understanding of your overall compensation package. Each code in this box corresponds to a specific type of payment or benefit, allowing you to see a more complete picture of your earnings for the year. For example, if you see code D in Box 12b, that indicates elective deferrals to a retirement plan such as a 401(k) or 403(b). By knowing how to interpret these codes, you can better plan for your financial future and make informed decisions about your benefits and tax obligations.

Discover the Hidden Treasures Inside Box 12b

As you delve deeper into the contents of Box 12b, you may come across codes that reveal unexpected perks or benefits that you weren’t aware of. Perhaps you’ll find code DD, which signifies the cost of employer-sponsored health coverage, or code E, which indicates elective deferrals under a Section 403(b) salary reduction agreement. These hidden treasures can provide valuable insights into the full scope of your compensation package and help you make more informed decisions about your finances.

In the end, decoding Box 12b on your W2 form is like unlocking a magical chest of treasures that can help you better understand your earnings and benefits. By taking the time to unravel the mystery of this box, you’ll gain a deeper appreciation for the various ways in which your employer compensates you. So don’t be afraid to dive into Box 12b and discover the hidden gems that await – you may be pleasantly surprised by what you find!

Below are some images related to Box 12b On W2 Form

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] pertaining to Box 12B On W2 Form](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-pertaining-to-box-12b-on-w2-form.jpg)

box 12b on w2 form, is box 12b on w2 taxable, what goes in box 12b on w2, what is box 12 b on a w-2 form, what is box 12b on w2, , Box 12b On W2 Form.

box 12b on w2 form, is box 12b on w2 taxable, what goes in box 12b on w2, what is box 12 b on a w-2 form, what is box 12b on w2, , Box 12b On W2 Form.