Form W2 Codes Box 14 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock the Magic of Box 14: Decoding Form W2 Codes!

Are you ready to unlock the hidden treasure trove of information contained in Box 14 of your W2 form? This often-overlooked section holds the key to understanding additional compensation and benefits provided by your employer. By learning how to decode the Form W2 codes in Box 14, you can uncover valuable insights that could potentially save you money or even boost your income. So, let’s dive in and discover the magic that awaits!

Crack the Code: Unveiling Box 14 on Your W2 Form!

Box 14 on your W2 form is like a secret code waiting to be decrypted. This section may contain a variety of codes that represent different types of payments or benefits you received throughout the tax year. From employer-provided education assistance to health insurance premiums paid by your company, each code tells a unique story about your compensation package. By taking the time to understand these codes, you can ensure that you are accurately reporting all of your income and potentially qualify for additional tax deductions or credits.

But how do you crack the code and make sense of the jumble of letters and numbers in Box 14? The key is to refer to your employer’s tax guide or reach out to your HR department for clarification. By familiarizing yourself with the common Form W2 codes used by employers, you can confidently navigate this section of your tax form and ensure that you are not missing out on any valuable information. With a little bit of sleuthing and a touch of curiosity, you can unlock the mystery of Box 14 and gain a deeper understanding of your financial situation.

Unleash the Magic: Mastering Form W2 Codes for Rewards!

Once you have mastered the art of decoding Form W2 codes in Box 14, you can unleash the magic that lies within. By understanding the various types of compensation and benefits provided by your employer, you can take advantage of potential tax savings or even negotiate for additional perks in the future. Whether it’s a bonus, relocation reimbursement, or a company car, each code in Box 14 represents a valuable piece of the puzzle that is your total compensation package. So, don’t let this treasure trove of information go to waste – unlock the magic of Box 14 and reap the rewards!

In conclusion, Box 14 of your W2 form holds the key to unlocking valuable insights into your compensation and benefits. By taking the time to decode the Form W2 codes in this section, you can ensure that you are accurately reporting your income and potentially maximize your tax savings. So, embrace the challenge of cracking the code, unleash the magic that awaits, and reap the rewards of mastering Form W2 codes!

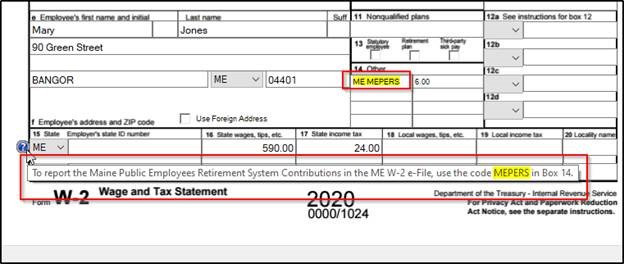

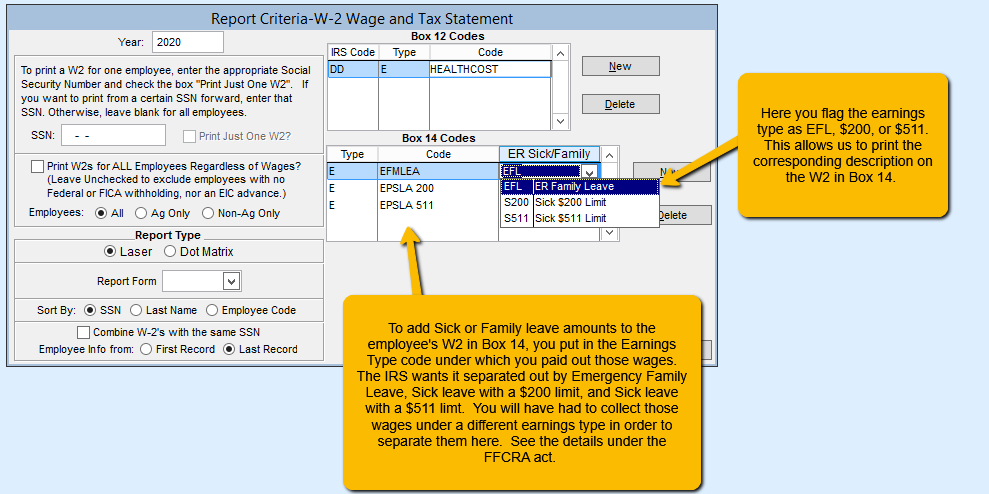

Below are some images related to Form W2 Codes Box 14

box 14 w2 codes, form w-2 box 14 code k, form w-2 box 14 code rsu, form w-2 box 14 code v, form w-2 box 14 code vpdi, , Form W2 Codes Box 14.

box 14 w2 codes, form w-2 box 14 code k, form w-2 box 14 code rsu, form w-2 box 14 code v, form w-2 box 14 code vpdi, , Form W2 Codes Box 14.