Sage W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash the Magic of Sage W2 Forms!

Do you want to streamline your payroll process and make tax season a breeze? Look no further than the enchanting power of Sage W2 forms! These forms are designed to make managing your employees’ tax information easy and efficient. With Sage W2 forms, you can unlock the secrets to a streamlined payroll system that will save you time and headache. Let’s dive into the world of Sage W2 forms and discover how they can work their magic for your business!

Discover the Enchanting Power of Sage W2 Forms!

Sage W2 forms are more than just a piece of paper – they are a powerful tool that can transform the way you handle employee tax information. These forms are specifically designed to comply with IRS regulations and make it easy for you to accurately report your employees’ wages, tips, and other compensation. With Sage W2 forms, you can ensure that your tax filings are accurate and that your employees receive the tax documents they need on time. Say goodbye to the days of manually calculating and filling out tax forms – Sage W2 forms will do the work for you!

Sage W2 forms are not just about compliance – they are also about efficiency. By using Sage W2 forms, you can streamline your payroll process and eliminate the need for manual data entry. These forms integrate seamlessly with Sage’s payroll software, allowing you to automatically populate the necessary information and generate accurate W2 forms with just a few clicks. With Sage W2 forms, you can save time, reduce errors, and focus on other important aspects of running your business. Say goodbye to the days of tedious payroll tasks – Sage W2 forms will make your life easier!

Are you ready to unlock the secrets to streamlined payroll and make tax season a breeze? Embrace the magic of Sage W2 forms and transform the way you manage your employees’ tax information. With Sage W2 forms, you can simplify your payroll process, ensure compliance with IRS regulations, and save time and effort. Say goodbye to the stress and frustration of tax season – let Sage W2 forms work their magic for your business today!

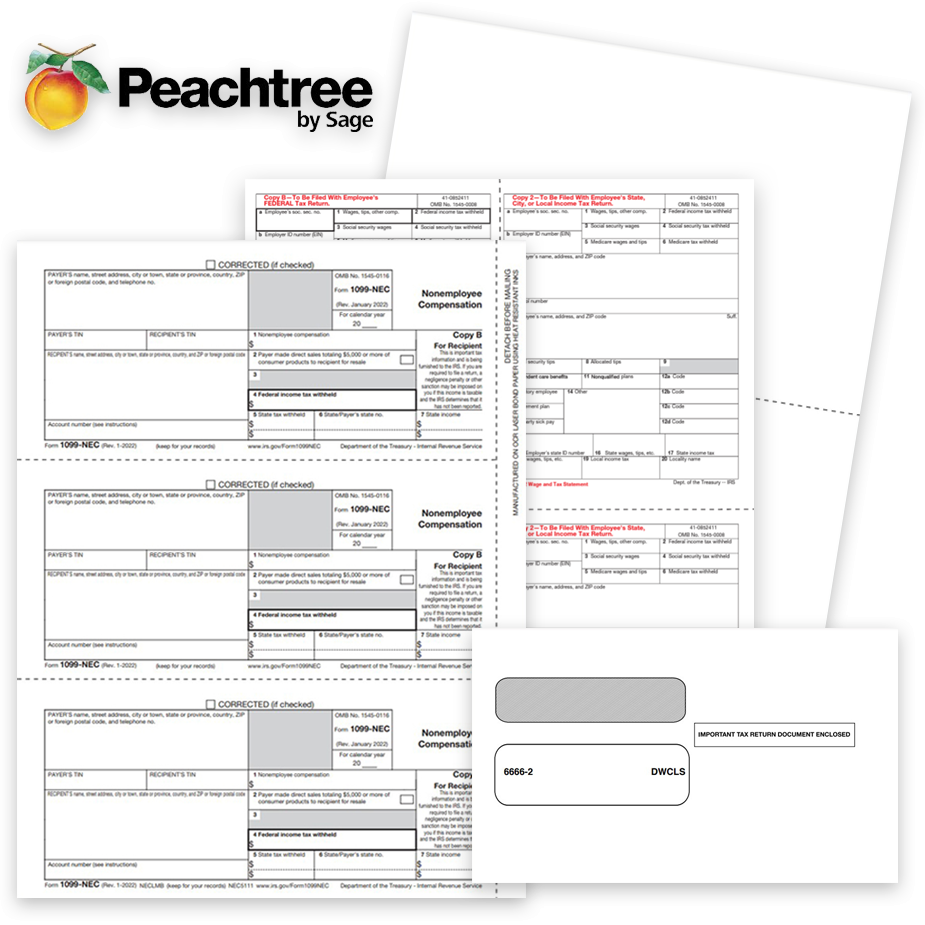

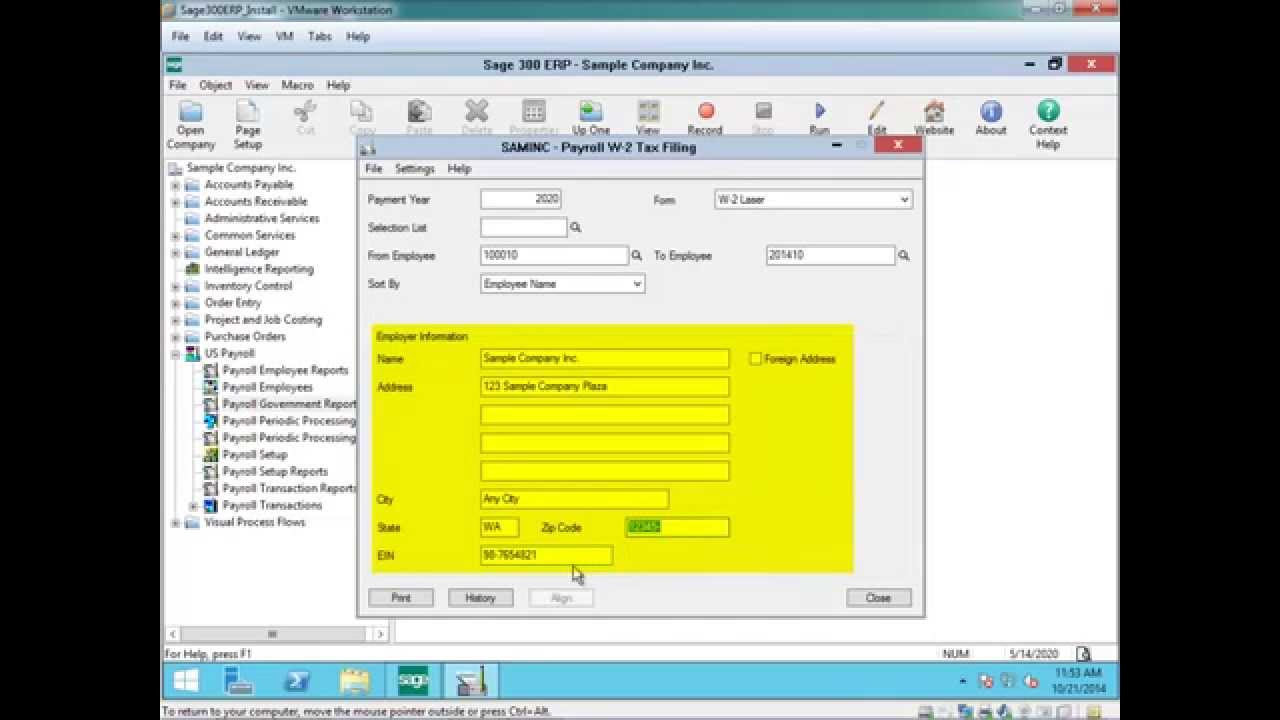

Below are some images related to Sage W2 Forms

can i create a w2 online, sage 50 w2 forms, sage w2 forms, where can i get my w2 forms online, , Sage W2 Forms.

can i create a w2 online, sage 50 w2 forms, sage w2 forms, where can i get my w2 forms online, , Sage W2 Forms.