W2 Form 401k Contribution – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

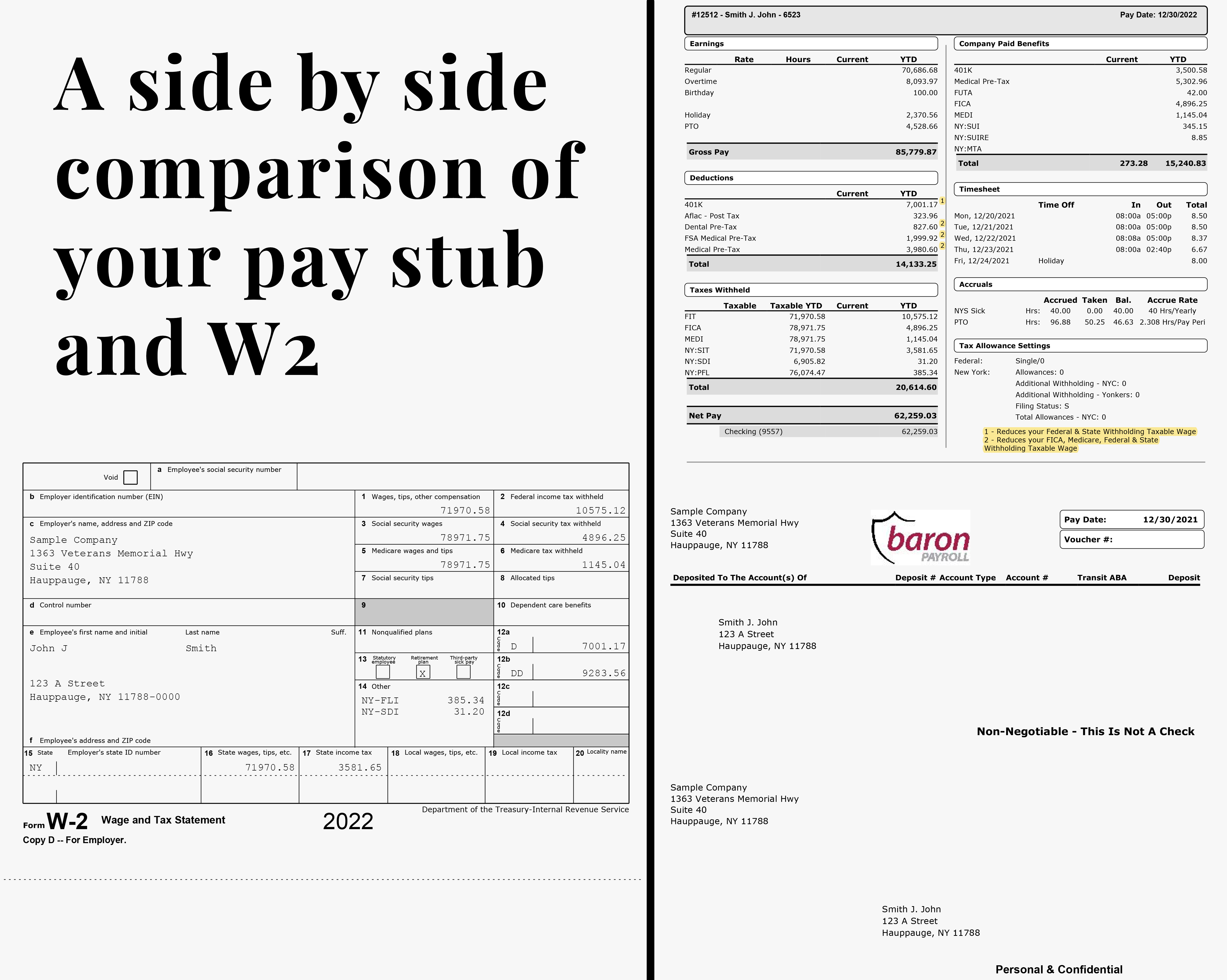

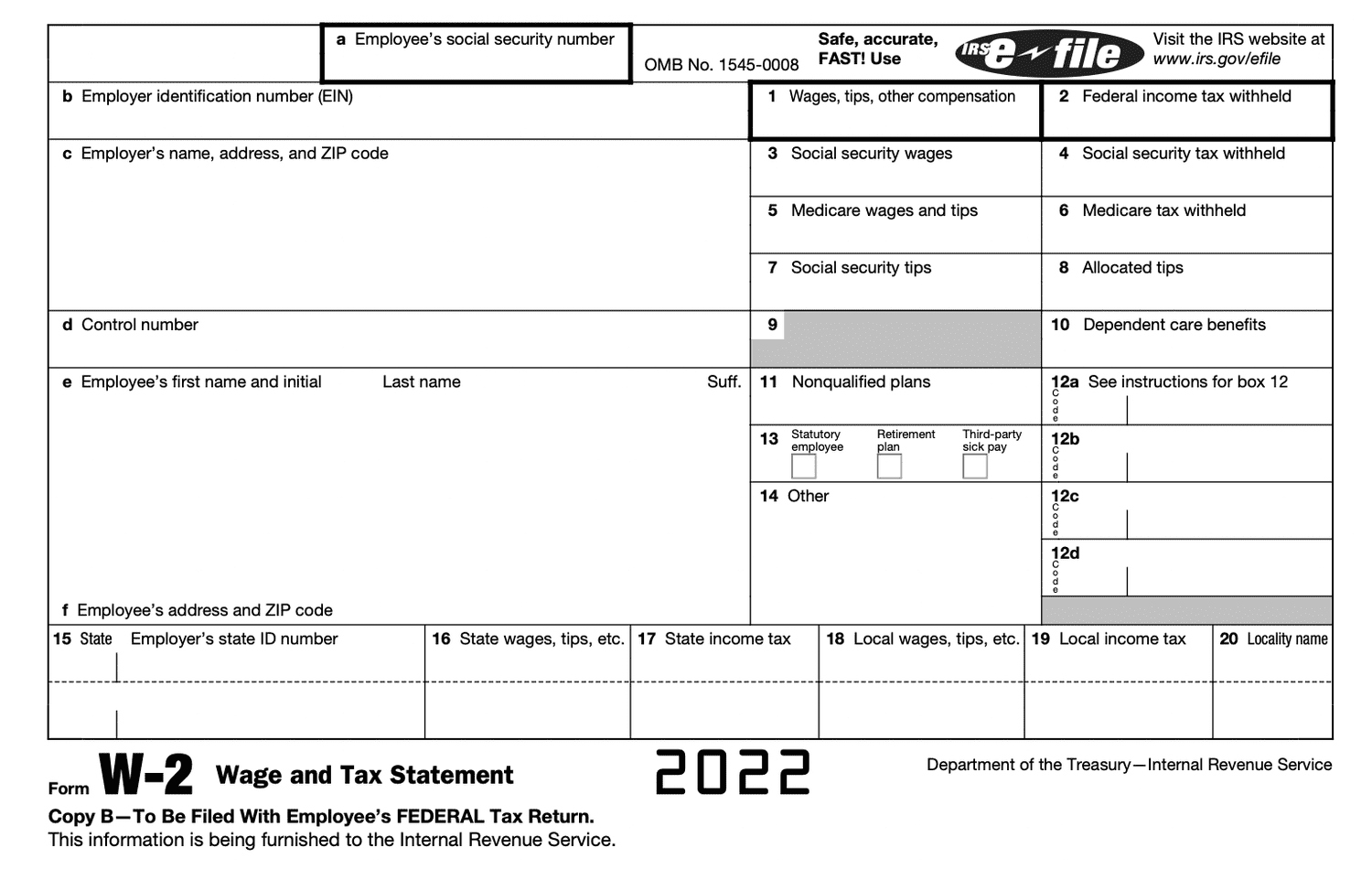

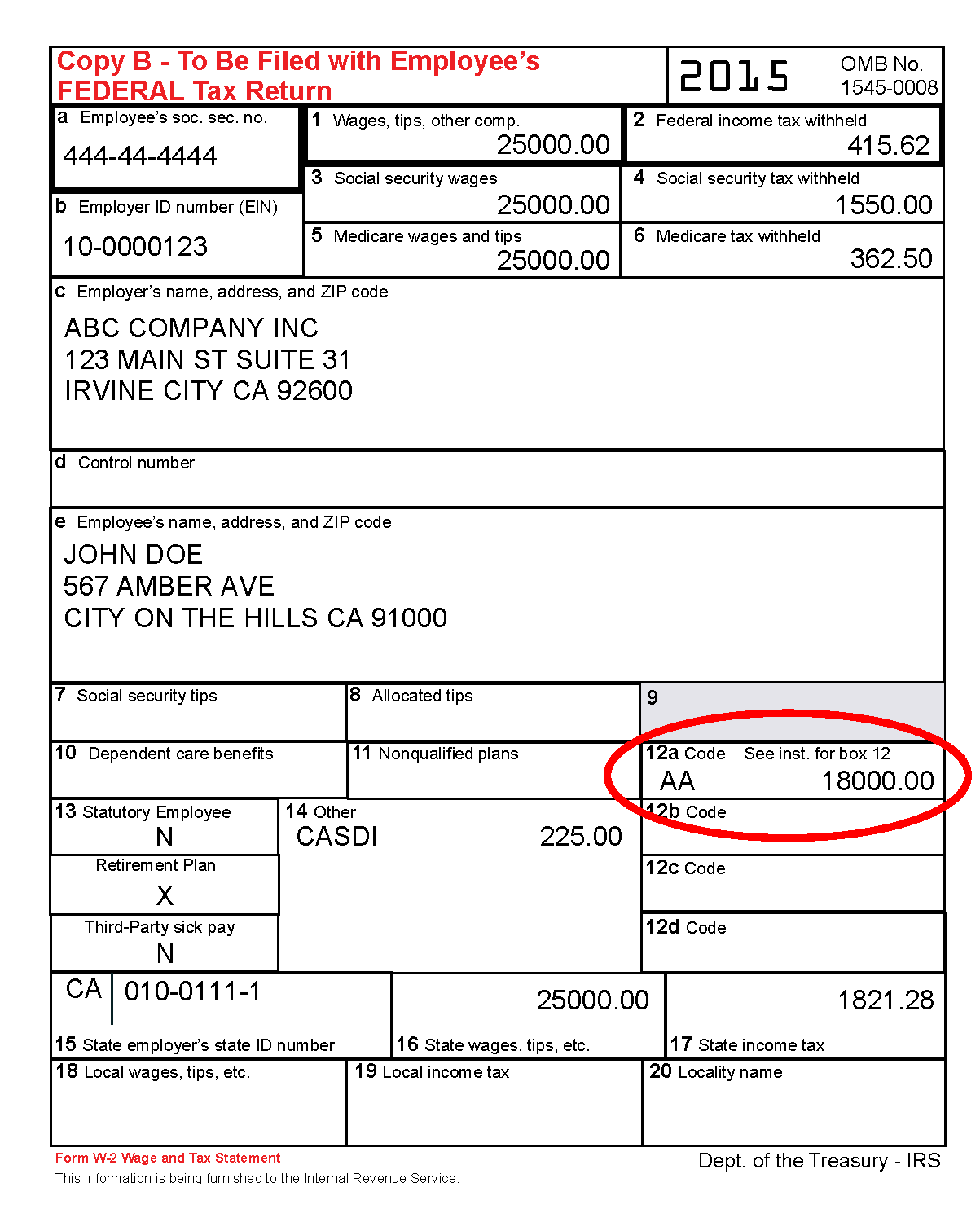

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximize Your Retirement Savings: W2 Form 401k Contribution!

Are you looking for ways to boost your retirement savings and secure a comfortable future for yourself? Look no further than your W2 form! By taking advantage of the 401k contribution option on your W2 form, you can turn your regular paycheck into a goldmine for retirement planning. With a little bit of planning and foresight, you can maximize your retirement savings and set yourself up for financial success in your golden years.

Boost Your Retirement Savings with W2 Form 401k Contribution!

One of the easiest and most effective ways to boost your retirement savings is by contributing to a 401k plan through your employer. By electing to have a portion of your paycheck deducted and deposited into your 401k account before taxes, you can lower your taxable income while simultaneously saving for retirement. Many employers also offer matching contributions, which can further enhance your retirement savings. By taking advantage of this benefit, you can make the most of your W2 form and ensure a secure financial future for yourself.

Turn Your W2 Form into a Goldmine for Retirement Planning!

When it comes to retirement planning, every dollar counts. By maximizing your contributions to your 401k plan through your W2 form, you can take control of your financial future and build a substantial nest egg for retirement. Whether you’re just starting out in your career or approaching retirement age, it’s never too early or too late to start saving for retirement. By making smart choices with your W2 form and maximizing your 401k contributions, you can set yourself up for a worry-free retirement and enjoy the golden years ahead.

Introduction

Your W2 form is more than just a record of your earnings – it’s a powerful tool for retirement planning. By taking advantage of the 401k contribution option on your W2 form, you can supercharge your retirement savings and set yourself up for financial success in the future. With a little bit of planning and foresight, you can turn your regular paycheck into a goldmine for retirement planning.

# Conclusion

Maximizing your retirement savings doesn’t have to be complicated or overwhelming. By making the most of the 401k contribution option on your W2 form, you can take control of your financial future and secure a comfortable retirement for yourself. So why wait? Start maximizing your retirement savings today and turn your W2 form into a goldmine for retirement planning!

Below are some images related to W2 Form 401k Contribution

are 401 k contributions included in w2 wages, does w2 show 401k contribution, w2 form 401k contribution, , W2 Form 401k Contribution.

are 401 k contributions included in w2 wages, does w2 show 401k contribution, w2 form 401k contribution, , W2 Form 401k Contribution.