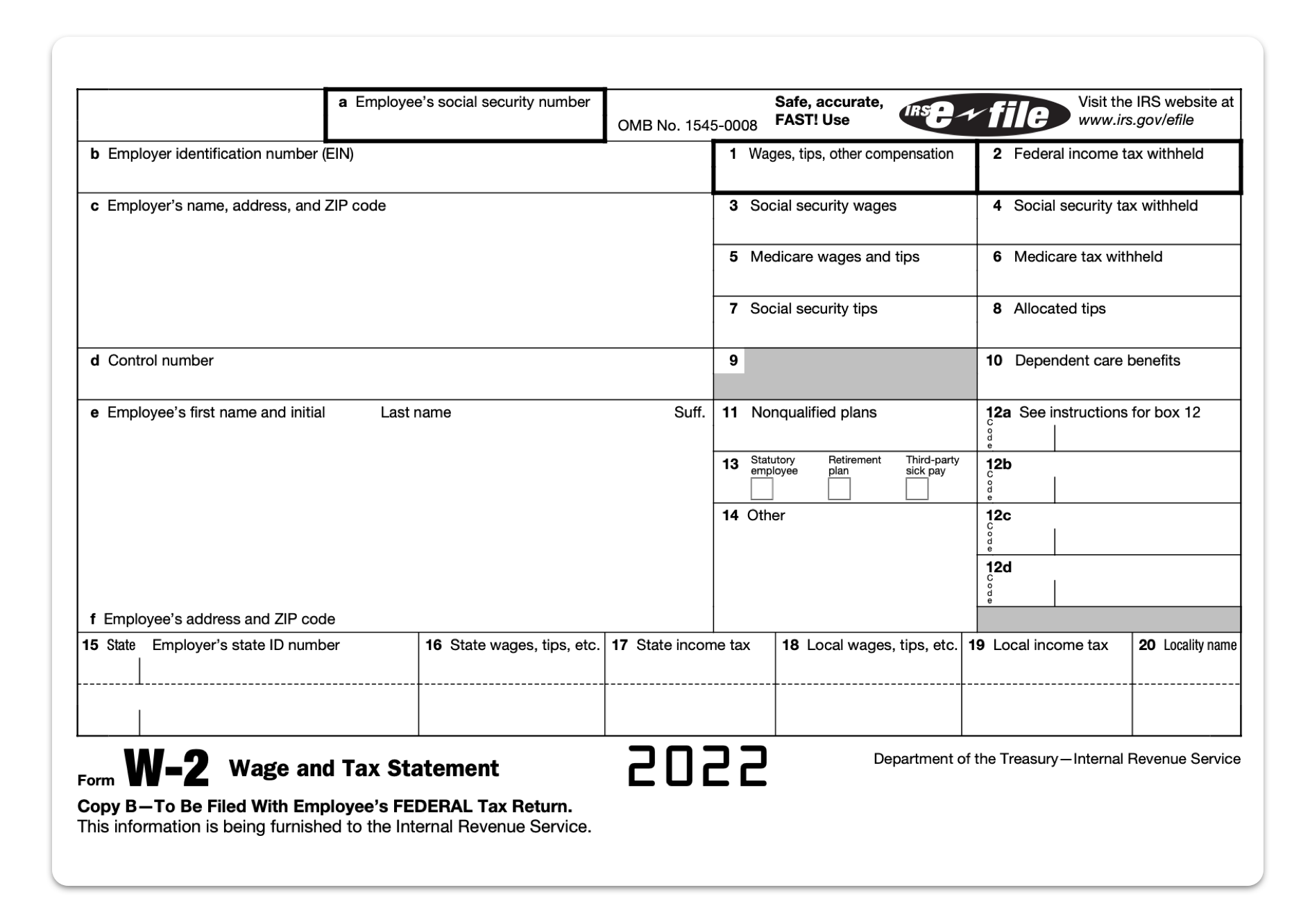

Difference Between W2 Form And W4 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

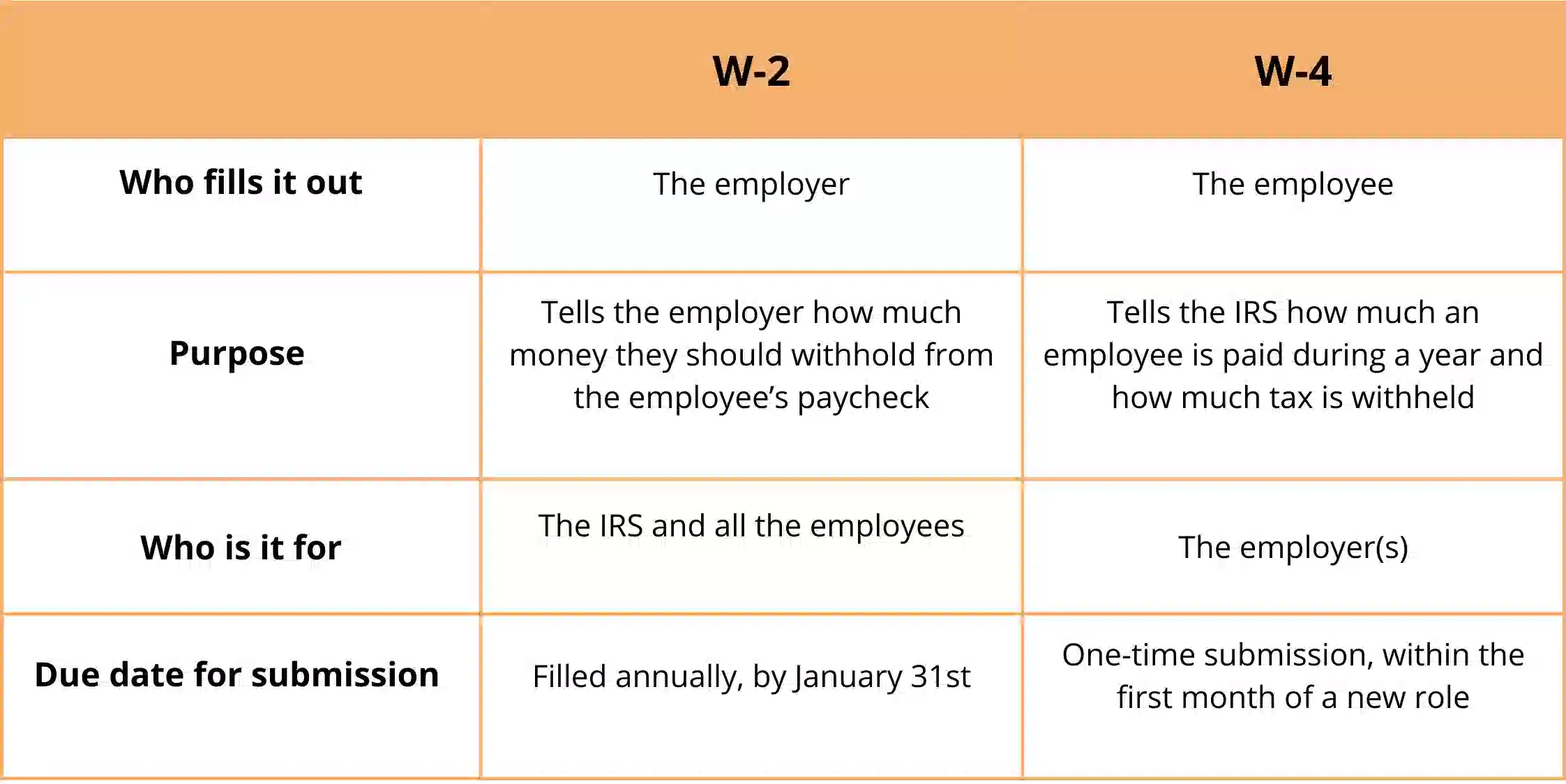

Decode the Dance of W2s and W4s!

Tax season can be a daunting time for many individuals, especially when it comes to deciphering those pesky tax forms like W2s and W4s. However, with a little bit of guidance and some fancy footwork, you can easily unravel the mystery of these forms and bust some moves with your taxes!

Unravel the Mystery of W2s and W4s!

First up, let’s tackle the W2 form. This form is provided by your employer and outlines your total earnings and taxes withheld throughout the year. It’s crucial to review this form carefully to ensure all information is accurate. Make sure your name, Social Security number, and income details are all correct. If you spot any discrepancies, be sure to reach out to your employer for corrections.

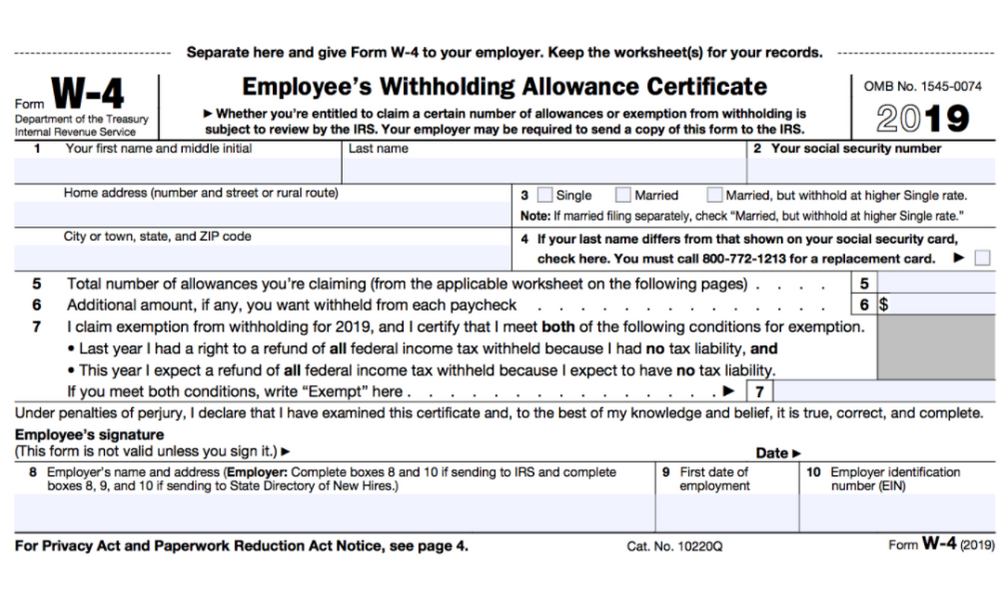

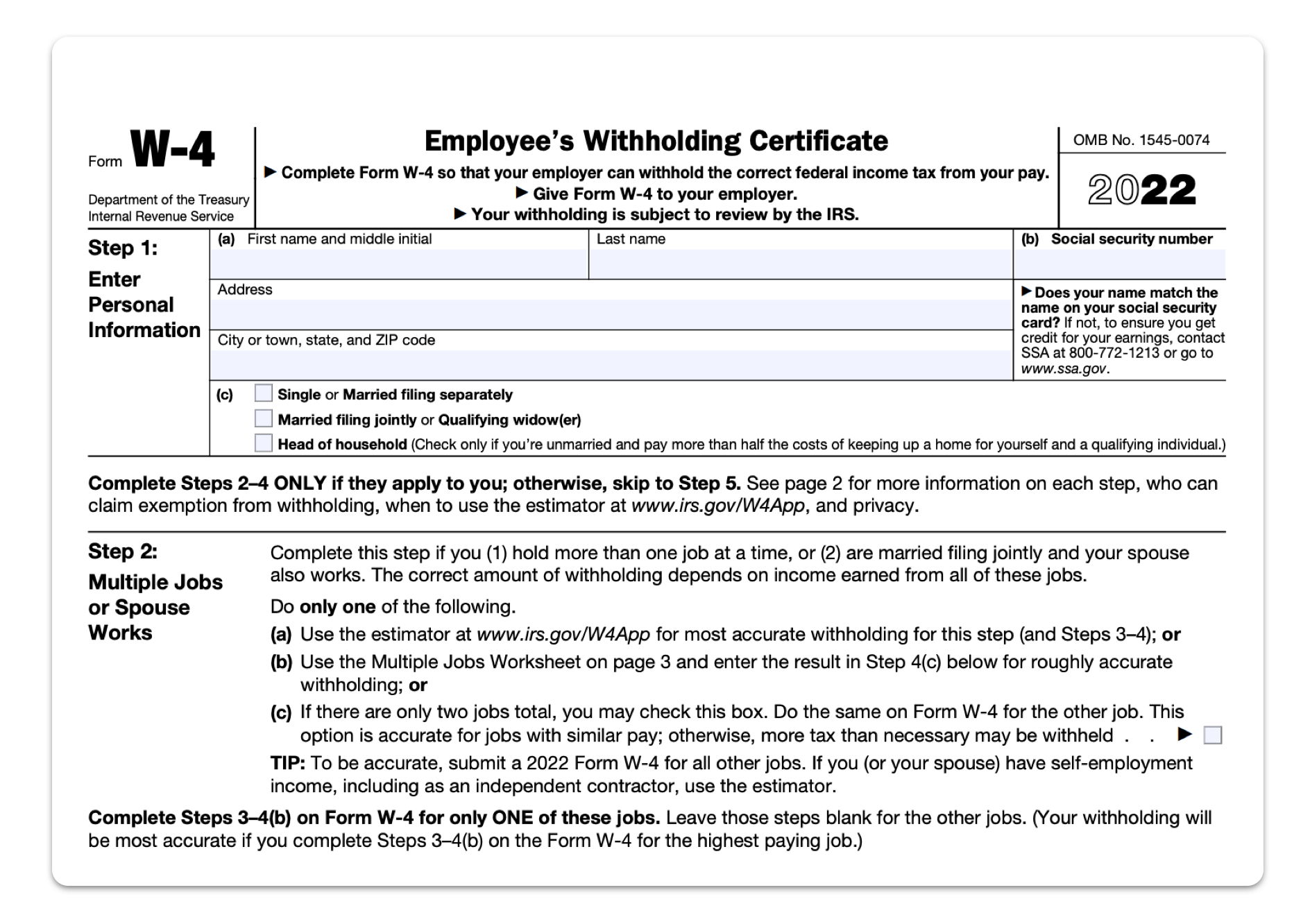

Next, let’s groove on over to the W4 form. This form is used to determine how much federal income tax should be withheld from your paycheck. It’s important to fill out this form accurately to avoid any surprises come tax time. Take the time to review your filing status, number of allowances, and any additional withholding amounts. If your personal or financial situation has changed, such as getting married or having a child, be sure to update your W4 form accordingly.

Now that you’ve mastered the basics of W2s and W4s, you’re ready to bust some moves with your taxes! By understanding these forms and taking the time to review them thoroughly, you can ensure a smoother and more stress-free tax season. So put on your dancing shoes, grab those tax forms, and get ready to hit the dance floor of financial success!

In conclusion, decoding the dance of W2s and W4s may seem like a daunting task at first, but with a little guidance and some careful attention to detail, you can easily navigate the tax season with confidence. So don’t be afraid to bust some moves with your taxes and show off your newfound tax form knowledge. With a bit of practice and a whole lot of determination, you’ll be waltzing through tax season like a pro in no time!

Below are some images related to Difference Between W2 Form And W4

difference between w2 form and w4, differences-between-irs-forms-w-2-and-w-4, is there a difference between w2 and w4, is w2 and w4 the same, , Difference Between W2 Form And W4.

difference between w2 form and w4, differences-between-irs-forms-w-2-and-w-4, is there a difference between w2 and w4, is w2 and w4 the same, , Difference Between W2 Form And W4.