Copies Of W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of W2 Wonders!

Are you ready to unlock the secrets of W2 wonders? Prepare to be amazed by the magic of these essential tax forms! Every year, countless individuals eagerly await the arrival of their W2s, knowing that they hold the key to unlocking financial insights and opportunities. From revealing your annual earnings to providing crucial information for tax filings, W2s are truly a wonder to behold.

Embracing the Joy of Back-Up Forms!

But wait, there’s more to the W2 story than meets the eye! Enter the world of back-up forms, the unsung heroes of tax season. These additional documents serve as a safety net, providing extra information and support for your W2. Whether it’s a 1099 form for additional income or a charitable donation receipt for deductions, back-up forms can make a world of difference in maximizing your tax benefits and ensuring accuracy in your filings. So why settle for just the basics when you can embrace the joy of back-up forms?

As you dive deeper into the world of W2 wonders and back-up forms, remember to approach tax season with a sense of excitement and curiosity. These documents are not just pieces of paper; they are tools that can help you navigate the complexities of the tax system and make the most of your financial situation. So embrace the magic, explore the possibilities, and revel in the joy of back-up forms as you embark on your tax-filing journey. Who knew that tax season could be so thrilling?

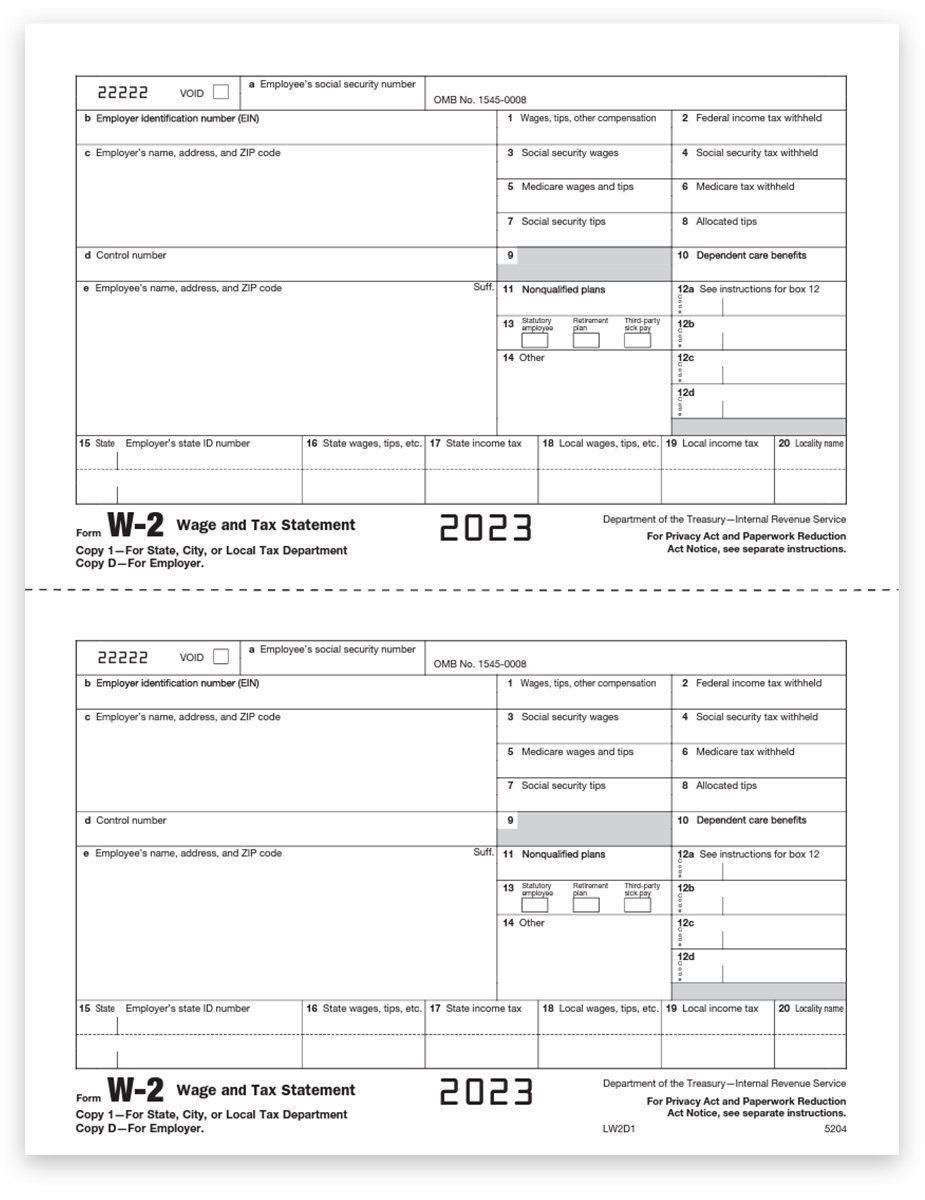

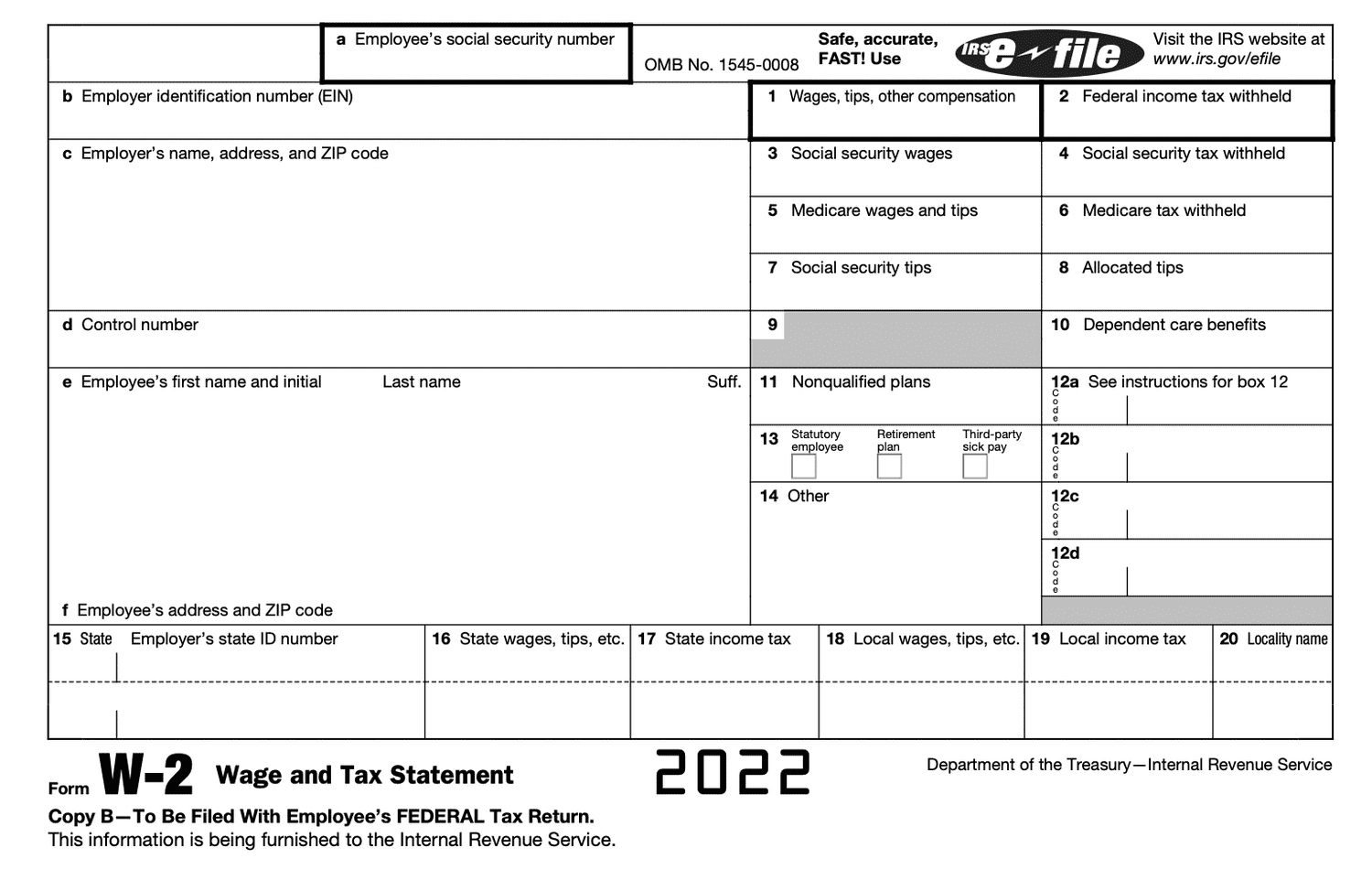

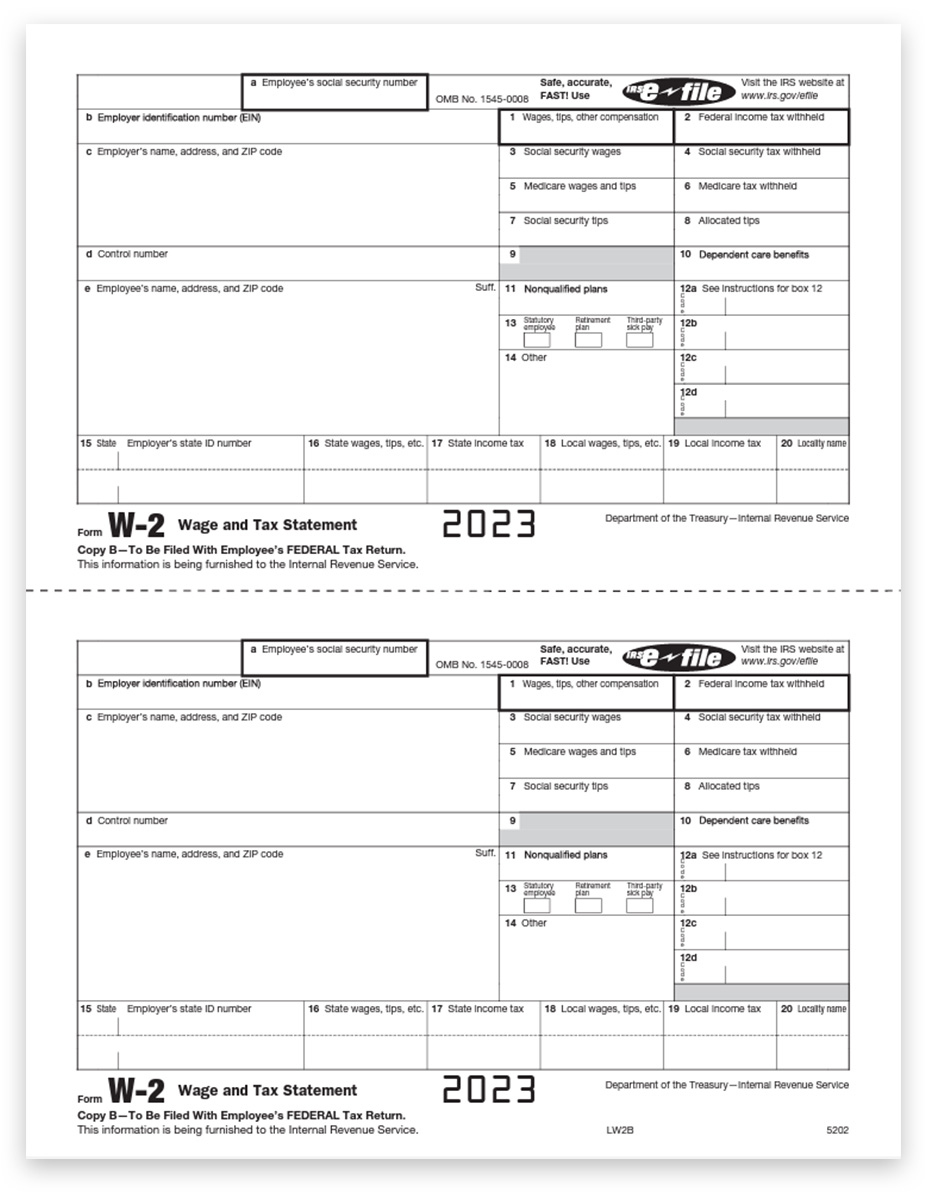

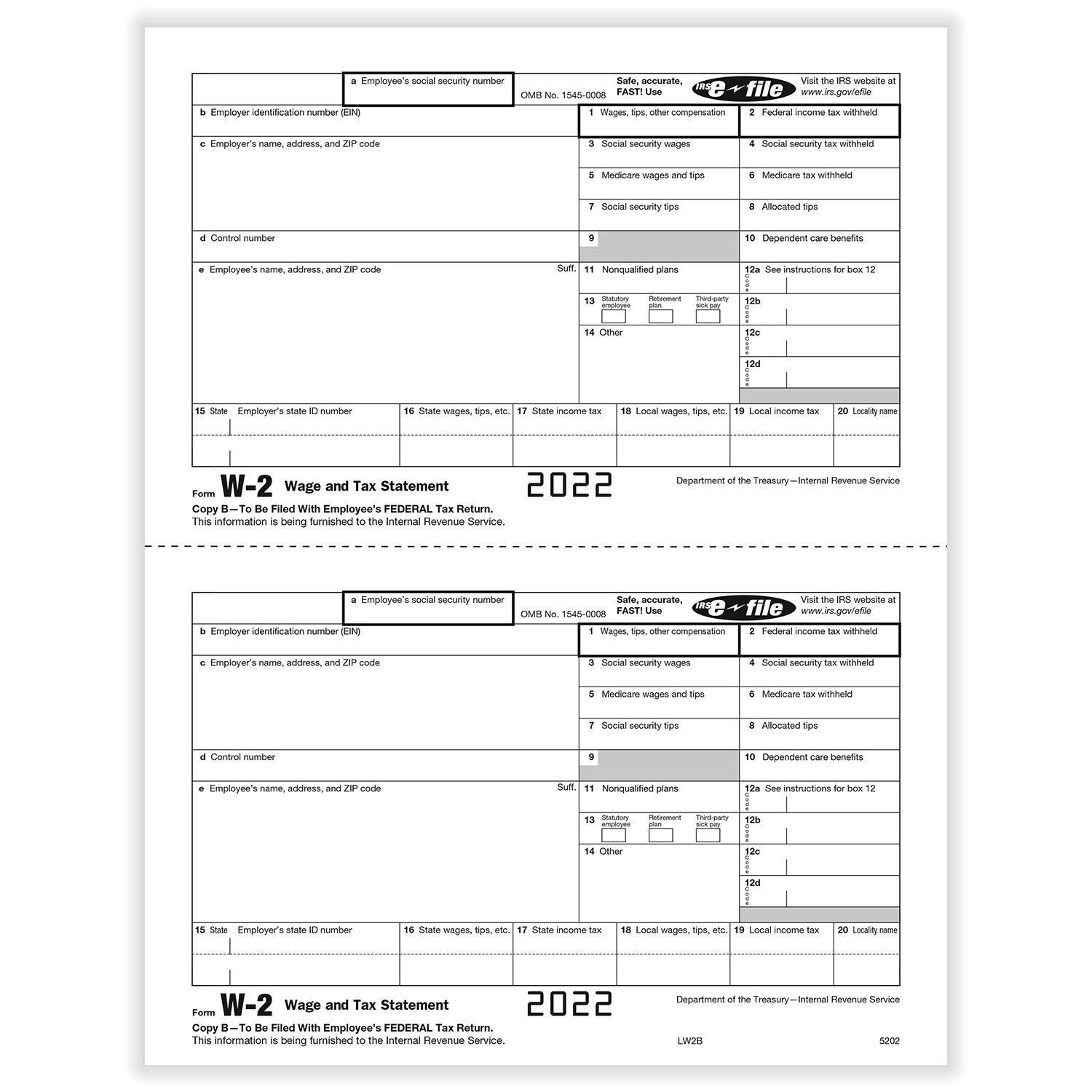

Below are some images related to Copies Of W2 Forms

can i get a copy of my w2 online, copies of w2 forms, how can i get a copy of my past w2 forms, how do i get copies of my w2 forms, where can i get a copy of my w2 forms, , Copies Of W2 Forms.

can i get a copy of my w2 online, copies of w2 forms, how can i get a copy of my past w2 forms, how do i get copies of my w2 forms, where can i get a copy of my w2 forms, , Copies Of W2 Forms.