Former Heb Employee W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

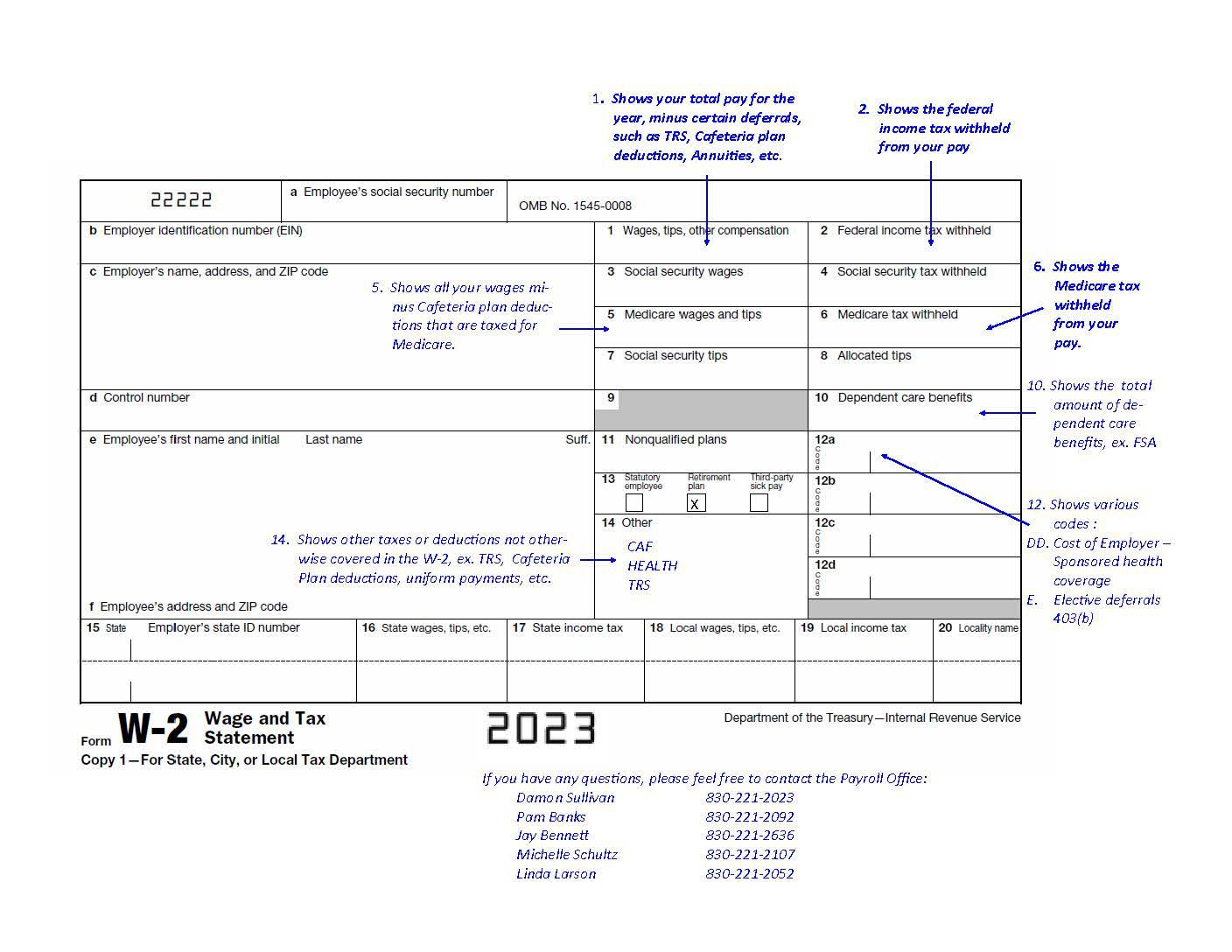

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Secrets of Your Former H-E-B Employee W2!

Have you recently left your job at H-E-B and received your W2 form in the mail? If so, you may be wondering what secrets it holds and how you can make the most of this important document. Fear not, for we are here to guide you through the process of unlocking the mysteries of your former H-E-B employee W2!

Discovering Hidden Treasures in Your Former H-E-B Employee W2!

As you open your W2 form, you may be overwhelmed by the numbers and codes staring back at you. But fear not, for each line of information holds valuable clues about your past year’s earnings, taxes withheld, and more. Take a closer look at your wages, deductions, and credits to uncover hidden treasures that may help you better understand your financial situation.

In addition, your former H-E-B employee W2 may also reveal insights into your retirement savings, health insurance contributions, and other benefits you received while working at the company. By carefully examining each section of the form, you can gain a deeper understanding of the perks and advantages you enjoyed as an H-E-B employee.

Unveiling the Mysteries of Your H-E-B Employee W2 Form!

Don’t let the complexity of your W2 form intimidate you – instead, embrace the opportunity to demystify its contents and gain a clearer picture of your financial status. By unlocking the secrets of your former H-E-B employee W2, you can take control of your finances, plan for the future, and make informed decisions about your tax filings. So grab your magnifying glass and get ready to uncover the hidden treasures within your W2 form!

In conclusion, your former H-E-B employee W2 is more than just a piece of paper – it is a valuable resource that can help you better understand your financial situation and make informed decisions about your tax filings. By taking the time to explore the hidden treasures within your W2 form, you can unlock the secrets of your past year’s earnings, deductions, and benefits. So don’t be afraid to dive in and unravel the mysteries of your former H-E-B employee W2 – the rewards are well worth the effort!

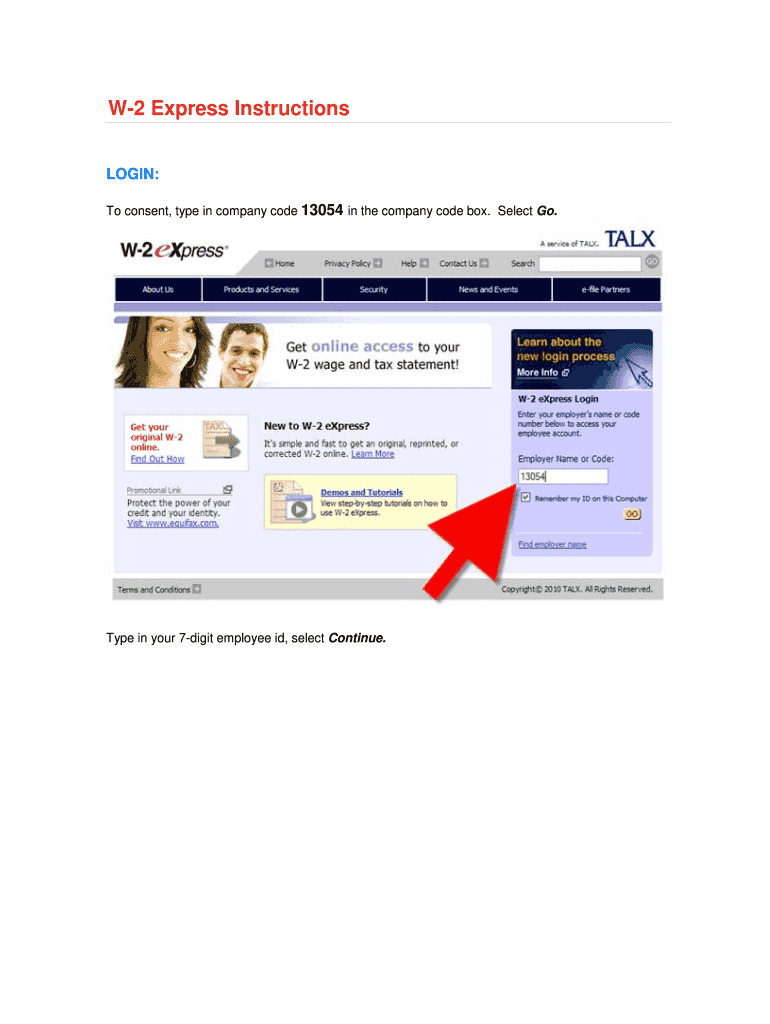

Below are some images related to Former Heb Employee W2

former heb employee w2, how do i get my w2 from my old employer, how do i get my w2 from walmart as a former employee, where can i get my w2 from previous employer, , Former Heb Employee W2.

former heb employee w2, how do i get my w2 from my old employer, how do i get my w2 from walmart as a former employee, where can i get my w2 from previous employer, , Former Heb Employee W2.