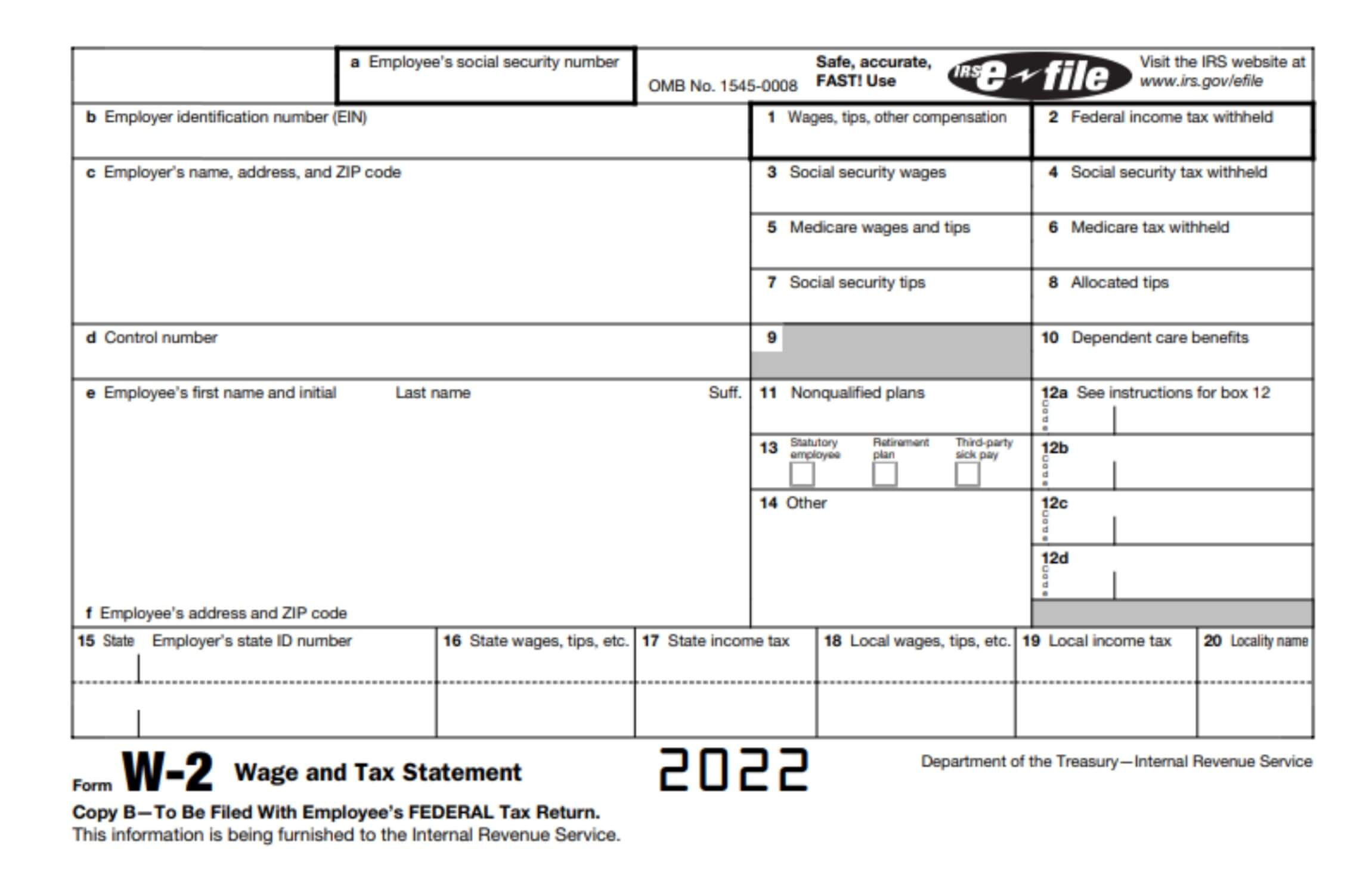

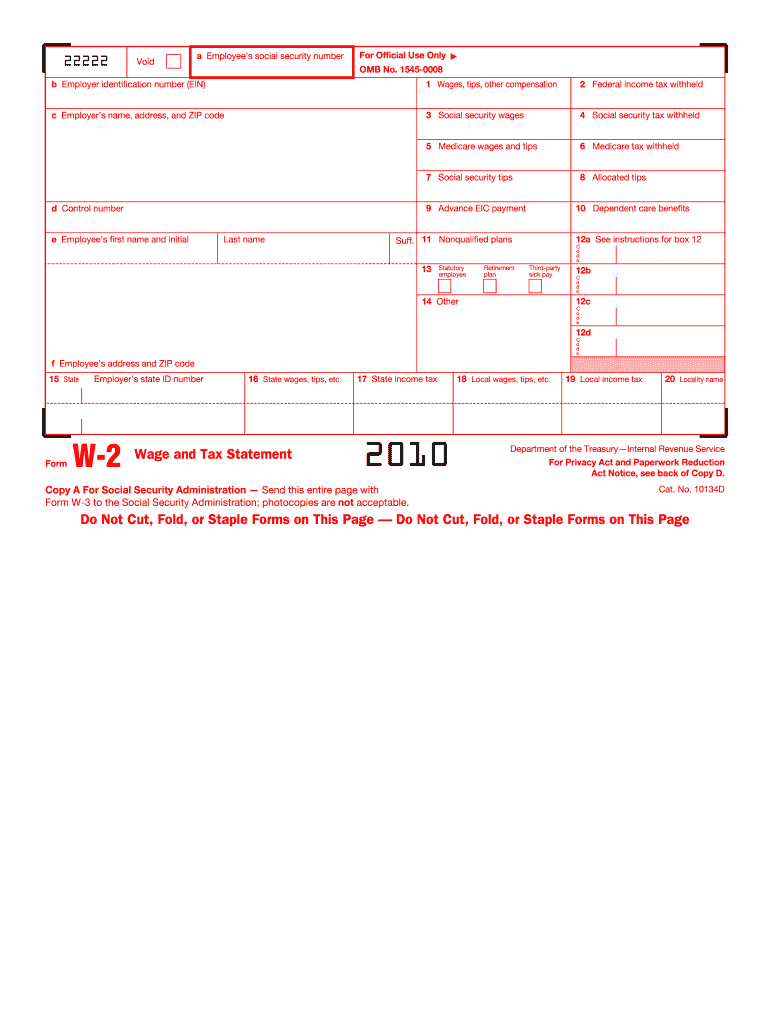

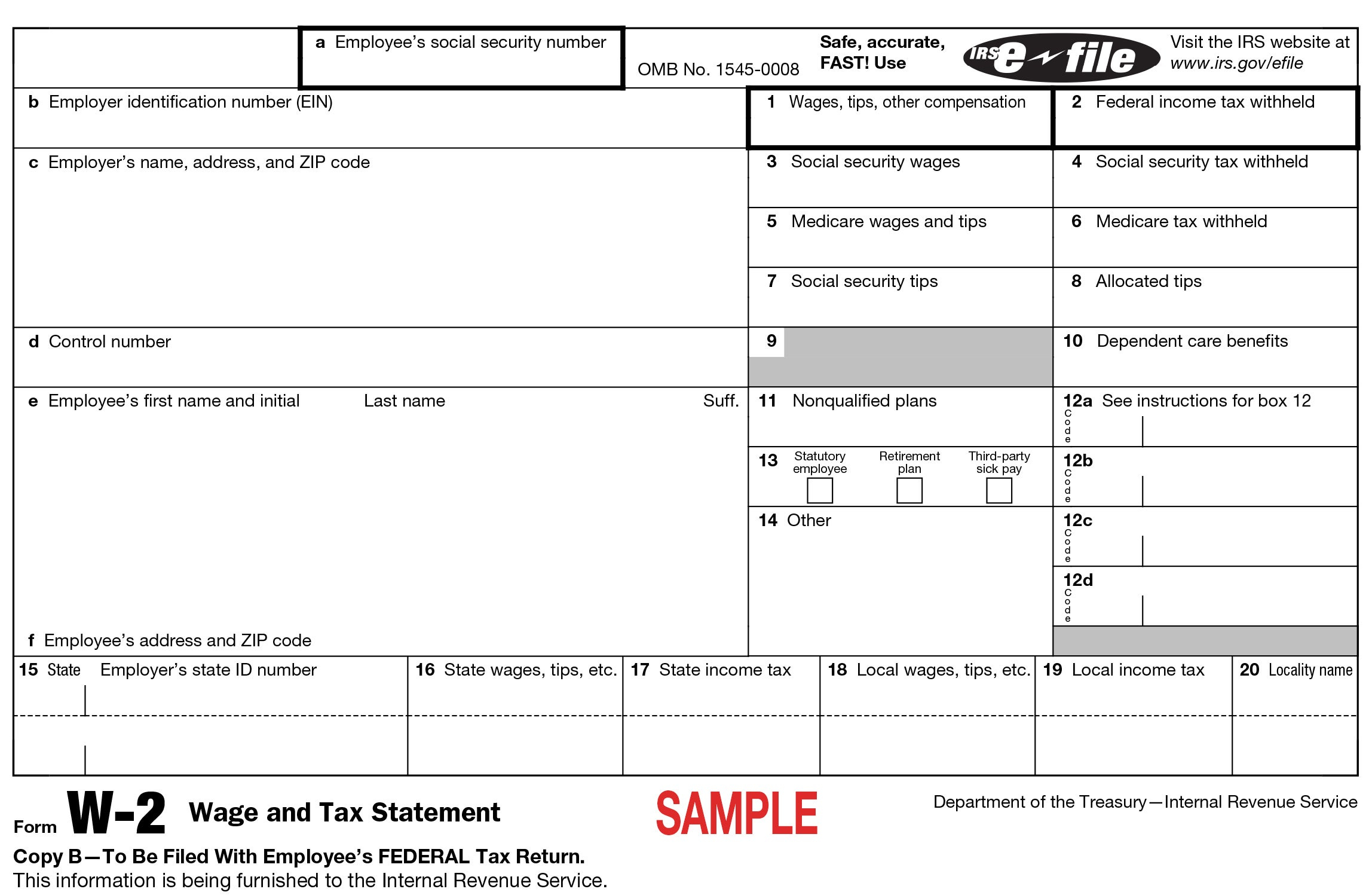

W2 Form 12d – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mysteries of W2 Form 12d

Are you ready to conquer tax season like a pro? Look no further than the W2 Form 12d – the unsung hero of your tax documents! This mysterious form may seem daunting at first, but fear not, for we are here to unravel its secrets and show you how it can lead you on the path to tax success. W2 Form 12d holds the key to unlocking vital information about your income and taxes withheld, making it an essential piece of the tax puzzle.

When you receive your W2 Form 12d from your employer, don’t let its seemingly complicated layout intimidate you. Take a closer look at each section, from your personal information to your wages and tax deductions. This form provides a comprehensive snapshot of your financial activity throughout the year, giving you insight into how much you earned and how much was deducted for taxes. By understanding the information on your W2 Form 12d, you can better prepare for filing your taxes and maximize your potential refunds.

As you delve deeper into the realm of W2 Form 12d, you’ll discover its power to simplify the tax filing process and ensure accuracy. Armed with this knowledge, you can confidently navigate through tax season with ease and confidence. With W2 Form 12d as your trusty guide, you’ll be well on your way to achieving tax success and making the most of your hard-earned money.

Discover How W2 Form 12d Can Transform Your Tax Season

Say goodbye to tax season stress and hello to a new era of tax success with W2 Form 12d by your side. This magical form has the ability to transform your tax filing experience from a daunting chore to a smooth and efficient process. By harnessing the power of W2 Form 12d, you can take control of your finances and ensure that you’re getting the most out of your tax return.

As you become more familiar with W2 Form 12d, you’ll start to see the bigger picture of your financial situation and how it relates to your taxes. By understanding the nuances of this form, you can make informed decisions about tax deductions, credits, and potential refunds. With W2 Form 12d as your beacon of light, you can navigate the complex world of taxes with confidence and clarity.

Embrace the magic of W2 Form 12d and let it lead you on a journey to tax success. By unlocking the mysteries of this form and harnessing its power, you’ll be well-equipped to tackle tax season like a seasoned pro. So, grab your W2 Form 12d and let its magic work wonders for your finances. Here’s to a successful tax season filled with refunds, savings, and peace of mind!

Below are some images related to W2 Form 12d

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] in W2 Form 12D](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-in-w2-form-12d.jpg) w2 form 12 c, w2 form 12b code dd, w2 form 12b code w, w2 form 12b w, w2 form 12d, , W2 Form 12d.

w2 form 12 c, w2 form 12b code dd, w2 form 12b code w, w2 form 12b w, w2 form 12d, , W2 Form 12d.