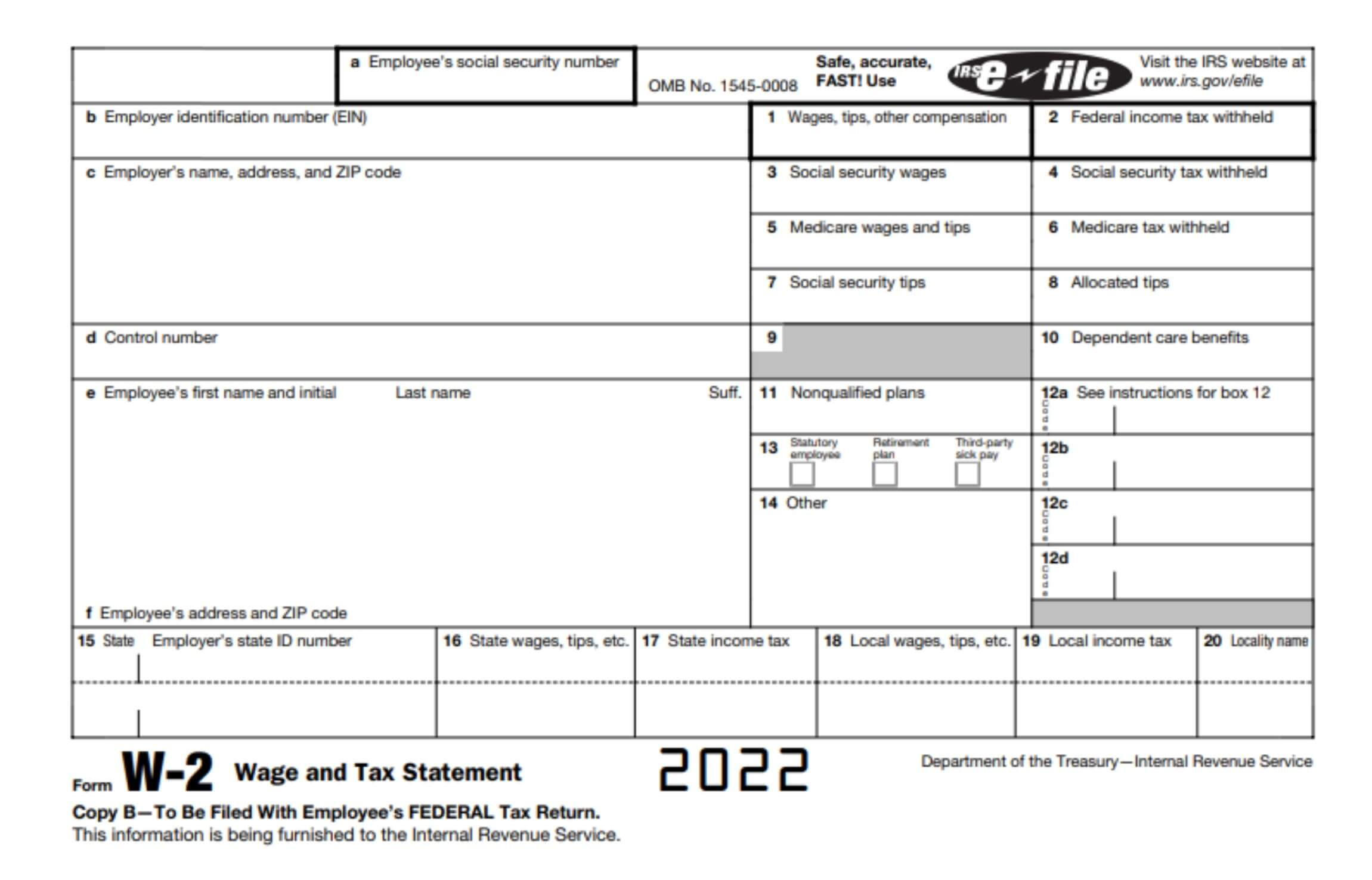

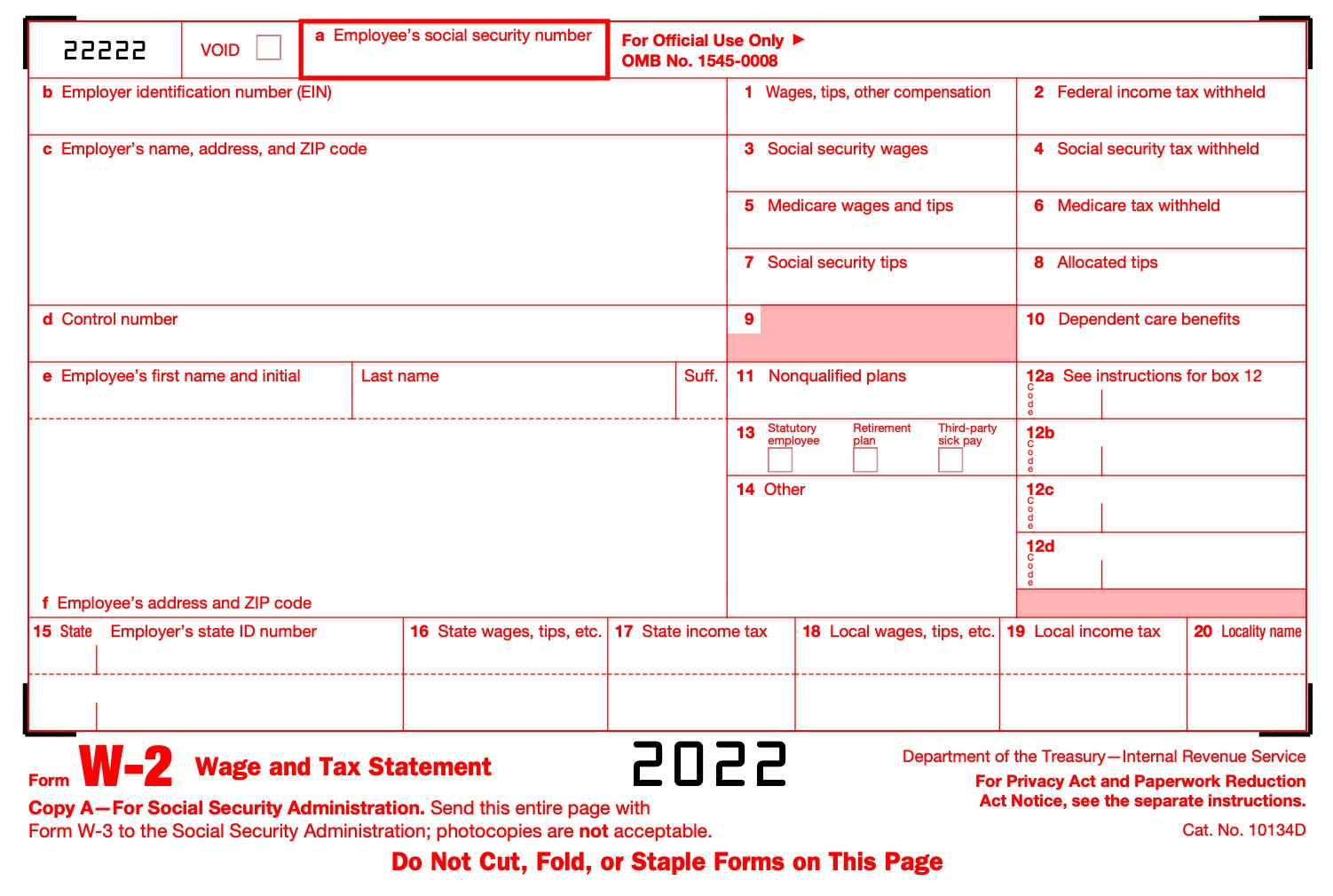

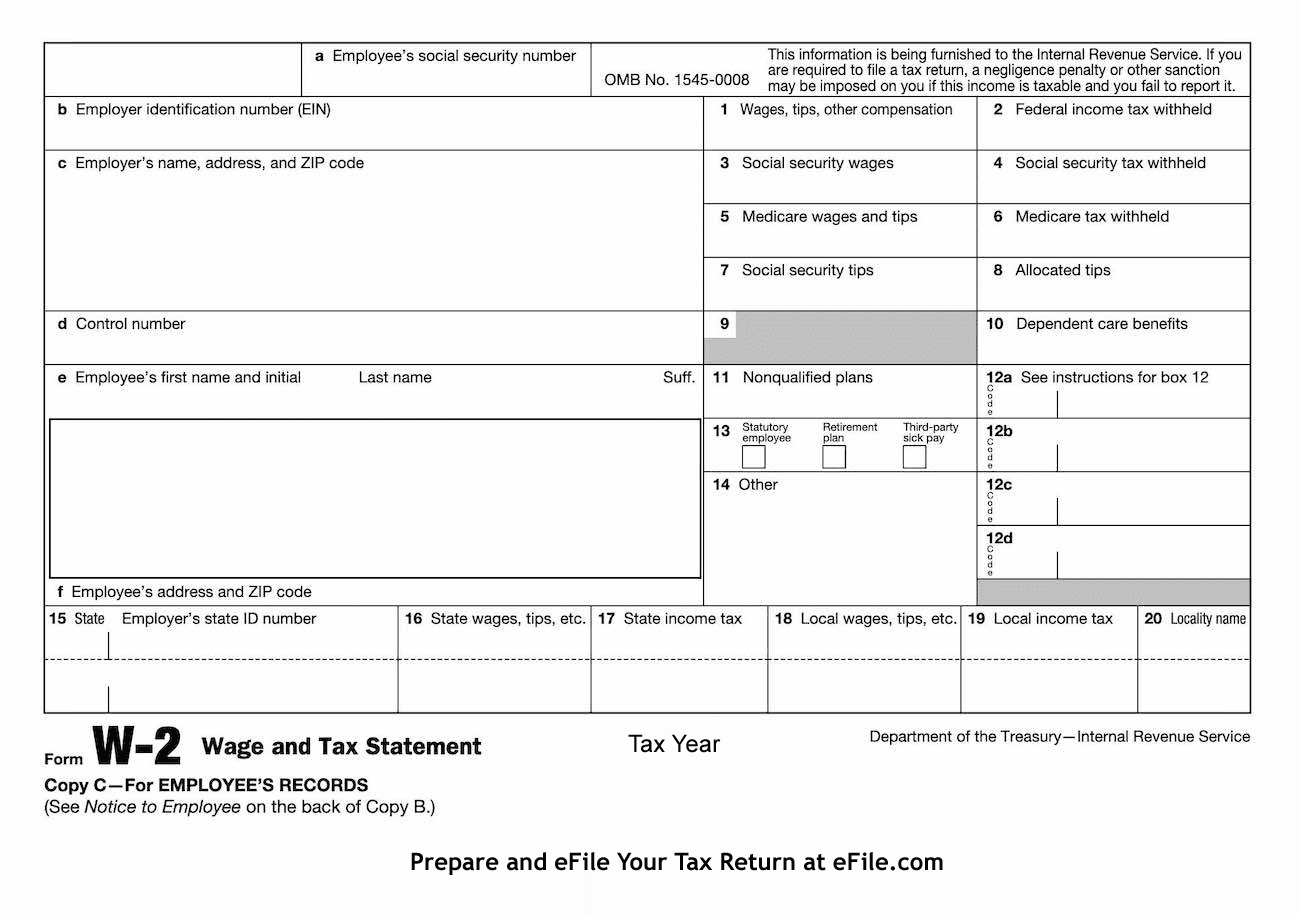

Where Do I Mail W2 Forms To Irs – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

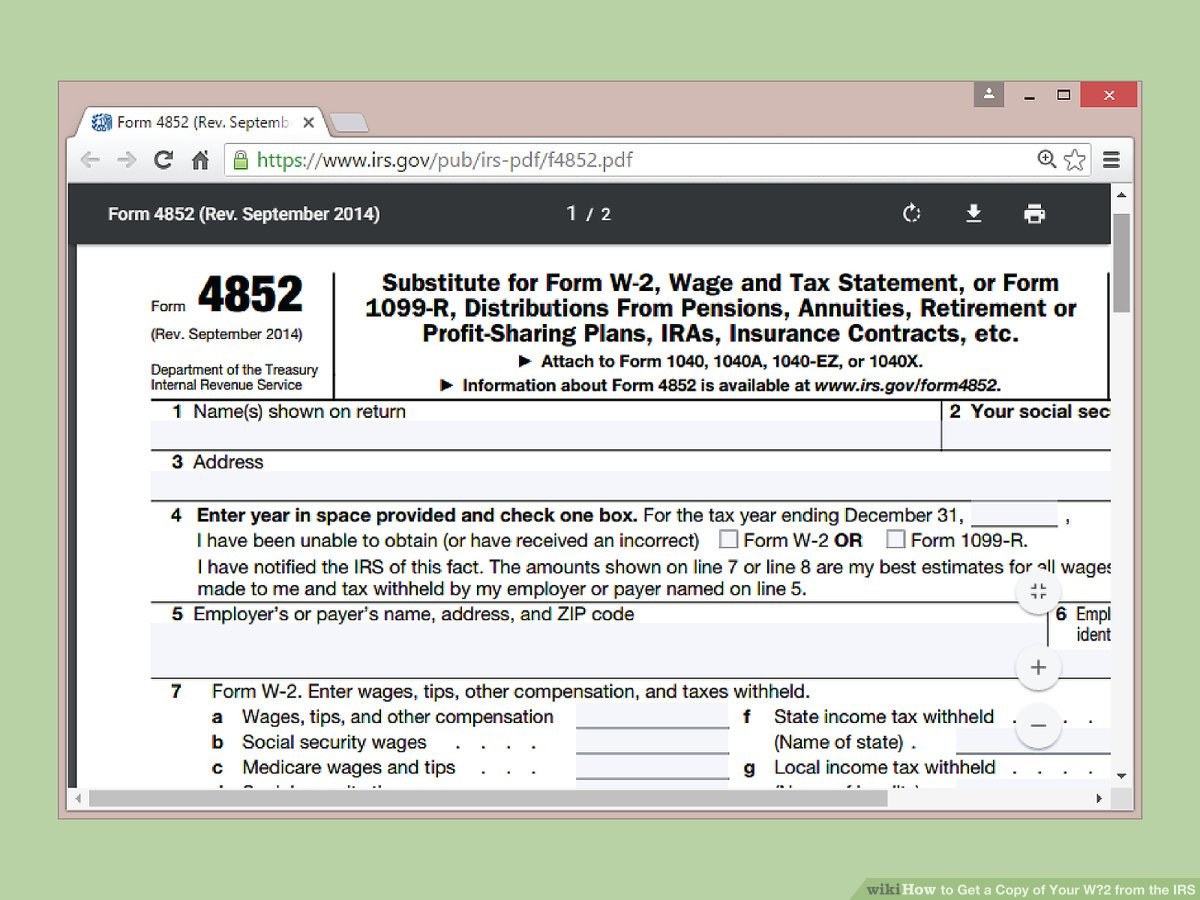

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Spreading Joy: A Guide to Sending W2 Forms to IRS

Feeling the holiday spirit and want to spread some cheer to the hardworking folks at the IRS? Sending in your W2 forms doesn’t have to be a dull task – it’s an opportunity to brighten someone’s day with a smile! By following the proper mailing instructions, you can ensure that your forms reach the IRS in a timely manner and make someone’s day a little bit better.

When mailing your W2 forms to the IRS, it’s important to double-check that you have filled out all the necessary information accurately. This includes your personal details, such as your name, social security number, and address, as well as your employer’s information and the income you earned throughout the year. Taking the time to review your forms before sending them off can help prevent any delays or issues with processing.

Once you’ve confirmed that your W2 forms are filled out correctly, it’s time to send them on their way to the IRS. By following the specific mailing address for your state, you can ensure that your forms are processed efficiently. Remember, sending in your W2 forms is not just a routine task – it’s an opportunity to make someone smile on the receiving end. So grab a pen, seal up those envelopes, and send some smiles along with your forms to the hardworking individuals at the IRS.

Brighten Their Day: Where to Mail Your W2 Forms

So, where exactly should you mail your W2 forms to bring some joy to the IRS staff? The mailing address you use will depend on your state and whether you are including a payment along with your forms. The IRS provides a list of addresses on their website, so you can easily find the one that corresponds to your location. Make sure to use the correct address to avoid any delays in processing.

If you are including a payment with your W2 forms, be sure to follow the instructions provided by the IRS for the specific type of payment you are making. This can help ensure that your payment is processed correctly and that your forms are matched up with the corresponding payment. By following the guidelines set forth by the IRS, you can make the process smoother for both you and the hardworking individuals who will be processing your forms.

Sending in your W2 forms may not be the most exciting task on your to-do list, but it’s a chance to bring a smile to someone’s face. By taking the time to fill out your forms accurately and mail them to the correct address, you can make the process a little brighter for the IRS staff who will be working hard to process them. So spread some joy this tax season and send in your W2 forms with a smile!

In conclusion, sending in your W2 forms to the IRS doesn’t have to be a mundane task – it’s an opportunity to spread some joy and make someone’s day a little brighter. By following the proper mailing instructions and ensuring that your forms are filled out accurately, you can help make the process smoother for both you and the IRS staff. So grab your envelopes, put a smile on your face, and send in those W2 forms with a touch of cheer!

Below are some images related to Where Do I Mail W2 Forms To Irs

where do employers send w2 forms to irs, where do i mail my w2 tax return, where do i mail my w2 to the irs, where do i mail w2 forms to irs, where do i mail w2 forms to irs online, , Where Do I Mail W2 Forms To Irs.

where do employers send w2 forms to irs, where do i mail my w2 tax return, where do i mail my w2 to the irs, where do i mail w2 forms to irs, where do i mail w2 forms to irs online, , Where Do I Mail W2 Forms To Irs.