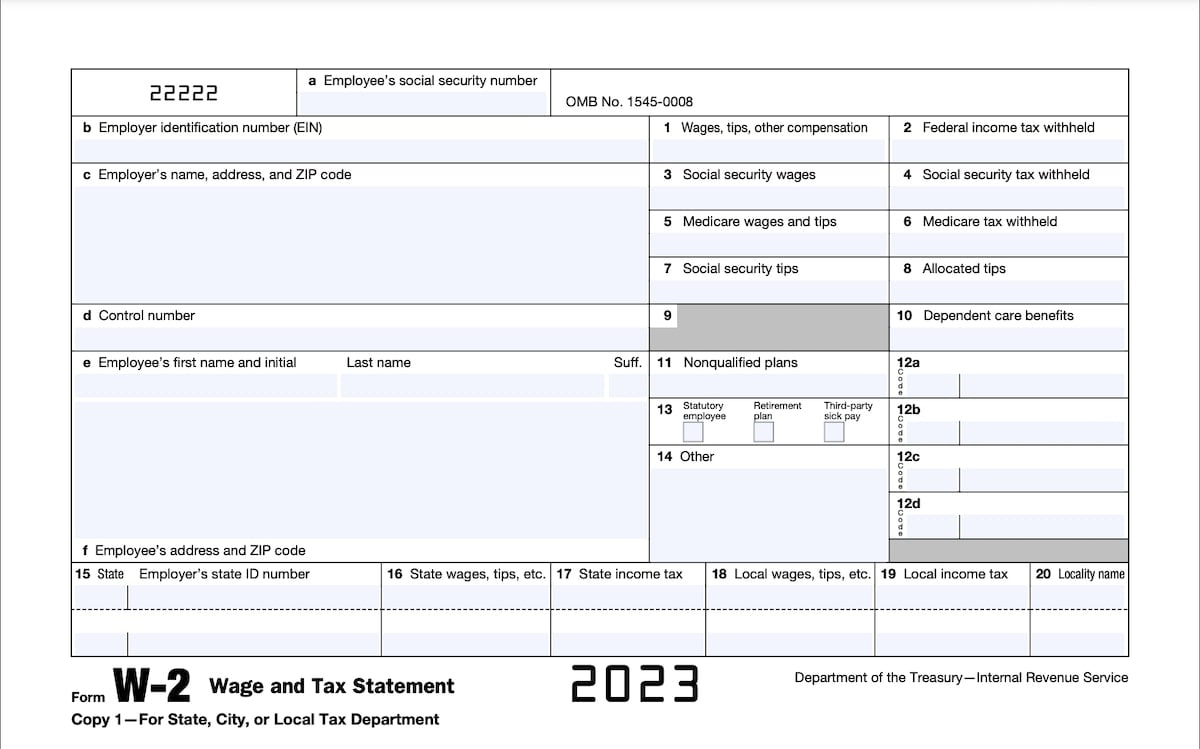

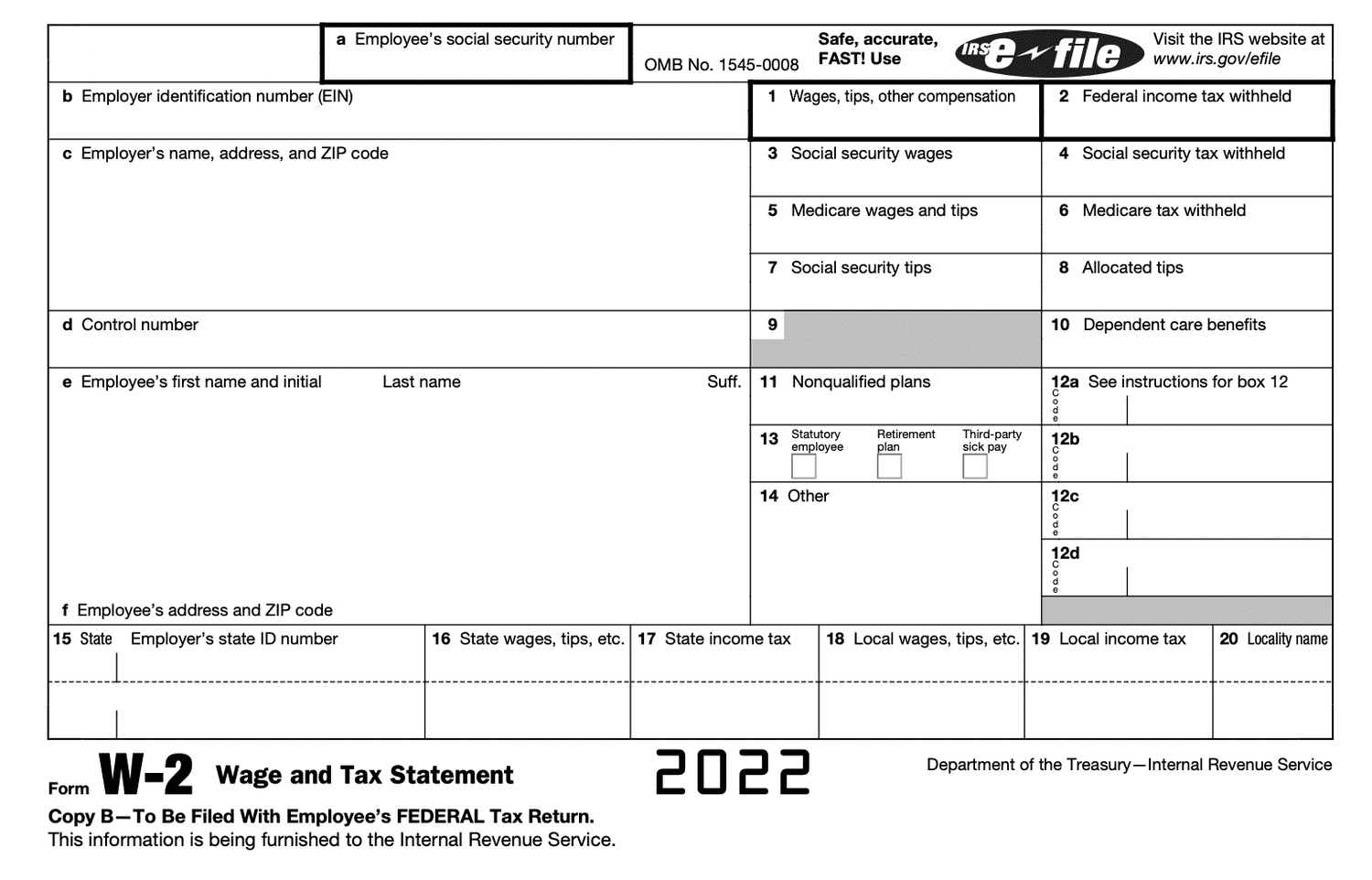

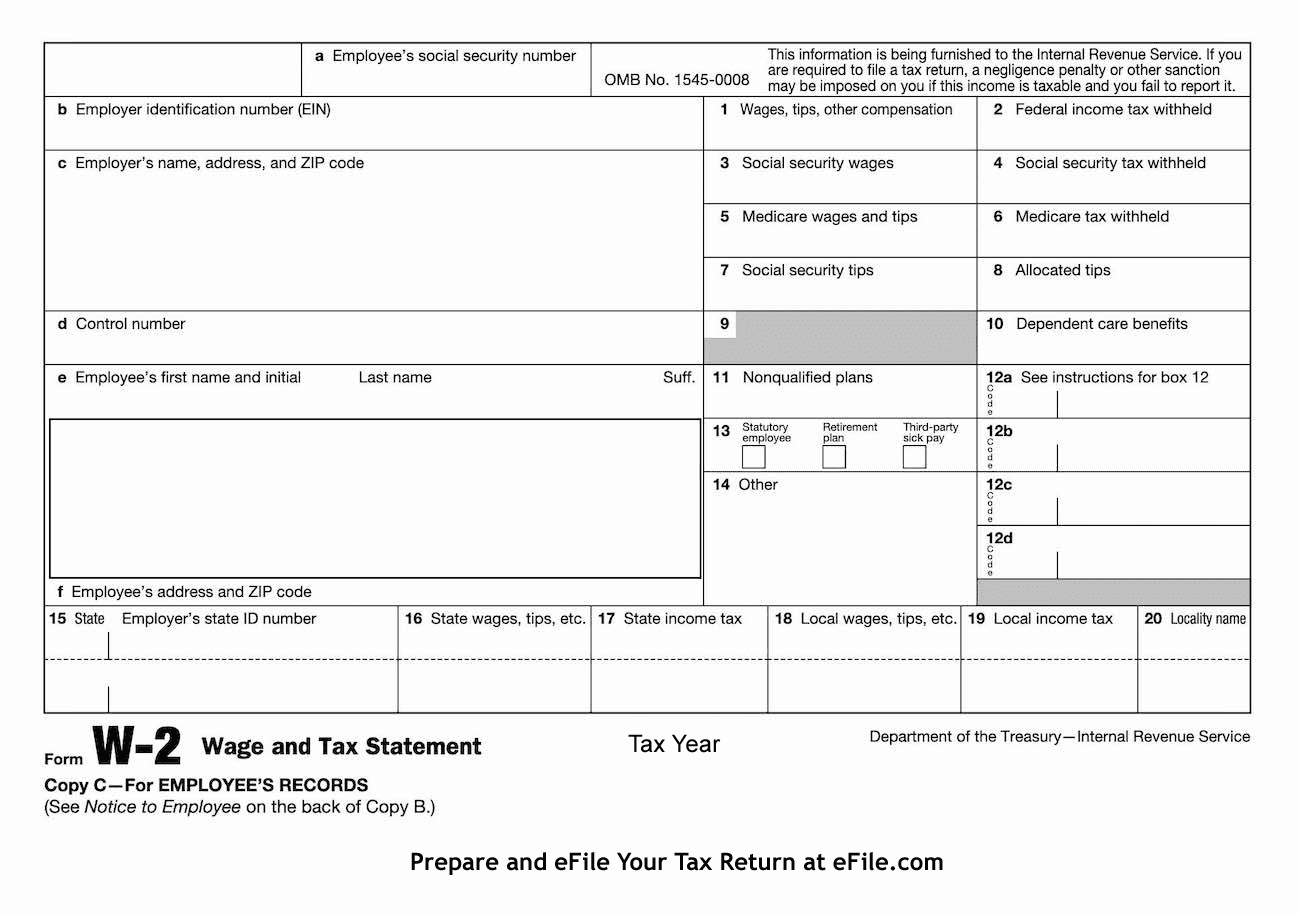

Whats A W2 Tax Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding the W2: Your Ticket to Tax Season Success!

Tax season can be a stressful time for many individuals, but understanding your W2 form can help alleviate some of that anxiety. Your W2 form is a crucial document that provides key information about your earnings and taxes withheld throughout the year. By decoding the mysteries of your W2, you can navigate the tax filing process with confidence and potentially maximize your tax refund.

Unraveling the Mysteries of Your W2 Form

Your W2 form may seem like a complicated puzzle at first glance, but breaking it down into smaller pieces can make it easier to understand. The form includes important details such as your total earnings, federal and state tax withholdings, and any deductions or contributions made throughout the year. Take the time to review each section carefully and ensure that all information is accurate. If you have any questions or notice any discrepancies, don’t hesitate to reach out to your employer or tax advisor for clarification.

One key aspect of your W2 form is Box 1, which shows your total taxable wages for the year. This amount is crucial for calculating your tax liability and determining whether you are entitled to a refund. Additionally, boxes 3 and 5 show your Social Security and Medicare wages, which may impact your overall tax liability. By understanding the information provided in these boxes, you can better assess your tax situation and plan accordingly for the filing season.

Tips and Tricks for Maximizing Your Tax Refund

When it comes to maximizing your tax refund, there are several strategies you can employ based on the information provided in your W2 form. One tip is to take advantage of any tax deductions or credits that you may be eligible for, such as the Earned Income Tax Credit or the Child Tax Credit. These credits can help reduce your tax liability and potentially increase your refund amount. Additionally, consider contributing to a retirement account or health savings plan to lower your taxable income and maximize your refund.

Another helpful tip is to review your withholding allowances and make any necessary adjustments to ensure that you are not overpaying or underpaying taxes throughout the year. By carefully managing your withholdings, you can avoid owing taxes at the end of the year and potentially increase your refund amount. Remember to keep track of any changes in your financial situation or employment status that may impact your tax liability. By staying informed and proactive, you can make the most of your tax refund and navigate the filing process with ease.

In conclusion, decoding your W2 form is the key to success during tax season. By understanding the information provided in your form and following these tips and tricks, you can take control of your tax situation and potentially maximize your refund. Remember to stay organized, seek assistance when needed, and be proactive in managing your taxes. With the right knowledge and preparation, you can conquer tax season with confidence and ease.

Below are some images related to Whats A W2 Tax Form

is w2 a tax form, what does a w2 tax form do, what is a 1040 tax form vs w2, what is a w2 form, what is a w2 tax form used for, , Whats A W2 Tax Form.

is w2 a tax form, what does a w2 tax form do, what is a 1040 tax form vs w2, what is a w2 form, what is a w2 tax form used for, , Whats A W2 Tax Form.