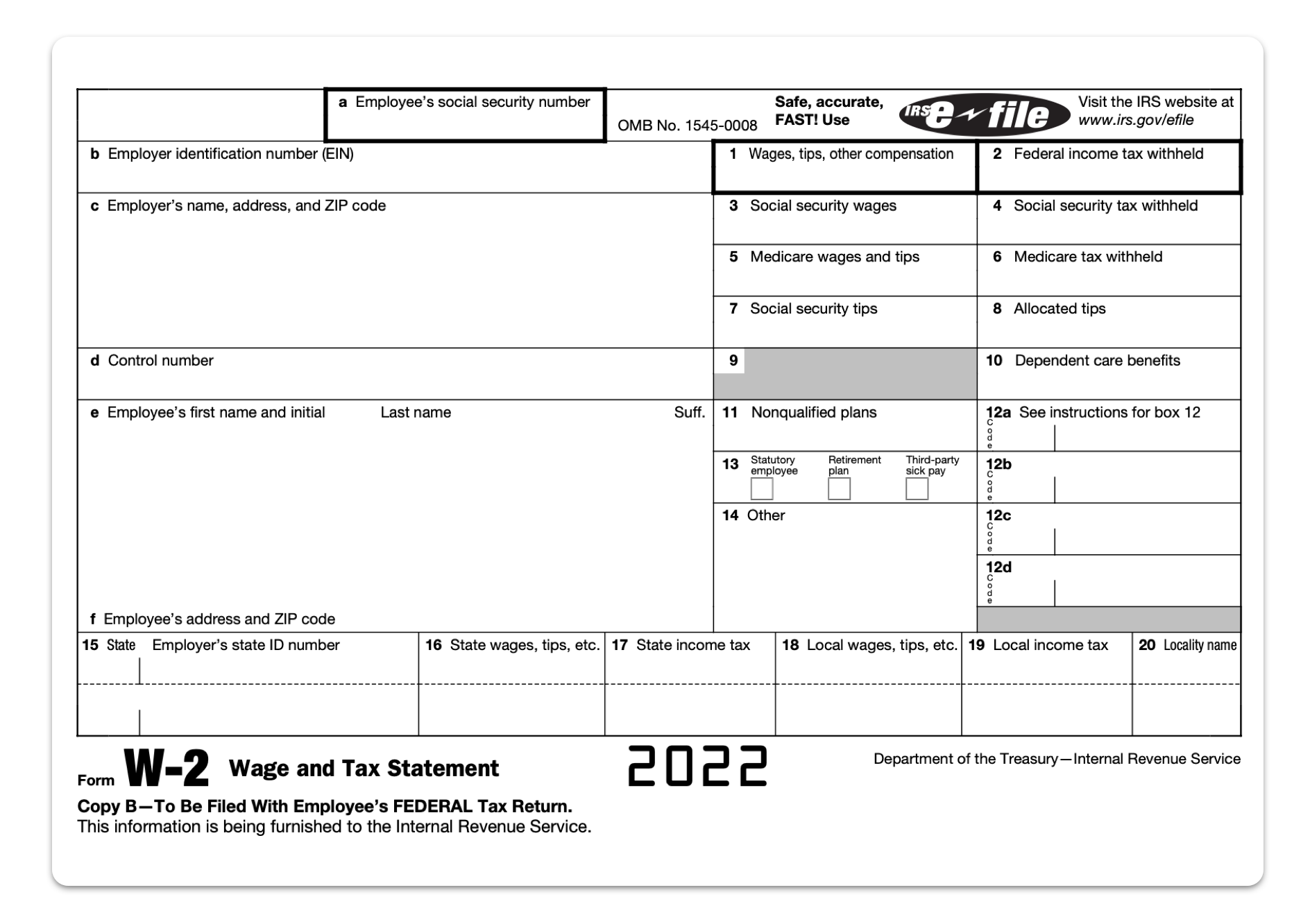

Michigan W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Magic of Michigan’s W2 Form!

Have you ever taken a moment to truly appreciate the beauty and complexity of Michigan’s W2 form? This seemingly mundane piece of paperwork holds within it a world of enchanting secrets waiting to be discovered. Join me as we dive into the mysteries of Michigan’s W2 form and uncover the magic hidden within its lines and boxes.

Diving into the Mysteries of Michigan’s W2 Form!

As you hold Michigan’s W2 form in your hands, you might be struck by its seemingly endless array of numbers and codes. But fear not, for beneath this facade of complexity lies a world of wonder waiting to be explored. Each number and code on the W2 form tells a unique story about your income, taxes withheld, and more. By taking the time to decipher these mysteries, you can gain a deeper understanding of your financial situation and empower yourself with knowledge.

Discovering the Enchanting Secrets within Michigan’s W2 Form!

Peeling back the layers of Michigan’s W2 form reveals a treasure trove of information that can help you make informed decisions about your finances. From understanding your tax liability to planning for the future, the secrets hidden within the W2 form can be a powerful tool in your financial arsenal. So don’t just glance over your W2 form – take the time to unravel its magic and discover the enchanting secrets that lie within.

In conclusion, Michigan’s W2 form may seem like just another piece of paperwork, but it is so much more than that. By delving into its mysteries and uncovering the magic hidden within, you can gain valuable insights into your financial situation and empower yourself to make informed decisions. So next time you receive your W2 form, take a moment to appreciate the beauty and complexity of this document, and remember that within its lines and boxes lies a world of enchanting secrets waiting to be discovered.

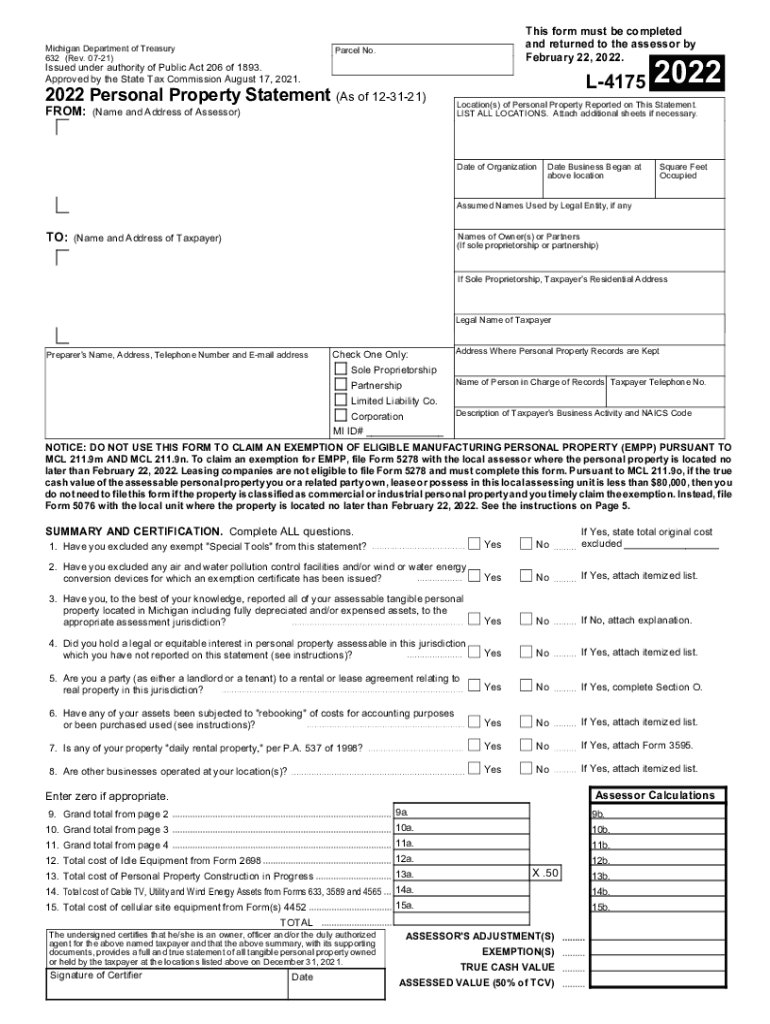

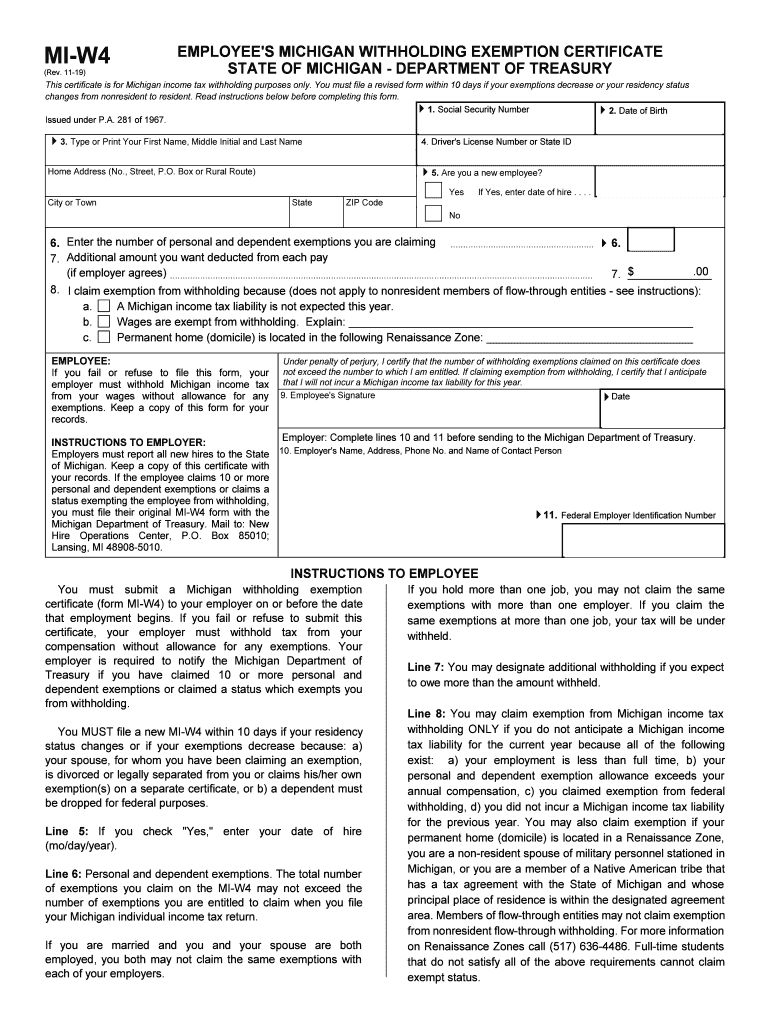

Below are some images related to Michigan W2 Form

how to submit w-2 to state of michigan, michigan unemployment w2 forms, michigan w2 form, michigan w2 form 2022, michigan w2 form 2023, , Michigan W2 Form.

how to submit w-2 to state of michigan, michigan unemployment w2 forms, michigan w2 form, michigan w2 form 2022, michigan w2 form 2023, , Michigan W2 Form.