When Is The W2 Form Received – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

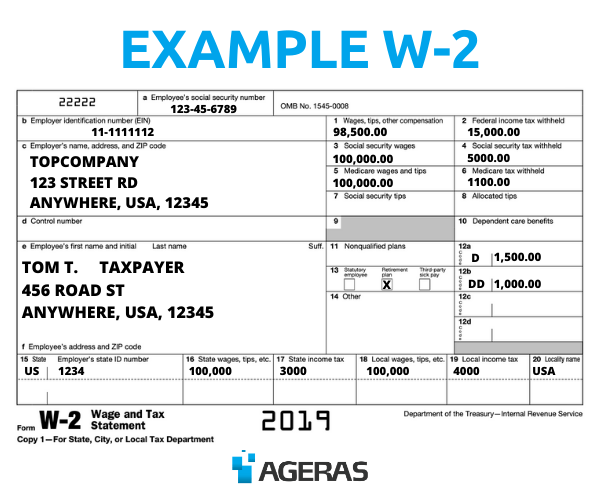

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping Your W2: A Guide to Receiving Your Tax Form!

Tax season is upon us, and that means it’s time to start thinking about filing your taxes. One of the most important documents you’ll need is your W2 form, which outlines your earnings and taxes withheld throughout the year. If you’re feeling a bit overwhelmed at the thought of tackling your taxes, fear not! In this guide, we’ll walk you through everything you need to know about unwrapping your W2 and understanding its contents.

Unwrapping Your W2: Let’s Dive Into Understanding Your Tax Form!

When your W2 arrives in the mail or is delivered electronically by your employer, it may seem like a jumble of numbers and codes. But fear not, we’re here to help you decode it all! Your W2 will include important information such as your total earnings for the year, taxes withheld, and any deductions or credits you may be eligible for. By taking the time to carefully review your W2, you can ensure that you’re maximizing your tax refund or minimizing any amount owed to the IRS.

One of the most crucial pieces of information on your W2 is your total taxable income, which is used to determine your tax bracket and the amount of taxes you owe. Additionally, your W2 will list any contributions you’ve made to retirement accounts or other pre-tax benefits, which can lower your taxable income and reduce your overall tax liability. By familiarizing yourself with the various sections of your W2, you can gain a clearer picture of your financial situation and make informed decisions when filing your taxes.

Unlock the Secrets of Your W2: A Step-by-Step Guide for Tax Time!

Now that you’ve unwrapped your W2 and have a better understanding of its contents, it’s time to start preparing your tax return. Whether you choose to file on your own or enlist the help of a tax professional, having your W2 in hand will make the process much smoother. Be sure to gather any additional documentation, such as receipts for deductible expenses or income from side gigs, to ensure that you’re accounting for all sources of income and potential deductions.

As you work through your tax return, refer back to your W2 to ensure that all information is accurately reported. Double-check that your name, Social Security number, and other personal details are correct, as any errors could lead to delays in processing your return. By taking the time to carefully review your W2 and follow the instructions provided, you can navigate tax season with confidence and peace of mind.

In conclusion, unwrapping your W2 may seem like a daunting task, but with a little guidance and patience, you can successfully navigate tax season and file your taxes with ease. Remember, your W2 is a valuable document that provides key insights into your financial situation, so be sure to review it thoroughly and seek help if needed. By taking the time to understand your W2 and make informed decisions when filing your taxes, you can set yourself up for a successful tax season and potentially maximize your refund. Happy filing!

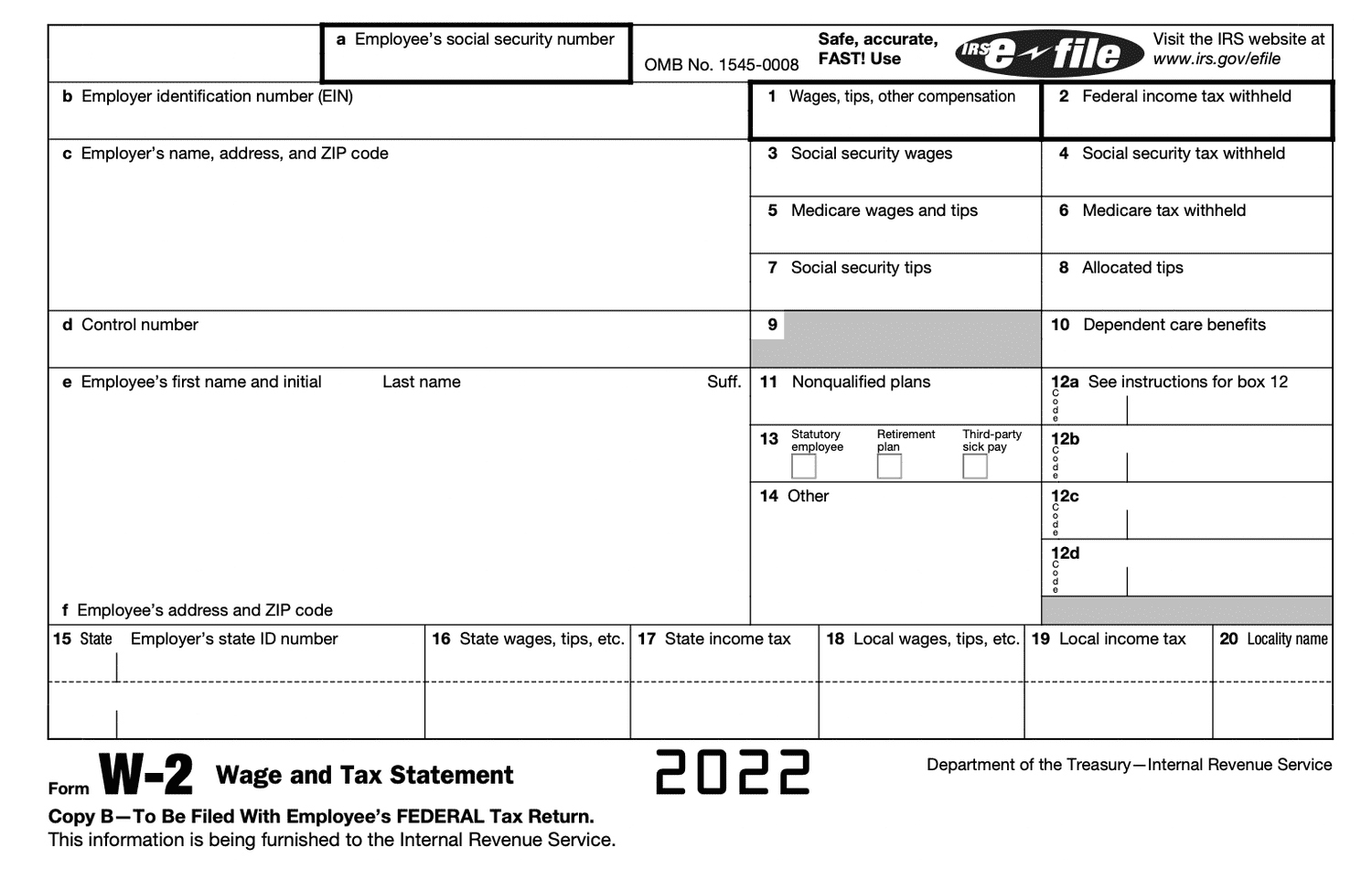

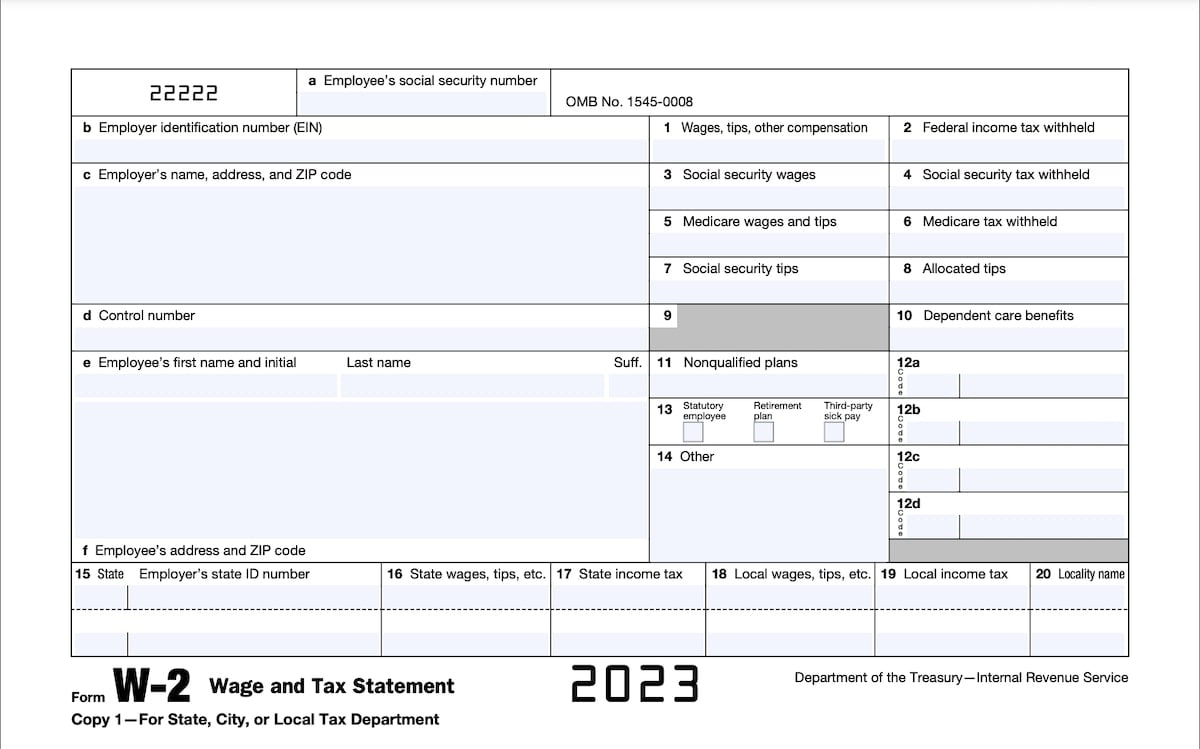

Below are some images related to When Is The W2 Form Received

when is the w2 form received, when is the w2 form received and completed, when must w2 be received, when should i receive my w2 by, why haven’t i received my w2 yet, , When Is The W2 Form Received.

when is the w2 form received, when is the w2 form received and completed, when must w2 be received, when should i receive my w2 by, why haven’t i received my w2 yet, , When Is The W2 Form Received.