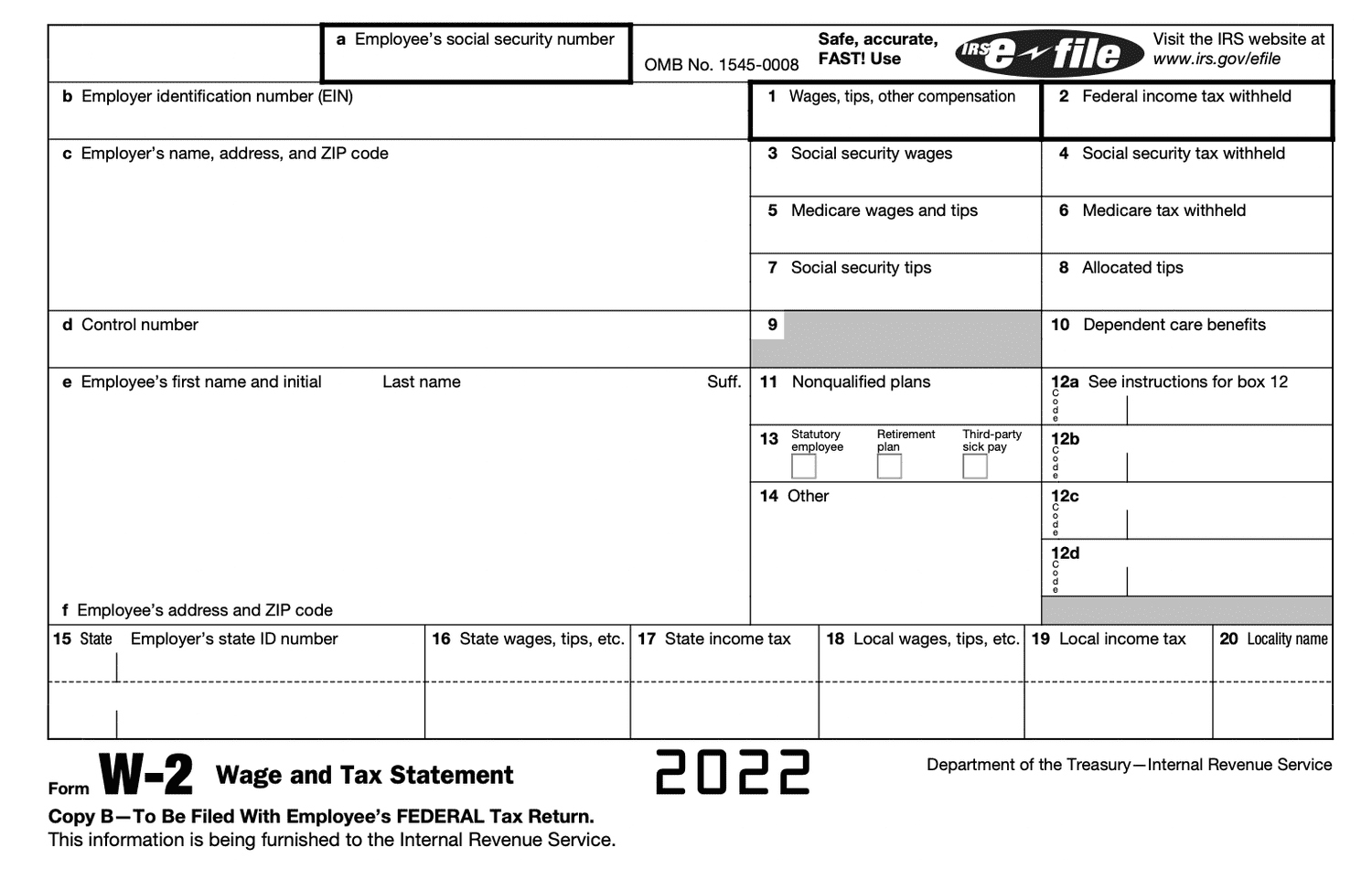

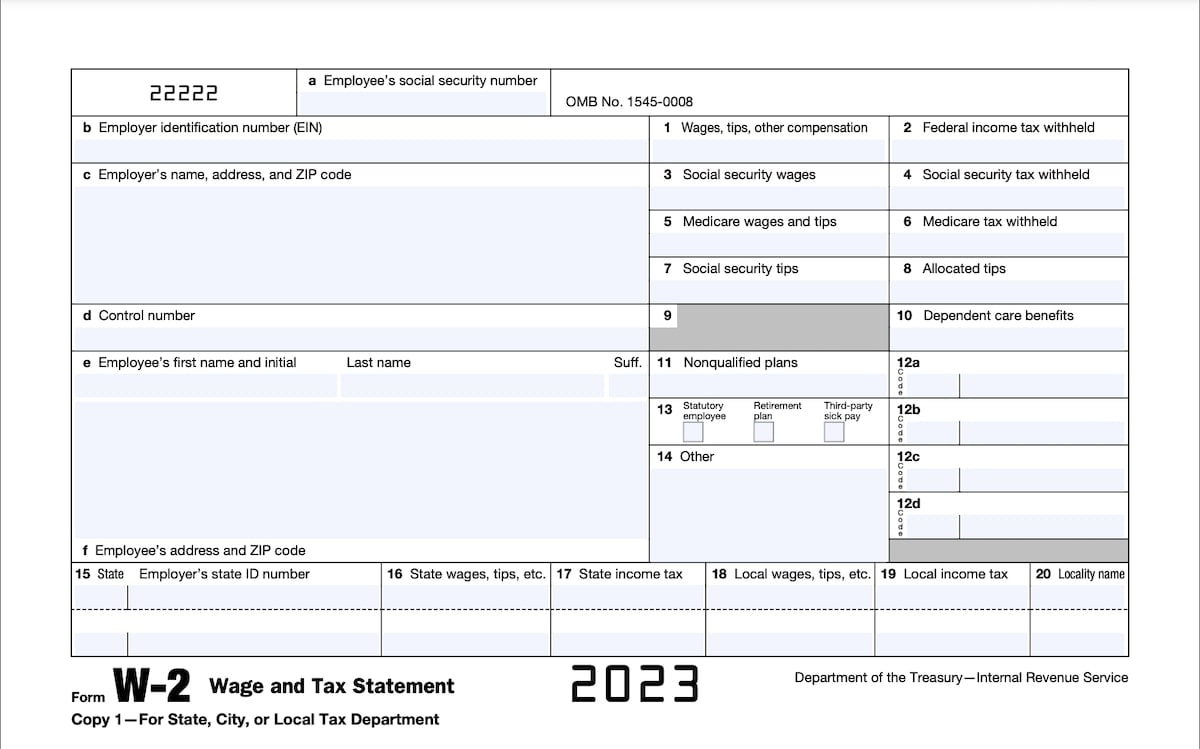

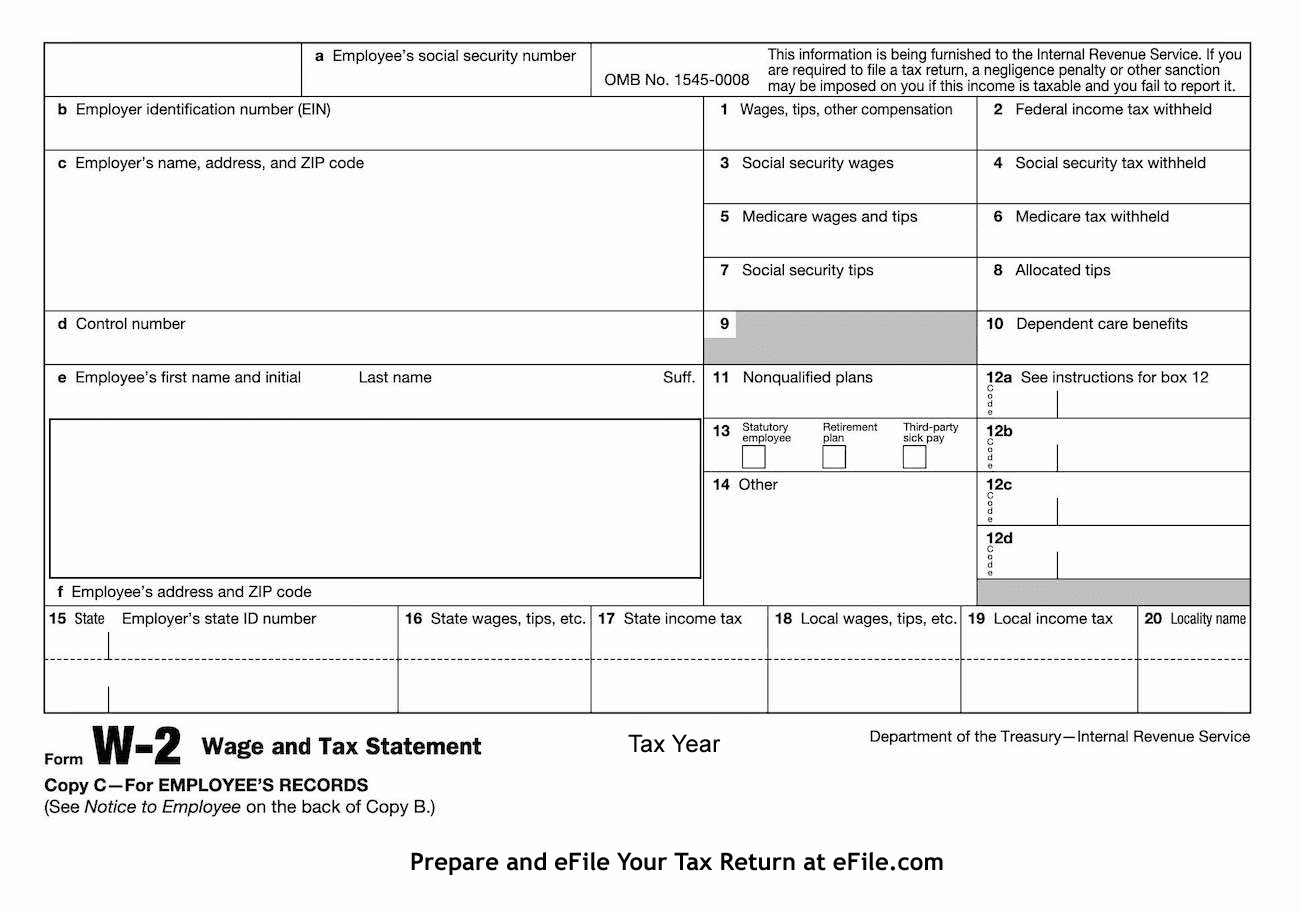

When Do We Get W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

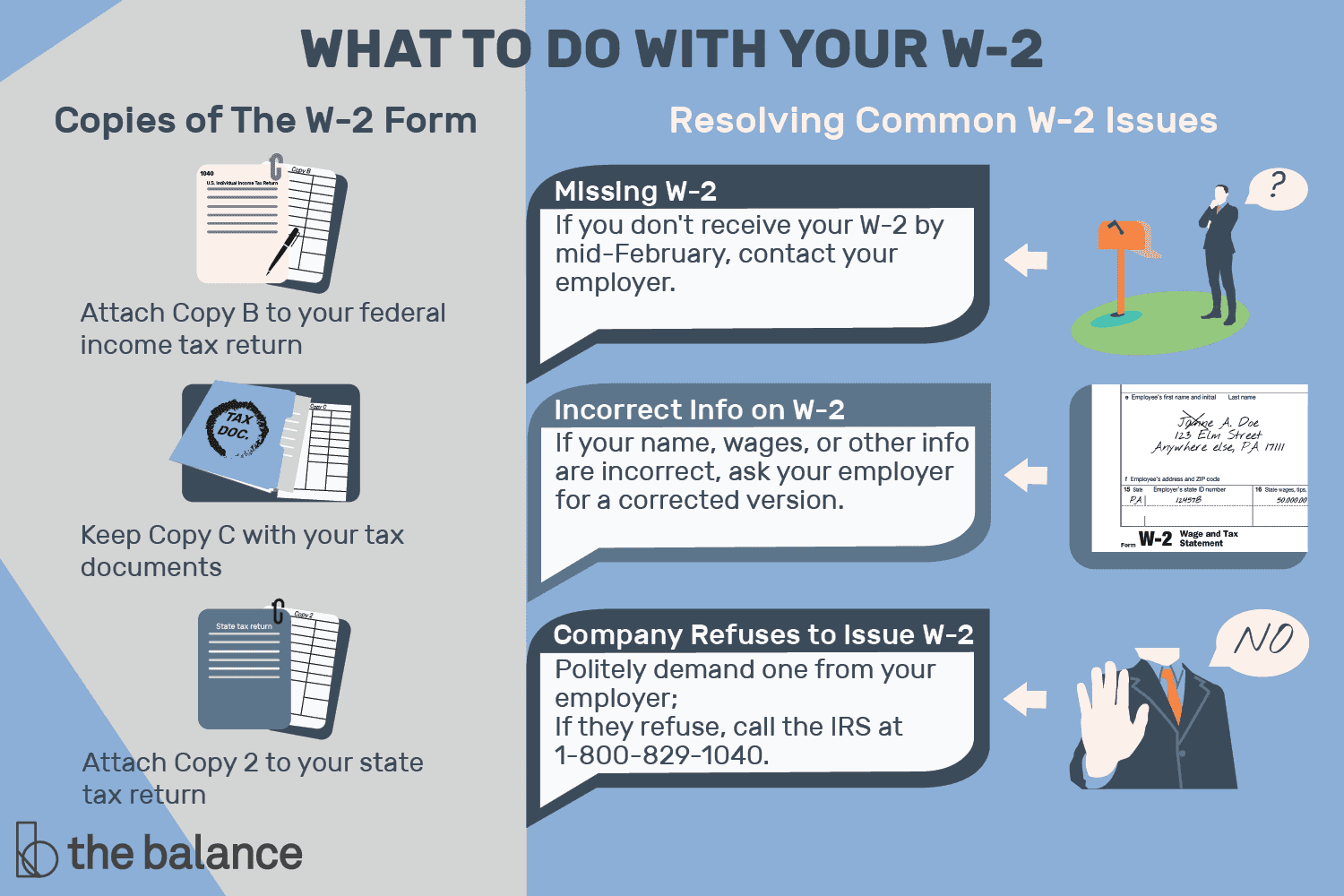

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Ready, Set, W2: The Countdown to Tax Time Begins!

Tax season is upon us, and it’s time to gear up for the annual ritual of filing our taxes. But fear not, because with a little preparation and organization, you can tackle tax time like a pro! The key to a stress-free tax season is to start early and stay organized. So let’s dive in and get ready to conquer those W2 forms!

Get Ready to Tackle Tax Time Like a Pro!

The first step in preparing for tax season is to gather all your necessary documents. Make sure you have your W2 forms from your employer, any 1099 forms for additional income, and any receipts or documentation for deductions and credits you plan to claim. Having all your paperwork in one place will make the process much smoother and more efficient.

Next, set aside some time to review your financial situation and make a plan for filing your taxes. Do you need to gather additional information or consult with a tax professional? Are there any changes in your life that may affect your tax situation, such as a new job, a home purchase, or a major life event? By taking the time to assess your tax situation early on, you can avoid any last-minute surprises and ensure a smooth filing process.

Once you have all your documents in order and a plan in place, it’s time to get down to business and start filling out those forms. Whether you choose to do your taxes yourself or enlist the help of a tax professional, staying organized and on top of deadlines is crucial. Be sure to double-check your entries, review for any mistakes or omissions, and submit your forms on time to avoid any penalties or delays.

The W2 Countdown has Begun – Let’s Get Organized!

As the W2 forms start rolling in, it’s time to get organized and create a system for managing your tax documents. Set up a designated folder or file for all your tax-related paperwork, and keep it in a safe and easily accessible place. This will help you stay on top of deadlines and ensure that you have all the necessary information at your fingertips when it’s time to file.

Take advantage of technology to streamline the tax-filing process. Many tax preparation software programs offer electronic filing options and can help you navigate the complexities of the tax code. Consider using a digital organizer or spreadsheet to track your expenses, deductions, and credits throughout the year, so you’re well-prepared come tax time.

Lastly, don’t forget to stay informed about any changes to the tax laws or regulations that may impact your filing. Keep an eye out for updates from the IRS or consult with a tax professional to ensure you’re taking advantage of all available deductions and credits. By staying organized and informed, you can make tax time a breeze and ensure a smooth and hassle-free filing process.

In conclusion, the countdown to tax time has officially begun, but with a little preparation and organization, you can tackle your taxes like a true pro. So gather your documents, make a plan, and stay on top of deadlines to ensure a stress-free filing process. With a positive attitude and a little bit of effort, you’ll be well on your way to a successful tax season. Happy filing!

Below are some images related to When Do We Get W2 Forms

when can i get w2 form, when do we get w2 forms, when do we receive w2 forms 2022, when do we receive w2 forms 2023, when do we receive w2 forms 2024, , When Do We Get W2 Forms.

when can i get w2 form, when do we get w2 forms, when do we receive w2 forms 2022, when do we receive w2 forms 2023, when do we receive w2 forms 2024, , When Do We Get W2 Forms.