What To Claim On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

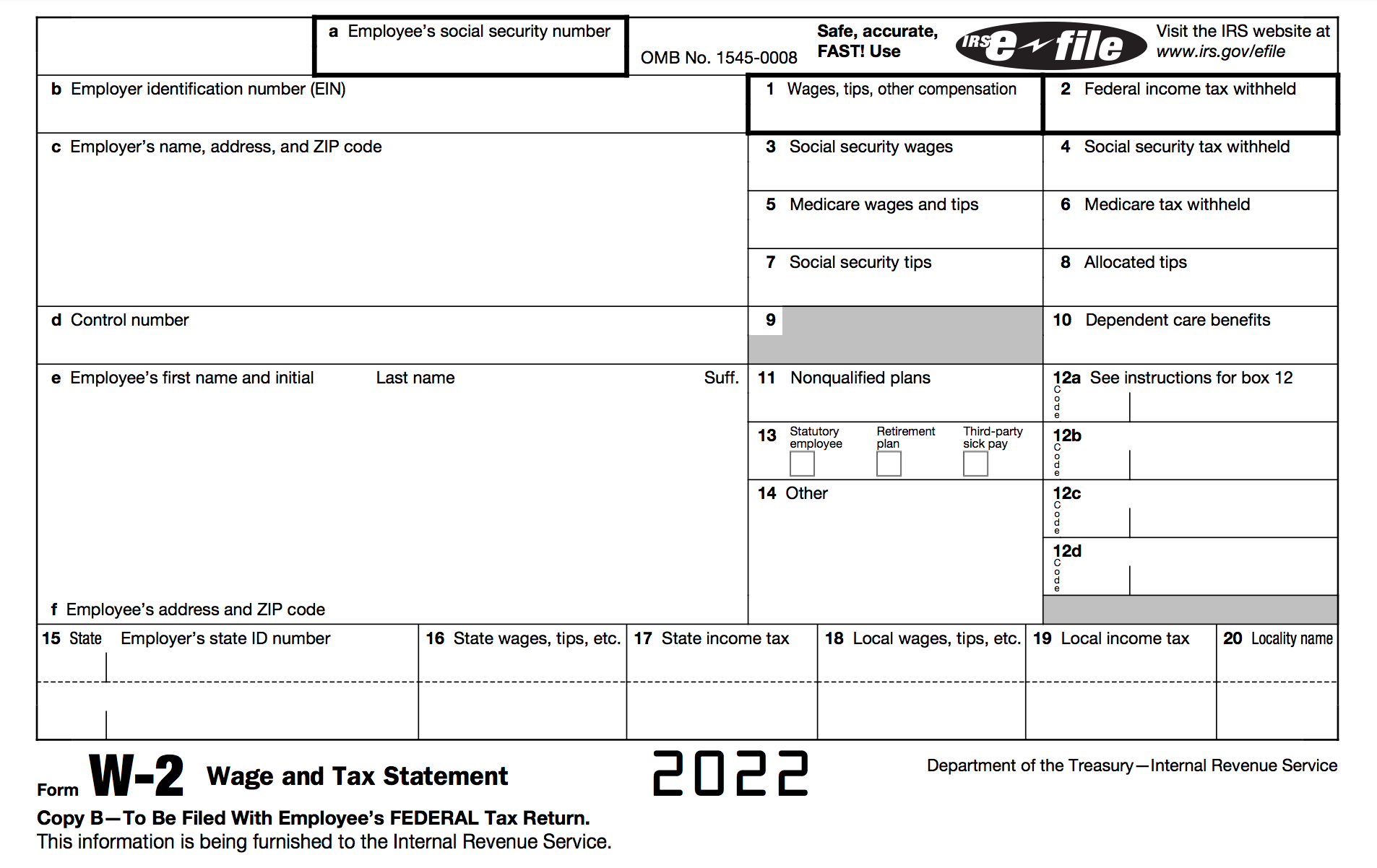

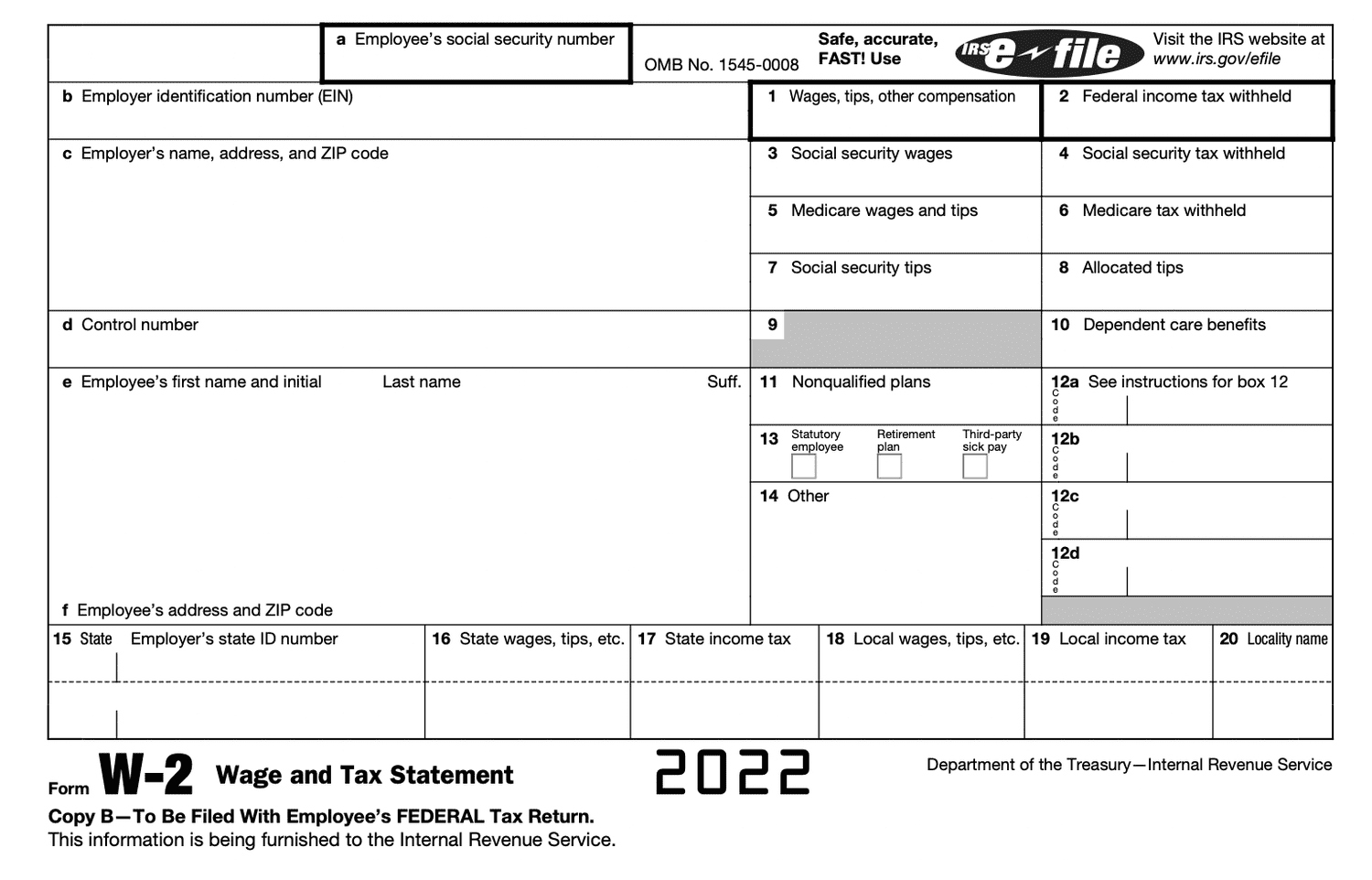

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

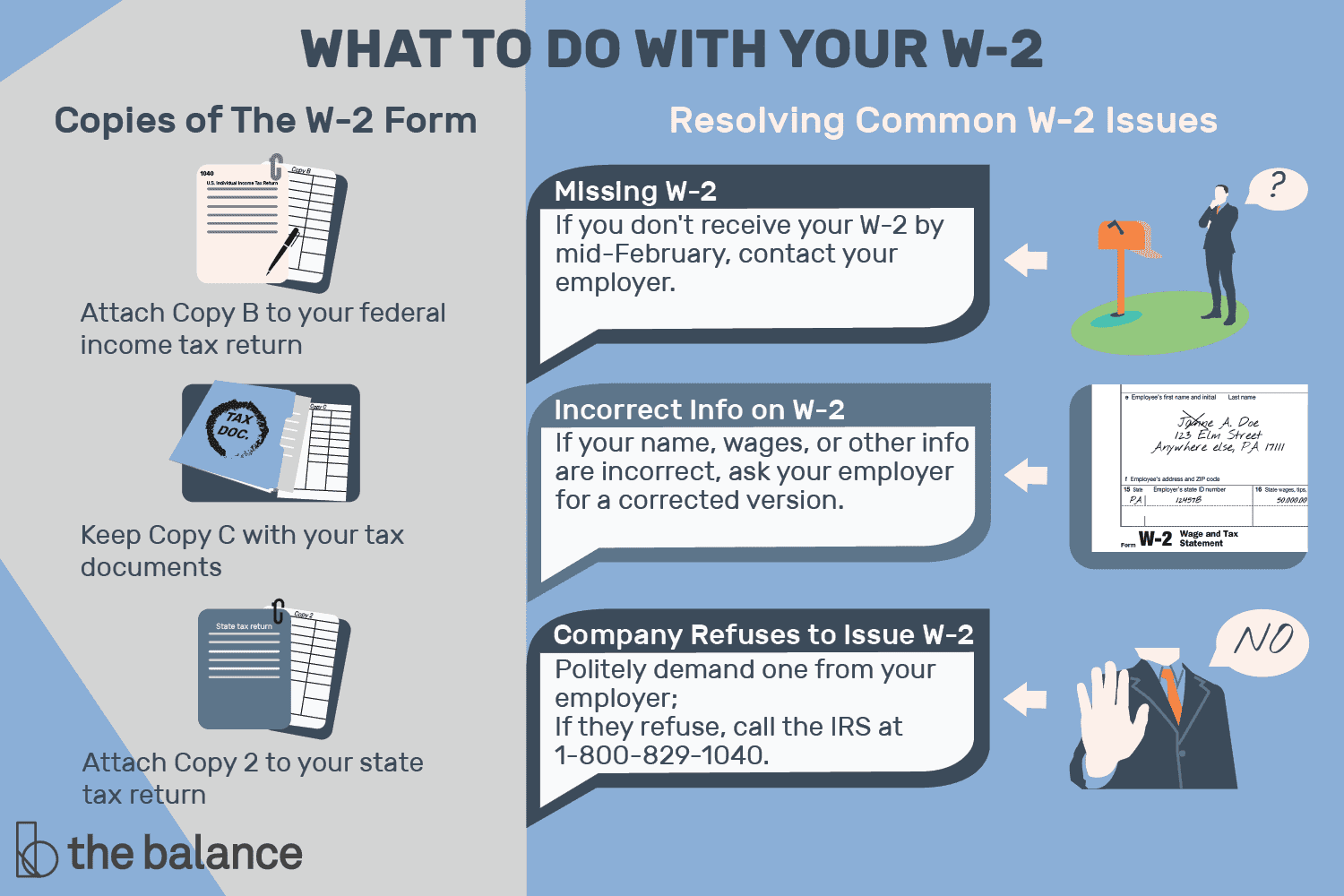

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximize Your Refund: The Ultimate Guide to W2 Form Claims!

Are you ready to take control of your tax refund and get the most out of your W2 form? Look no further! With these tips and tricks, you can unleash your refund potential and maximize your tax return like never before. Don’t leave money on the table – follow this ultimate guide to W2 form claims and watch your refund grow!

Unleash Your Refund Potential with These W2 Form Tips!

When it comes to maximizing your refund, the key is in knowing what deductions and credits you qualify for. Start by carefully reviewing your W2 form and ensuring all the information is accurate. Look for any potential deductions, such as student loan interest or contributions to retirement accounts, that can help lower your taxable income and increase your refund. Additionally, don’t forget to claim any tax credits you may be eligible for, such as the Earned Income Tax Credit or the Child Tax Credit.

Another important tip to maximize your refund is to consider filing electronically. E-filing your tax return can help you receive your refund faster and more accurately. Plus, many online tax preparation services can help you identify additional deductions and credits you may have missed. By taking advantage of technology, you can ensure you’re getting the most out of your W2 form and maximizing your refund potential.

Lastly, don’t forget to keep track of your expenses throughout the year. Whether it’s medical expenses, charitable donations, or business expenses, keeping thorough records can help you maximize your deductions and increase your refund. By staying organized and proactive about your finances, you can ensure you’re making the most out of your tax return and claiming all the credits and deductions you’re entitled to.

Get the Most out of Your Taxes: The Ultimate W2 Form Guide!

To truly get the most out of your taxes, it’s essential to understand how your W2 form works and how it impacts your tax return. Your W2 form contains important information about your income, taxes withheld, and any deductions or credits you may qualify for. By carefully reviewing your W2 form and understanding what each box means, you can ensure you’re maximizing your refund potential.

One key strategy to get the most out of your taxes is to take advantage of tax-advantaged accounts, such as a 401(k) or Health Savings Account (HSA). By contributing to these accounts, you can reduce your taxable income and increase your refund. Additionally, be sure to report any income you may have received throughout the year, such as freelance work or rental income, to ensure you’re accurately reporting all your earnings.

Lastly, consider seeking professional help if you’re unsure about how to maximize your refund. A tax professional can help you navigate the complexities of the tax code and identify opportunities to reduce your tax liability. By investing in expert advice, you can ensure you’re getting the most out of your W2 form and maximizing your refund potential. So don’t wait – start maximizing your refund today!

In conclusion, maximizing your refund is all about being proactive, organized, and knowledgeable about your tax situation. By following these tips and tricks, you can unleash your refund potential and get the most out of your W2 form. So take control of your tax return, claim all the deductions and credits you’re entitled to, and watch your refund grow! Cheers to a successful tax season!

Below are some images related to What To Claim On W2 Form

how to claim dependents on w2 form, what are allowances on w2 form, what can you claim on w2, what should i claim on my w2, what to claim on w2, , What To Claim On W2 Form.

how to claim dependents on w2 form, what are allowances on w2 form, what can you claim on w2, what should i claim on my w2, what to claim on w2, , What To Claim On W2 Form.